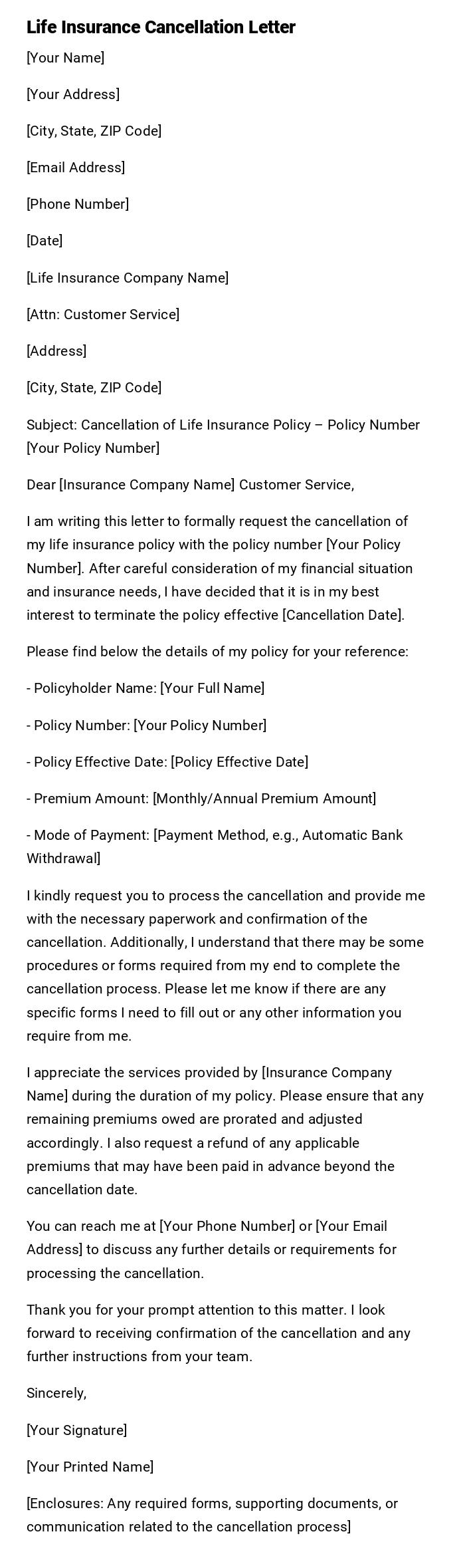

Life Insurance Cancellation Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Life Insurance Company Name]

[Attn: Customer Service]

[Address]

[City, State, ZIP Code]

Subject: Cancellation of Life Insurance Policy – Policy Number [Your Policy Number]

Dear [Insurance Company Name] Customer Service,

I am writing this letter to formally request the cancellation of my life insurance policy with the policy number [Your Policy Number]. After careful consideration of my financial situation and insurance needs, I have decided that it is in my best interest to terminate the policy effective [Cancellation Date].

Please find below the details of my policy for your reference:

- Policyholder Name: [Your Full Name]

- Policy Number: [Your Policy Number]

- Policy Effective Date: [Policy Effective Date]

- Premium Amount: [Monthly/Annual Premium Amount]

- Mode of Payment: [Payment Method, e.g., Automatic Bank Withdrawal]

I kindly request you to process the cancellation and provide me with the necessary paperwork and confirmation of the cancellation. Additionally, I understand that there may be some procedures or forms required from my end to complete the cancellation process. Please let me know if there are any specific forms I need to fill out or any other information you require from me.

I appreciate the services provided by [Insurance Company Name] during the duration of my policy. Please ensure that any remaining premiums owed are prorated and adjusted accordingly. I also request a refund of any applicable premiums that may have been paid in advance beyond the cancellation date.

You can reach me at [Your Phone Number] or [Your Email Address] to discuss any further details or requirements for processing the cancellation.

Thank you for your prompt attention to this matter. I look forward to receiving confirmation of the cancellation and any further instructions from your team.

Sincerely,

[Your Signature]

[Your Printed Name]

[Enclosures: Any required forms, supporting documents, or communication related to the cancellation process]

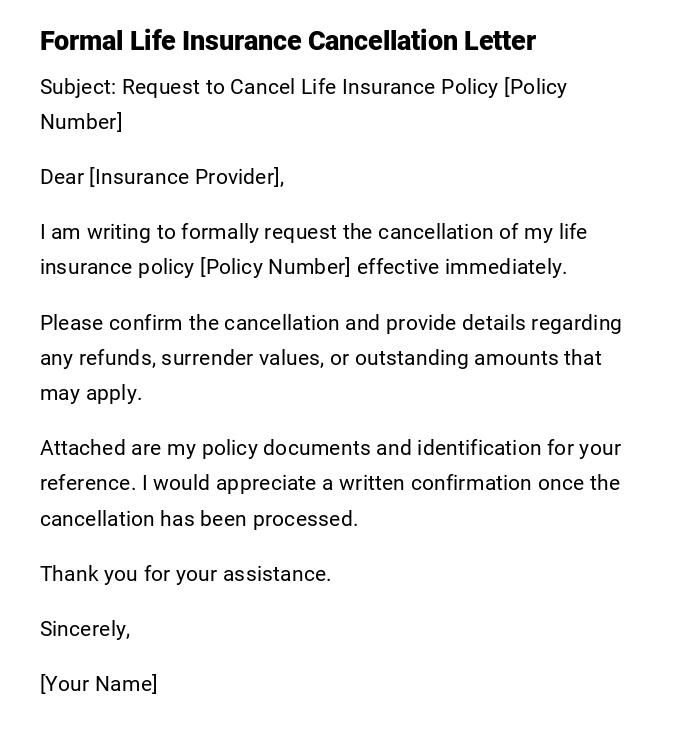

Formal Life Insurance Cancellation Letter

Subject: Request to Cancel Life Insurance Policy [Policy Number]

Dear [Insurance Provider],

I am writing to formally request the cancellation of my life insurance policy [Policy Number] effective immediately.

Please confirm the cancellation and provide details regarding any refunds, surrender values, or outstanding amounts that may apply.

Attached are my policy documents and identification for your reference. I would appreciate a written confirmation once the cancellation has been processed.

Thank you for your assistance.

Sincerely,

[Your Name]

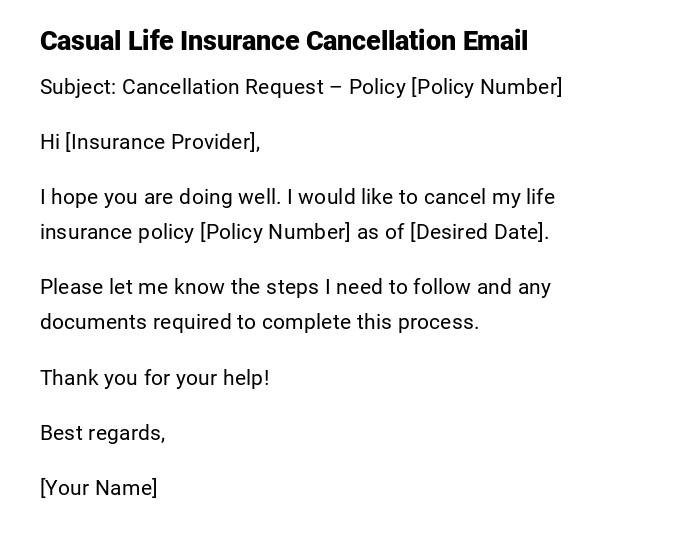

Casual Email Requesting Life Insurance Policy Cancellation

Subject: Cancellation Request – Policy [Policy Number]

Hi [Insurance Provider],

I hope you are doing well. I would like to cancel my life insurance policy [Policy Number] as of [Desired Date].

Please let me know the steps I need to follow and any documents required to complete this process.

Thank you for your help!

Best regards,

[Your Name]

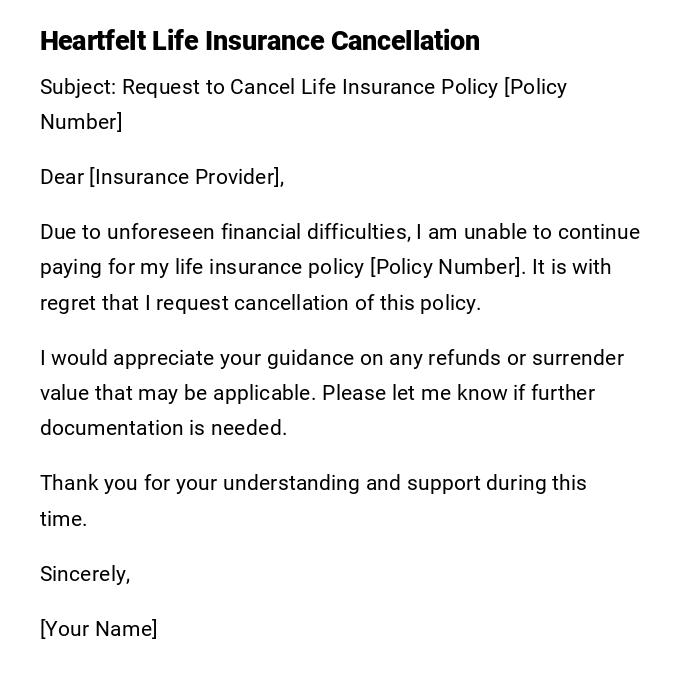

Heartfelt Life Insurance Cancellation Letter Due to Financial Hardship

Subject: Request to Cancel Life Insurance Policy [Policy Number]

Dear [Insurance Provider],

Due to unforeseen financial difficulties, I am unable to continue paying for my life insurance policy [Policy Number]. It is with regret that I request cancellation of this policy.

I would appreciate your guidance on any refunds or surrender value that may be applicable. Please let me know if further documentation is needed.

Thank you for your understanding and support during this time.

Sincerely,

[Your Name]

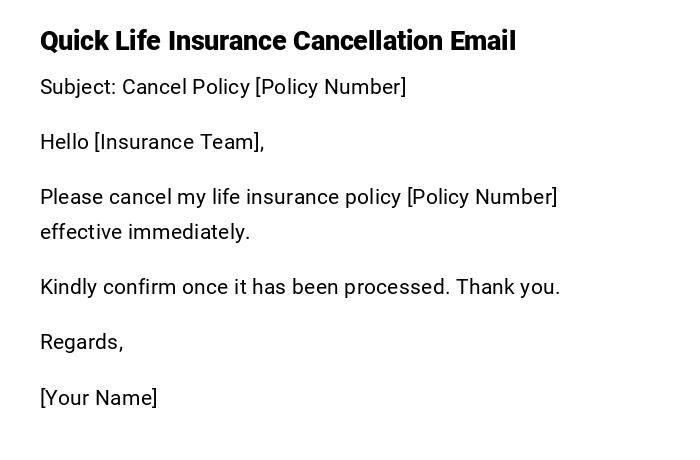

Quick Email Life Insurance Cancellation Request

Subject: Cancel Policy [Policy Number]

Hello [Insurance Team],

Please cancel my life insurance policy [Policy Number] effective immediately.

Kindly confirm once it has been processed. Thank you.

Regards,

[Your Name]

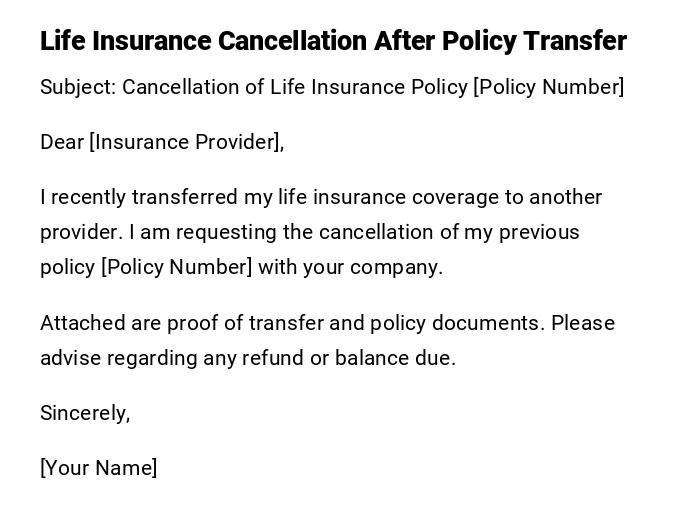

Formal Letter to Cancel Life Insurance After Policy Transfer

Subject: Cancellation of Life Insurance Policy [Policy Number]

Dear [Insurance Provider],

I recently transferred my life insurance coverage to another provider. I am requesting the cancellation of my previous policy [Policy Number] with your company.

Attached are proof of transfer and policy documents. Please advise regarding any refund or balance due.

Sincerely,

[Your Name]

What is a Life Insurance Cancellation Letter and Why It Is Needed

A life insurance cancellation letter is a formal or informal request to terminate a life insurance policy before its maturity or due date.

It serves multiple purposes:

- Officially communicates the policyholder's intention to cancel the policy

- Requests information on refunds, surrender values, or outstanding premiums

- Provides documentation for legal and financial records

- Ensures that the insurance company stops debiting premiums

Who Should Send a Life Insurance Cancellation Letter

- The policyholder themselves

- Authorized representatives or legal guardians if the policyholder is unable

- Financial advisors acting on behalf of clients with explicit consent

Whom the Cancellation Letter Should Be Addressed To

- Customer service department of the insurance company

- Policy administration team

- Specific insurance agents if the policy is managed individually

- Online portals or digital support teams if cancellation is processed digitally

When to Send a Life Insurance Cancellation Letter

- When the policyholder no longer requires coverage

- Financial hardship making premium payments unsustainable

- Policy transfer to another insurer

- Policy term is no longer suitable for personal or family needs

- Dissatisfaction with policy features or benefits

Requirements and Prerequisites Before Sending

- Policy number and details

- Personal identification documents

- Knowledge of surrender value, cancellation fees, or penalties

- Written authorization if a representative sends the letter

- Copies of any recent correspondence with the insurer

How to Write and Send a Life Insurance Cancellation Letter

- Begin with a clear subject or opening line stating policy cancellation

- Include policy number, personal details, and effective cancellation date

- Explain the reason for cancellation if necessary

- Attach relevant documents like ID, policy copies, or proof of transfer

- Request confirmation of cancellation and information on refunds or balance

- Use appropriate tone: formal, casual, or heartfelt based on situation

- Send via mail, email, or through company’s official portal

Formatting Guidelines for a Life Insurance Cancellation Letter

- Length: Short, 3–5 paragraphs

- Tone: Professional for formal situations, casual for email, heartfelt for financial hardship

- Wording: Clear, concise, polite, and direct

- Mode: Letter for formal/legal purposes, email or message for quicker response

- Attachments: Always include policy documents and identification

- Etiquette: Avoid blaming language or emotional aggression

After Sending the Cancellation Letter

- Wait for confirmation from the insurance company

- Track any refunds or surrender amounts due

- Keep copies of all correspondence and attachments

- Follow up politely if no response is received within the expected timeframe

- Verify that future premiums are no longer debited from your account

Common Mistakes to Avoid in Life Insurance Cancellation Letters

- Forgetting to include policy number or identification

- Sending without confirming required documents

- Using aggressive or emotional language

- Missing deadlines that affect refund or surrender values

- Not requesting confirmation of cancellation

Elements and Structure of a Life Insurance Cancellation Letter

- Subject line clearly indicating cancellation

- Greeting addressing the insurance company or agent

- Policy number and relevant personal details

- Clear statement requesting cancellation

- Explanation or reason for cancellation (optional)

- Request for confirmation and refund details

- Attachments such as policy documents and ID

- Closing with signature or name

Tips and Best Practices for Life Insurance Cancellation

- Always verify the cancellation terms in your policy

- Keep a record of when and how you sent the letter

- Attach all necessary documents in one submission

- Use a polite and clear tone to avoid delays

- Follow up through official channels if no response is received

- Ask for written confirmation to prevent future billing issues

Pros and Cons of Sending a Life Insurance Cancellation Letter

Pros:

- Stops unnecessary premium payments

- Provides official documentation of cancellation

- Can access surrender value or refunds

- Avoids future disputes with insurer

Cons:

- Possible financial loss if surrender fees apply

- Loss of life insurance coverage and associated benefits

- May require administrative effort or follow-up

Compare and Contrast with Similar Letters

- Policy Adjustment Letter: Requests changes to coverage instead of cancellation

- Premium Payment Stop Letter: Stops automatic payment but keeps policy active

- Refund Request Letter: Focuses on monetary reimbursement, may accompany cancellation

- Life Insurance Cancellation Letter: Specifically ends policy and may request refunds or surrender value

Download Word Doc

Download Word Doc

Download PDF

Download PDF