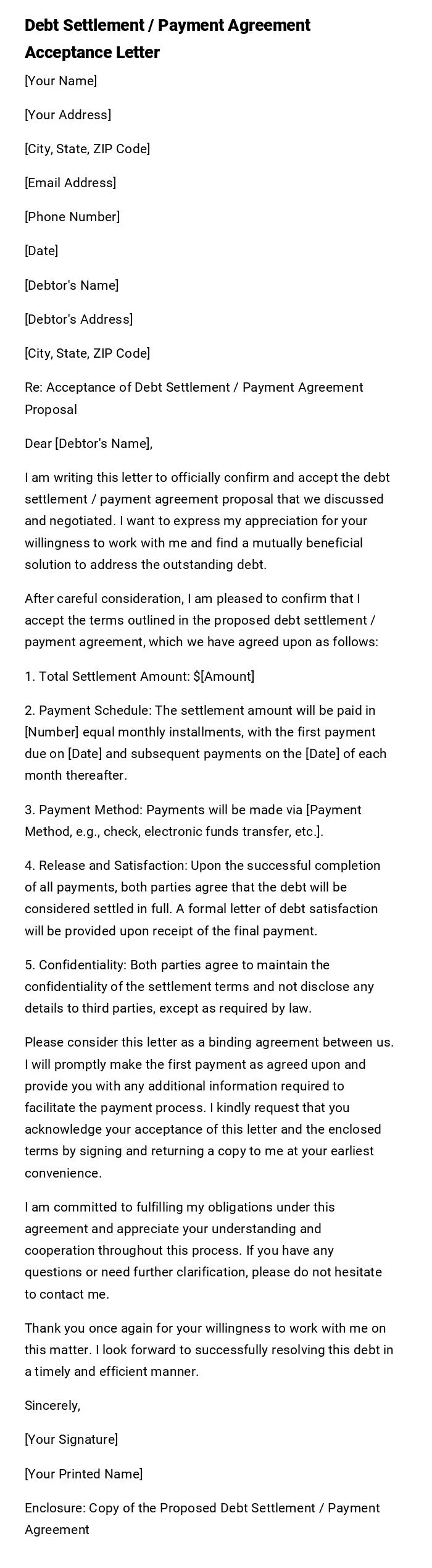

Debt Settlement / Payment Agreement Acceptance Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Debtor's Name]

[Debtor's Address]

[City, State, ZIP Code]

Re: Acceptance of Debt Settlement / Payment Agreement Proposal

Dear [Debtor's Name],

I am writing this letter to officially confirm and accept the debt settlement / payment agreement proposal that we discussed and negotiated. I want to express my appreciation for your willingness to work with me and find a mutually beneficial solution to address the outstanding debt.

After careful consideration, I am pleased to confirm that I accept the terms outlined in the proposed debt settlement / payment agreement, which we have agreed upon as follows:

1. Total Settlement Amount: $[Amount]

2. Payment Schedule: The settlement amount will be paid in [Number] equal monthly installments, with the first payment due on [Date] and subsequent payments on the [Date] of each month thereafter.

3. Payment Method: Payments will be made via [Payment Method, e.g., check, electronic funds transfer, etc.].

4. Release and Satisfaction: Upon the successful completion of all payments, both parties agree that the debt will be considered settled in full. A formal letter of debt satisfaction will be provided upon receipt of the final payment.

5. Confidentiality: Both parties agree to maintain the confidentiality of the settlement terms and not disclose any details to third parties, except as required by law.

Please consider this letter as a binding agreement between us. I will promptly make the first payment as agreed upon and provide you with any additional information required to facilitate the payment process. I kindly request that you acknowledge your acceptance of this letter and the enclosed terms by signing and returning a copy to me at your earliest convenience.

I am committed to fulfilling my obligations under this agreement and appreciate your understanding and cooperation throughout this process. If you have any questions or need further clarification, please do not hesitate to contact me.

Thank you once again for your willingness to work with me on this matter. I look forward to successfully resolving this debt in a timely and efficient manner.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosure: Copy of the Proposed Debt Settlement / Payment Agreement

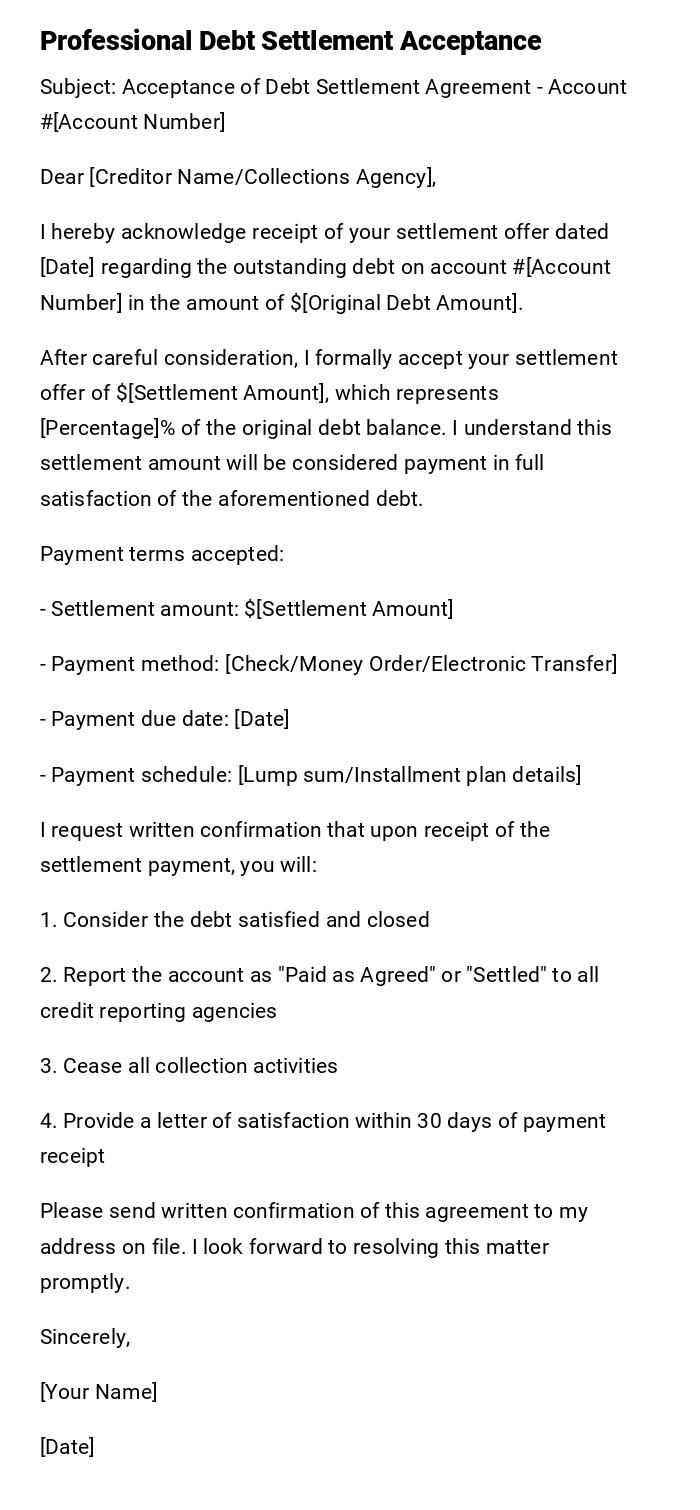

Formal Business Debt Settlement Acceptance Letter

Subject: Acceptance of Debt Settlement Agreement - Account #[Account Number]

Dear [Creditor Name/Collections Agency],

I hereby acknowledge receipt of your settlement offer dated [Date] regarding the outstanding debt on account #[Account Number] in the amount of $[Original Debt Amount].

After careful consideration, I formally accept your settlement offer of $[Settlement Amount], which represents [Percentage]% of the original debt balance. I understand this settlement amount will be considered payment in full satisfaction of the aforementioned debt.

Payment terms accepted:

- Settlement amount: $[Settlement Amount]

- Payment method: [Check/Money Order/Electronic Transfer]

- Payment due date: [Date]

- Payment schedule: [Lump sum/Installment plan details]

I request written confirmation that upon receipt of the settlement payment, you will:

1. Consider the debt satisfied and closed

2. Report the account as "Paid as Agreed" or "Settled" to all credit reporting agencies

3. Cease all collection activities

4. Provide a letter of satisfaction within 30 days of payment receipt

Please send written confirmation of this agreement to my address on file. I look forward to resolving this matter promptly.

Sincerely,

[Your Name]

[Date]

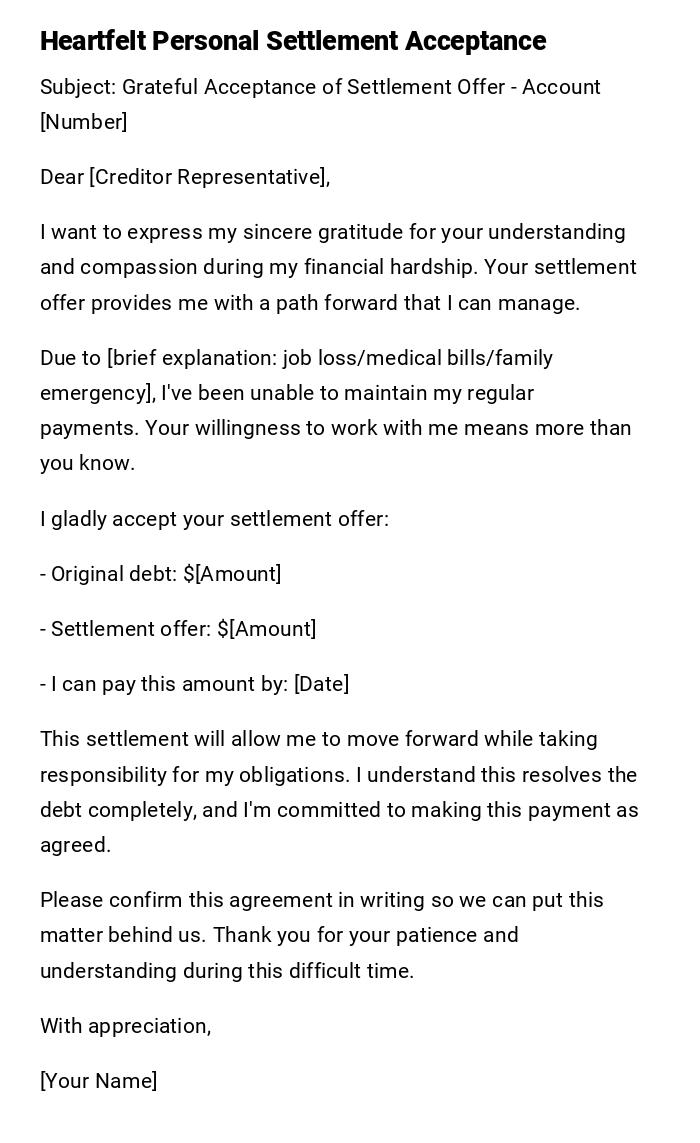

Personal Hardship Debt Settlement Acceptance Email

Subject: Grateful Acceptance of Settlement Offer - Account [Number]

Dear [Creditor Representative],

I want to express my sincere gratitude for your understanding and compassion during my financial hardship. Your settlement offer provides me with a path forward that I can manage.

Due to [brief explanation: job loss/medical bills/family emergency], I've been unable to maintain my regular payments. Your willingness to work with me means more than you know.

I gladly accept your settlement offer:

- Original debt: $[Amount]

- Settlement offer: $[Amount]

- I can pay this amount by: [Date]

This settlement will allow me to move forward while taking responsibility for my obligations. I understand this resolves the debt completely, and I'm committed to making this payment as agreed.

Please confirm this agreement in writing so we can put this matter behind us. Thank you for your patience and understanding during this difficult time.

With appreciation,

[Your Name]

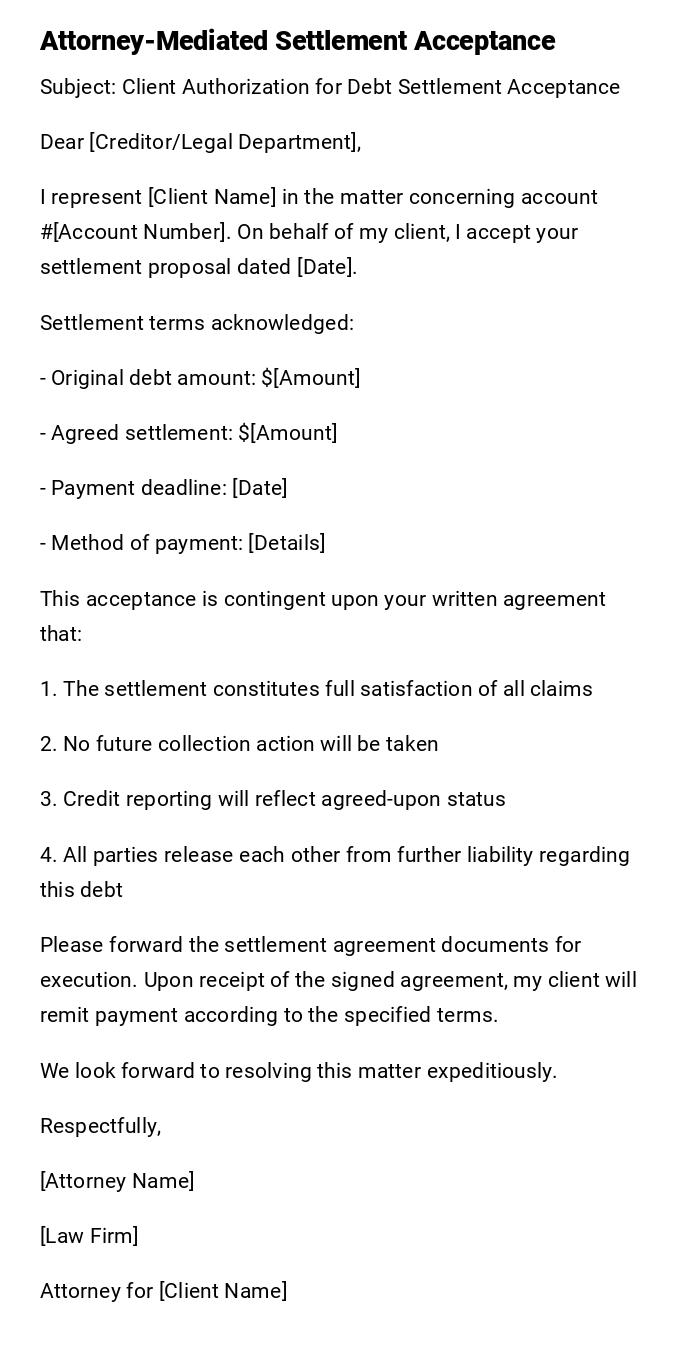

Legal Representative Debt Settlement Acceptance Letter

Subject: Client Authorization for Debt Settlement Acceptance

Dear [Creditor/Legal Department],

I represent [Client Name] in the matter concerning account #[Account Number]. On behalf of my client, I accept your settlement proposal dated [Date].

Settlement terms acknowledged:

- Original debt amount: $[Amount]

- Agreed settlement: $[Amount]

- Payment deadline: [Date]

- Method of payment: [Details]

This acceptance is contingent upon your written agreement that:

1. The settlement constitutes full satisfaction of all claims

2. No future collection action will be taken

3. Credit reporting will reflect agreed-upon status

4. All parties release each other from further liability regarding this debt

Please forward the settlement agreement documents for execution. Upon receipt of the signed agreement, my client will remit payment according to the specified terms.

We look forward to resolving this matter expeditiously.

Respectfully,

[Attorney Name]

[Law Firm]

Attorney for [Client Name]

Small Business Debt Settlement Acceptance Message

Subject: Business Debt Settlement Agreement Acceptance - Invoice #[Number]

Dear [Business Partner/Vendor],

Thank you for your flexibility in offering a settlement arrangement for our outstanding invoice #[Number] dated [Date].

[Business Name] accepts your settlement proposal:

- Outstanding amount: $[Amount]

- Settlement amount: $[Amount]

- Payment terms: [Details]

We appreciate your understanding of our current cash flow situation and your willingness to work with us to resolve this matter. This settlement will help preserve our business relationship while addressing the outstanding obligation.

Our accounting department will process payment according to the agreed schedule. Please provide a formal settlement agreement for our records, and confirm that this payment will close the account.

We value our business relationship and look forward to future transactions under normal payment terms.

Best regards,

[Your Name]

[Title]

[Business Name]

Medical Debt Settlement Acceptance Email

Subject: Acceptance of Medical Debt Settlement Offer - Patient Account [Number]

Dear [Healthcare Provider/Billing Department],

I am writing to accept the settlement offer for my medical debt from treatment received on [Date(s)] for [brief description if comfortable sharing].

Settlement details accepted:

- Patient Account: [Number]

- Original charges: $[Amount]

- Settlement offer: $[Amount]

- Payment plan: [Lump sum/Monthly payments of $X for X months]

Given my current financial circumstances, this settlement arrangement allows me to resolve my obligation while managing my ongoing healthcare needs. I'm grateful for your willingness to work with patients facing financial difficulties.

Please send written confirmation of this agreement and update my account accordingly. I will submit payment by [Date] as agreed.

Thank you for your understanding and quality care.

Sincerely,

[Patient Name]

[Date of Birth for account verification]

Credit Card Debt Settlement Acceptance Letter

Subject: Formal Acceptance - Settlement Agreement for Account [Last 4 digits]

Dear [Credit Card Company],

I acknowledge receipt of your settlement offer dated [Date] for my credit card account ending in [Last 4 digits].

After reviewing my financial situation, I accept the following settlement terms:

- Current balance: $[Amount]

- Settlement amount: $[Amount]

- Discount: $[Amount] ([Percentage]%)

- Payment due: [Date]

I understand that accepting this settlement may impact my credit score, but it allows me to resolve this debt responsibly given my current circumstances.

Conditions for acceptance:

1. Written confirmation that settlement satisfies the debt in full

2. Agreement to cease collection calls and correspondence

3. Proper reporting to credit bureaus as agreed

4. No tax implications beyond standard 1099-C if applicable

Please provide written confirmation of these terms. I will submit payment via [Method] by the specified deadline.

Thank you for offering this settlement option.

Respectfully,

[Your Name]

Account Holder

Student Loan Settlement Acceptance Message

Subject: Acceptance of Student Loan Settlement - Loan ID [Number]

Dear [Loan Servicer/Collections Agency],

I am writing to formally accept the settlement offer for my defaulted student loan(s) with ID number [Number].

Your settlement proposal:

- Outstanding principal and interest: $[Amount]

- Settlement amount: $[Amount]

- Payment schedule: [Terms]

I accept these terms and understand that this settlement resolves my obligation under this loan agreement. This settlement enables me to move forward financially while addressing my educational debt responsibility.

I request written documentation confirming:

- The loan(s) will be considered satisfied upon payment

- Collection activities will cease

- Credit reporting agencies will be notified appropriately

- My loan rehabilitation/consolidation options, if any

Please send the settlement agreement for my records. I am prepared to begin payments immediately upon confirmation.

Thank you for providing this opportunity to resolve my student loan debt.

Sincerely,

[Your Name]

SSN: [Last 4 digits for verification]

What is a Debt Settlement Acceptance Letter and Why Do You Need One

A debt settlement acceptance letter is a formal written document that confirms your agreement to a creditor's or collection agency's settlement offer for a debt you owe. This letter serves as legal documentation that you accept specific terms to pay less than the full amount owed in exchange for considering the debt satisfied.

The primary purposes include:

- Creating a paper trail of the agreed settlement terms

- Protecting yourself from future collection attempts

- Establishing clear payment expectations and deadlines

- Ensuring both parties understand the agreement conditions

- Providing evidence for credit reporting purposes

- Demonstrating good faith effort to resolve the debt responsibly

Who Should Send a Debt Settlement Acceptance Letter

- Individual debtors who have received settlement offers from creditors or collection agencies

- Business owners accepting settlement terms for commercial debts or vendor obligations

- Legal representatives acting on behalf of clients in debt settlement negotiations

- Estate executors settling debts of deceased individuals

- Financial advisors authorized to handle client debt settlements

- Bankruptcy attorneys negotiating pre-filing settlements for clients

- Debt management companies representing multiple debtors in settlement programs

When to Send a Debt Settlement Acceptance Letter

Settlement acceptance letters should be sent when:

- You receive a formal settlement offer that meets your financial capabilities

- After unsuccessful attempts at full payment arrangements

- Before the settlement offer expires (most offers have time limits)

- When facing potential legal action from creditors

- During financial hardship periods (job loss, medical emergencies, business closure)

- As part of debt consolidation or management programs

- When seeking to avoid bankruptcy proceedings

- After negotiating better terms than initially offered

- Before any payment is made to ensure terms are documented

How to Write and Send Your Settlement Acceptance Letter

Start by carefully reviewing the settlement offer to understand all terms and conditions. Document the original debt amount, settlement amount, payment deadline, and any special conditions.

Write your letter professionally, including:

- Clear subject line referencing account numbers

- Acknowledgment of receiving the settlement offer

- Explicit acceptance of specific terms

- Request for written confirmation

- Your contact information and preferred communication method

Send the letter via certified mail with return receipt for paper correspondence, or use email with read receipts for electronic communication. Keep copies of all correspondence and track delivery confirmation.

Follow up within 48-72 hours to confirm receipt if you don't receive acknowledgment. Maintain detailed records of all communications throughout the settlement process.

Requirements and Prerequisites Before Sending Your Letter

Before accepting any settlement offer, ensure you:

- Have verified the debt legitimacy and amount owed

- Reviewed your complete financial situation and budget

- Confirmed you can meet the payment terms without further hardship

- Understood tax implications of forgiven debt (1099-C forms)

- Consulted with a financial advisor or attorney if the amount is substantial

- Gathered all relevant account documentation and correspondence

- Confirmed the settlement offer is from an authorized representative

- Determined the impact on your credit score and future creditworthiness

- Checked state statutes of limitations on debt collection

- Considered alternatives like payment plans or hardship programs

Formatting Guidelines for Settlement Acceptance Letters

Keep letters between 200-400 words for clarity and professionalism. Use formal business letter format for serious debts over $5,000, and more casual email format for smaller personal debts.

Maintain a respectful, professional tone regardless of previous negative interactions. Include specific details like account numbers, dates, and dollar amounts to avoid confusion.

Send via certified mail for legal protection with debts over $1,000, or secure email for smaller amounts. Always request written confirmation of the agreement before making any payments.

Use clear, simple language avoiding legal jargon unless working with attorneys. Include deadlines and specific payment methods to prevent misunderstandings about settlement terms.

Follow-up Actions After Sending Your Acceptance Letter

Wait for written confirmation before making any payments to ensure terms are properly documented. Track your letter delivery and follow up within one week if you haven't received acknowledgment.

Once confirmed, make payments exactly as agreed and keep detailed payment records including receipts, bank statements, and correspondence. Monitor your credit report after settlement completion to ensure accurate reporting.

Obtain a satisfaction letter once payment is complete, confirming the debt is resolved. Keep all settlement documentation permanently for future reference and potential disputes.

If the creditor doesn't honor the agreement terms, document the breach and consider legal consultation. Continue monitoring for any unauthorized collection attempts after settlement completion.

Common Mistakes to Avoid When Accepting Debt Settlements

Never make payments before receiving written settlement confirmation, as verbal agreements lack legal protection. Avoid accepting settlement terms you cannot realistically meet, as this may worsen your situation.

Don't ignore tax implications of forgiven debt amounts over $600, which may be reported as income. Resist pressure to accept the first offer without negotiating better terms when possible.

Never provide bank account information for automatic withdrawals without thoroughly reviewing terms and maintaining control over payment timing. Avoid settling without understanding how the agreement affects your credit report.

Don't assume all collection activity will stop immediately; some third-party agencies may not receive immediate notification. Prevent future problems by keeping comprehensive records of all settlement communications and payments.

Essential Elements Your Settlement Letter Must Include

Your letter must contain specific account identification including account numbers, original creditor names, and debt amounts. Include exact settlement terms with dollar amounts, payment deadlines, and accepted payment methods.

Clearly state your understanding that the settlement amount represents full satisfaction of the debt. Request specific written confirmation of the agreement terms and credit reporting procedures.

Include your current contact information and preferred communication methods for future correspondence. Add any special conditions or requirements you need met as part of the settlement agreement.

Reference the original settlement offer date and any previous correspondence to maintain clear communication history. Specify consequences if either party fails to meet the agreed terms and conditions.

Download Word Doc

Download Word Doc

Download PDF

Download PDF