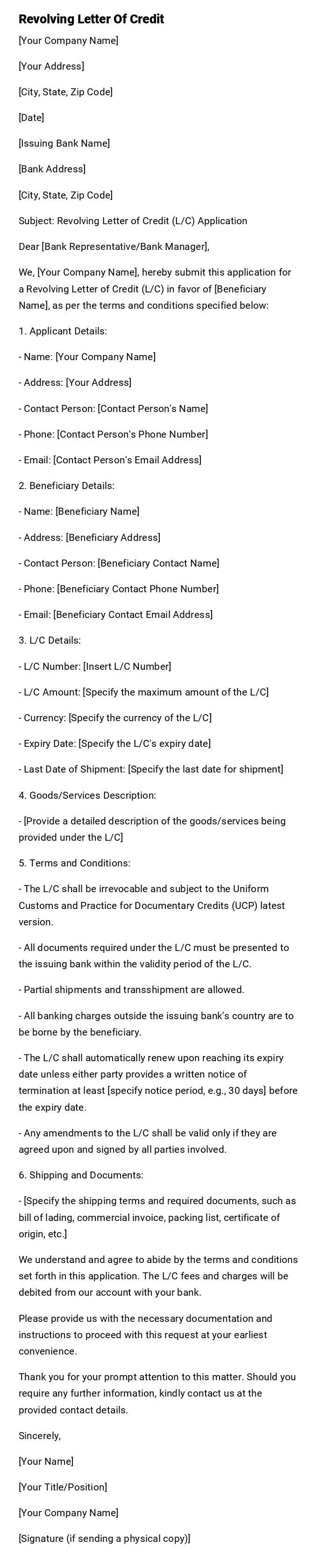

Revolving Letter Of Credit

[Your Company Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Issuing Bank Name]

[Bank Address]

[City, State, Zip Code]

Subject: Revolving Letter of Credit (L/C) Application

Dear [Bank Representative/Bank Manager],

We, [Your Company Name], hereby submit this application for a Revolving Letter of Credit (L/C) in favor of [Beneficiary Name], as per the terms and conditions specified below:

1. Applicant Details:

- Name: [Your Company Name]

- Address: [Your Address]

- Contact Person: [Contact Person's Name]

- Phone: [Contact Person's Phone Number]

- Email: [Contact Person's Email Address]

2. Beneficiary Details:

- Name: [Beneficiary Name]

- Address: [Beneficiary Address]

- Contact Person: [Beneficiary Contact Name]

- Phone: [Beneficiary Contact Phone Number]

- Email: [Beneficiary Contact Email Address]

3. L/C Details:

- L/C Number: [Insert L/C Number]

- L/C Amount: [Specify the maximum amount of the L/C]

- Currency: [Specify the currency of the L/C]

- Expiry Date: [Specify the L/C's expiry date]

- Last Date of Shipment: [Specify the last date for shipment]

4. Goods/Services Description:

- [Provide a detailed description of the goods/services being provided under the L/C]

5. Terms and Conditions:

- The L/C shall be irrevocable and subject to the Uniform Customs and Practice for Documentary Credits (UCP) latest version.

- All documents required under the L/C must be presented to the issuing bank within the validity period of the L/C.

- Partial shipments and transshipment are allowed.

- All banking charges outside the issuing bank's country are to be borne by the beneficiary.

- The L/C shall automatically renew upon reaching its expiry date unless either party provides a written notice of termination at least [specify notice period, e.g., 30 days] before the expiry date.

- Any amendments to the L/C shall be valid only if they are agreed upon and signed by all parties involved.

6. Shipping and Documents:

- [Specify the shipping terms and required documents, such as bill of lading, commercial invoice, packing list, certificate of origin, etc.]

We understand and agree to abide by the terms and conditions set forth in this application. The L/C fees and charges will be debited from our account with your bank.

Please provide us with the necessary documentation and instructions to proceed with this request at your earliest convenience.

Thank you for your prompt attention to this matter. Should you require any further information, kindly contact us at the provided contact details.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company Name]

[Signature (if sending a physical copy)]

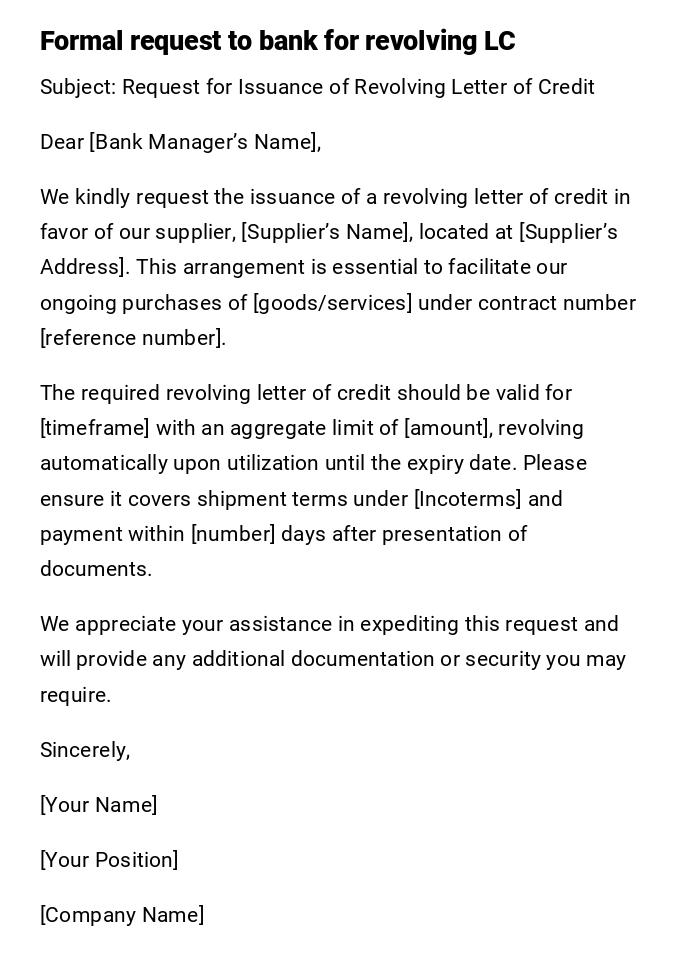

Formal Request Letter for Revolving Letter of Credit

Subject: Request for Issuance of Revolving Letter of Credit

Dear [Bank Manager’s Name],

We kindly request the issuance of a revolving letter of credit in favor of our supplier, [Supplier’s Name], located at [Supplier’s Address]. This arrangement is essential to facilitate our ongoing purchases of [goods/services] under contract number [reference number].

The required revolving letter of credit should be valid for [timeframe] with an aggregate limit of [amount], revolving automatically upon utilization until the expiry date. Please ensure it covers shipment terms under [Incoterms] and payment within [number] days after presentation of documents.

We appreciate your assistance in expediting this request and will provide any additional documentation or security you may require.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

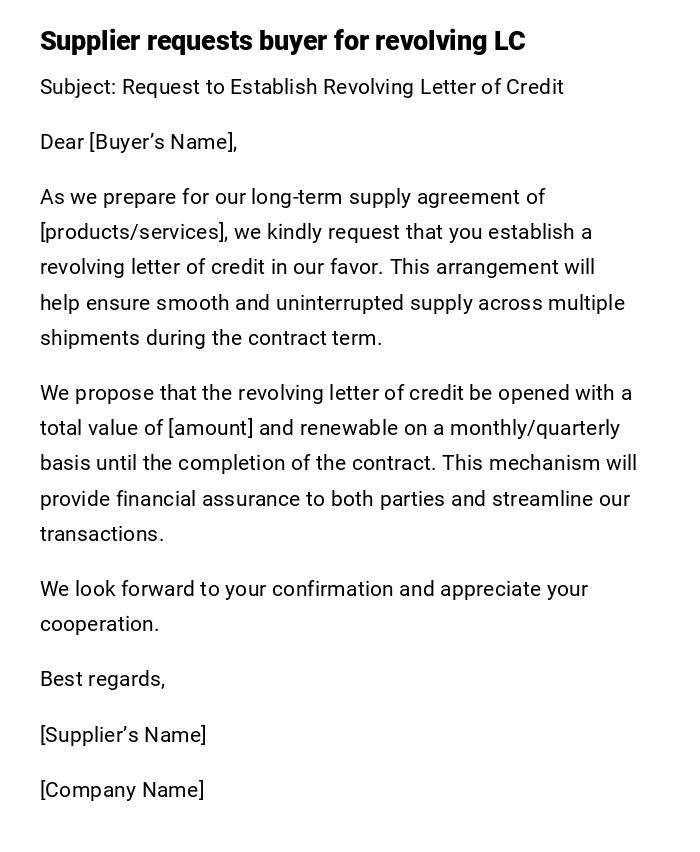

Supplier Request Letter for Buyer to Open Revolving LC

Subject: Request to Establish Revolving Letter of Credit

Dear [Buyer’s Name],

As we prepare for our long-term supply agreement of [products/services], we kindly request that you establish a revolving letter of credit in our favor. This arrangement will help ensure smooth and uninterrupted supply across multiple shipments during the contract term.

We propose that the revolving letter of credit be opened with a total value of [amount] and renewable on a monthly/quarterly basis until the completion of the contract. This mechanism will provide financial assurance to both parties and streamline our transactions.

We look forward to your confirmation and appreciate your cooperation.

Best regards,

[Supplier’s Name]

[Company Name]

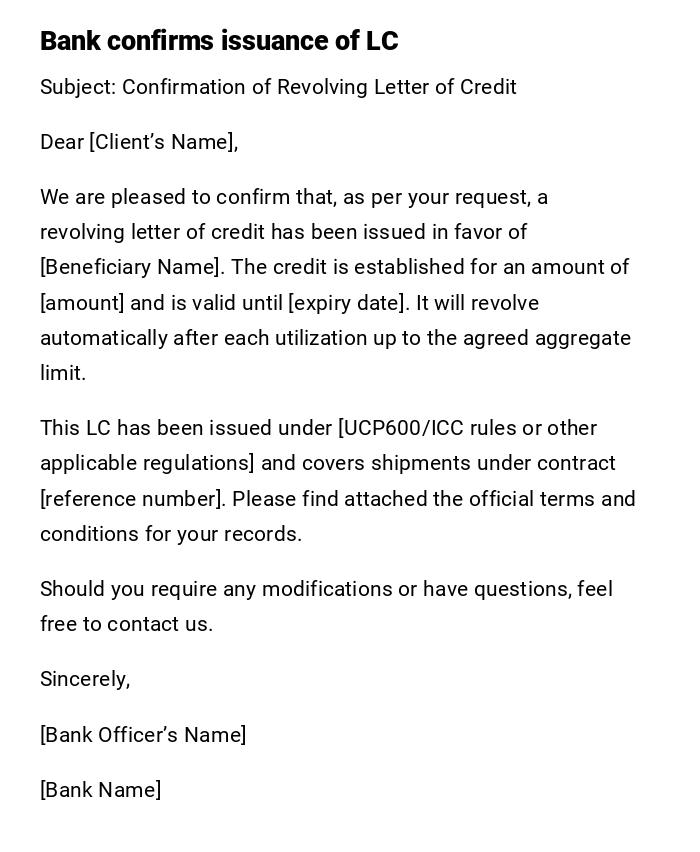

Bank Confirmation Letter for Revolving Letter of Credit

Subject: Confirmation of Revolving Letter of Credit

Dear [Client’s Name],

We are pleased to confirm that, as per your request, a revolving letter of credit has been issued in favor of [Beneficiary Name]. The credit is established for an amount of [amount] and is valid until [expiry date]. It will revolve automatically after each utilization up to the agreed aggregate limit.

This LC has been issued under [UCP600/ICC rules or other applicable regulations] and covers shipments under contract [reference number]. Please find attached the official terms and conditions for your records.

Should you require any modifications or have questions, feel free to contact us.

Sincerely,

[Bank Officer’s Name]

[Bank Name]

Provisional Approval Letter for Revolving LC

Subject: Provisional Approval of Revolving Letter of Credit

Dear [Client’s Name],

We acknowledge receipt of your request for a revolving letter of credit. We are pleased to inform you that provisional approval has been granted, subject to submission of the required supporting documents including financial statements, board resolution, and collateral details.

Once the necessary documents have been reviewed and approved, the revolving letter of credit will be formally issued. Kindly arrange to provide these documents at the earliest convenience to avoid delays.

Thank you for your cooperation.

Sincerely,

[Bank Manager’s Name]

[Bank Name]

Amendment Request Letter for Revolving LC

Subject: Request for Amendment of Revolving Letter of Credit

Dear [Bank Manager’s Name],

We refer to the revolving letter of credit issued on [date] under reference number [LC number]. Due to changes in our supply arrangement, we request the following amendments:

1. Increase in the credit limit from [old amount] to [new amount].

2. Extension of expiry date to [new expiry date].

3. Adjustment of shipment schedule to align with the revised delivery terms.

We kindly request your urgent action to incorporate these amendments and provide confirmation once updated.

Sincerely,

[Your Name]

[Company Name]

Simple Buyer Email Requesting LC Setup

Subject: Request for Revolving Letter of Credit

Hi [Bank Contact],

We need to set up a revolving letter of credit for our contract with [Supplier’s Name]. The LC should be valid for [time period] with a limit of [amount] and should revolve after each shipment.

Please let me know the documentation you require so we can get this processed quickly.

Thanks,

[Your Name]

[Company Name]

Supplier Follow-up Message on Revolving LC

Subject: Follow-Up on Revolving Letter of Credit

Dear [Buyer’s Name],

We wish to follow up on our earlier request regarding the opening of a revolving letter of credit. As our shipment schedule is approaching, confirmation of the LC is necessary to avoid delays in dispatch.

Please confirm the status of the LC issuance so we can finalize logistics accordingly.

Warm regards,

[Supplier’s Name]

[Company Name]

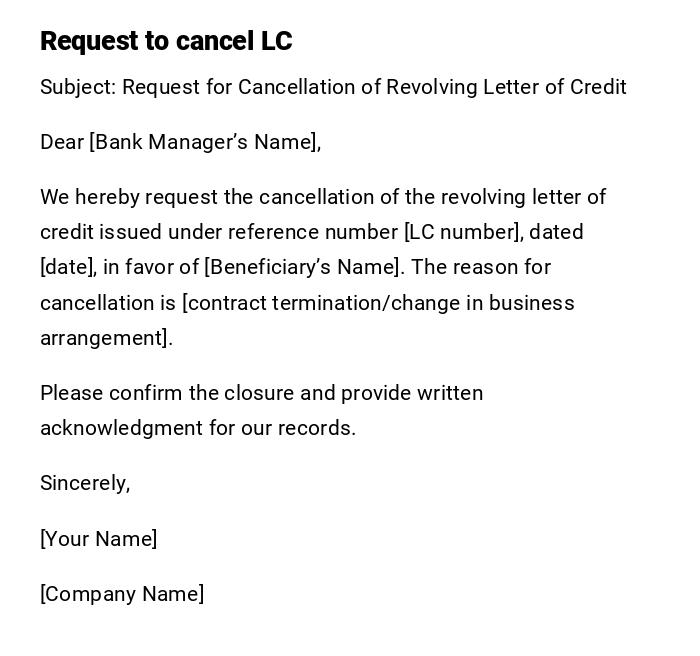

Cancellation Letter for Revolving LC

Subject: Request for Cancellation of Revolving Letter of Credit

Dear [Bank Manager’s Name],

We hereby request the cancellation of the revolving letter of credit issued under reference number [LC number], dated [date], in favor of [Beneficiary’s Name]. The reason for cancellation is [contract termination/change in business arrangement].

Please confirm the closure and provide written acknowledgment for our records.

Sincerely,

[Your Name]

[Company Name]

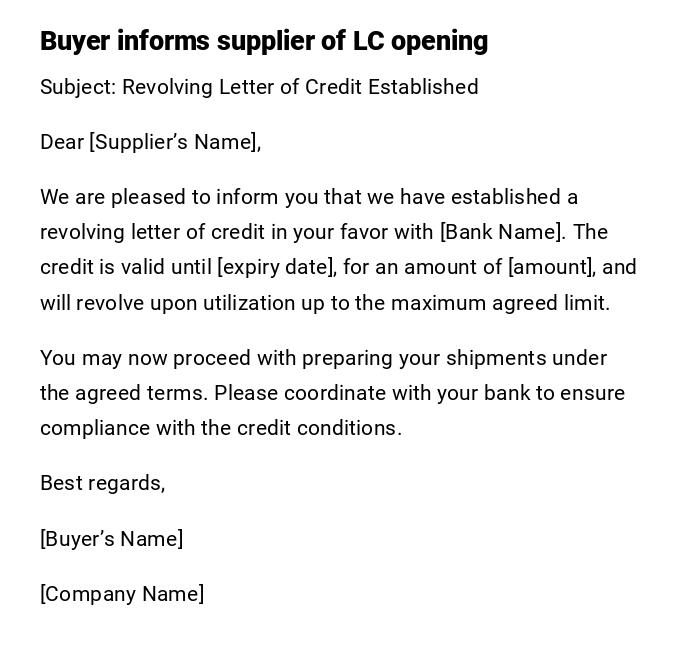

Buyer to Supplier Notification of LC Establishment

Subject: Revolving Letter of Credit Established

Dear [Supplier’s Name],

We are pleased to inform you that we have established a revolving letter of credit in your favor with [Bank Name]. The credit is valid until [expiry date], for an amount of [amount], and will revolve upon utilization up to the maximum agreed limit.

You may now proceed with preparing your shipments under the agreed terms. Please coordinate with your bank to ensure compliance with the credit conditions.

Best regards,

[Buyer’s Name]

[Company Name]

What is a revolving letter of credit and why do you need it?

A revolving letter of credit (LC) is a financial instrument issued by a bank that allows repeated withdrawals or utilizations up to a certain limit within a specified period. It is commonly used in international trade where multiple shipments are made under a long-term contract. Businesses need it to reduce administrative work, ensure continuous trade financing, and provide payment security for sellers and buyers.

Who should issue and manage revolving letters of credit?

- Issuing Bank: The buyer’s bank is responsible for issuing the LC.

- Applicant: The buyer or importer initiates the request.

- Beneficiary: The seller or exporter benefits from the LC and receives payments.

- Advising/Confirming Bank: Sometimes the seller’s bank is involved to advise or confirm the LC, ensuring credibility.

Whom should a revolving LC letter be addressed to?

- A bank, when requesting issuance or amendments.

- A supplier, when confirming LC establishment.

- A buyer, when suppliers request financial assurance.

- Trade partners, for updates or follow-ups on status.

When is a revolving LC letter needed?

- At the beginning of a long-term supply agreement.

- When regular shipments are planned under one contract.

- When amending terms due to changes in quantity, value, or delivery.

- For follow-ups and confirmations of LC establishment.

- Upon termination or cancellation of a contract requiring closure of LC.

How do you prepare and send a revolving LC letter?

- Clearly state subject and purpose (request, confirmation, amendment, or cancellation).

- Include contract reference numbers and financial details.

- Specify validity, amount, and terms of utilization.

- Use professional and formal language, unless it’s a quick internal message.

- Send via secure means: printed signed letters for banks, emails for quick communication with suppliers or buyers.

- Attach supporting documents where necessary.

How many types of revolving LCs are there?

- Cumulative: Any unused portion carries forward.

- Non-cumulative: Unused portions expire each cycle.

- Time-based: Revolves on a fixed schedule (monthly/quarterly).

- Value-based: Revolves upon full utilization of amount.

Each type affects how much can be drawn and when it refreshes.

Requirements and prerequisites before writing a revolving LC letter

- A signed trade agreement or purchase contract.

- Agreement between buyer and supplier on LC terms.

- Approval from the buyer’s bank regarding credit limits.

- Proper documentation: invoices, shipping schedules, collateral details.

- Knowledge of trade regulations and compliance under ICC/UCP rules.

Formatting guidelines for revolving LC letters

- Tone: Always professional and serious.

- Length: One page is usually enough, concise but detailed.

- Style: Clear, factual, and free of ambiguity.

- Content: Should include subject, beneficiary, issuing bank, LC number, validity, and conditions.

- Mode: Printed signed letters for official bank communication; email is acceptable for buyer-supplier correspondence.

What follow-up is required after sending a revolving LC letter?

- Confirm receipt and acceptance with the bank or supplier.

- Track the LC status and monitor utilization.

- Amend terms if business conditions change.

- Ensure all documents presented match LC requirements.

- Close the LC formally once the contract ends.

Pros and cons of revolving letters of credit

Pros:

- Saves time by avoiding multiple LC issuances.

- Provides continuous payment security.

- Reduces administrative workload.

- Encourages long-term trade relationships.

Cons:

- Requires strong trust and creditworthiness.

- Higher fees compared to single LCs.

- Complexity in monitoring usage.

- Possible disputes if terms are unclear.

Compare and contrast revolving LC with other types of credit

- Revolving LC vs. Standard LC: Revolving allows repeated use; standard is one-time only.

- Revolving LC vs. Open Account: Revolving LC is more secure but costlier; open account is cheaper but riskier.

- Revolving LC vs. Bank Guarantee: LC ensures payment upon compliance; guarantee covers default risks.

Tips for writing effective revolving LC letters

- Always include reference numbers for clarity.

- State exact amounts and expiry dates.

- Avoid vague wording that may cause disputes.

- Keep a copy of every communication for records.

- Use legal or compliance officers to review before submission.

Common mistakes to avoid

- Forgetting to mention validity or expiry date.

- Using vague terms like “as soon as possible” instead of specific timelines.

- Not attaching supporting documents.

- Sending informal messages for formal bank requests.

- Misunderstanding between cumulative and non-cumulative LC types.

Essential elements and structure of revolving LC letters

- Subject line specifying the purpose.

- Proper salutation to bank, buyer, or supplier.

- Clear reference to contract and LC number.

- Terms of validity, revolving mechanism, and value.

- Requested action (issue, amend, confirm, cancel).

- Closing remarks and signature.

- Attachments: invoices, schedules, agreements.

Does a revolving LC letter require attestation or authorization?

In most cases, yes. Letters sent to banks regarding issuance or amendments must be authorized by company signatories and may require board resolutions. Some jurisdictions or banks may also demand notarization or official company seal for validity. Letters between buyer and supplier typically do not require attestation but should still be signed by authorized personnel.

Download Word Doc

Download Word Doc

Download PDF

Download PDF