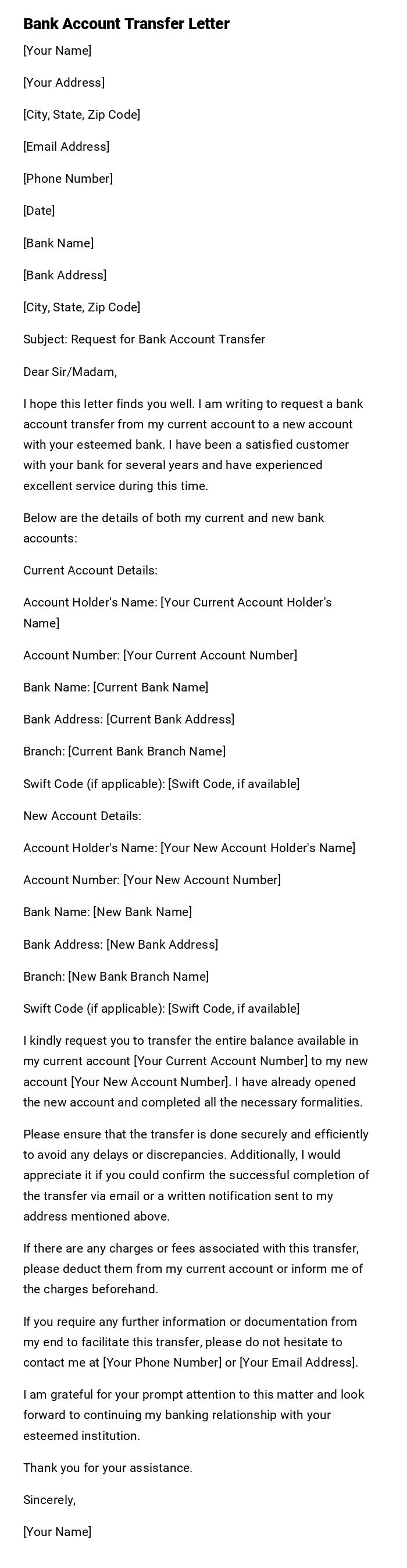

Bank Account Transfer Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Bank Address]

[City, State, Zip Code]

Subject: Request for Bank Account Transfer

Dear Sir/Madam,

I hope this letter finds you well. I am writing to request a bank account transfer from my current account to a new account with your esteemed bank. I have been a satisfied customer with your bank for several years and have experienced excellent service during this time.

Below are the details of both my current and new bank accounts:

Current Account Details:

Account Holder's Name: [Your Current Account Holder's Name]

Account Number: [Your Current Account Number]

Bank Name: [Current Bank Name]

Bank Address: [Current Bank Address]

Branch: [Current Bank Branch Name]

Swift Code (if applicable): [Swift Code, if available]

New Account Details:

Account Holder's Name: [Your New Account Holder's Name]

Account Number: [Your New Account Number]

Bank Name: [New Bank Name]

Bank Address: [New Bank Address]

Branch: [New Bank Branch Name]

Swift Code (if applicable): [Swift Code, if available]

I kindly request you to transfer the entire balance available in my current account [Your Current Account Number] to my new account [Your New Account Number]. I have already opened the new account and completed all the necessary formalities.

Please ensure that the transfer is done securely and efficiently to avoid any delays or discrepancies. Additionally, I would appreciate it if you could confirm the successful completion of the transfer via email or a written notification sent to my address mentioned above.

If there are any charges or fees associated with this transfer, please deduct them from my current account or inform me of the charges beforehand.

If you require any further information or documentation from my end to facilitate this transfer, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

I am grateful for your prompt attention to this matter and look forward to continuing my banking relationship with your esteemed institution.

Thank you for your assistance.

Sincerely,

[Your Name]

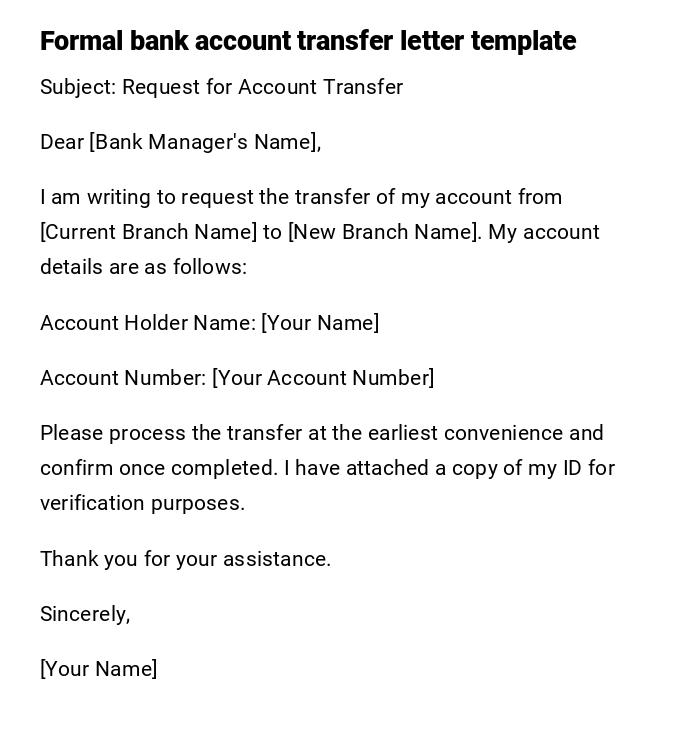

Formal Bank Account Transfer Letter

Subject: Request for Account Transfer

Dear [Bank Manager's Name],

I am writing to request the transfer of my account from [Current Branch Name] to [New Branch Name]. My account details are as follows:

Account Holder Name: [Your Name]

Account Number: [Your Account Number]

Please process the transfer at the earliest convenience and confirm once completed. I have attached a copy of my ID for verification purposes.

Thank you for your assistance.

Sincerely,

[Your Name]

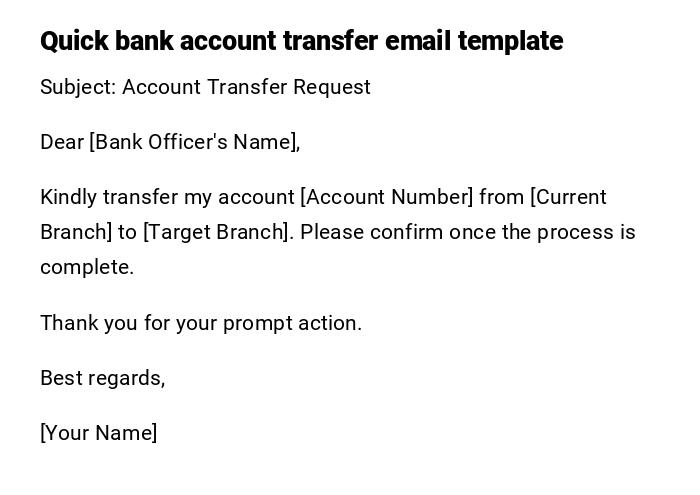

Quick Bank Account Transfer Email

Subject: Account Transfer Request

Dear [Bank Officer's Name],

Kindly transfer my account [Account Number] from [Current Branch] to [Target Branch]. Please confirm once the process is complete.

Thank you for your prompt action.

Best regards,

[Your Name]

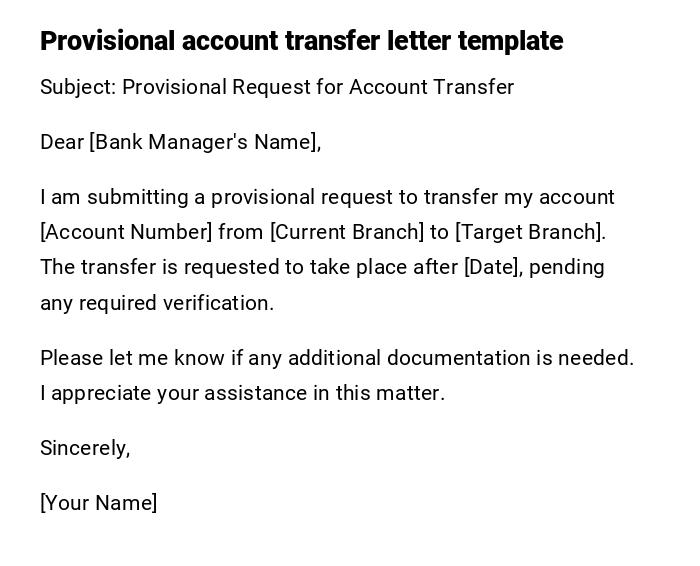

Provisional Account Transfer Letter

Subject: Provisional Request for Account Transfer

Dear [Bank Manager's Name],

I am submitting a provisional request to transfer my account [Account Number] from [Current Branch] to [Target Branch]. The transfer is requested to take place after [Date], pending any required verification.

Please let me know if any additional documentation is needed. I appreciate your assistance in this matter.

Sincerely,

[Your Name]

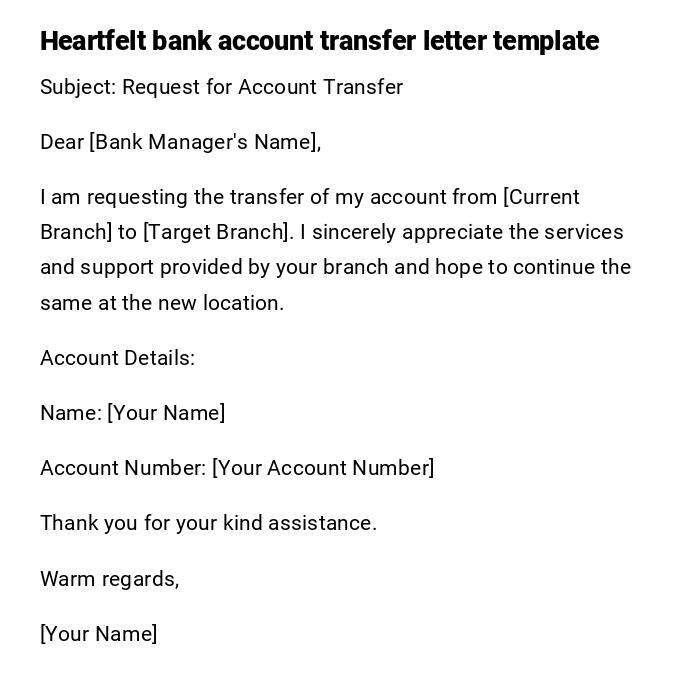

Heartfelt Thank You Bank Account Transfer Letter

Subject: Request for Account Transfer

Dear [Bank Manager's Name],

I am requesting the transfer of my account from [Current Branch] to [Target Branch]. I sincerely appreciate the services and support provided by your branch and hope to continue the same at the new location.

Account Details:

Name: [Your Name]

Account Number: [Your Account Number]

Thank you for your kind assistance.

Warm regards,

[Your Name]

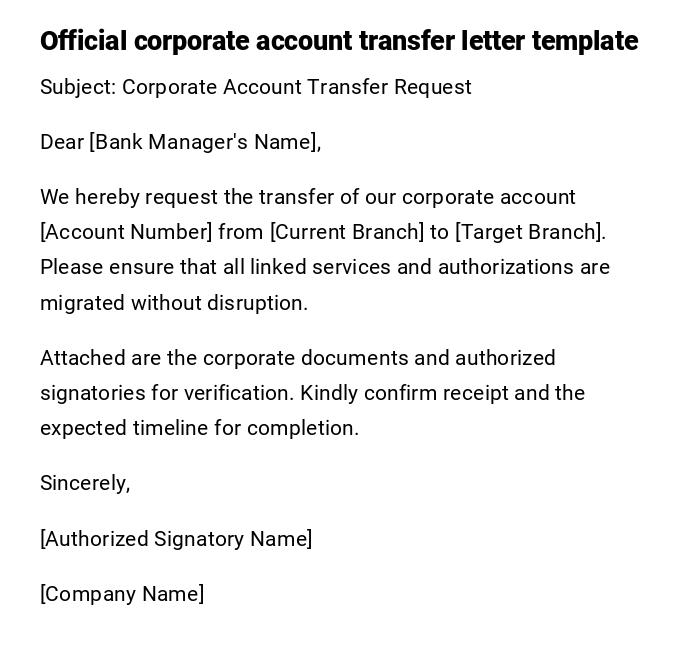

Official Account Transfer Letter for Corporate Clients

Subject: Corporate Account Transfer Request

Dear [Bank Manager's Name],

We hereby request the transfer of our corporate account [Account Number] from [Current Branch] to [Target Branch]. Please ensure that all linked services and authorizations are migrated without disruption.

Attached are the corporate documents and authorized signatories for verification. Kindly confirm receipt and the expected timeline for completion.

Sincerely,

[Authorized Signatory Name]

[Company Name]

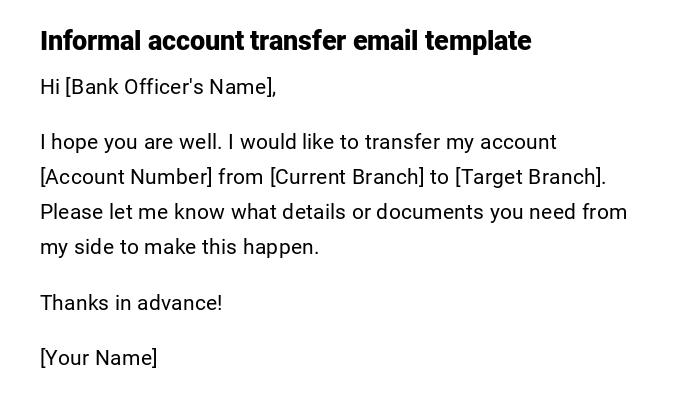

Informal Customer Account Transfer Email

Hi [Bank Officer's Name],

I hope you are well. I would like to transfer my account [Account Number] from [Current Branch] to [Target Branch]. Please let me know what details or documents you need from my side to make this happen.

Thanks in advance!

[Your Name]

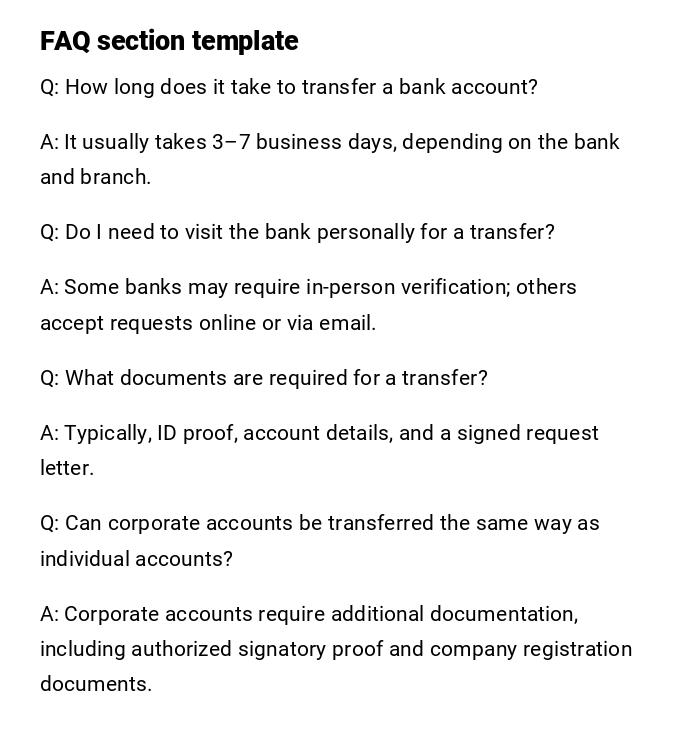

FAQ for Bank Account Transfer Letters

Q: How long does it take to transfer a bank account?

A: It usually takes 3–7 business days, depending on the bank and branch.

Q: Do I need to visit the bank personally for a transfer?

A: Some banks may require in-person verification; others accept requests online or via email.

Q: What documents are required for a transfer?

A: Typically, ID proof, account details, and a signed request letter.

Q: Can corporate accounts be transferred the same way as individual accounts?

A: Corporate accounts require additional documentation, including authorized signatory proof and company registration documents.

What is a Bank Account Transfer Letter and Why It Is Needed

A bank account transfer letter is a formal request submitted by a customer to a bank to move their account from one branch to another.

Reasons for sending such a letter include:

- Convenience due to relocation or proximity to a new branch.

- Access to branch-specific services.

- Streamlining banking operations for corporate or personal purposes.

- Maintaining uninterrupted banking facilities and linked services.

Who Should Send a Bank Account Transfer Letter

- Individual account holders requesting personal account relocation.

- Corporate clients seeking transfer of business accounts.

- Authorized representatives or signatories, if permitted by the bank.

- Any customer intending to change the servicing branch for convenience or operational reasons.

Whom Should the Letter Be Addressed To

- Branch manager of the current branch.

- Customer service officer or relationship manager handling account services.

- Corporate accounts may be addressed to the bank's corporate desk or branch manager.

When to Send a Bank Account Transfer Letter

- Relocating to a new city or area where another branch is more convenient.

- Business or corporate restructuring requiring account consolidation.

- Accessing branch-specific services or facilities unavailable at the current branch.

- Following bank requests or compliance requirements for account reallocation.

How to Write and Send a Bank Account Transfer Letter

- Include a clear subject line: “Request for Account Transfer”.

- Start with a polite greeting addressed to the bank manager or officer.

- Provide complete account details: account number, name, branch details.

- State the target branch for the transfer.

- Attach necessary identification or corporate authorization documents.

- Request confirmation of processing and mention any preferred timelines.

- Sign off professionally with name and contact information.

Formatting Guidelines for Bank Account Transfer Letters

- Length: One page or less, concise and clear.

- Tone: Professional and courteous.

- Style: Formal for official processing; informal for internal branch requests.

- Mode: Physical letter for official record; email may be used for preliminary request.

- Wording: Clear, unambiguous, and polite.

- Etiquette: Avoid unnecessary explanations; focus on factual information.

Requirements and Prerequisites Before Sending the Letter

- Verify current account details and branch information.

- Confirm the target branch has facilities required.

- Prepare any identification or corporate authorization documents.

- Ensure signatures match those on bank records.

- Check bank-specific policies for account transfer requests.

After Sending a Bank Account Transfer Letter

- Follow up with the branch to confirm receipt.

- Keep a copy of the letter or email for records.

- Verify the transfer completion and linked services.

- Ensure no disruption in automated transactions or standing instructions.

Tricks and Tips for a Smooth Bank Account Transfer

- Submit the request well in advance to allow processing time.

- Confirm operational hours and procedures of the target branch.

- Use clear subject lines in emails for quick attention.

- Keep records of all correspondence for future reference.

- Provide complete documentation to avoid delays.

Common Mistakes to Avoid in Bank Account Transfer Letters

- Missing essential account or identification details.

- Not specifying the target branch clearly.

- Sending unsigned letters or incomplete documentation.

- Failing to follow up on the transfer process.

- Assuming immediate processing without confirmation.

Elements and Structure of a Bank Account Transfer Letter

- Subject line: Request for account transfer.

- Polite greeting to bank manager or officer.

- Current account details: account number, holder name, branch.

- Target branch for transfer.

- Reason for transfer (optional but helpful).

- Attachments: ID proof, authorization documents.

- Request for confirmation and timeline.

- Professional closing and signature.

Pros and Cons of Sending a Bank Account Transfer Letter

Pros:

- Ensures formal processing of account relocation.

- Provides documentation for bank and customer records.

- Helps maintain continuity of services and transactions.

Cons:

- Processing may take several business days.

- Errors in details may delay the transfer.

- Some services may require additional verification or approvals.

Comparison with Similar Letters

- Bank Account Closure Letter: Permanently closes account; transfer letter relocates the account.

- Address Change Letter: Updates records without moving the branch; transfer letter affects branch operations.

- Standing Instruction Update: Modifies transaction instructions but does not relocate the account.

- Corporate Authorization Letter: Needed for signatories; transfer letter may require similar documentation for corporate accounts.

Download Word Doc

Download Word Doc

Download PDF

Download PDF