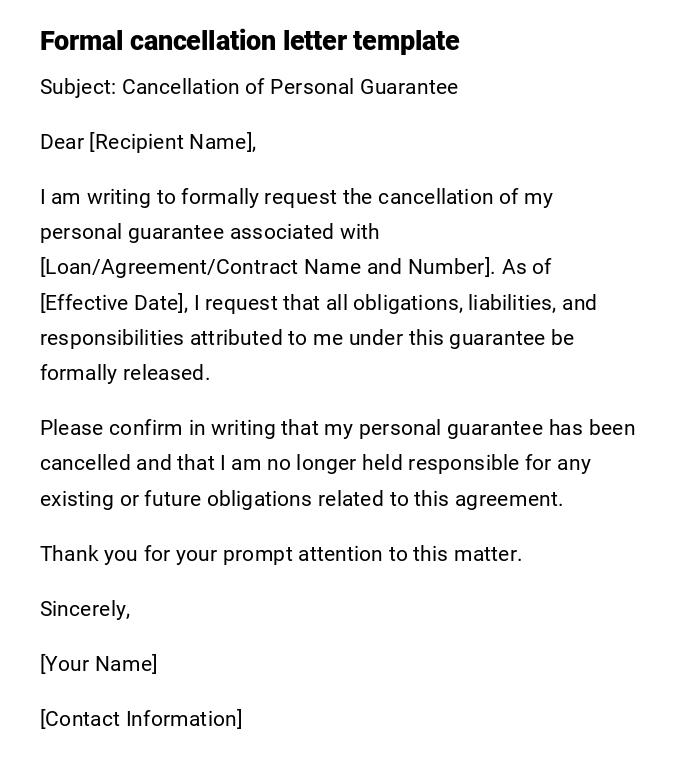

Formal Personal Guarantee Cancellation Letter

Subject: Cancellation of Personal Guarantee

Dear [Recipient Name],

I am writing to formally request the cancellation of my personal guarantee associated with [Loan/Agreement/Contract Name and Number]. As of [Effective Date], I request that all obligations, liabilities, and responsibilities attributed to me under this guarantee be formally released.

Please confirm in writing that my personal guarantee has been cancelled and that I am no longer held responsible for any existing or future obligations related to this agreement.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Contact Information]

Email Request for Personal Guarantee Release

Subject: Request for Release from Personal Guarantee

Dear [Recipient Name],

I hope this message finds you well. I am reaching out to request a formal release from the personal guarantee I hold for [Loan/Contract Name]. Considering [reason, e.g., full repayment, restructuring, or personal circumstances], I kindly ask that you process this cancellation effective immediately.

Please acknowledge receipt of this email and confirm the release at your earliest convenience.

Thank you for your cooperation.

Best regards,

[Your Name]

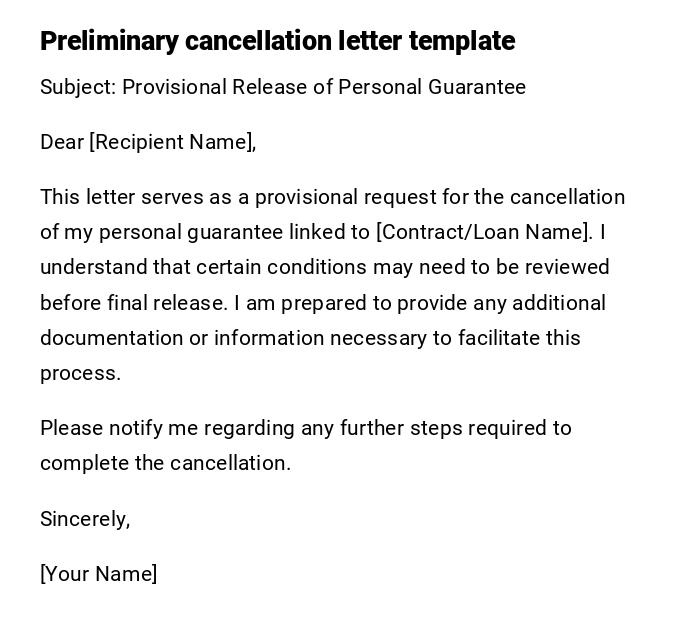

Provisional Personal Guarantee Cancellation Letter

Subject: Provisional Release of Personal Guarantee

Dear [Recipient Name],

This letter serves as a provisional request for the cancellation of my personal guarantee linked to [Contract/Loan Name]. I understand that certain conditions may need to be reviewed before final release. I am prepared to provide any additional documentation or information necessary to facilitate this process.

Please notify me regarding any further steps required to complete the cancellation.

Sincerely,

[Your Name]

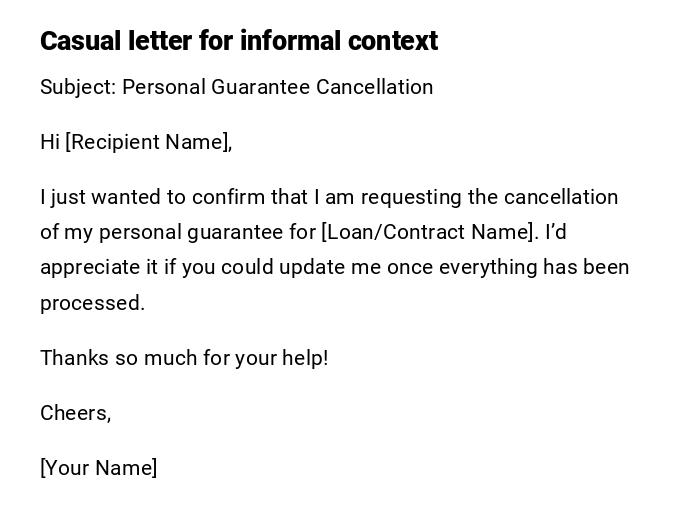

Informal Personal Guarantee Release Letter

Subject: Personal Guarantee Cancellation

Hi [Recipient Name],

I just wanted to confirm that I am requesting the cancellation of my personal guarantee for [Loan/Contract Name]. I’d appreciate it if you could update me once everything has been processed.

Thanks so much for your help!

Cheers,

[Your Name]

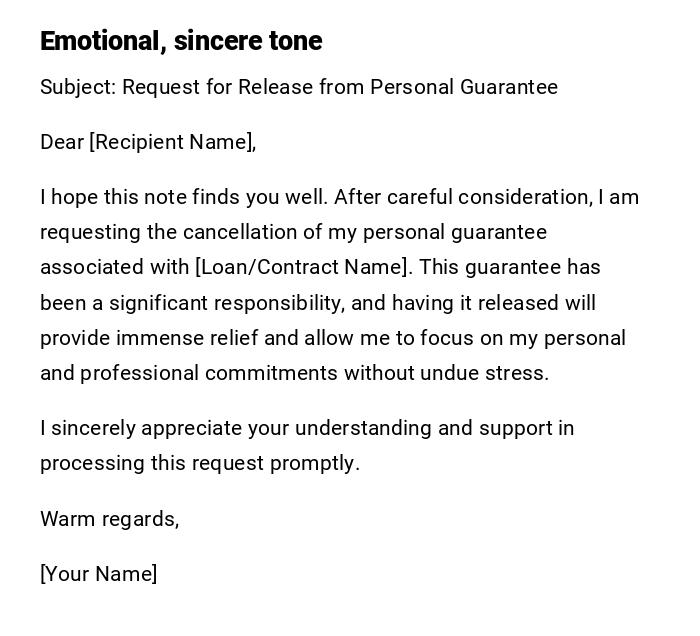

Heartfelt Personal Guarantee Cancellation Request

Subject: Request for Release from Personal Guarantee

Dear [Recipient Name],

I hope this note finds you well. After careful consideration, I am requesting the cancellation of my personal guarantee associated with [Loan/Contract Name]. This guarantee has been a significant responsibility, and having it released will provide immense relief and allow me to focus on my personal and professional commitments without undue stress.

I sincerely appreciate your understanding and support in processing this request promptly.

Warm regards,

[Your Name]

What / Why of Personal Guarantee Cancellation Letters

A Personal Guarantee Cancellation Letter is a formal or informal communication used to request the release of an individual from obligations they have guaranteed on behalf of another party.

The purpose of this letter is to:

- Formally notify the lender or relevant party of the request.

- Document the cancellation for legal and personal records.

- Ensure the guarantor is no longer liable for future obligations.

- Provide a written record to prevent misunderstandings or disputes.

Who Should Send a Personal Guarantee Cancellation Letter

- The guarantor themselves, who wants to be released from their obligations.

- In cases of corporate guarantees, an authorized representative of the guarantor.

- Sometimes, a legal representative or attorney may send it on behalf of the guarantor.

- It is always preferable that the sender has clear legal authority to make the request.

Whom the Letter Should Be Addressed To

- The bank, financial institution, or lender holding the guarantee.

- The company or entity benefiting from the guarantee.

- Legal or contract management departments if the organization is large.

- Occasionally, to an attorney or mediator if the guarantee is disputed or requires legal oversight.

When to Send a Personal Guarantee Cancellation Letter

- After full repayment of the associated loan or fulfillment of contractual obligations.

- When refinancing or restructuring the loan, removing personal guarantees.

- Upon mutual agreement between the guarantor and lender.

- If the guarantor wishes to withdraw from the agreement due to personal or financial changes.

- When the guarantee period has expired as per contract terms.

How to Write and Send the Letter

- Start with a clear subject line: "Request for Personal Guarantee Cancellation."

- Use a professional and polite tone, adjusting formality to the recipient.

- Include relevant contract or loan details for clarity.

- Mention reasons if appropriate (optional but can facilitate approval).

- Request confirmation in writing and provide contact information.

- Choose the mode of sending:

- Email: Quick, formal, keeps electronic record.

- Printed Letter: Official, may be required for legal or banking purposes.

- Keep a copy for your personal and legal records.

Requirements and Prerequisites Before Sending

- Full understanding of the terms of the original personal guarantee.

- Documentation proving repayment or fulfillment of obligations.

- Any prior approvals or consents required by the lender.

- Accurate contact details for the recipient.

- Optional: Legal consultation to ensure proper wording and avoid unintended liabilities.

Formatting Tips for Personal Guarantee Cancellation Letters

- Length: 1–2 pages maximum, concise and focused.

- Tone: Formal or professional for institutions; casual or informal may be used for smaller entities.

- Wording: Clear, polite, and unambiguous. Avoid complex legal jargon unless necessary.

- Mode: Email for speed and record, printed letter for official confirmation.

- Etiquette: Address recipient respectfully, use proper greetings and closings.

Pros and Cons of Sending a Personal Guarantee Cancellation Letter

Pros:

- Provides formal release from liability.

- Protects the guarantor legally.

- Creates a documented record for future reference.

Cons:

- Lender may reject the request if conditions are unmet.

- Could delay finalizing related financial agreements.

- Requires proper timing and documentation to be effective.

FAQ About Personal Guarantee Cancellation Letters

Q: Can I cancel a personal guarantee unilaterally?

A: Usually not; lender approval is required unless the contract allows unilateral cancellation.

Q: How long does it take for the cancellation to be effective?

A: It depends on the lender; confirmation in writing usually defines the effective date.

Q: Do I need to provide reasons for cancellation?

A: Not always, but providing context can facilitate approval.

Q: Is legal advice necessary?

A: It is recommended, especially for large guarantees or complex agreements.

Elements and Structure of a Personal Guarantee Cancellation Letter

- Subject line: Clearly state purpose.

- Greeting: Address the recipient formally.

- Introduction: State who you are and your relation to the guarantee.

- Body:

- Reference the guarantee and associated agreement.

- State reason or condition for cancellation (optional).

- Request confirmation of release.

- Conclusion: Thank the recipient, indicate readiness to provide documentation.

- Closing: Formal sign-off.

- Attachments: Include supporting documents, proof of repayment, or prior correspondence.

After Sending / Follow-up Actions

- Wait for written acknowledgment or confirmation.

- Follow up if no response is received within a reasonable timeframe (usually 7–14 days).

- Keep copies of all communications for records.

- Confirm the release has been processed and obtain a final official statement.

- Update personal and financial records to reflect cancellation.

Tricks and Tips for Effective Personal Guarantee Cancellation Letters

- Keep your message concise but complete.

- Reference exact contract or loan numbers for clarity.

- Always request written confirmation.

- Send through traceable methods (email with read receipts or registered mail).

- Consider attaching supporting documents upfront to reduce back-and-forth.

- Maintain polite and professional language; avoid confrontation.

Common Mistakes to Avoid

- Failing to reference the specific agreement or contract.

- Not providing sufficient information for the lender to process the request.

- Using ambiguous or informal language that may lead to misinterpretation.

- Assuming unilateral cancellation without lender approval.

- Neglecting to follow up for confirmation.

Does It Require Attestation or Authorization?

- For formal bank or corporate guarantees, official attestation or notarization may be required.

- Some lenders may require signatures of authorized representatives or corporate seals.

- Email requests may not need attestation but should be sent from verified accounts.

- Always check with the lender’s policy before sending the letter.

Download Word Doc

Download Word Doc

Download PDF

Download PDF