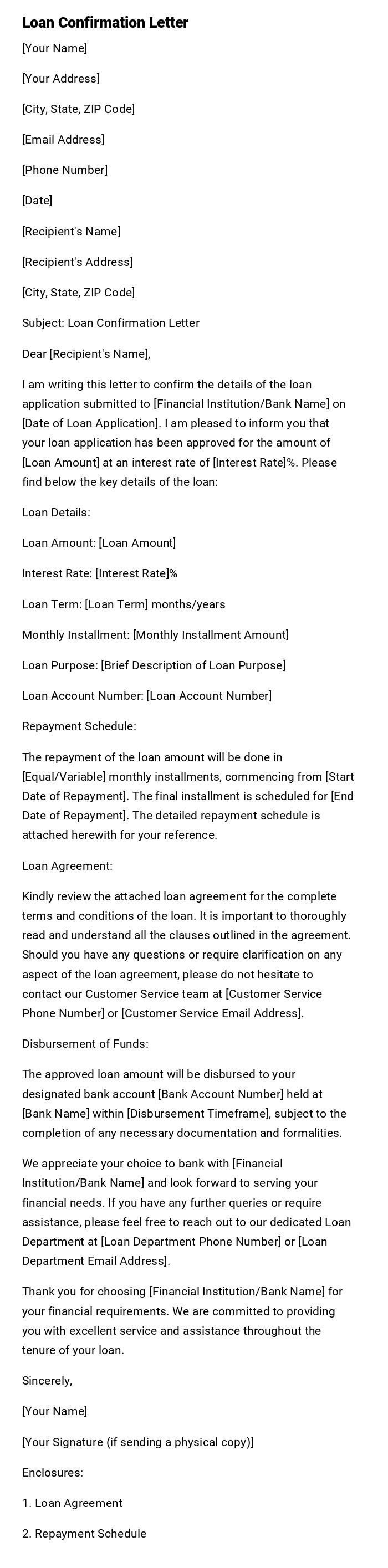

Loan Confirmation Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Loan Confirmation Letter

Dear [Recipient's Name],

I am writing this letter to confirm the details of the loan application submitted to [Financial Institution/Bank Name] on [Date of Loan Application]. I am pleased to inform you that your loan application has been approved for the amount of [Loan Amount] at an interest rate of [Interest Rate]%. Please find below the key details of the loan:

Loan Details:

Loan Amount: [Loan Amount]

Interest Rate: [Interest Rate]%

Loan Term: [Loan Term] months/years

Monthly Installment: [Monthly Installment Amount]

Loan Purpose: [Brief Description of Loan Purpose]

Loan Account Number: [Loan Account Number]

Repayment Schedule:

The repayment of the loan amount will be done in [Equal/Variable] monthly installments, commencing from [Start Date of Repayment]. The final installment is scheduled for [End Date of Repayment]. The detailed repayment schedule is attached herewith for your reference.

Loan Agreement:

Kindly review the attached loan agreement for the complete terms and conditions of the loan. It is important to thoroughly read and understand all the clauses outlined in the agreement. Should you have any questions or require clarification on any aspect of the loan agreement, please do not hesitate to contact our Customer Service team at [Customer Service Phone Number] or [Customer Service Email Address].

Disbursement of Funds:

The approved loan amount will be disbursed to your designated bank account [Bank Account Number] held at [Bank Name] within [Disbursement Timeframe], subject to the completion of any necessary documentation and formalities.

We appreciate your choice to bank with [Financial Institution/Bank Name] and look forward to serving your financial needs. If you have any further queries or require assistance, please feel free to reach out to our dedicated Loan Department at [Loan Department Phone Number] or [Loan Department Email Address].

Thank you for choosing [Financial Institution/Bank Name] for your financial requirements. We are committed to providing you with excellent service and assistance throughout the tenure of your loan.

Sincerely,

[Your Name]

[Your Signature (if sending a physical copy)]

Enclosures:

1. Loan Agreement

2. Repayment Schedule

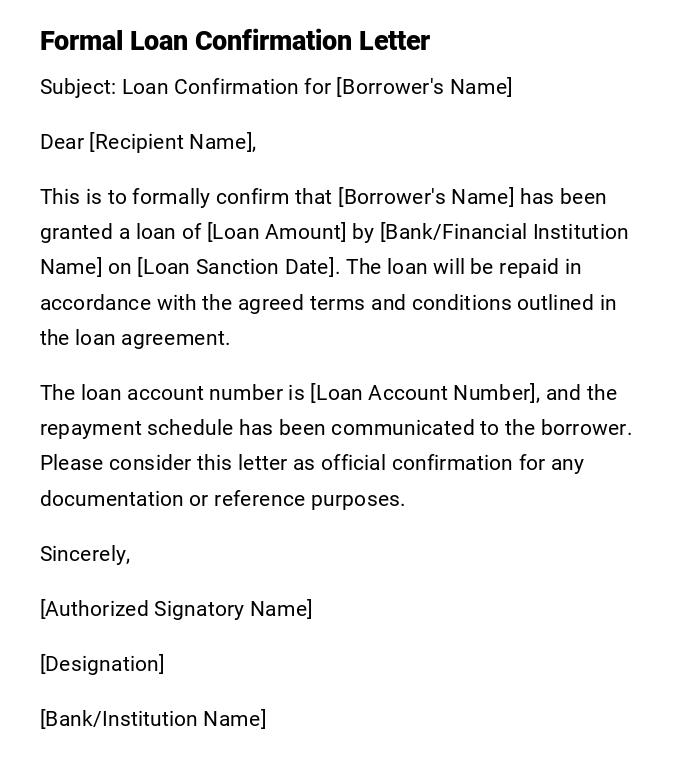

Formal Loan Confirmation Letter

Subject: Loan Confirmation for [Borrower's Name]

Dear [Recipient Name],

This is to formally confirm that [Borrower's Name] has been granted a loan of [Loan Amount] by [Bank/Financial Institution Name] on [Loan Sanction Date]. The loan will be repaid in accordance with the agreed terms and conditions outlined in the loan agreement.

The loan account number is [Loan Account Number], and the repayment schedule has been communicated to the borrower. Please consider this letter as official confirmation for any documentation or reference purposes.

Sincerely,

[Authorized Signatory Name]

[Designation]

[Bank/Institution Name]

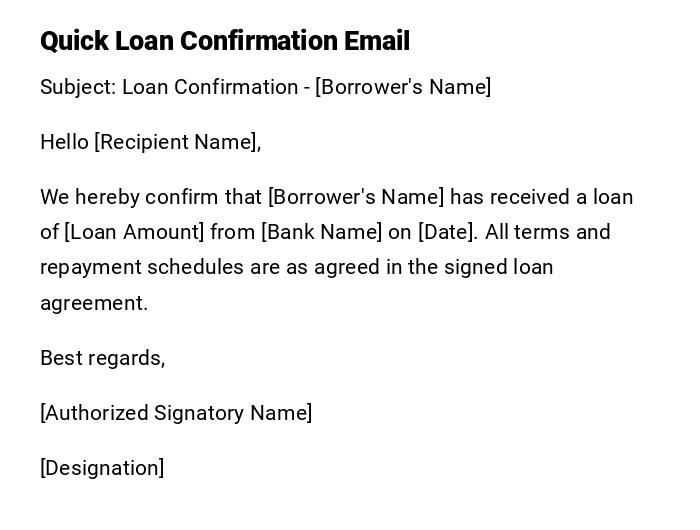

Quick Loan Confirmation Email

Subject: Loan Confirmation - [Borrower's Name]

Hello [Recipient Name],

We hereby confirm that [Borrower's Name] has received a loan of [Loan Amount] from [Bank Name] on [Date]. All terms and repayment schedules are as agreed in the signed loan agreement.

Best regards,

[Authorized Signatory Name]

[Designation]

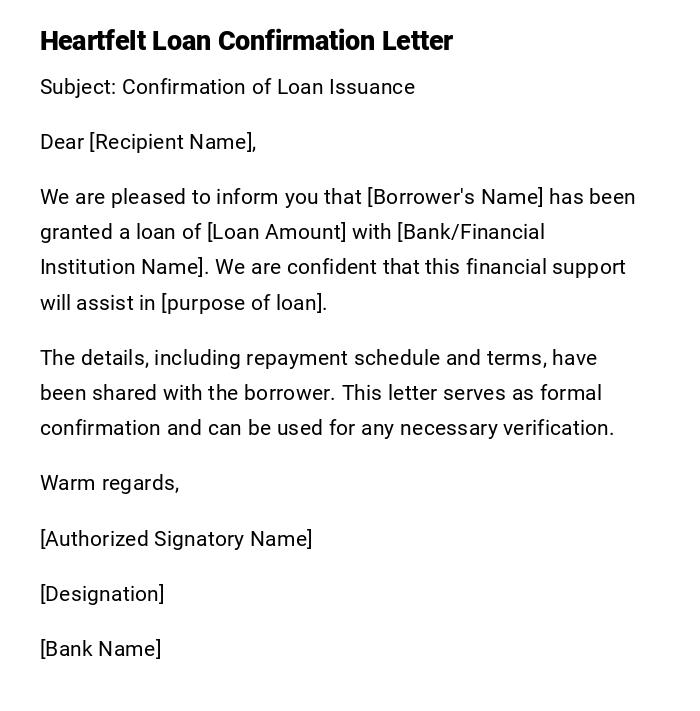

Heartfelt Loan Confirmation Letter

Subject: Confirmation of Loan Issuance

Dear [Recipient Name],

We are pleased to inform you that [Borrower's Name] has been granted a loan of [Loan Amount] with [Bank/Financial Institution Name]. We are confident that this financial support will assist in [purpose of loan].

The details, including repayment schedule and terms, have been shared with the borrower. This letter serves as formal confirmation and can be used for any necessary verification.

Warm regards,

[Authorized Signatory Name]

[Designation]

[Bank Name]

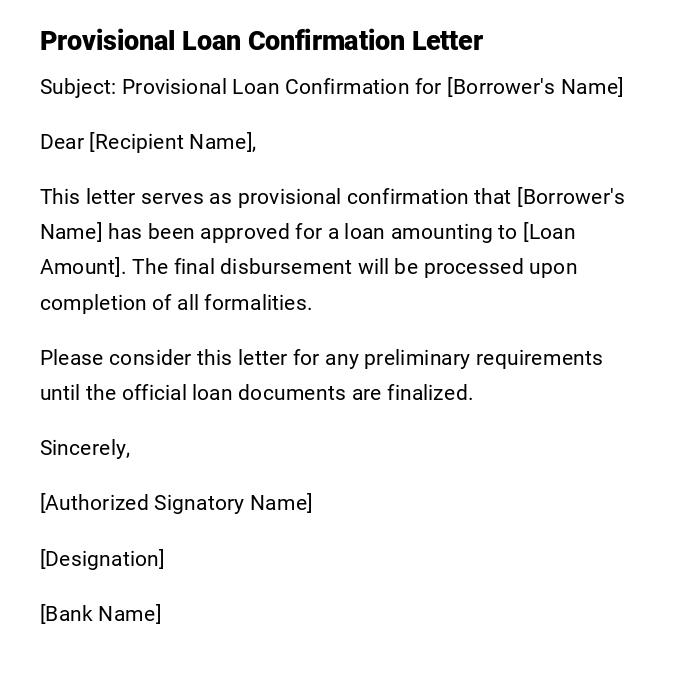

Provisional Loan Confirmation Letter

Subject: Provisional Loan Confirmation for [Borrower's Name]

Dear [Recipient Name],

This letter serves as provisional confirmation that [Borrower's Name] has been approved for a loan amounting to [Loan Amount]. The final disbursement will be processed upon completion of all formalities.

Please consider this letter for any preliminary requirements until the official loan documents are finalized.

Sincerely,

[Authorized Signatory Name]

[Designation]

[Bank Name]

Casual Loan Confirmation Email

Subject: Your Loan Confirmation

Hi [Recipient Name],

We confirm that [Borrower's Name] has received a loan of [Loan Amount] from [Bank Name]. All details have been shared as per the agreement.

Thanks,

[Authorized Signatory Name]

What is a Loan Confirmation Letter and why it is needed

- A Loan Confirmation Letter is an official document issued by a bank or financial institution confirming the sanction and receipt of a loan.

- Purpose: Provides formal acknowledgment of loan approval and details for record-keeping, verification, or legal purposes.

- Essential for borrowers to use as proof for financial planning, disbursement, and documentation with third parties.

Who should issue a Loan Confirmation Letter

- Authorized bank officials or financial institution representatives.

- Officers in charge of loan processing or customer accounts.

- Signatories authorized to confirm financial transactions on behalf of the bank.

Who should receive a Loan Confirmation Letter

- Borrowers who have been granted the loan.

- Employers or institutions requesting loan verification for financial purposes.

- Third parties or government agencies that require proof of sanctioned loan.

When to issue a Loan Confirmation Letter

- Immediately after loan sanction and disbursement.

- When a borrower requests official confirmation for documentation or verification.

- Prior to submission for housing, education, or business loan purposes.

- Whenever third-party verification of loan status is required.

How to write and send a Loan Confirmation Letter

- Begin with a clear subject line indicating loan confirmation.

- Address the borrower or recipient formally.

- Mention the borrower's name, loan amount, and date of sanction.

- Include loan account number, repayment schedule, and relevant terms.

- Close with a formal sign-off and authorized signature.

- Send via official email, postal mail, or hand-delivered letter as appropriate.

Requirements and prerequisites before issuing a Loan Confirmation Letter

- Completed loan approval process and disbursement.

- Verified borrower's identification and account details.

- Accurate documentation of loan amount, interest rate, and repayment schedule.

- Authorization from bank officer or financial institution to issue confirmation.

- Any necessary internal approvals completed for official issuance.

Formatting and style guidelines for Loan Confirmation Letters

- Length: Short and precise, typically 150–250 words.

- Tone: Formal, professional, and courteous.

- Wording: Clear, unambiguous, and factual.

- Style: Letter format for printed documents; email format for digital correspondence.

- Attachments: Include relevant loan agreement references if required.

- Etiquette: Use bank letterhead, authorized signature, and official seal if applicable.

Common mistakes to avoid in Loan Confirmation Letters

- Providing incorrect loan amount or account number.

- Omitting repayment schedule or essential loan terms.

- Using informal or casual language in official letters.

- Sending without proper authorization or bank seal.

- Failing to clearly identify the borrower or recipient.

Tips and best practices for Loan Confirmation Letters

- Double-check all figures, dates, and account details before issuance.

- Maintain professional formatting and bank branding.

- Ensure the letter references relevant agreements or sanction numbers.

- Use clear and simple language to avoid confusion.

- Provide contact information for follow-up inquiries.

Key elements and structure of a Loan Confirmation Letter

- Subject Line: Clearly mention loan confirmation.

- Recipient Greeting: Address the borrower or institution.

- Loan Details: Borrower name, amount, account number, sanction date, repayment terms.

- Purpose Statement: Optional note on usage or verification.

- Closing: Formal sign-off with authorized signature and designation.

- Attachments (optional): Reference loan documents, agreements, or sanction letters.

After sending a Loan Confirmation Letter

- Confirm receipt with the borrower or requesting party.

- Maintain a copy in the official bank records.

- Respond to any inquiries regarding loan details or verification.

- Update internal systems to reflect the issuance of confirmation.

Pros and cons of sending a Loan Confirmation Letter

- Pros: Provides official verification, aids in legal and financial documentation, builds trust with borrower, ensures clarity in loan terms.

- Cons: Minor risk of errors in figures affecting trust, requires proper authorization, can be time-sensitive if delayed.

Download Word Doc

Download Word Doc

Download PDF

Download PDF