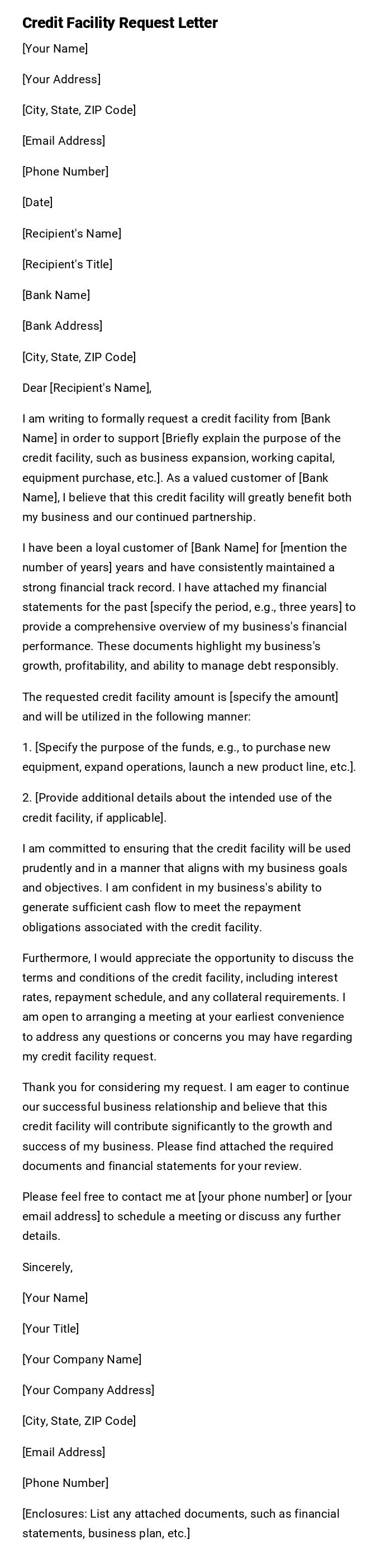

Credit Facility Request Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing to formally request a credit facility from [Bank Name] in order to support [Briefly explain the purpose of the credit facility, such as business expansion, working capital, equipment purchase, etc.]. As a valued customer of [Bank Name], I believe that this credit facility will greatly benefit both my business and our continued partnership.

I have been a loyal customer of [Bank Name] for [mention the number of years] years and have consistently maintained a strong financial track record. I have attached my financial statements for the past [specify the period, e.g., three years] to provide a comprehensive overview of my business's financial performance. These documents highlight my business's growth, profitability, and ability to manage debt responsibly.

The requested credit facility amount is [specify the amount] and will be utilized in the following manner:

1. [Specify the purpose of the funds, e.g., to purchase new equipment, expand operations, launch a new product line, etc.].

2. [Provide additional details about the intended use of the credit facility, if applicable].

I am committed to ensuring that the credit facility will be used prudently and in a manner that aligns with my business goals and objectives. I am confident in my business's ability to generate sufficient cash flow to meet the repayment obligations associated with the credit facility.

Furthermore, I would appreciate the opportunity to discuss the terms and conditions of the credit facility, including interest rates, repayment schedule, and any collateral requirements. I am open to arranging a meeting at your earliest convenience to address any questions or concerns you may have regarding my credit facility request.

Thank you for considering my request. I am eager to continue our successful business relationship and believe that this credit facility will contribute significantly to the growth and success of my business. Please find attached the required documents and financial statements for your review.

Please feel free to contact me at [your phone number] or [your email address] to schedule a meeting or discuss any further details.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Your Company Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Enclosures: List any attached documents, such as financial statements, business plan, etc.]

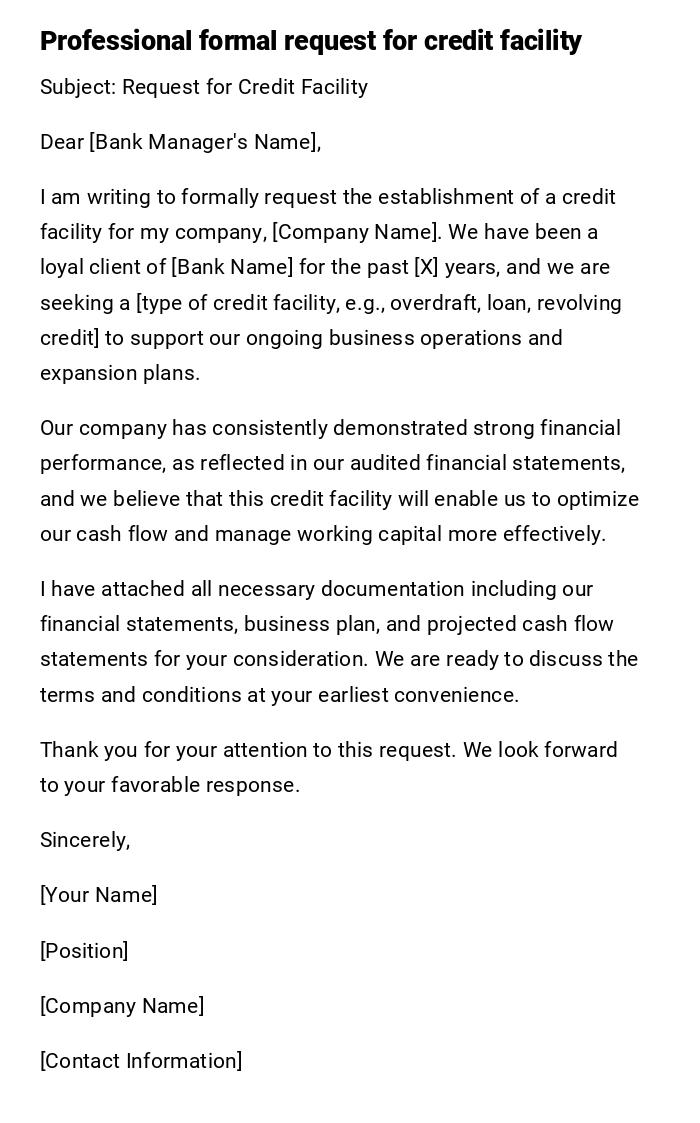

Formal Credit Facility Request Letter

Subject: Request for Credit Facility

Dear [Bank Manager's Name],

I am writing to formally request the establishment of a credit facility for my company, [Company Name]. We have been a loyal client of [Bank Name] for the past [X] years, and we are seeking a [type of credit facility, e.g., overdraft, loan, revolving credit] to support our ongoing business operations and expansion plans.

Our company has consistently demonstrated strong financial performance, as reflected in our audited financial statements, and we believe that this credit facility will enable us to optimize our cash flow and manage working capital more effectively.

I have attached all necessary documentation including our financial statements, business plan, and projected cash flow statements for your consideration. We are ready to discuss the terms and conditions at your earliest convenience.

Thank you for your attention to this request. We look forward to your favorable response.

Sincerely,

[Your Name]

[Position]

[Company Name]

[Contact Information]

Provisional Credit Facility Request Email

Subject: Provisional Credit Facility Request

Dear [Bank Officer's Name],

I hope this message finds you well. I am writing to explore the possibility of securing a provisional credit facility for [Company Name]. We are currently assessing our short-term funding requirements and would appreciate your guidance on the provisional terms available.

We have provided preliminary financial statements and a brief summary of our anticipated funding needs. We are eager to discuss the facility limits, interest rates, and repayment schedules at your convenience.

Thank you for considering this preliminary request. We look forward to your response and guidance on the next steps.

Best regards,

[Your Name]

[Position]

[Company Name]

[Email / Phone]

Informal Credit Request Email

Subject: Request for Credit Facility Assistance

Hi [Bank Officer's First Name],

I hope you’re doing well! I wanted to reach out to see if [Bank Name] could assist us with a short-term credit facility for our upcoming projects at [Company Name]. We’re looking at something flexible to help with cash flow for the next few months.

Let me know what info you need from our side to get the process started. Really appreciate your support!

Thanks a lot,

[Your Name]

[Position]

[Company Name]

Credit Facility Request for Expansion Projects

Subject: Credit Facility Request for Business Expansion

Dear [Bank Manager's Name],

Our company, [Company Name], is planning a major expansion in the next fiscal year and requires a credit facility to finance this growth. We are seeking a [loan/overdraft/revolving credit] of [amount] to cover costs associated with [specific expansion activities, e.g., equipment purchase, inventory, infrastructure].

Enclosed are our recent audited financial statements, business expansion plan, and projected cash flow. We are confident that our strong operational performance and strategic plan will ensure timely repayment.

We would appreciate the opportunity to discuss the terms and conditions at your earliest convenience.

Warm regards,

[Your Name]

[Position]

[Company Name]

[Contact Information]

Urgent Credit Facility Request Letter

Subject: Urgent Request for Credit Facility

Dear [Bank Manager's Name],

I am writing to urgently request the provision of a short-term credit facility for [Company Name] due to immediate working capital requirements. A facility of [amount] is needed to manage [specific urgent need, e.g., supplier payments, payroll, emergency expenditures].

All relevant financial documents, including recent bank statements and accounts, are attached for your review. We kindly request expedited consideration and would greatly appreciate your prompt response.

Sincerely,

[Your Name]

[Position]

[Company Name]

[Contact Information]

Credit Facility Request for Seasonal Business Needs

Subject: Seasonal Credit Facility Request

Dear [Bank Manager's Name],

As our business experiences seasonal fluctuations, we are seeking a temporary credit facility to manage inventory and operational costs during peak seasons. We request a facility of [amount] to ensure smooth operations and timely supplier payments.

Attached are our financial records and a projection of seasonal cash flow requirements. We hope to discuss the facility limits, duration, and repayment terms at your earliest convenience.

Thank you for your support.

Best regards,

[Your Name]

[Position]

[Company Name]

[Contact Information]

What is a Credit Facility Request Letter and Why Send One

A credit facility request letter is a formal or informal document sent by an individual or a business to a financial institution requesting access to credit or loans.

The purpose of this letter is to:

- Request financial assistance to support business operations or personal needs

- Outline the amount required and the intended purpose

- Provide assurance of repayment ability through financial statements or projections

- Establish a formal communication record with the bank or lender

Who Should Send a Credit Facility Request Letter

- Business owners seeking working capital or expansion funds

- Individuals requesting personal or business loans

- Company financial managers or accountants authorized to handle banking relationships

- Legal representatives or agents acting on behalf of a company with proper authorization

Whom Should Receive the Credit Facility Request

- Bank managers or loan officers at financial institutions

- Corporate banking relationship managers

- Authorized representatives of lending organizations

- Digital banking portals for formal email submissions, if available

When to Send a Credit Facility Request Letter

- Planning new business expansions or projects

- Facing seasonal cash flow requirements

- Experiencing urgent operational funding needs

- Preparing to negotiate loan terms or overdraft facilities

- Before formal meetings with bank representatives

How to Write and Send a Credit Facility Request Letter

- Begin with a clear subject line indicating the request

- Use an appropriate greeting based on formal or informal tone

- Explain the purpose of the requested credit and the amount needed

- Attach supporting documents such as financial statements or projections

- End with a courteous closing and contact information

- Send via email for digital requests or print and deliver for formal submissions

How Much Credit Can Be Requested

- The amount should align with the business's or individual's repayment capacity

- It may be based on:

- Previous banking history and relationship

- Projected cash flows or budget needs

- Type of facility requested (overdraft, loan, revolving credit)

- Typically banks will evaluate and propose a limit based on risk assessment

Requirements and Prerequisites Before Sending

- Current financial statements (audited if possible)

- Business plans or project proposals

- Identification and company registration documents

- Clear calculation of required credit amount and purpose

- Authorization letters if sending on behalf of a company

- Knowledge of banking policies for the requested facility

Formatting Guidelines

- Length: 1–2 pages for formal letters, shorter for emails

- Tone: Professional, formal for banks; casual or friendly for preliminary emails

- Style: Clear, concise, and polite

- Structure: Introduction, purpose, financial justification, closing

- Attachments: Always list or mention supporting documents

- Mode: Email or printed letter depending on urgency and formality

After Sending the Credit Facility Request

- Confirm receipt via phone call or email if possible

- Be ready to provide additional documentation if requested

- Schedule meetings with bank officials to discuss terms

- Track deadlines for responses or provisional approvals

- Maintain records for follow-up and auditing purposes

Common Mistakes to Avoid

- Requesting an amount that exceeds repayment capacity

- Failing to attach necessary financial documents

- Using vague or unclear language about the purpose

- Ignoring bank procedures or submission guidelines

- Missing deadlines for urgent or seasonal funding requests

Elements and Structure of a Credit Facility Request Letter

- Subject line clearly stating the request

- Polite greeting and introduction

- Purpose of the credit facility request

- Specific amount requested and repayment plan

- Supporting documents or attachments

- Closing statement with contact information

- Optional: Request for meeting or discussion of terms

Tricks and Tips for an Effective Request

- Use concise and professional language

- Highlight strong financial performance and repayment capability

- Attach only relevant documents, well-organized

- Tailor tone based on bank relationship (formal vs casual)

- Mention urgency or special circumstances if applicable

- Follow up politely after 3–5 business days if no response

Compare and Contrast with Other Requests

- Compared to a simple loan inquiry: A credit facility request is more detailed and formal

- Compared to an informal email: Letters carry a stronger professional tone and official record

- Alternative approaches: Online loan applications, verbal requests during meetings, provisional emails

- Choosing the right approach depends on urgency, bank policies, and business size

Download Word Doc

Download Word Doc

Download PDF

Download PDF