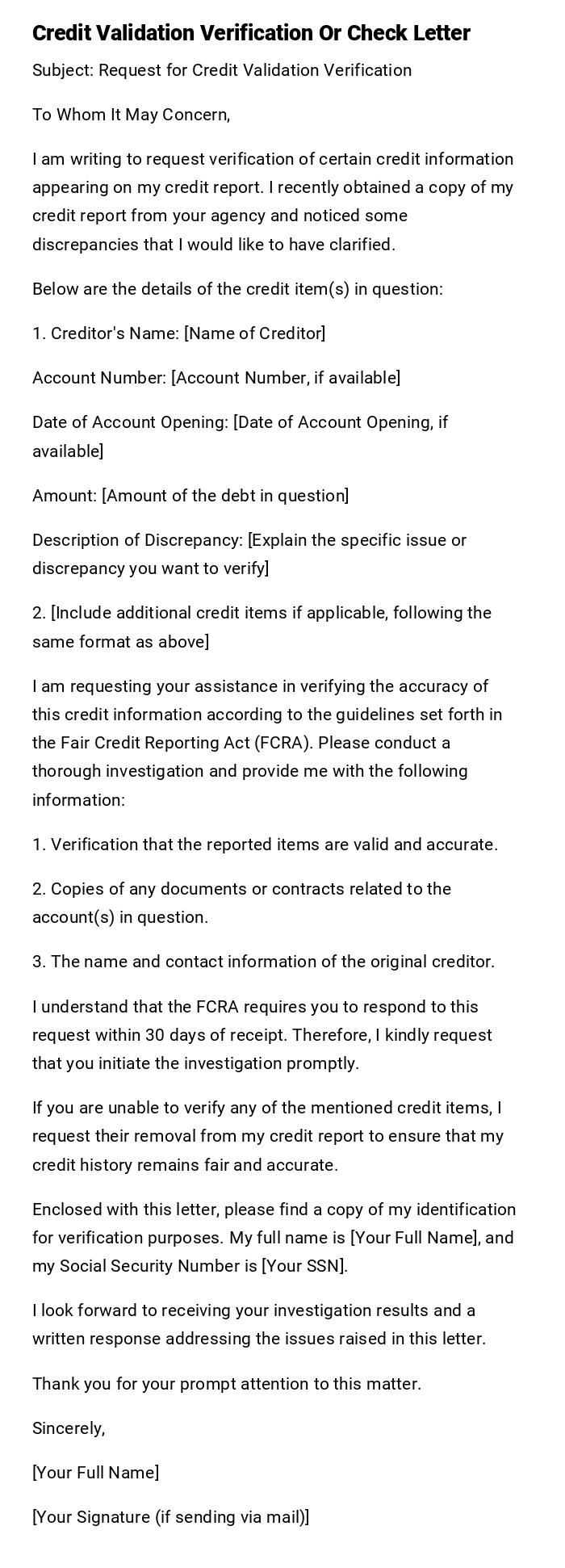

Credit Validation Verification Or Check Letter

Subject: Request for Credit Validation Verification

To Whom It May Concern,

I am writing to request verification of certain credit information appearing on my credit report. I recently obtained a copy of my credit report from your agency and noticed some discrepancies that I would like to have clarified.

Below are the details of the credit item(s) in question:

1. Creditor's Name: [Name of Creditor]

Account Number: [Account Number, if available]

Date of Account Opening: [Date of Account Opening, if available]

Amount: [Amount of the debt in question]

Description of Discrepancy: [Explain the specific issue or discrepancy you want to verify]

2. [Include additional credit items if applicable, following the same format as above]

I am requesting your assistance in verifying the accuracy of this credit information according to the guidelines set forth in the Fair Credit Reporting Act (FCRA). Please conduct a thorough investigation and provide me with the following information:

1. Verification that the reported items are valid and accurate.

2. Copies of any documents or contracts related to the account(s) in question.

3. The name and contact information of the original creditor.

I understand that the FCRA requires you to respond to this request within 30 days of receipt. Therefore, I kindly request that you initiate the investigation promptly.

If you are unable to verify any of the mentioned credit items, I request their removal from my credit report to ensure that my credit history remains fair and accurate.

Enclosed with this letter, please find a copy of my identification for verification purposes. My full name is [Your Full Name], and my Social Security Number is [Your SSN].

I look forward to receiving your investigation results and a written response addressing the issues raised in this letter.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

[Your Signature (if sending via mail)]

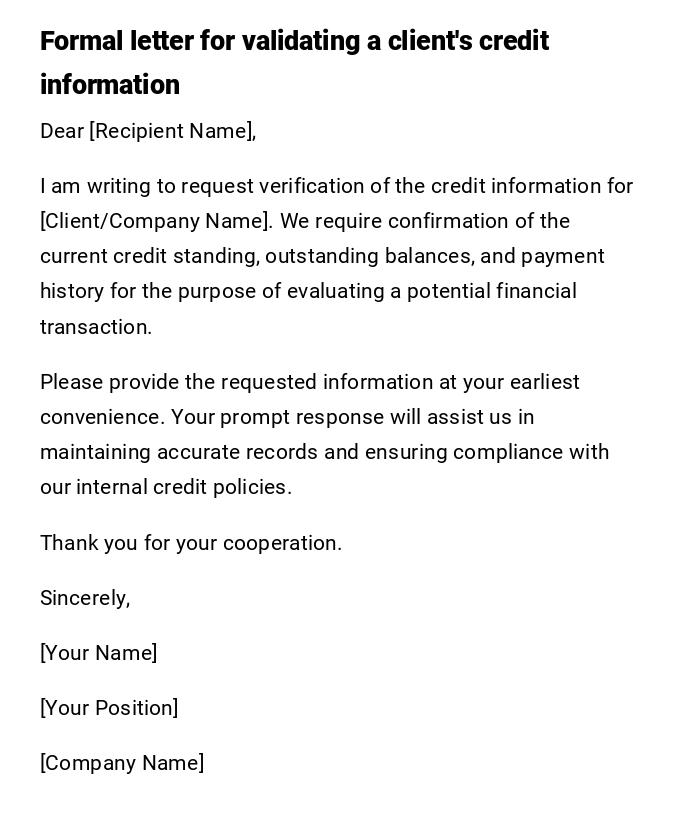

Professional Credit Validation Letter

Dear [Recipient Name],

I am writing to request verification of the credit information for [Client/Company Name]. We require confirmation of the current credit standing, outstanding balances, and payment history for the purpose of evaluating a potential financial transaction.

Please provide the requested information at your earliest convenience. Your prompt response will assist us in maintaining accurate records and ensuring compliance with our internal credit policies.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

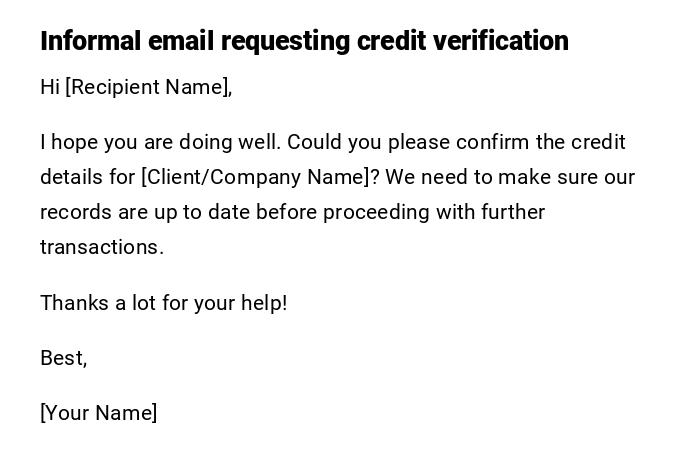

Casual Credit Check Email

Hi [Recipient Name],

I hope you are doing well. Could you please confirm the credit details for [Client/Company Name]? We need to make sure our records are up to date before proceeding with further transactions.

Thanks a lot for your help!

Best,

[Your Name]

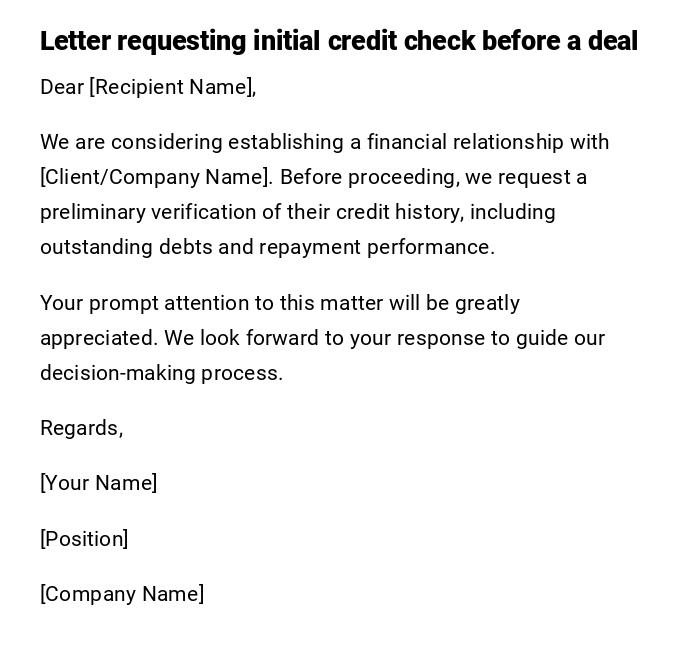

Preliminary Credit Verification Letter

Dear [Recipient Name],

We are considering establishing a financial relationship with [Client/Company Name]. Before proceeding, we request a preliminary verification of their credit history, including outstanding debts and repayment performance.

Your prompt attention to this matter will be greatly appreciated. We look forward to your response to guide our decision-making process.

Regards,

[Your Name]

[Position]

[Company Name]

Urgent Credit Verification Request Email

Hello [Recipient Name],

We urgently need to verify the credit status of [Client/Company Name] for an upcoming transaction. Could you please provide the details as soon as possible?

Thank you in advance for your quick response.

Best regards,

[Your Name]

Detailed Credit Validation Letter

Dear [Recipient Name],

This letter is to formally request a comprehensive credit validation for [Client/Company Name]. Please include the following information:

- Current credit limit and outstanding balances

- Payment history for the last 12 months

- Any overdue or disputed amounts

- Any notes or observations relevant to credit assessment

Your cooperation in providing this information will help us make an informed decision regarding future credit extensions.

Thank you for your assistance.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

Informal Credit Check Message

Hi [Recipient Name],

Can you confirm the credit details for [Client/Company Name]? Just need to make sure everything is in order before we proceed.

Thanks!

[Your Name]

Credit Verification Follow-up Letter

Dear [Recipient Name],

I am following up on my previous request for credit verification of [Client/Company Name]. We have not yet received the necessary details, and timely receipt is crucial for our ongoing evaluation.

Please provide the information at your earliest convenience.

Thank you for your attention.

Sincerely,

[Your Name]

[Position]

[Company Name]

What is a Credit Validation Verification or Check Letter and Why You Need It

A Credit Validation Verification or Check Letter is a formal or informal communication used to confirm a client's or company's credit status.

It is necessary to:

- Verify payment history and current debts

- Assess financial stability before granting credit

- Avoid financial risk in transactions

- Maintain accurate records for accounting and compliance purposes

Who Should Send a Credit Validation Verification Letter

- Financial officers or credit managers

- Accounts receivable or accounting departments

- Procurement officers in cases of vendor credit checks

- Bank officers or lending institutions

Whom Should Receive a Credit Validation Verification Letter

- The client or company whose credit is being checked

- Third-party credit reporting agencies

- Financial institutions or banks providing credit references

- Internal stakeholders when internal verification is required

When to Send a Credit Validation Verification Letter

- Before extending credit to a new client or customer

- When evaluating existing clients for credit limit adjustments

- Prior to finalizing large transactions or contracts

- During periodic audits or compliance checks

- When a credit rating or report needs verification

How to Write and Send a Credit Validation Verification Letter

- Determine the required tone: professional, informal, urgent, or detailed

- Clearly identify the subject and the recipient

- Specify the credit information required

- Use official letterhead for formal letters or email templates for digital communication

- Review for accuracy, completeness, and legal compliance before sending

Requirements and Prerequisites Before Sending a Credit Validation Letter

- Obtain consent from the client if required by law

- Identify the correct recipient for the credit check

- Have a clear purpose for requesting credit information

- Prepare all necessary client information (account numbers, legal name, etc.)

- Align letter content with internal policies and regulatory requirements

Formatting Tips for Credit Validation Letters

- Length: concise, 150–300 words for emails, one page for printed letters

- Tone: professional and polite, avoid aggressive language

- Structure: opening, purpose, requested details, closing

- Mode: email for quick verification, printed letter for formal requests

- Include signature, title, and company information

After Sending a Credit Validation Verification Letter

- Confirm receipt with the recipient

- Follow up if information is not received within a reasonable timeframe

- Record received information in official files

- Use verified credit information to make informed decisions

Common Mistakes to Avoid in Credit Verification Letters

- Being vague about requested information

- Sending to the wrong recipient or outdated contacts

- Failing to mention the purpose or urgency

- Ignoring legal or compliance requirements

- Omitting signature or official identification for authenticity

Elements and Structure of a Credit Validation Verification Letter

- Greeting addressing the recipient professionally

- Clear subject line or opening paragraph stating purpose

- Specific details requested (credit limits, payment history, balances)

- Timeframe for response

- Closing with appreciation and signature

- Optional attachments: forms or internal reference documents

Tips and Best Practices for Credit Validation Verification Letters

- Personalize the letter with recipient and client details

- Keep language professional and concise

- Use bullet points for clarity on requested information

- Send reminders or follow-ups if needed

- Maintain confidentiality and comply with data protection regulations

Download Word Doc

Download Word Doc

Download PDF

Download PDF