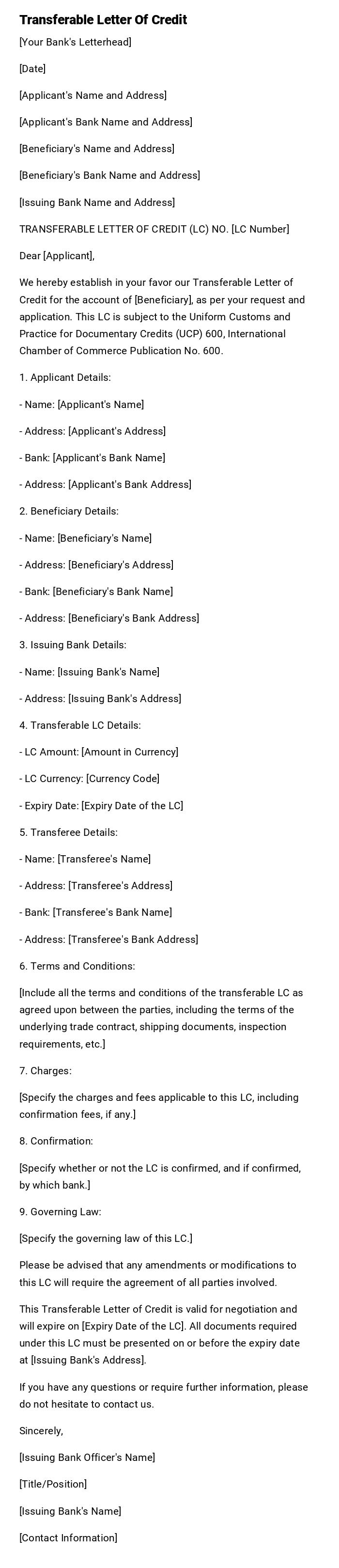

Transferable Letter Of Credit

[Your Bank's Letterhead]

[Date]

[Applicant's Name and Address]

[Applicant's Bank Name and Address]

[Beneficiary's Name and Address]

[Beneficiary's Bank Name and Address]

[Issuing Bank Name and Address]

TRANSFERABLE LETTER OF CREDIT (LC) NO. [LC Number]

Dear [Applicant],

We hereby establish in your favor our Transferable Letter of Credit for the account of [Beneficiary], as per your request and application. This LC is subject to the Uniform Customs and Practice for Documentary Credits (UCP) 600, International Chamber of Commerce Publication No. 600.

1. Applicant Details:

- Name: [Applicant's Name]

- Address: [Applicant's Address]

- Bank: [Applicant's Bank Name]

- Address: [Applicant's Bank Address]

2. Beneficiary Details:

- Name: [Beneficiary's Name]

- Address: [Beneficiary's Address]

- Bank: [Beneficiary's Bank Name]

- Address: [Beneficiary's Bank Address]

3. Issuing Bank Details:

- Name: [Issuing Bank's Name]

- Address: [Issuing Bank's Address]

4. Transferable LC Details:

- LC Amount: [Amount in Currency]

- LC Currency: [Currency Code]

- Expiry Date: [Expiry Date of the LC]

5. Transferee Details:

- Name: [Transferee's Name]

- Address: [Transferee's Address]

- Bank: [Transferee's Bank Name]

- Address: [Transferee's Bank Address]

6. Terms and Conditions:

[Include all the terms and conditions of the transferable LC as agreed upon between the parties, including the terms of the underlying trade contract, shipping documents, inspection requirements, etc.]

7. Charges:

[Specify the charges and fees applicable to this LC, including confirmation fees, if any.]

8. Confirmation:

[Specify whether or not the LC is confirmed, and if confirmed, by which bank.]

9. Governing Law:

[Specify the governing law of this LC.]

Please be advised that any amendments or modifications to this LC will require the agreement of all parties involved.

This Transferable Letter of Credit is valid for negotiation and will expire on [Expiry Date of the LC]. All documents required under this LC must be presented on or before the expiry date at [Issuing Bank's Address].

If you have any questions or require further information, please do not hesitate to contact us.

Sincerely,

[Issuing Bank Officer's Name]

[Title/Position]

[Issuing Bank's Name]

[Contact Information]

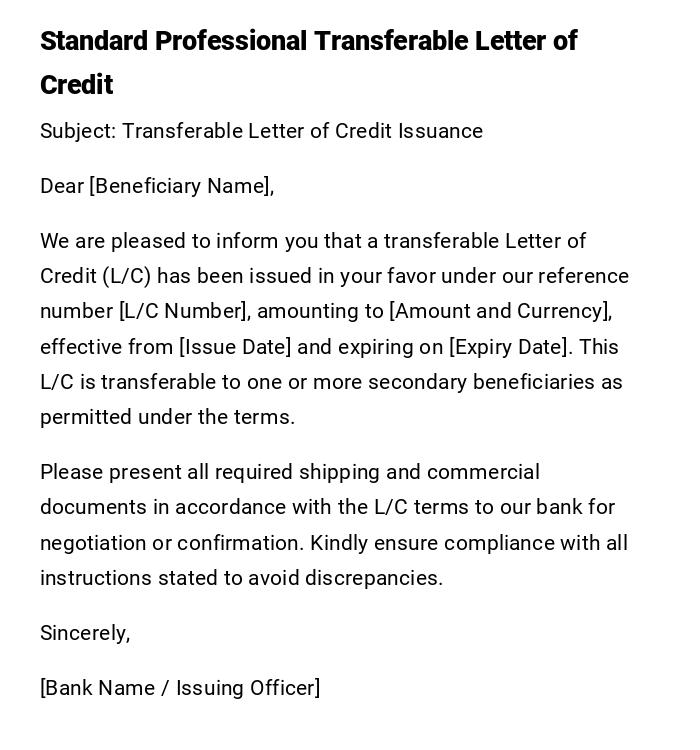

Transferable Letter of Credit – Standard Template

Subject: Transferable Letter of Credit Issuance

Dear [Beneficiary Name],

We are pleased to inform you that a transferable Letter of Credit (L/C) has been issued in your favor under our reference number [L/C Number], amounting to [Amount and Currency], effective from [Issue Date] and expiring on [Expiry Date]. This L/C is transferable to one or more secondary beneficiaries as permitted under the terms.

Please present all required shipping and commercial documents in accordance with the L/C terms to our bank for negotiation or confirmation. Kindly ensure compliance with all instructions stated to avoid discrepancies.

Sincerely,

[Bank Name / Issuing Officer]

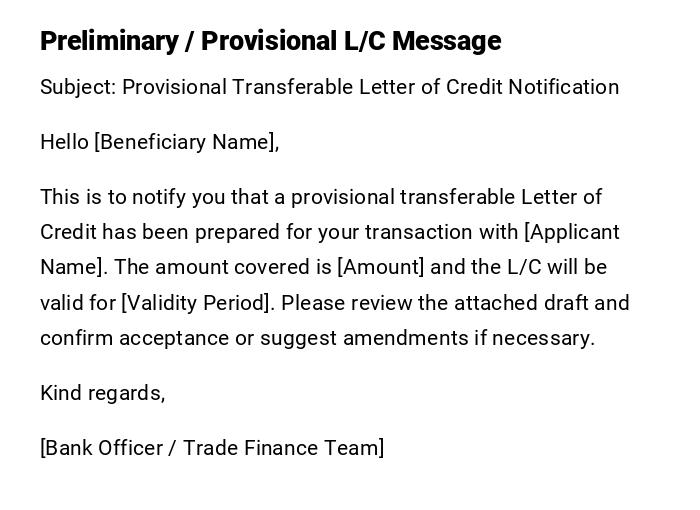

Transferable Letter of Credit – Preliminary Approval

Subject: Provisional Transferable Letter of Credit Notification

Hello [Beneficiary Name],

This is to notify you that a provisional transferable Letter of Credit has been prepared for your transaction with [Applicant Name]. The amount covered is [Amount] and the L/C will be valid for [Validity Period]. Please review the attached draft and confirm acceptance or suggest amendments if necessary.

Kind regards,

[Bank Officer / Trade Finance Team]

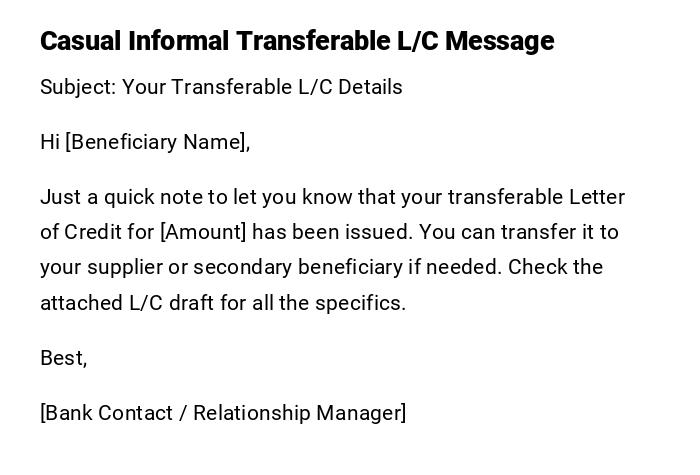

Transferable Letter of Credit – Informal Message

Subject: Your Transferable L/C Details

Hi [Beneficiary Name],

Just a quick note to let you know that your transferable Letter of Credit for [Amount] has been issued. You can transfer it to your supplier or secondary beneficiary if needed. Check the attached L/C draft for all the specifics.

Best,

[Bank Contact / Relationship Manager]

Transferable Letter of Credit – Urgent Notification

Subject: Urgent – Transferable L/C Issued

Dear [Beneficiary Name],

This is an urgent notification that your transferable Letter of Credit under reference [L/C Number] has been issued and is now effective. Immediate action may be required to facilitate the first transfer to the nominated beneficiary. Please review and respond without delay.

Regards,

[Bank Officer]

Transferable Letter of Credit – Heartfelt Message

Subject: Transferable Letter of Credit Confirmation

Dear [Beneficiary Name],

We are delighted to confirm the issuance of a transferable Letter of Credit in your favor. This facility is designed to support your trade activities seamlessly and allow flexibility in transferring the credit to your partners. We look forward to seeing your business thrive through this arrangement.

Warm regards,

[Bank Officer / Trade Services Team]

What is a Transferable Letter of Credit and why it is important

- A transferable Letter of Credit (L/C) is a financial document issued by a bank allowing the beneficiary to transfer all or part of the credit to a secondary beneficiary.

- Purpose: Facilitates international trade, especially when intermediaries are involved.

- Importance: Provides security to both buyer and seller by guaranteeing payment upon compliance with L/C terms.

- It allows intermediaries or suppliers to receive payment directly without altering the original trade agreement.

Who should issue or send a Transferable Letter of Credit

- Typically issued by a bank or financial institution on behalf of an applicant (buyer or importer).

- Should be sent by authorized bank officers familiar with trade finance rules.

- The sender may also include corporate finance teams or trade consultants handling international transactions.

Whom should receive a Transferable Letter of Credit

- Primary beneficiary: Usually the exporter or supplier who fulfills the trade contract.

- Secondary beneficiaries: Other suppliers or subcontractors who may receive funds through the transfer.

- Sometimes forwarded to logistics or shipping agents if documents require physical delivery.

When is a Transferable Letter of Credit applicable

- When a buyer wants to ensure payment to a supplier via a bank guarantee.

- In multi-tiered supply chains requiring payments to secondary beneficiaries.

- During international trade involving intermediaries or agents.

- When risk management is necessary to secure both parties’ obligations.

How to write and send a Transferable Letter of Credit

- Identify all parties involved: applicant, primary beneficiary, secondary beneficiary(s).

- Specify all terms: amount, currency, expiry, documents required, and transfer conditions.

- Draft in a formal or professional tone suitable for banking standards.

- Confirm compliance with UCP 600 or relevant banking rules.

- Send digitally or physically depending on the bank’s procedures.

Quantities and values to consider in a Transferable L/C

- Total credit amount: specify exact currency and amount.

- Number of transfers allowed: some L/Cs allow partial or multiple transfers.

- Expiry dates and validity periods should be precise.

- Include contingencies for partial shipment and multiple beneficiaries if applicable.

Frequently Asked Questions (FAQ) about Transferable Letters of Credit

- Can the L/C be partially transferred? Yes, if the terms allow partial transfers.

- Who bears the risk during transfer? The issuing bank remains responsible for payment under compliance.

- Can a transferable L/C be amended? Yes, but amendments require agreement of all parties.

- Is a transferable L/C irrevocable? Usually yes, most transferable L/Cs are irrevocable.

- Can secondary beneficiaries further transfer the L/C? Only if explicitly allowed in the original terms.

Requirements and Prerequisites before issuing a Transferable L/C

- Signed contract or purchase agreement between buyer and primary beneficiary.

- Identification and verification of all parties involved.

- Bank account details for transfer of funds.

- Agreement on documents required (invoices, bills of lading, insurance documents).

- Compliance with international banking standards (e.g., UCP 600).

Formatting and style for Transferable Letters of Credit

- Length: concise yet detailed enough to include all conditions.

- Tone: professional, formal, or preliminary depending on context.

- Wording: clear, unambiguous, and compliant with banking standards.

- Style: Standardized banking templates preferred; informal messages only for internal communication.

- Mode: Email for notifications, printed letter for formal issuance.

- Etiquette: Ensure accuracy, clarity, and official authorization.

After Sending / Follow-up actions

- Confirm receipt with the beneficiary or secondary beneficiaries.

- Track document presentation and negotiation status.

- Respond promptly to queries or discrepancies reported by beneficiaries.

- Ensure all transfers comply with the original L/C terms.

Pros and Cons of using a Transferable Letter of Credit

Pros:

- Provides payment security to sellers.

- Allows flexibility for multiple suppliers or intermediaries.

- Reduces risk in complex international transactions.

Cons:

- Requires strict compliance with banking regulations.

- Complex documentation may lead to delays if mishandled.

- Partial transfers may complicate financial tracking.

Tricks and Tips for effective Transferable L/C usage

- Always specify clearly whether partial transfers are allowed.

- Maintain an organized checklist of required documents.

- Double-check beneficiary details to avoid transfer errors.

- Communicate proactively with secondary beneficiaries.

- Use draft L/C notifications to prevent mistakes before issuance.

Common mistakes to avoid

- Allowing transfers without clearly stating limits or conditions.

- Omitting critical documents or terms in the L/C.

- Using informal or ambiguous wording in official L/Cs.

- Failing to track expiry dates and deadlines for presentation.

- Not confirming receipt or acknowledgment from beneficiaries.

Elements and Structure of a Transferable Letter of Credit

- Subject line: clearly states “Transferable Letter of Credit.”

- Salutation and greeting to beneficiary.

- Credit amount, currency, and reference number.

- Expiry date and validity period.

- Transfer instructions: full or partial, number of transfers allowed.

- Documents required for payment: invoice, bill of lading, insurance, etc.

- Closing with bank officer signature and contact information.

- Optional attachments: draft L/C, contracts, supporting documents.

Does a Transferable Letter of Credit require attestation or authorization

- Yes, it requires official authorization from the issuing bank.

- Attestation ensures legal enforceability and compliance with banking regulations.

- Some banks may require additional verification if international jurisdictions are involved.

Download Word Doc

Download Word Doc

Download PDF

Download PDF