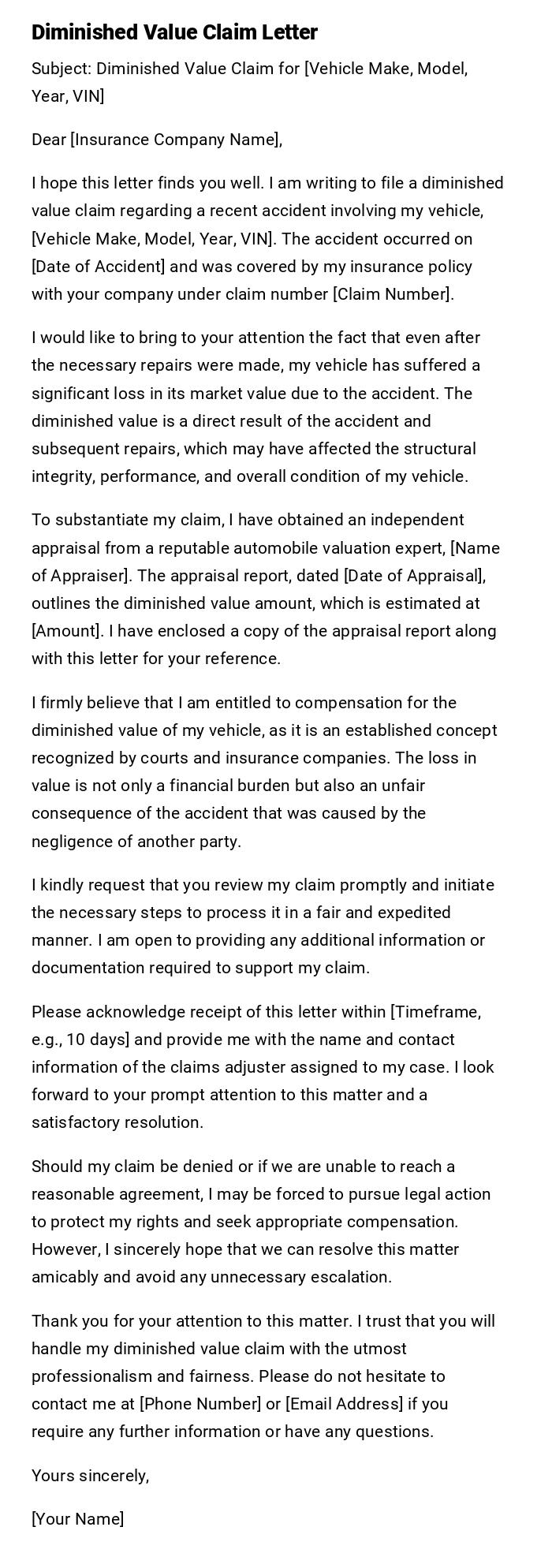

Diminished Value Claim Letter

Subject: Diminished Value Claim for [Vehicle Make, Model, Year, VIN]

Dear [Insurance Company Name],

I hope this letter finds you well. I am writing to file a diminished value claim regarding a recent accident involving my vehicle, [Vehicle Make, Model, Year, VIN]. The accident occurred on [Date of Accident] and was covered by my insurance policy with your company under claim number [Claim Number].

I would like to bring to your attention the fact that even after the necessary repairs were made, my vehicle has suffered a significant loss in its market value due to the accident. The diminished value is a direct result of the accident and subsequent repairs, which may have affected the structural integrity, performance, and overall condition of my vehicle.

To substantiate my claim, I have obtained an independent appraisal from a reputable automobile valuation expert, [Name of Appraiser]. The appraisal report, dated [Date of Appraisal], outlines the diminished value amount, which is estimated at [Amount]. I have enclosed a copy of the appraisal report along with this letter for your reference.

I firmly believe that I am entitled to compensation for the diminished value of my vehicle, as it is an established concept recognized by courts and insurance companies. The loss in value is not only a financial burden but also an unfair consequence of the accident that was caused by the negligence of another party.

I kindly request that you review my claim promptly and initiate the necessary steps to process it in a fair and expedited manner. I am open to providing any additional information or documentation required to support my claim.

Please acknowledge receipt of this letter within [Timeframe, e.g., 10 days] and provide me with the name and contact information of the claims adjuster assigned to my case. I look forward to your prompt attention to this matter and a satisfactory resolution.

Should my claim be denied or if we are unable to reach a reasonable agreement, I may be forced to pursue legal action to protect my rights and seek appropriate compensation. However, I sincerely hope that we can resolve this matter amicably and avoid any unnecessary escalation.

Thank you for your attention to this matter. I trust that you will handle my diminished value claim with the utmost professionalism and fairness. Please do not hesitate to contact me at [Phone Number] or [Email Address] if you require any further information or have any questions.

Yours sincerely,

[Your Name]

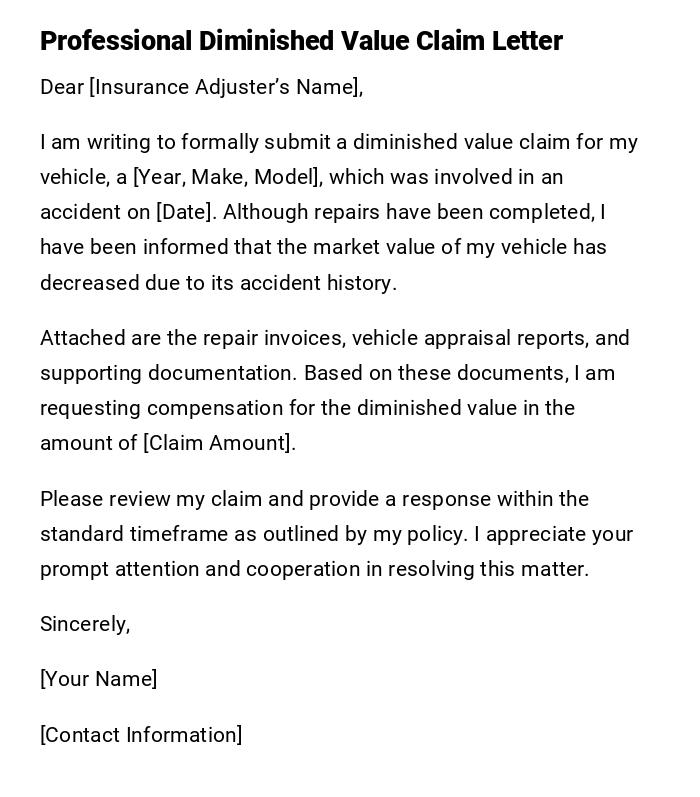

Professional Diminished Value Claim Letter

Dear [Insurance Adjuster’s Name],

I am writing to formally submit a diminished value claim for my vehicle, a [Year, Make, Model], which was involved in an accident on [Date]. Although repairs have been completed, I have been informed that the market value of my vehicle has decreased due to its accident history.

Attached are the repair invoices, vehicle appraisal reports, and supporting documentation. Based on these documents, I am requesting compensation for the diminished value in the amount of [Claim Amount].

Please review my claim and provide a response within the standard timeframe as outlined by my policy. I appreciate your prompt attention and cooperation in resolving this matter.

Sincerely,

[Your Name]

[Contact Information]

Casual Diminished Value Email

Hi [Adjuster's Name],

I’m reaching out regarding my car, a [Year, Make, Model], which was in an accident on [Date]. Even though the repairs are done, I understand the car has lost some of its market value.

I’d like to submit a claim for this diminished value. I’ve attached all the necessary repair receipts and appraisal documents. Could you let me know the next steps?

Thanks,

[Your Name]

Formal and Legal Diminished Value Letter

To Whom It May Concern,

This letter constitutes a formal request for compensation due to diminished value of my [Year, Make, Model], which sustained damage in an accident on [Date]. Despite repairs being completed, the vehicle’s market value has been adversely affected.

Enclosed are all supporting documents including appraisals, repair invoices, and photographs. I request the insurance company to assess and remunerate the diminished value in accordance with state law and policy provisions.

Please provide a written response within [X] days.

Sincerely,

[Your Name]

[Contact Information]

Preliminary Diminished Value Notification

Dear [Adjuster's Name],

I am notifying you that I intend to file a diminished value claim for my [Year, Make, Model] involved in an accident on [Date]. Repairs have been completed, but the vehicle’s resale value has decreased.

This notice is preliminary; I will submit detailed documentation shortly, including repair records and independent appraisals.

Thank you for your attention.

Sincerely,

[Your Name]

Quick Diminished Value Claim Message

Hello [Insurance Representative],

I am filing a diminished value claim for my [Year, Make, Model] after the accident on [Date]. Repairs are done, and I have documentation showing the market value loss.

Please advise on the claim process and next steps.

Thank you,

[Your Name]

Detailed Diminished Value Claim Letter With Evidence

Dear [Adjuster's Name],

Following the accident on [Date], my [Year, Make, Model] has been repaired. However, its resale value has significantly decreased. I am submitting a diminished value claim supported by the following:

- Repair invoices and receipts

- Independent vehicle appraisal report

- Photographs of damages pre- and post-repair

- Original purchase documentation

I request an assessment of the vehicle’s current market value and reimbursement for the diminished value. I look forward to your timely response.

Sincerely,

[Your Name]

[Contact Information]

Friendly Diminished Value Claim Email

Hi [Adjuster's Name],

I hope you’re doing well. I’m submitting a claim for the diminished value of my [Year, Make, Model] after the accident on [Date]. Repairs are finished, but its resale value has dropped.

I’ve attached all the supporting documents, including appraisals and invoices. Please let me know if anything else is needed to process this claim.

Thanks a lot,

[Your Name]

What is a Diminished Value Claim Letter and Why It Is Needed

A diminished value claim letter is a formal request to an insurance company for compensation for the loss in market value of a vehicle after repairs from an accident. Purpose:

- Notify the insurance company of the decreased resale value.

- Provide supporting evidence of loss.

- Request compensation as allowed under the policy or law.

Who Should Send a Diminished Value Claim Letter

- Vehicle owners who have experienced a loss in resale value due to an accident.

- Legal representatives acting on behalf of the owner.

- Auto appraisers providing documentation for clients.

Whom the Letter Should Be Addressed To

- Insurance company claims adjuster handling the accident.

- Insurance company claims department if no specific adjuster is assigned.

- Occasionally legal counsel for the insurer if required.

When to Send a Diminished Value Claim Letter

- After repairs are completed on a vehicle.

- Within the time limits specified by the insurance policy or state law.

- When an independent appraisal shows a significant reduction in market value.

- After receiving the initial repair settlement if it does not cover diminished value.

How to Write and Submit a Diminished Value Claim Letter

- Include vehicle details (year, make, model, VIN).

- Describe the accident and date.

- Provide supporting documentation (repair invoices, appraisals, photographs).

- Clearly state the claimed amount.

- Send via certified mail or secure email and keep copies for records.

How Much Compensation to Request

- Base the claim on independent appraisal reports.

- Consider fair market value before and after the accident.

- Provide calculations in the letter for clarity.

- Avoid exaggeration; document all figures with evidence.

Requirements and Prerequisites Before Sending the Letter

- Completed vehicle repairs.

- Copies of all repair invoices.

- Independent appraisal documenting diminished value.

- Policy review to understand coverage and submission requirements.

- Personal or legal contact information for follow-up.

Formatting Guidelines for Diminished Value Claim Letters

- Length: 1–2 pages.

- Tone: Professional, factual, and courteous.

- Structure: Introduction, background, evidence, claim request, closing.

- Attach all supporting documents.

- Send using traceable methods to confirm receipt.

After Sending the Letter: Follow-up Actions

- Confirm receipt with the insurance company.

- Track response deadlines as per policy or legal requirements.

- Respond promptly to any questions or requests for additional documentation.

- Keep all correspondence organized for potential disputes.

Tricks and Tips for a Strong Diminished Value Claim

- Include clear, organized documentation.

- Reference policy terms or state laws supporting the claim.

- Use professional and courteous language to improve cooperation.

- Consider hiring a certified appraiser for credibility.

- Keep a copy of every letter and attachment sent.

Common Mistakes to Avoid

- Failing to provide proof of diminished value.

- Sending the claim after policy or state deadlines.

- Making unsubstantiated or exaggerated claims.

- Omitting vehicle or accident details.

- Not keeping records of submission and communications.

Elements and Structure of a Diminished Value Claim Letter

- Salutation and recipient identification.

- Vehicle information (year, make, model, VIN).

- Date and details of the accident.

- Description of repairs completed.

- Evidence of diminished market value.

- Specific claim amount requested.

- Closing with signature and contact information.

- Attachments: appraisals, invoices, photographs.

Download Word Doc

Download Word Doc

Download PDF

Download PDF