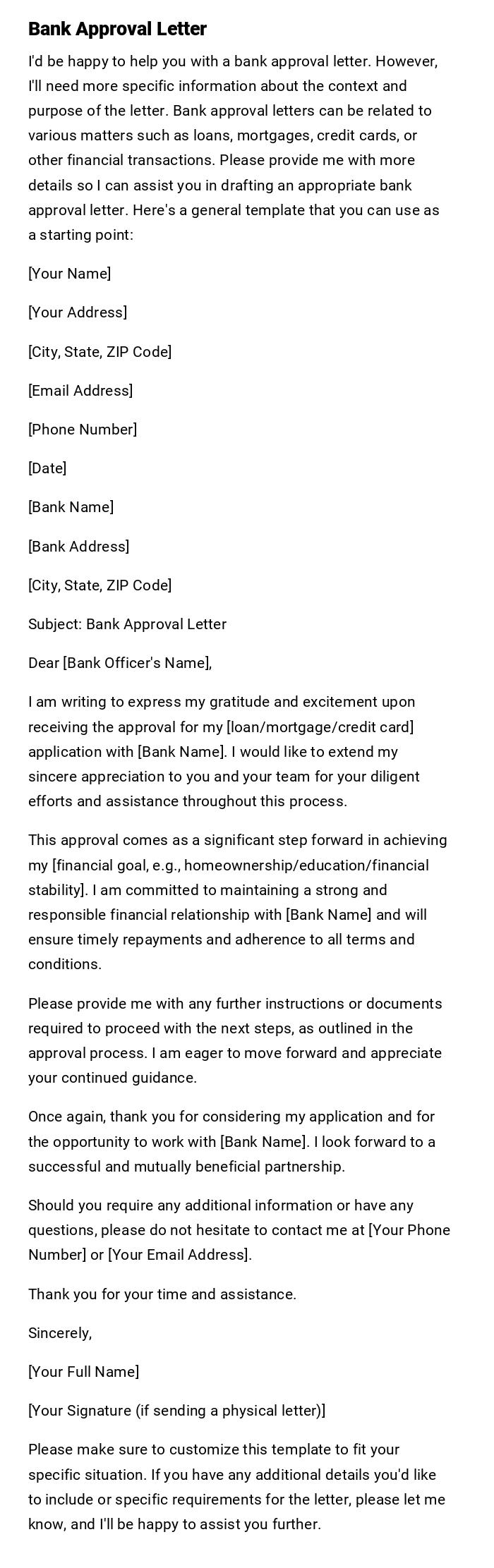

Bank Approval Letter

I'd be happy to help you with a bank approval letter. However, I'll need more specific information about the context and purpose of the letter. Bank approval letters can be related to various matters such as loans, mortgages, credit cards, or other financial transactions. Please provide me with more details so I can assist you in drafting an appropriate bank approval letter. Here's a general template that you can use as a starting point:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Bank Approval Letter

Dear [Bank Officer's Name],

I am writing to express my gratitude and excitement upon receiving the approval for my [loan/mortgage/credit card] application with [Bank Name]. I would like to extend my sincere appreciation to you and your team for your diligent efforts and assistance throughout this process.

This approval comes as a significant step forward in achieving my [financial goal, e.g., homeownership/education/financial stability]. I am committed to maintaining a strong and responsible financial relationship with [Bank Name] and will ensure timely repayments and adherence to all terms and conditions.

Please provide me with any further instructions or documents required to proceed with the next steps, as outlined in the approval process. I am eager to move forward and appreciate your continued guidance.

Once again, thank you for considering my application and for the opportunity to work with [Bank Name]. I look forward to a successful and mutually beneficial partnership.

Should you require any additional information or have any questions, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your time and assistance.

Sincerely,

[Your Full Name]

[Your Signature (if sending a physical letter)]

Please make sure to customize this template to fit your specific situation. If you have any additional details you'd like to include or specific requirements for the letter, please let me know, and I'll be happy to assist you further.

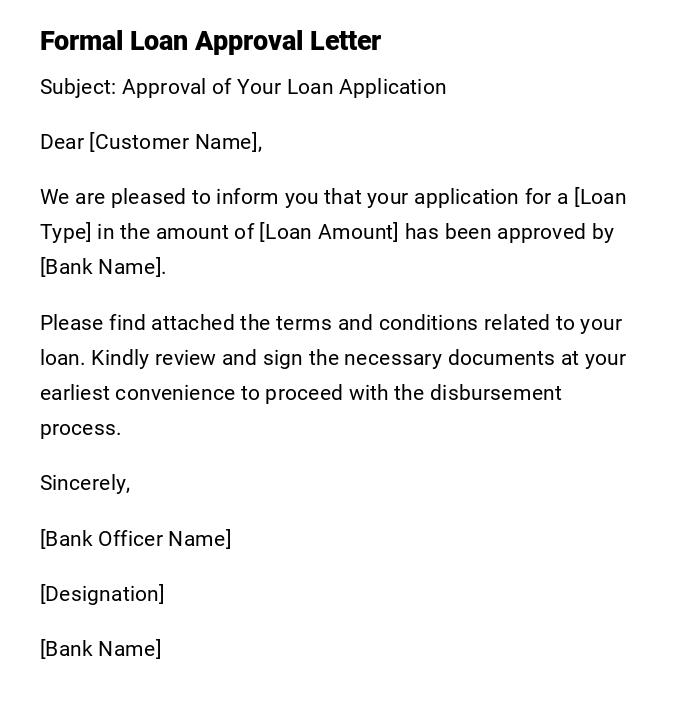

Bank Loan Approval Letter

Subject: Approval of Your Loan Application

Dear [Customer Name],

We are pleased to inform you that your application for a [Loan Type] in the amount of [Loan Amount] has been approved by [Bank Name].

Please find attached the terms and conditions related to your loan. Kindly review and sign the necessary documents at your earliest convenience to proceed with the disbursement process.

Sincerely,

[Bank Officer Name]

[Designation]

[Bank Name]

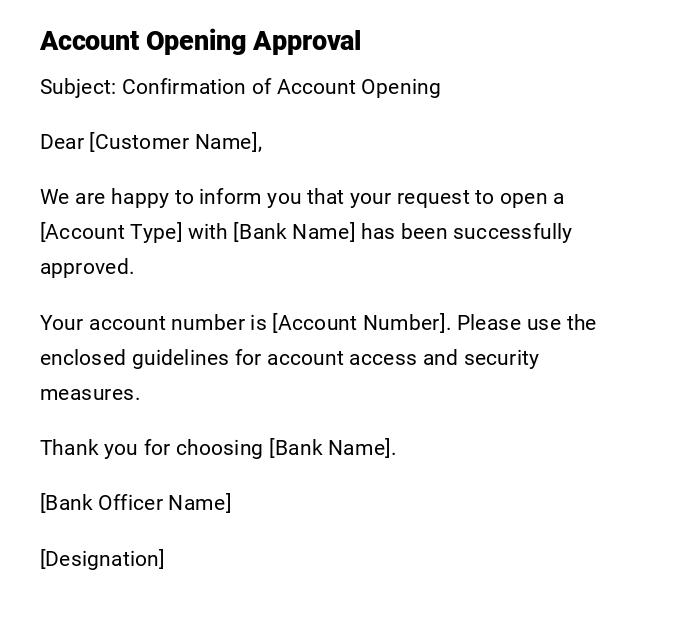

Bank Account Opening Approval Letter

Subject: Confirmation of Account Opening

Dear [Customer Name],

We are happy to inform you that your request to open a [Account Type] with [Bank Name] has been successfully approved.

Your account number is [Account Number]. Please use the enclosed guidelines for account access and security measures.

Thank you for choosing [Bank Name].

[Bank Officer Name]

[Designation]

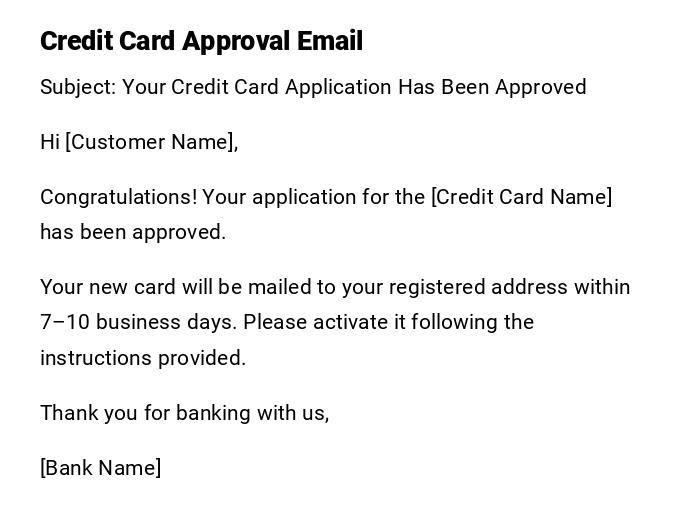

Credit Card Approval Email

Subject: Your Credit Card Application Has Been Approved

Hi [Customer Name],

Congratulations! Your application for the [Credit Card Name] has been approved.

Your new card will be mailed to your registered address within 7–10 business days. Please activate it following the instructions provided.

Thank you for banking with us,

[Bank Name]

Business Loan Approval Letter

Subject: Approval of Business Loan Application

Dear [Business Owner Name],

We are pleased to inform you that your business loan request for [Loan Amount] has been approved.

Please review the attached terms and conditions, and contact our office to schedule the signing of required agreements and release of funds.

Sincerely,

[Bank Officer Name]

[Bank Name]

Mortgage Loan Approval Letter

Subject: Mortgage Loan Approval Notification

Dear [Customer Name],

We are pleased to confirm the approval of your mortgage loan application for the property located at [Property Address].

Enclosed are the loan terms and disbursement details. Kindly complete the necessary documentation to proceed with the loan release.

Thank you,

[Bank Officer Name]

[Bank Name]

Provisional Bank Approval Letter

Subject: Provisional Approval of Your Loan Application

Dear [Customer Name],

We are happy to provide provisional approval for your [Loan Type] application for [Loan Amount], subject to submission of the following documents: [List of Documents].

Once the required documents are submitted and verified, final approval will be granted, and funds disbursed.

Regards,

[Bank Officer Name]

[Bank Name]

What is a Bank Approval Letter and Why It Is Important

A bank approval letter is an official document issued by a bank to confirm approval for financial requests such as loans, credit cards, or account openings.

Purpose:

- Serves as formal confirmation of approval

- Provides the terms and conditions for the financial service

- Acts as a record for both the bank and customer

- Enables the recipient to proceed with financial transactions or agreements

Who Can Issue a Bank Approval Letter

- Bank officers authorized to approve loans, credit cards, or accounts

- Branch managers or relationship managers for individual customers

- Corporate banking representatives for business clients

- Any designated bank official with authorization to communicate approvals

Who Should Receive a Bank Approval Letter

- Individual customers applying for personal loans, credit cards, or accounts

- Business owners seeking business loans

- Mortgage applicants

- Authorized representatives acting on behalf of account holders

When to Send a Bank Approval Letter

- Upon completion and verification of a customer’s application

- After all regulatory and internal approval checks are satisfied

- Before the disbursement of funds or issuance of financial products

- Immediately following formal bank approval to confirm the decision

How to Draft and Send a Bank Approval Letter

- Verify customer and application details

- Clearly state the type of approval and any conditions

- Include required next steps (document submission, signing agreements)

- Attach terms and conditions or relevant schedules

- Choose sending mode: printed letter for formal record or email for speed

Requirements and Prerequisites Before Issuing

- Complete review of customer application

- Approval from authorized bank personnel

- Accurate verification of customer identity and documents

- Drafting of terms and conditions for transparency

- Ensure legal and regulatory compliance

Elements and Structure of a Bank Approval Letter

- Subject line indicating approval

- Salutation and customer name

- Type of financial product approved

- Approval amount or limit

- Terms and conditions summary

- Next steps or required actions

- Contact information for queries

- Professional closing with signature and designation

Formatting Guidelines for Bank Approval Letters

- Length: concise, 1 page recommended

- Tone: professional, formal, and courteous

- Wording: clear, precise, and unambiguous

- Attachments: include terms, schedules, and relevant agreements

- Mode: printed letter for legal purposes, email for speed and convenience

Tricks and Tips for Bank Approval Letters

- Double-check customer details and loan amounts

- Highlight key terms and conditions clearly

- Ensure signatures are properly authorized

- Use a formal template to maintain consistency

- Provide clear instructions for the next steps to avoid confusion

Common Mistakes to Avoid in Bank Approval Letters

- Omitting essential information such as loan amount or product type

- Using vague or ambiguous terms

- Sending without proper authorization

- Failing to attach necessary terms and conditions

- Delaying communication after approval

FAQ About Bank Approval Letters

-

Q: Can a bank approval be provisional?

A: Yes, provisional approval is given pending submission of additional documents. -

Q: Is signature necessary on the letter?

A: For formal approvals, yes; it ensures authenticity and legal validity. -

Q: Can the approval letter be emailed?

A: Yes, email is acceptable for speed, but printed letters are recommended for legal purposes. -

Q: What happens after approval?

A: Customers must follow the next steps, such as signing agreements or submitting documents, to finalize the process. -

Q: Can the approval be revoked?

A: Only if the customer fails to meet conditions or provides incorrect information.

Download Word Doc

Download Word Doc

Download PDF

Download PDF