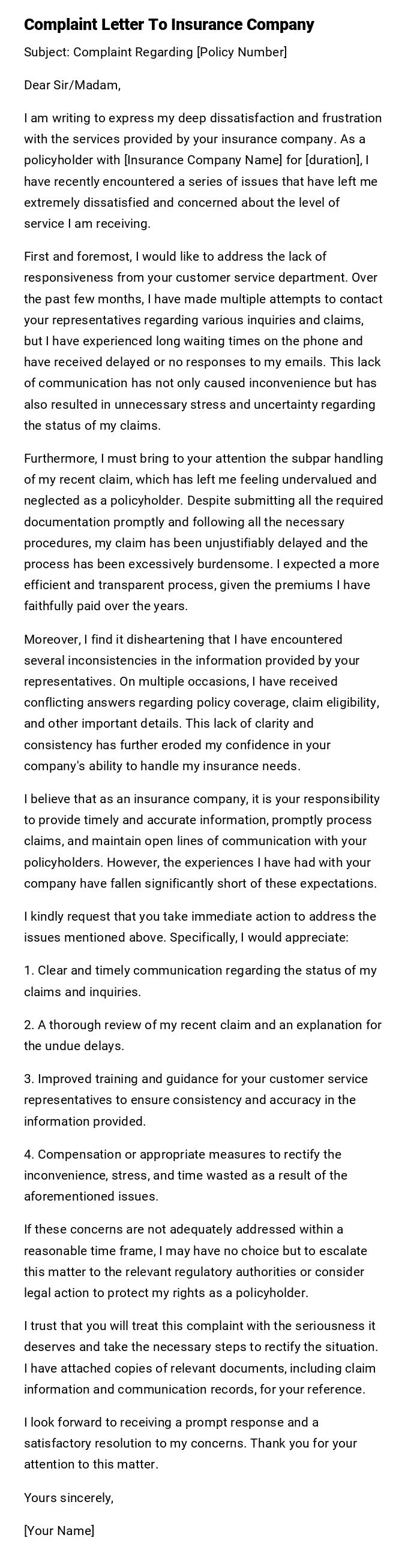

Complaint Letter To Insurance Company

Subject: Complaint Regarding [Policy Number]

Dear Sir/Madam,

I am writing to express my deep dissatisfaction and frustration with the services provided by your insurance company. As a policyholder with [Insurance Company Name] for [duration], I have recently encountered a series of issues that have left me extremely dissatisfied and concerned about the level of service I am receiving.

First and foremost, I would like to address the lack of responsiveness from your customer service department. Over the past few months, I have made multiple attempts to contact your representatives regarding various inquiries and claims, but I have experienced long waiting times on the phone and have received delayed or no responses to my emails. This lack of communication has not only caused inconvenience but has also resulted in unnecessary stress and uncertainty regarding the status of my claims.

Furthermore, I must bring to your attention the subpar handling of my recent claim, which has left me feeling undervalued and neglected as a policyholder. Despite submitting all the required documentation promptly and following all the necessary procedures, my claim has been unjustifiably delayed and the process has been excessively burdensome. I expected a more efficient and transparent process, given the premiums I have faithfully paid over the years.

Moreover, I find it disheartening that I have encountered several inconsistencies in the information provided by your representatives. On multiple occasions, I have received conflicting answers regarding policy coverage, claim eligibility, and other important details. This lack of clarity and consistency has further eroded my confidence in your company's ability to handle my insurance needs.

I believe that as an insurance company, it is your responsibility to provide timely and accurate information, promptly process claims, and maintain open lines of communication with your policyholders. However, the experiences I have had with your company have fallen significantly short of these expectations.

I kindly request that you take immediate action to address the issues mentioned above. Specifically, I would appreciate:

1. Clear and timely communication regarding the status of my claims and inquiries.

2. A thorough review of my recent claim and an explanation for the undue delays.

3. Improved training and guidance for your customer service representatives to ensure consistency and accuracy in the information provided.

4. Compensation or appropriate measures to rectify the inconvenience, stress, and time wasted as a result of the aforementioned issues.

If these concerns are not adequately addressed within a reasonable time frame, I may have no choice but to escalate this matter to the relevant regulatory authorities or consider legal action to protect my rights as a policyholder.

I trust that you will treat this complaint with the seriousness it deserves and take the necessary steps to rectify the situation. I have attached copies of relevant documents, including claim information and communication records, for your reference.

I look forward to receiving a prompt response and a satisfactory resolution to my concerns. Thank you for your attention to this matter.

Yours sincerely,

[Your Name]

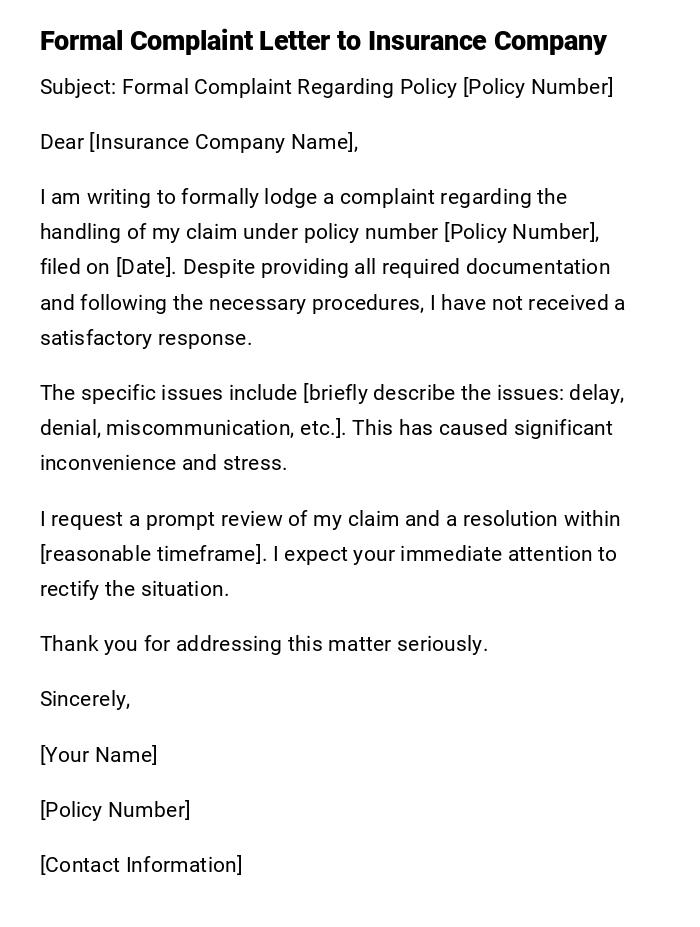

Formal Complaint Letter to Insurance Company

Subject: Formal Complaint Regarding Policy [Policy Number]

Dear [Insurance Company Name],

I am writing to formally lodge a complaint regarding the handling of my claim under policy number [Policy Number], filed on [Date]. Despite providing all required documentation and following the necessary procedures, I have not received a satisfactory response.

The specific issues include [briefly describe the issues: delay, denial, miscommunication, etc.]. This has caused significant inconvenience and stress.

I request a prompt review of my claim and a resolution within [reasonable timeframe]. I expect your immediate attention to rectify the situation.

Thank you for addressing this matter seriously.

Sincerely,

[Your Name]

[Policy Number]

[Contact Information]

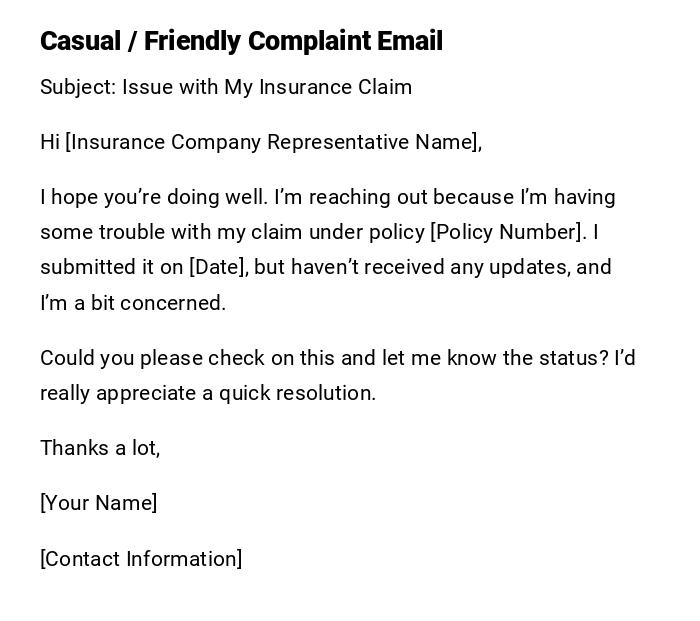

Casual / Friendly Complaint Email

Subject: Issue with My Insurance Claim

Hi [Insurance Company Representative Name],

I hope you’re doing well. I’m reaching out because I’m having some trouble with my claim under policy [Policy Number]. I submitted it on [Date], but haven’t received any updates, and I’m a bit concerned.

Could you please check on this and let me know the status? I’d really appreciate a quick resolution.

Thanks a lot,

[Your Name]

[Contact Information]

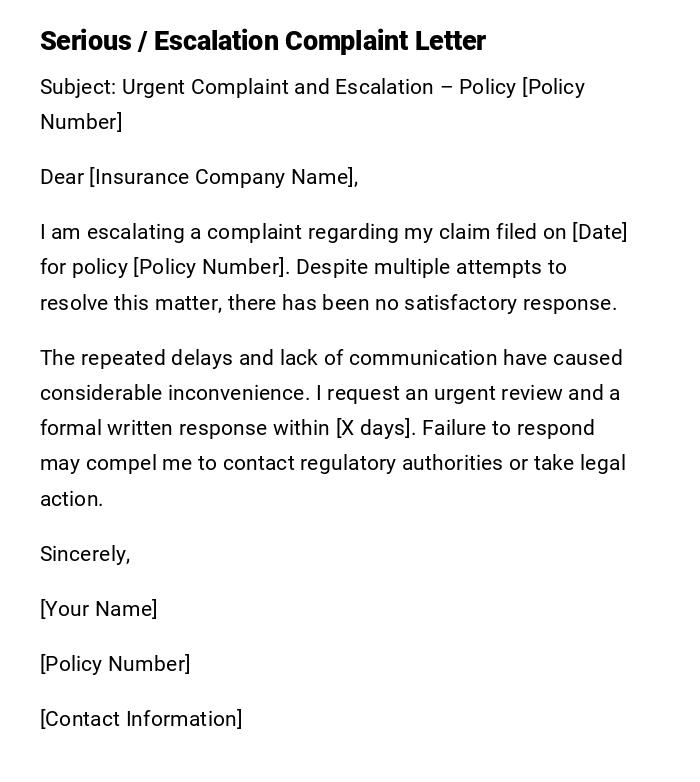

Serious / Escalation Complaint Letter

Subject: Urgent Complaint and Escalation – Policy [Policy Number]

Dear [Insurance Company Name],

I am escalating a complaint regarding my claim filed on [Date] for policy [Policy Number]. Despite multiple attempts to resolve this matter, there has been no satisfactory response.

The repeated delays and lack of communication have caused considerable inconvenience. I request an urgent review and a formal written response within [X days]. Failure to respond may compel me to contact regulatory authorities or take legal action.

Sincerely,

[Your Name]

[Policy Number]

[Contact Information]

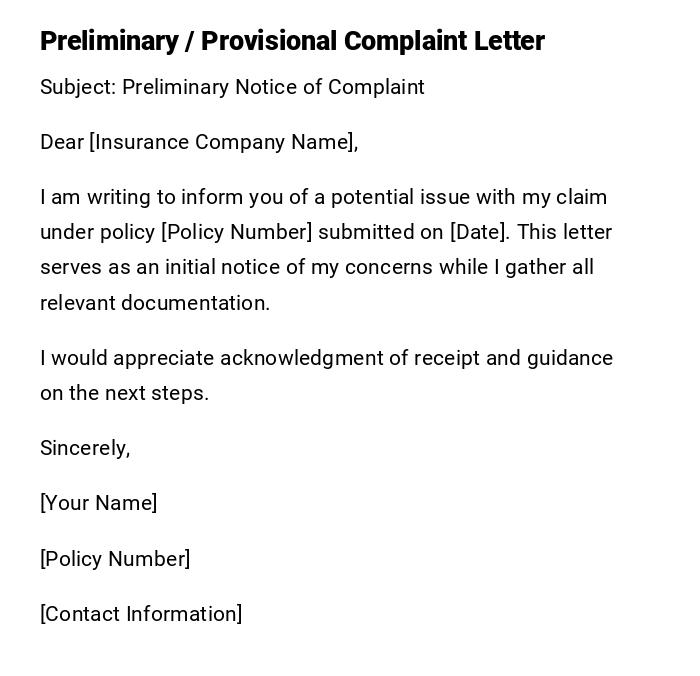

Preliminary / Provisional Complaint Letter

Subject: Preliminary Notice of Complaint

Dear [Insurance Company Name],

I am writing to inform you of a potential issue with my claim under policy [Policy Number] submitted on [Date]. This letter serves as an initial notice of my concerns while I gather all relevant documentation.

I would appreciate acknowledgment of receipt and guidance on the next steps.

Sincerely,

[Your Name]

[Policy Number]

[Contact Information]

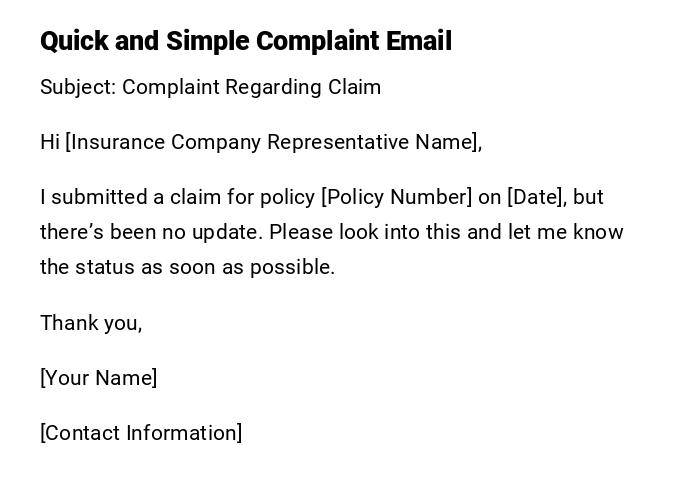

Quick and Simple Complaint Email

Subject: Complaint Regarding Claim

Hi [Insurance Company Representative Name],

I submitted a claim for policy [Policy Number] on [Date], but there’s been no update. Please look into this and let me know the status as soon as possible.

Thank you,

[Your Name]

[Contact Information]

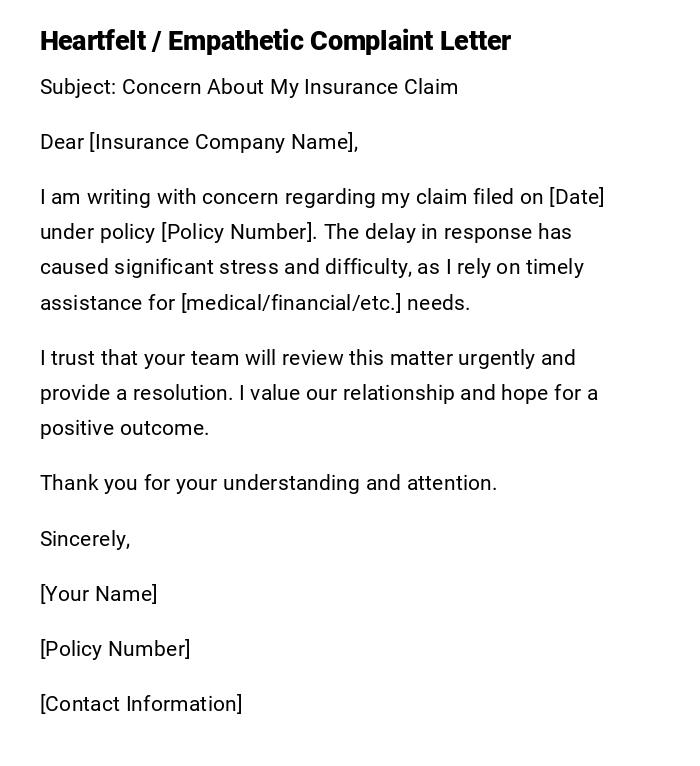

Heartfelt / Empathetic Complaint Letter

Subject: Concern About My Insurance Claim

Dear [Insurance Company Name],

I am writing with concern regarding my claim filed on [Date] under policy [Policy Number]. The delay in response has caused significant stress and difficulty, as I rely on timely assistance for [medical/financial/etc.] needs.

I trust that your team will review this matter urgently and provide a resolution. I value our relationship and hope for a positive outcome.

Thank you for your understanding and attention.

Sincerely,

[Your Name]

[Policy Number]

[Contact Information]

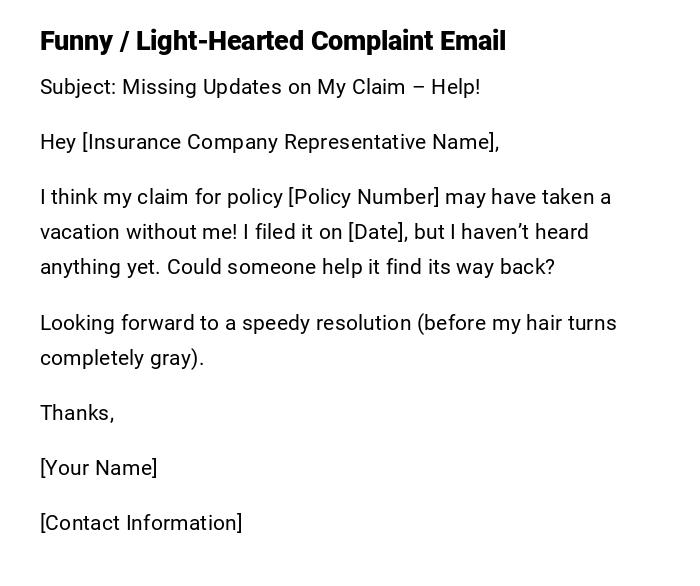

Funny / Light-Hearted Complaint Email

Subject: Missing Updates on My Claim – Help!

Hey [Insurance Company Representative Name],

I think my claim for policy [Policy Number] may have taken a vacation without me! I filed it on [Date], but I haven’t heard anything yet. Could someone help it find its way back?

Looking forward to a speedy resolution (before my hair turns completely gray).

Thanks,

[Your Name]

[Contact Information]

Professional Request for Investigation Letter

Subject: Request for Investigation Regarding Claim [Policy Number]

Dear [Insurance Company Name],

I am submitting a formal complaint regarding the handling of my claim filed on [Date] under policy [Policy Number]. There appears to be an error in processing, resulting in [specific problem].

I request a thorough investigation into the matter and a written report on the findings. Prompt resolution is highly appreciated.

Sincerely,

[Your Name]

[Policy Number]

[Contact Information]

What / Why is a Complaint Letter to an Insurance Company

- A complaint letter to an insurance company is a formal document addressing dissatisfaction with the handling of claims, services, or policy issues.

- Its purpose is to notify the company of a problem, request corrective action, and create a written record of the concern.

- It helps protect the complainant's rights and encourages accountability.

Who Should Send a Complaint Letter to an Insurance Company

- Policyholders experiencing delays, denials, or errors in their claims.

- Beneficiaries or authorized representatives of the policyholder.

- Legal representatives if escalation or legal intervention is anticipated.

Whom Should the Complaint Letter Be Addressed To

- Customer service department or claims department of the insurance company.

- Specific claims adjuster or representative involved.

- Regulatory authority if escalation is required.

When to Send a Complaint Letter to an Insurance Company

- When a claim is denied without explanation.

- If there is an undue delay in processing a claim.

- When misinformation or miscommunication occurs.

- After repeated attempts to resolve the issue informally.

How to Write and Send a Complaint Letter

- Begin with a clear subject line and reference to policy number.

- Describe the issue concisely and factually.

- Include relevant dates, documentation, and prior correspondence.

- Specify requested action or resolution.

- Maintain a professional tone, except for informal or light-hearted emails.

- Send via email for speed or certified mail for formal proof of delivery.

Requirements and Prerequisites Before Sending

- Copy of the insurance policy and claim details.

- Supporting documents such as bills, receipts, or medical records.

- Summary of prior communications with the insurance company.

- Understanding of deadlines for complaints or escalation.

Formatting Guidelines for Complaint Letters

- Length: 1–2 pages for formal letters; concise for emails.

- Tone: professional, firm, empathetic, or occasionally humorous.

- Structure: subject line, greeting, problem description, requested resolution, closing.

- Include attachments of supporting documents.

- Use clear, direct language without unnecessary legal jargon.

After Sending / Follow-up Actions

- Confirm receipt of the letter via email or certified mail.

- Allow the company reasonable time to respond, usually 14–30 days.

- Follow up with phone calls or additional correspondence if necessary.

- Maintain records of all communications for potential escalation.

Pros and Cons of Sending a Complaint Letter

Pros:

- Provides documented evidence of dissatisfaction.

- Encourages timely resolution and accountability.

- May prevent legal escalation by creating a record.

Cons:

- May take time to receive a response.

- Poorly worded letters could weaken the case.

- Escalation may require additional effort or legal consultation.

Compare and Contrast with Other Methods

- Compared to phone complaints, letters provide formal documentation.

- Compared to social media complaints, letters are private and more likely to receive official action.

- Alternative methods include in-person meetings or complaint forms on the insurer’s website.

Tricks and Tips for Effective Complaint Letters

- Include all relevant dates and references to prior communications.

- Be concise and focus on facts rather than emotions.

- Attach supporting evidence for credibility.

- Specify the resolution or action expected.

- Keep a copy for personal records.

Common Mistakes to Avoid

- Sending vague or emotional letters without evidence.

- Failing to mention policy numbers or claim identifiers.

- Ignoring prior attempts to resolve the issue.

- Using unprofessional language or threats.

- Forgetting to include contact information for follow-up.

Elements and Structure of a Complaint Letter

- Subject line: Clear reference to claim or policy.

- Greeting: Addressed to the correct department or individual.

- Introduction: Identify policy and complaint.

- Body: Explain the issue with dates and details.

- Supporting evidence: Attach relevant documents.

- Requested action: Specify resolution expected.

- Closing: Polite, firm, and professional.

- Signature: Include name, policy number, and contact information.

Does it Require Attestation or Authorization

- Usually, a signature of the policyholder is sufficient.

- Authorized representatives should include proof of authority.

- Certified mail or email with read receipt can serve as acknowledgment of delivery.

Download Word Doc

Download Word Doc

Download PDF

Download PDF