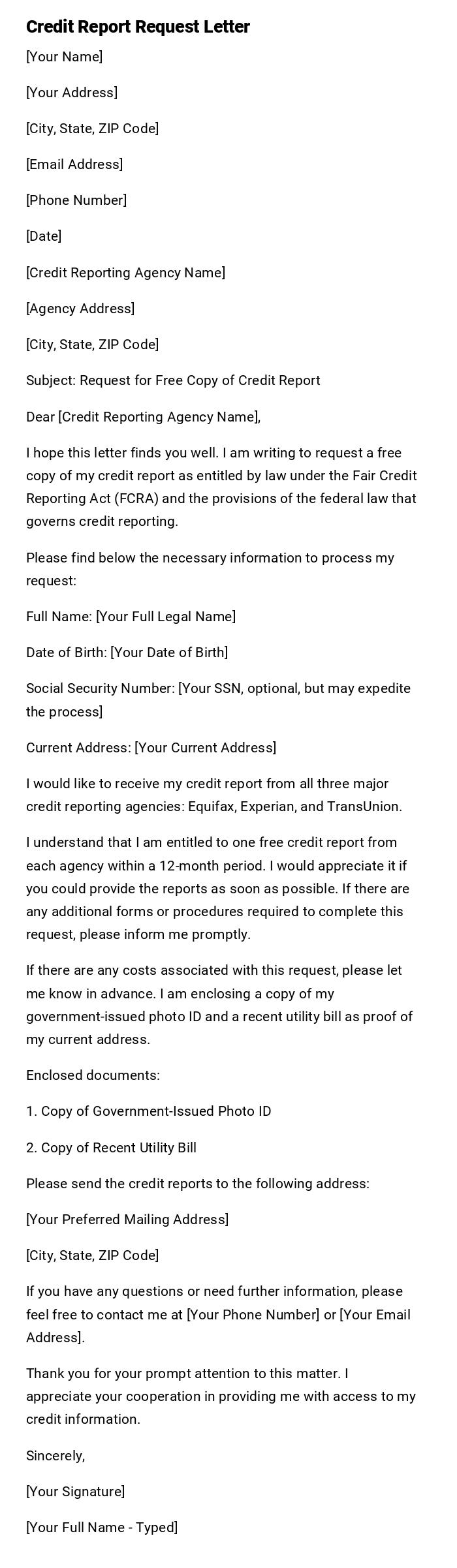

Credit Report Request Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Credit Reporting Agency Name]

[Agency Address]

[City, State, ZIP Code]

Subject: Request for Free Copy of Credit Report

Dear [Credit Reporting Agency Name],

I hope this letter finds you well. I am writing to request a free copy of my credit report as entitled by law under the Fair Credit Reporting Act (FCRA) and the provisions of the federal law that governs credit reporting.

Please find below the necessary information to process my request:

Full Name: [Your Full Legal Name]

Date of Birth: [Your Date of Birth]

Social Security Number: [Your SSN, optional, but may expedite the process]

Current Address: [Your Current Address]

I would like to receive my credit report from all three major credit reporting agencies: Equifax, Experian, and TransUnion.

I understand that I am entitled to one free credit report from each agency within a 12-month period. I would appreciate it if you could provide the reports as soon as possible. If there are any additional forms or procedures required to complete this request, please inform me promptly.

If there are any costs associated with this request, please let me know in advance. I am enclosing a copy of my government-issued photo ID and a recent utility bill as proof of my current address.

Enclosed documents:

1. Copy of Government-Issued Photo ID

2. Copy of Recent Utility Bill

Please send the credit reports to the following address:

[Your Preferred Mailing Address]

[City, State, ZIP Code]

If you have any questions or need further information, please feel free to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your prompt attention to this matter. I appreciate your cooperation in providing me with access to my credit information.

Sincerely,

[Your Signature]

[Your Full Name - Typed]

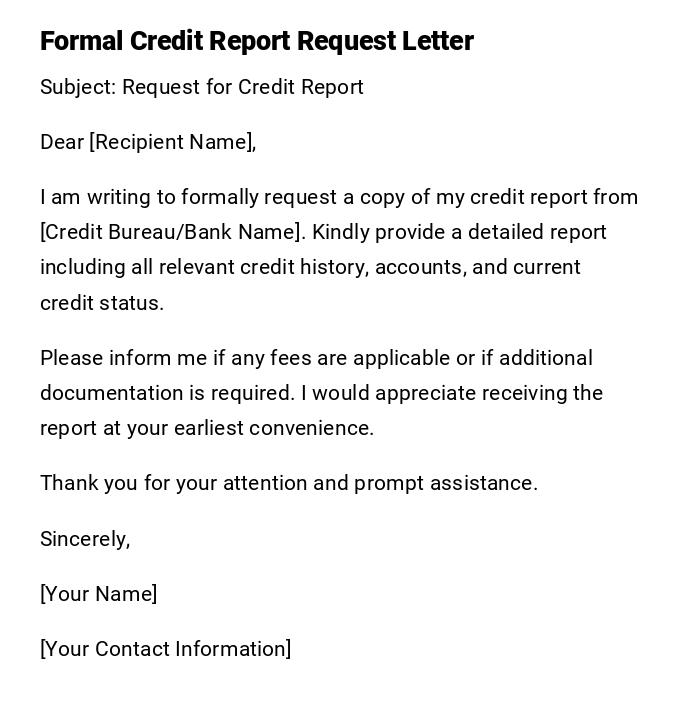

Formal Credit Report Request Letter

Subject: Request for Credit Report

Dear [Recipient Name],

I am writing to formally request a copy of my credit report from [Credit Bureau/Bank Name]. Kindly provide a detailed report including all relevant credit history, accounts, and current credit status.

Please inform me if any fees are applicable or if additional documentation is required. I would appreciate receiving the report at your earliest convenience.

Thank you for your attention and prompt assistance.

Sincerely,

[Your Name]

[Your Contact Information]

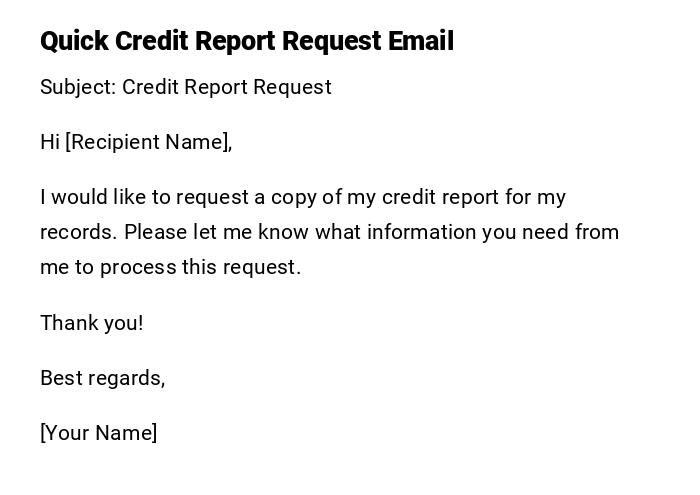

Quick Credit Report Request Email

Subject: Credit Report Request

Hi [Recipient Name],

I would like to request a copy of my credit report for my records. Please let me know what information you need from me to process this request.

Thank you!

Best regards,

[Your Name]

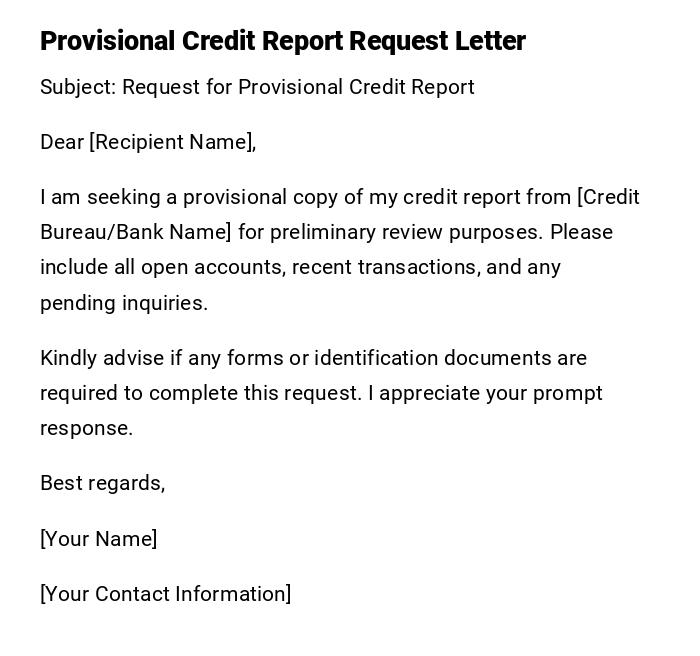

Provisional Credit Report Request Letter

Subject: Request for Provisional Credit Report

Dear [Recipient Name],

I am seeking a provisional copy of my credit report from [Credit Bureau/Bank Name] for preliminary review purposes. Please include all open accounts, recent transactions, and any pending inquiries.

Kindly advise if any forms or identification documents are required to complete this request. I appreciate your prompt response.

Best regards,

[Your Name]

[Your Contact Information]

Heartfelt Credit Report Request Letter

Subject: Request for Credit Report

Dear [Recipient Name],

I hope this message finds you well. I am requesting a copy of my credit report to better understand and manage my financial situation. Your assistance in providing a detailed report would greatly help me make informed decisions.

Thank you sincerely for your time and support.

Warm regards,

[Your Name]

Casual Credit Report Request Email

Subject: Credit Report Request

Hello [Recipient Name],

Can you please send me a copy of my credit report? I want to check my credit history and make sure everything looks correct.

Thanks a lot!

[Your Name]

What / Why is a Credit Report Request Letter

A credit report request letter is a formal or informal communication sent to a financial institution or credit bureau requesting access to an individual's credit history.

- Purpose: To obtain a copy of credit records for personal review, loan applications, or financial planning.

- Importance: Ensures transparency and allows individuals to correct inaccuracies or monitor their creditworthiness.

Who Should Send a Credit Report Request Letter

- The individual whose credit report is being requested.

- Legal guardians or authorized representatives in case of minors or individuals unable to act themselves.

- Financial advisors or lawyers with proper authorization may request reports on behalf of clients.

Whom Should the Credit Report Request Letter Be Addressed To

- The specific credit bureau (e.g., Experian, Equifax, TransUnion) or bank providing the credit report.

- Customer service or records department designated for handling credit inquiries.

- In some cases, a general contact email for credit requests may suffice.

When to Send a Credit Report Request Letter

- When applying for a loan, mortgage, or credit card.

- To monitor credit status regularly for personal financial planning.

- To verify information or resolve discrepancies in your credit report.

- When planning major purchases requiring credit checks.

How to Write and Send a Credit Report Request Letter

- Identify the recipient and appropriate department.

- Include clear subject and personal identification details.

- Specify the type of credit report requested (full, provisional, or summary).

- Mention preferred delivery method (email, postal mail, online portal).

- Sign and include contact information for follow-up.

- Send through official channels to ensure timely processing.

Requirements and Prerequisites for Requesting a Credit Report

- Valid personal identification (ID, passport, or social security number where applicable).

- Account numbers or customer reference if required by the institution.

- Written consent if requesting on behalf of another individual.

- Understanding of any applicable fees or processing time.

Formatting Guidelines for a Credit Report Request Letter

- Keep the letter concise: 2–4 paragraphs are usually sufficient.

- Maintain a polite, professional tone; casual or informal tone may be used in email for personal requests.

- Clearly state the request and specify the information needed.

- Include proper contact details and preferred delivery method.

- Avoid unnecessary information; focus on identification and report request details.

FAQ About Credit Report Request Letters

- Q: Can I request a credit report for free?

A: Many countries allow at least one free annual credit report; additional requests may incur a fee. - Q: How long does it take to receive a credit report?

A: Typically a few days to two weeks depending on the institution. - Q: Can I request a credit report online?

A: Most credit bureaus provide online request forms for convenience. - Q: What should I do if I find errors in my credit report?

A: Contact the credit bureau immediately with supporting documentation to correct inaccuracies.

After Sending / Follow-up Actions

- Confirm receipt of your request if possible.

- Track expected delivery date or online access details.

- Review the report carefully upon receipt.

- Address any discrepancies promptly with the credit bureau.

Tricks and Tips for Requesting a Credit Report

- Request your report from multiple bureaus to get a complete picture.

- Keep a copy for your records and update regularly.

- Include all identification information to avoid delays.

- Use certified mail for printed requests to ensure proof of submission.

- If requesting digitally, ensure you are using secure, official websites.

Common Mistakes to Avoid

- Omitting critical personal identification details.

- Sending requests to the wrong department or outdated addresses.

- Failing to specify the type of report needed.

- Using unclear language that may delay processing.

- Forgetting to follow up on the request if delivery takes longer than expected.

Elements and Structure of a Credit Report Request Letter

- Subject line: Clearly mention "Credit Report Request".

- Greeting: Personalize if possible.

- Introduction: State purpose of the letter.

- Body: Provide identification details and specify requested report.

- Closing: Express appreciation and include contact info.

- Sign-off: Name and optionally position if representing another entity.

- Attachments: Copies of ID or authorization forms if required.

Download Word Doc

Download Word Doc

Download PDF

Download PDF