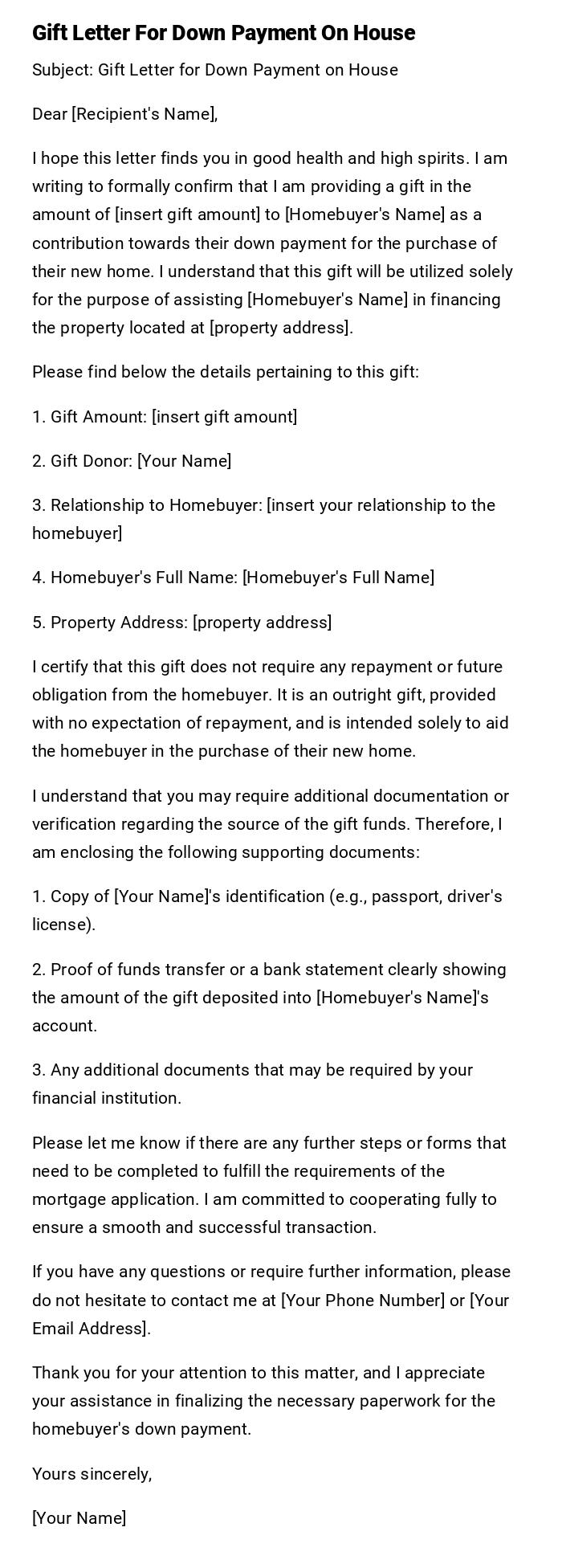

Gift Letter For Down Payment On House

Subject: Gift Letter for Down Payment on House

Dear [Recipient's Name],

I hope this letter finds you in good health and high spirits. I am writing to formally confirm that I am providing a gift in the amount of [insert gift amount] to [Homebuyer's Name] as a contribution towards their down payment for the purchase of their new home. I understand that this gift will be utilized solely for the purpose of assisting [Homebuyer's Name] in financing the property located at [property address].

Please find below the details pertaining to this gift:

1. Gift Amount: [insert gift amount]

2. Gift Donor: [Your Name]

3. Relationship to Homebuyer: [insert your relationship to the homebuyer]

4. Homebuyer's Full Name: [Homebuyer's Full Name]

5. Property Address: [property address]

I certify that this gift does not require any repayment or future obligation from the homebuyer. It is an outright gift, provided with no expectation of repayment, and is intended solely to aid the homebuyer in the purchase of their new home.

I understand that you may require additional documentation or verification regarding the source of the gift funds. Therefore, I am enclosing the following supporting documents:

1. Copy of [Your Name]'s identification (e.g., passport, driver's license).

2. Proof of funds transfer or a bank statement clearly showing the amount of the gift deposited into [Homebuyer's Name]'s account.

3. Any additional documents that may be required by your financial institution.

Please let me know if there are any further steps or forms that need to be completed to fulfill the requirements of the mortgage application. I am committed to cooperating fully to ensure a smooth and successful transaction.

If you have any questions or require further information, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your attention to this matter, and I appreciate your assistance in finalizing the necessary paperwork for the homebuyer's down payment.

Yours sincerely,

[Your Name]

Standard Gift Letter for Down Payment on House

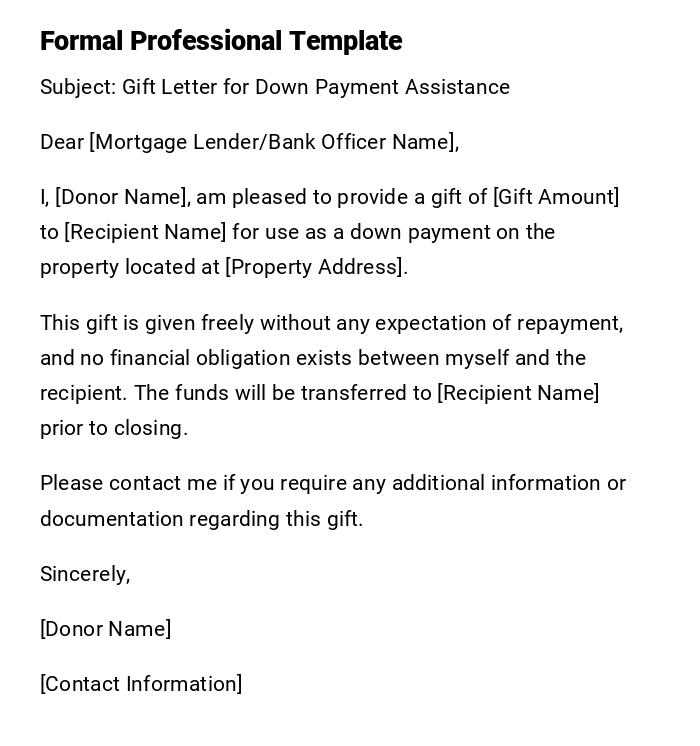

Subject: Gift Letter for Down Payment Assistance

Dear [Mortgage Lender/Bank Officer Name],

I, [Donor Name], am pleased to provide a gift of [Gift Amount] to [Recipient Name] for use as a down payment on the property located at [Property Address].

This gift is given freely without any expectation of repayment, and no financial obligation exists between myself and the recipient. The funds will be transferred to [Recipient Name] prior to closing.

Please contact me if you require any additional information or documentation regarding this gift.

Sincerely,

[Donor Name]

[Contact Information]

Family Member Gift Letter for House Down Payment

Subject: Gift Letter for Home Purchase Assistance

Dear [Mortgage Lender Name],

I am writing to confirm that I am gifting [Recipient Name] an amount of [Gift Amount] to assist with the down payment for their new home at [Property Address].

This gift does not need to be repaid, and I will have no financial interest in the property. I am providing this gift out of love and support for [Recipient Name] as they take this important step.

If further verification is required, please feel free to contact me directly.

Warm regards,

[Donor Name]

[Relationship to Recipient]

[Contact Information]

Friend’s Gift Letter for Down Payment

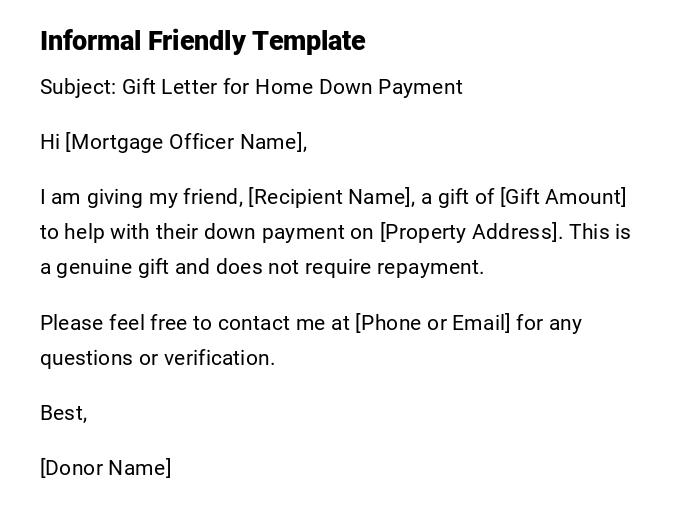

Subject: Gift Letter for Home Down Payment

Hi [Mortgage Officer Name],

I am giving my friend, [Recipient Name], a gift of [Gift Amount] to help with their down payment on [Property Address]. This is a genuine gift and does not require repayment.

Please feel free to contact me at [Phone or Email] for any questions or verification.

Best,

[Donor Name]

Joint Gift Letter from Multiple Donors

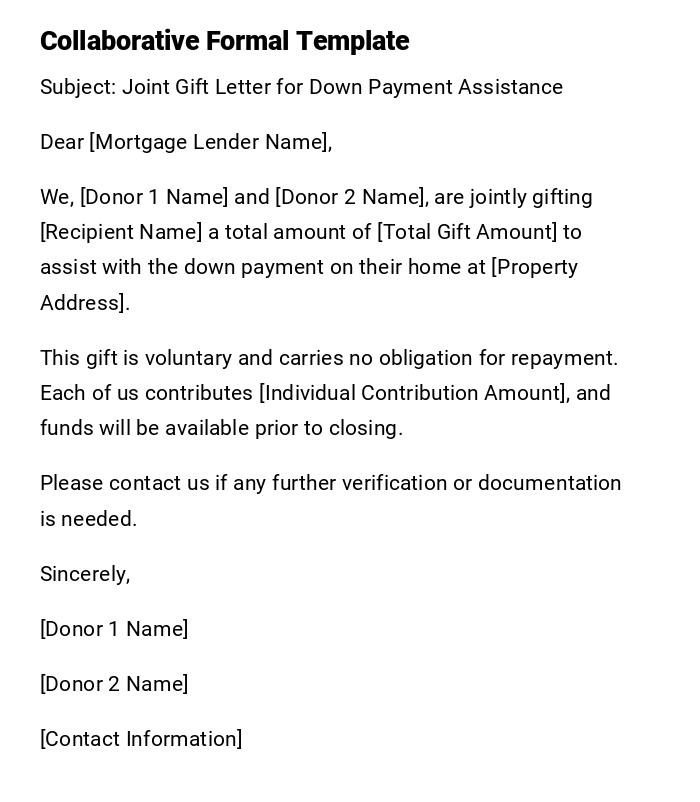

Subject: Joint Gift Letter for Down Payment Assistance

Dear [Mortgage Lender Name],

We, [Donor 1 Name] and [Donor 2 Name], are jointly gifting [Recipient Name] a total amount of [Total Gift Amount] to assist with the down payment on their home at [Property Address].

This gift is voluntary and carries no obligation for repayment. Each of us contributes [Individual Contribution Amount], and funds will be available prior to closing.

Please contact us if any further verification or documentation is needed.

Sincerely,

[Donor 1 Name]

[Donor 2 Name]

[Contact Information]

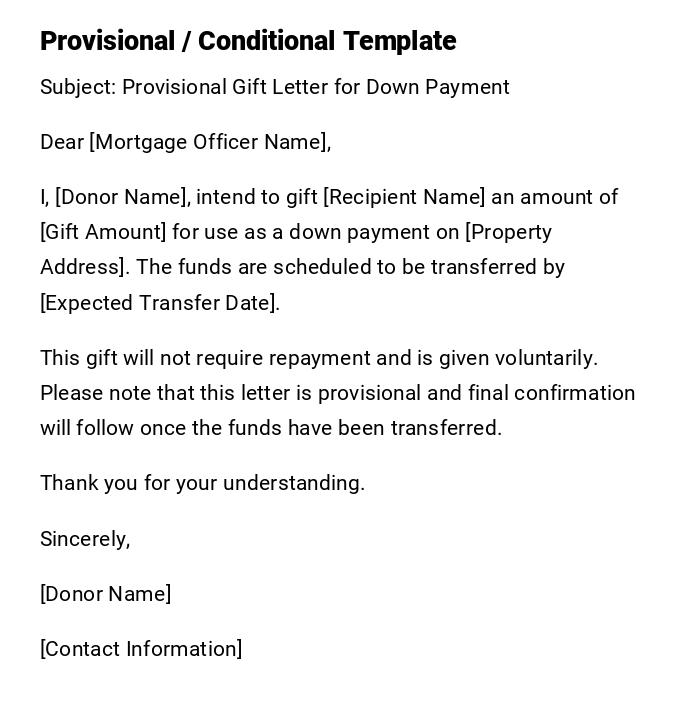

Provisional Gift Letter for Pending Funds

Subject: Provisional Gift Letter for Down Payment

Dear [Mortgage Officer Name],

I, [Donor Name], intend to gift [Recipient Name] an amount of [Gift Amount] for use as a down payment on [Property Address]. The funds are scheduled to be transferred by [Expected Transfer Date].

This gift will not require repayment and is given voluntarily. Please note that this letter is provisional and final confirmation will follow once the funds have been transferred.

Thank you for your understanding.

Sincerely,

[Donor Name]

[Contact Information]

What / Why: Purpose of a Gift Letter for Down Payment

What / Why: Purpose of a Gift Letter for Down Payment

- Confirms that a sum of money given for a home down payment is a gift and not a loan.

- Provides documentation required by mortgage lenders for loan approval.

- Ensures transparency and prevents misclassification of gifted funds as debt.

- Supports the recipient in qualifying for a mortgage by supplementing their down payment.

Who Should Send a Gift Letter for Down Payment

- Family members, friends, or legal guardians providing financial assistance.

- Individuals with no expectation of repayment from the recipient.

- Co-donors jointly contributing to a single down payment.

- Donors who have direct access to the funds being gifted.

Whom the Gift Letter Should Be Addressed To

- The mortgage lender or bank issuing the loan.

- Mortgage loan officers or underwriters reviewing the home purchase application.

- Occasionally, the title company or real estate closing agent requiring documentation.

When to Provide a Gift Letter for Down Payment

- At the time of mortgage application or prior to closing.

- When the borrower requires documentation of gifted funds to meet down payment requirements.

- In cases where multiple sources of funds are contributing to the down payment.

- When the lender explicitly requests a formal gift letter to verify fund origin.

How to Write and Send a Gift Letter for Down Payment

- Clearly state donor name, recipient name, and relationship.

- Specify the gift amount, property address, and purpose of funds.

- Include an explicit statement that the gift does not require repayment.

- Provide donor contact information for verification.

- Deliver as a signed letter or scanned email attachment to the lender.

How Much Can Be Gifted for a Down Payment

- Typically, the full down payment or a portion thereof may be gifted.

- Lenders may impose maximum limits or require documentation if funds exceed a certain amount.

- Multiple donors can contribute jointly, but each gift must be documented separately.

Requirements and Prerequisites Before Sending a Gift Letter

- Access to funds and confirmation of availability.

- Relationship verification if lender requires proof of familial connection.

- Mortgage application details including property address and loan amount.

- Donor identification and contact information.

- Clear understanding that funds must be transferred before closing.

Formatting Guidelines for a Gift Letter

- Length: typically one page, concise and clear.

- Tone: formal, professional, and factual.

- Essential wording: donor name, recipient name, gift amount, property address, statement of non-repayment.

- Mode: signed printed letter or scanned PDF for email submission.

- Optional: notarization if requested by lender for additional verification.

After Sending / Follow-up Actions

- Confirm that the lender has received and accepted the gift letter.

- Ensure the funds have been transferred to the borrower’s account prior to closing.

- Respond promptly to any lender inquiries for verification or clarification.

- Retain a copy of the gift letter for personal records.

Common Mistakes to Avoid in Gift Letters

- Failing to explicitly state that the funds are a gift and not a loan.

- Omitting donor or recipient contact information.

- Providing inaccurate gift amount or property details.

- Not signing the letter or sending it too late in the loan process.

- Using vague or ambiguous language that could confuse the lender.

Elements and Structure of a Gift Letter

- Subject line specifying it is a Gift Letter for Down Payment.

- Greeting addressed to the lender or mortgage officer.

- Donor information including name and relationship to recipient.

- Recipient information and property address.

- Gift amount clearly stated in words and numbers.

- Explicit non-repayment statement.

- Closing and donor signature.

- Contact information for verification purposes.

Tricks and Tips for a Smooth Gift Letter Process

- Provide the gift letter well in advance of the closing date.

- Keep language simple and unambiguous to avoid lender questions.

- Include a statement of intent to transfer funds and timeline if not immediate.

- For multiple donors, provide separate letters to simplify lender review.

- Consider notarization if lender requests extra assurance.

Does a Gift Letter Require Authorization or Attestation?

- Typically, a signature from the donor suffices.

- Some lenders may require notarization to verify authenticity.

- No additional legal authorization is usually necessary unless funds exceed certain thresholds.

Download Word Doc

Download Word Doc

Download PDF

Download PDF