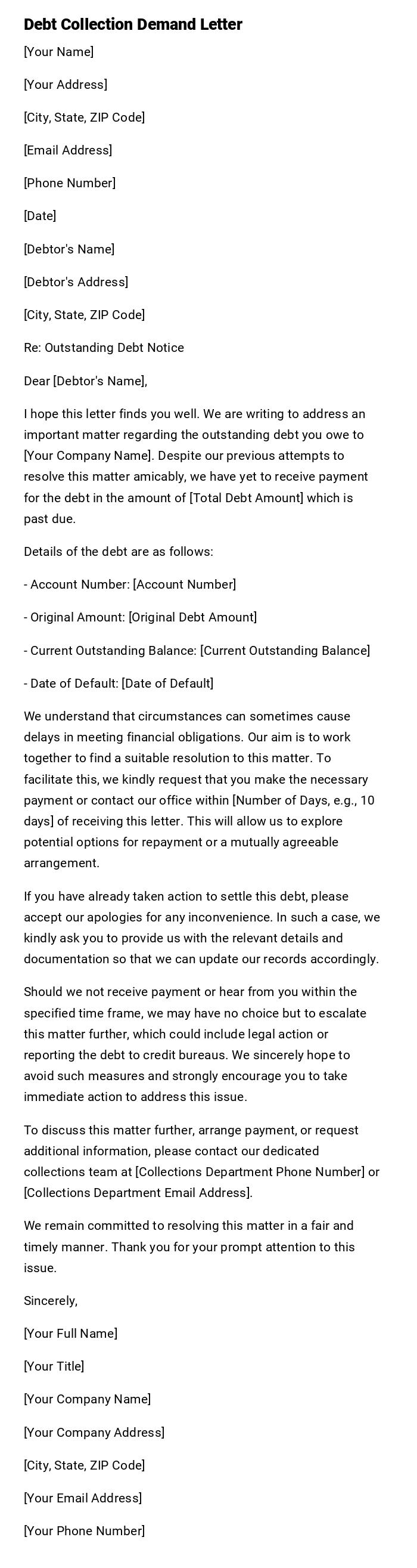

Debt Collection Demand Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Debtor's Name]

[Debtor's Address]

[City, State, ZIP Code]

Re: Outstanding Debt Notice

Dear [Debtor's Name],

I hope this letter finds you well. We are writing to address an important matter regarding the outstanding debt you owe to [Your Company Name]. Despite our previous attempts to resolve this matter amicably, we have yet to receive payment for the debt in the amount of [Total Debt Amount] which is past due.

Details of the debt are as follows:

- Account Number: [Account Number]

- Original Amount: [Original Debt Amount]

- Current Outstanding Balance: [Current Outstanding Balance]

- Date of Default: [Date of Default]

We understand that circumstances can sometimes cause delays in meeting financial obligations. Our aim is to work together to find a suitable resolution to this matter. To facilitate this, we kindly request that you make the necessary payment or contact our office within [Number of Days, e.g., 10 days] of receiving this letter. This will allow us to explore potential options for repayment or a mutually agreeable arrangement.

If you have already taken action to settle this debt, please accept our apologies for any inconvenience. In such a case, we kindly ask you to provide us with the relevant details and documentation so that we can update our records accordingly.

Should we not receive payment or hear from you within the specified time frame, we may have no choice but to escalate this matter further, which could include legal action or reporting the debt to credit bureaus. We sincerely hope to avoid such measures and strongly encourage you to take immediate action to address this issue.

To discuss this matter further, arrange payment, or request additional information, please contact our dedicated collections team at [Collections Department Phone Number] or [Collections Department Email Address].

We remain committed to resolving this matter in a fair and timely manner. Thank you for your prompt attention to this issue.

Sincerely,

[Your Full Name]

[Your Title]

[Your Company Name]

[Your Company Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

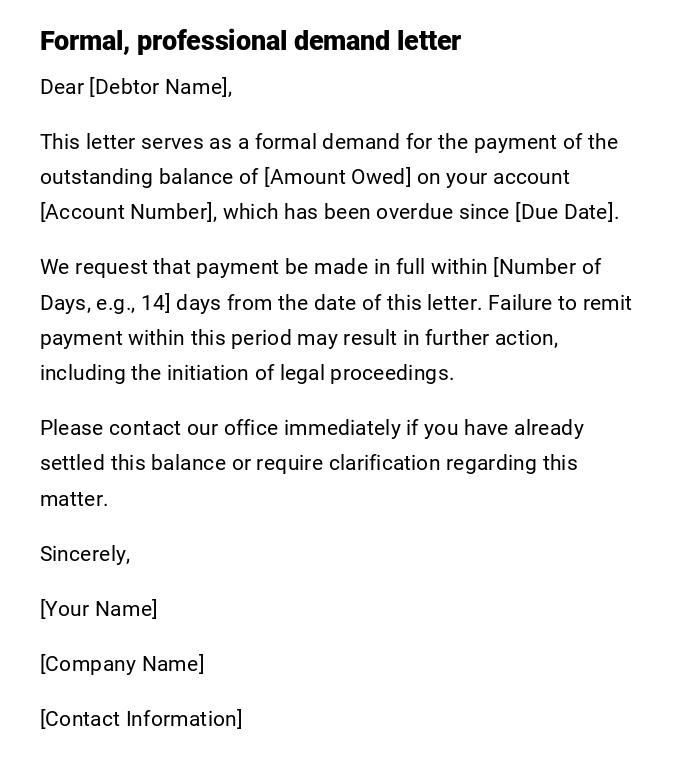

Professional Debt Collection Demand Letter

Dear [Debtor Name],

This letter serves as a formal demand for the payment of the outstanding balance of [Amount Owed] on your account [Account Number], which has been overdue since [Due Date].

We request that payment be made in full within [Number of Days, e.g., 14] days from the date of this letter. Failure to remit payment within this period may result in further action, including the initiation of legal proceedings.

Please contact our office immediately if you have already settled this balance or require clarification regarding this matter.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

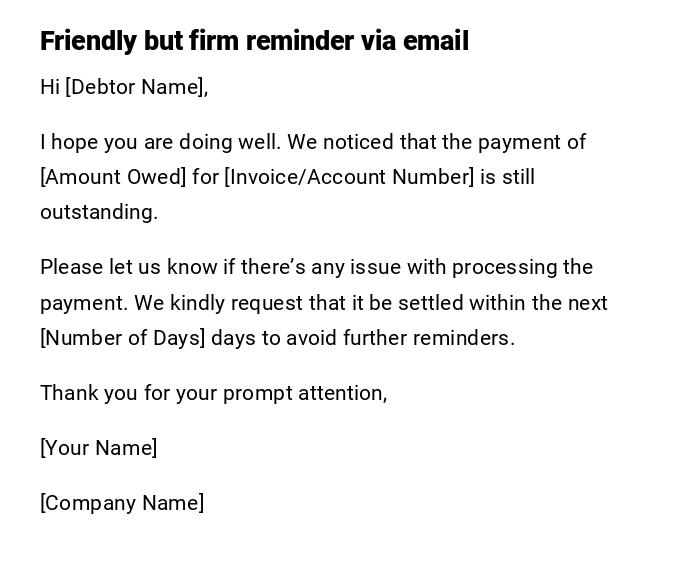

Casual Debt Collection Reminder Email

Hi [Debtor Name],

I hope you are doing well. We noticed that the payment of [Amount Owed] for [Invoice/Account Number] is still outstanding.

Please let us know if there’s any issue with processing the payment. We kindly request that it be settled within the next [Number of Days] days to avoid further reminders.

Thank you for your prompt attention,

[Your Name]

[Company Name]

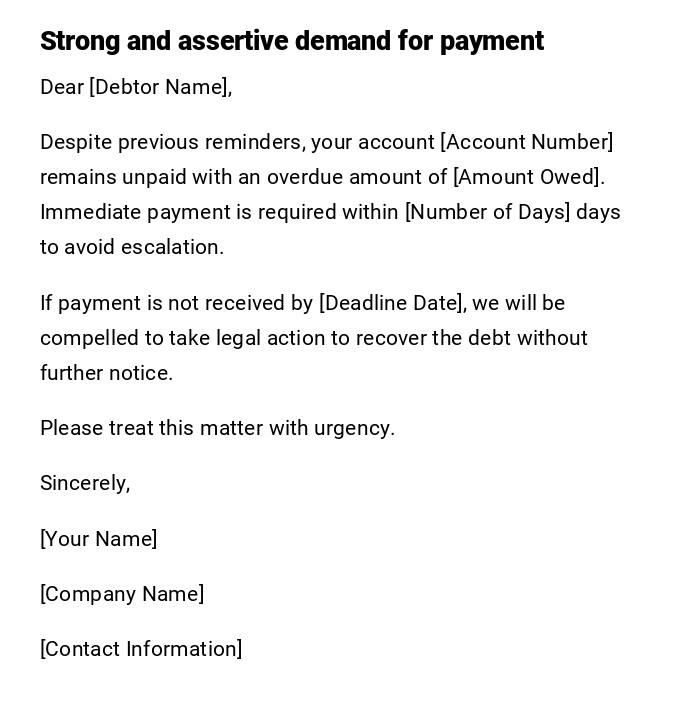

Firm Debt Collection Demand Letter

Dear [Debtor Name],

Despite previous reminders, your account [Account Number] remains unpaid with an overdue amount of [Amount Owed]. Immediate payment is required within [Number of Days] days to avoid escalation.

If payment is not received by [Deadline Date], we will be compelled to take legal action to recover the debt without further notice.

Please treat this matter with urgency.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

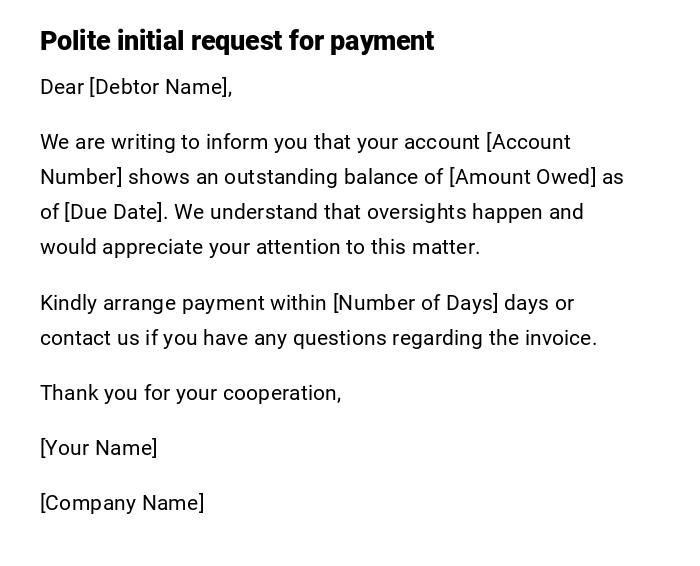

Preliminary Debt Collection Letter

Dear [Debtor Name],

We are writing to inform you that your account [Account Number] shows an outstanding balance of [Amount Owed] as of [Due Date]. We understand that oversights happen and would appreciate your attention to this matter.

Kindly arrange payment within [Number of Days] days or contact us if you have any questions regarding the invoice.

Thank you for your cooperation,

[Your Name]

[Company Name]

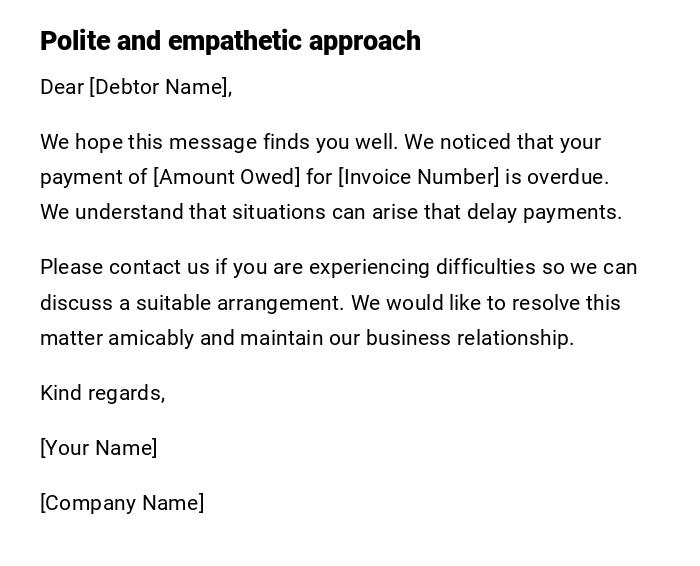

Heartfelt Debt Collection Letter

Dear [Debtor Name],

We hope this message finds you well. We noticed that your payment of [Amount Owed] for [Invoice Number] is overdue. We understand that situations can arise that delay payments.

Please contact us if you are experiencing difficulties so we can discuss a suitable arrangement. We would like to resolve this matter amicably and maintain our business relationship.

Kind regards,

[Your Name]

[Company Name]

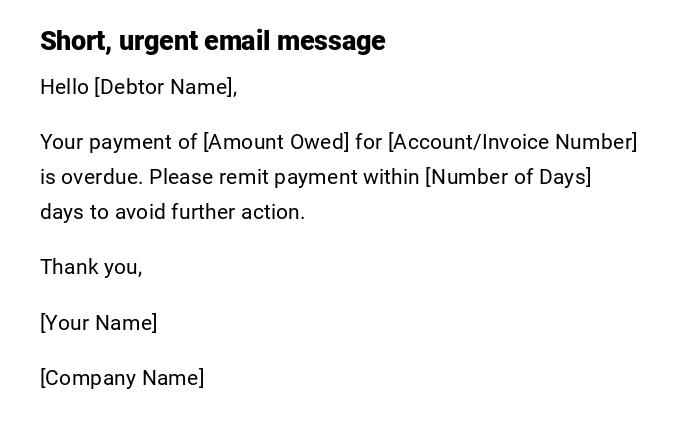

Quick Debt Collection Demand Message

Hello [Debtor Name],

Your payment of [Amount Owed] for [Account/Invoice Number] is overdue. Please remit payment within [Number of Days] days to avoid further action.

Thank you,

[Your Name]

[Company Name]

What is a Debt Collection Demand Letter and why it is necessary

A Debt Collection Demand Letter is a formal written notice sent to a debtor requesting payment of an overdue amount.

Its purposes include:

- Officially informing the debtor of the outstanding debt.

- Setting a clear payment deadline.

- Demonstrating seriousness and providing legal evidence if escalation is needed.

- Maintaining professionalism while recovering owed funds.

Who should send a Debt Collection Demand Letter

- Business owners or finance managers seeking payment from clients.

- Legal representatives acting on behalf of a creditor.

- Collection agencies handling overdue accounts.

- Companies or individuals seeking to document and enforce debt collection efforts.

Whom should the letter be addressed to

- The individual or company that owes the debt.

- Authorized representatives if the debtor is a business entity.

- In cases of shared accounts, the primary responsible party.

- Ensure accurate legal names to avoid disputes or delays.

When should you send a Debt Collection Demand Letter

- After a payment is overdue beyond the agreed terms.

- Following informal reminders that have not resolved the debt.

- Before initiating legal action or formal collection procedures.

- After multiple attempts to contact the debtor via email, phone, or in person.

How to write and send a Debt Collection Demand Letter

- Review the debtor's account details and confirm the overdue amount.

- Choose an appropriate tone: polite for preliminary, firm for escalated cases.

- Clearly state the amount owed, invoice numbers, and due dates.

- Set a specific deadline for payment.

- Mention consequences of non-payment if necessary.

- Provide contact information for queries or arrangements.

- Send via certified mail, email, or other trackable methods to ensure receipt.

Requirements and Prerequisites before sending

- Accurate documentation of the debt, including invoices, contracts, and previous reminders.

- Confirm the debtor's contact information and legal name.

- Decide on tone and escalation strategy based on the debtor's history.

- Verify legal compliance for debt collection in your jurisdiction.

- Prepare supporting evidence for potential legal proceedings.

Formatting guidelines for Debt Collection Demand Letters

- Length: concise but comprehensive (150–300 words).

- Tone: polite for early-stage, firm for escalated demands.

- Structure: clear introduction, account details, payment request, deadline, consequences, closing.

- Mode: email for quick reach; printed letters for legal documentation.

- Etiquette: avoid abusive language; maintain professionalism throughout.

After Sending a Debt Collection Demand Letter

- Track delivery confirmation if sent via certified mail or email.

- Monitor the payment deadline and follow up promptly if unpaid.

- Keep detailed records for legal or accounting purposes.

- Escalate to legal action or collection agency if necessary.

Tricks and Tips for Effective Debt Collection Letters

- Personalize each letter with debtor's name and account details.

- Reference previous reminders and communications.

- Clearly specify the deadline and consequences to encourage prompt payment.

- Use professional letterhead or branded email for credibility.

- Proofread to avoid errors that could weaken your case.

Common Mistakes to Avoid

- Using aggressive or threatening language unnecessarily.

- Failing to include correct payment details or invoice numbers.

- Sending to incorrect addresses or outdated contact information.

- Ignoring legal requirements and debt collection regulations.

- Delaying follow-up after sending the letter.

Elements and Structure of a Debt Collection Demand Letter

- Greeting addressing the debtor properly.

- Statement of the overdue amount and relevant account or invoice numbers.

- Reference to previous communications (if any).

- Specific payment deadline.

- Consequences of non-payment (legal action, collection agencies).

- Contact information for payment or questions.

- Closing and signature.

- Optional: Attach supporting documents such as invoices or statements.

Pros and Cons of Sending a Debt Collection Demand Letter

Pros:

- Provides formal evidence of the debt.

- Encourages timely payment without immediate legal action.

- Maintains professional record of collection efforts.

Cons:

- May strain client relationships if perceived as aggressive.

- Requires careful adherence to legal guidelines.

- Could be ignored if not clearly communicated or followed up.

Download Word Doc

Download Word Doc

Download PDF

Download PDF