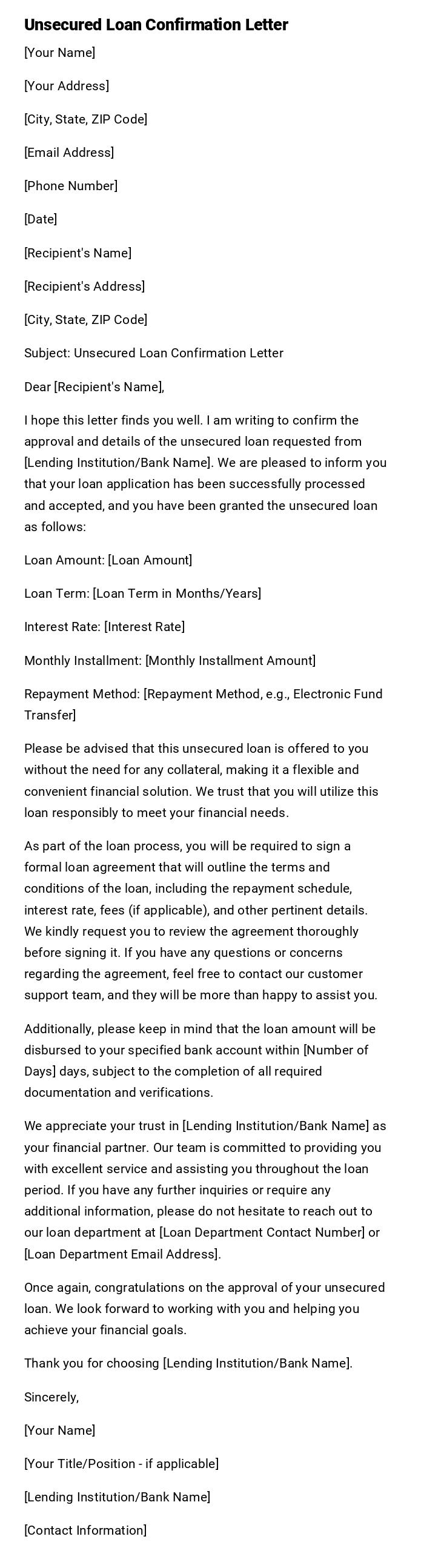

Unsecured Loan Confirmation Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Unsecured Loan Confirmation Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to confirm the approval and details of the unsecured loan requested from [Lending Institution/Bank Name]. We are pleased to inform you that your loan application has been successfully processed and accepted, and you have been granted the unsecured loan as follows:

Loan Amount: [Loan Amount]

Loan Term: [Loan Term in Months/Years]

Interest Rate: [Interest Rate]

Monthly Installment: [Monthly Installment Amount]

Repayment Method: [Repayment Method, e.g., Electronic Fund Transfer]

Please be advised that this unsecured loan is offered to you without the need for any collateral, making it a flexible and convenient financial solution. We trust that you will utilize this loan responsibly to meet your financial needs.

As part of the loan process, you will be required to sign a formal loan agreement that will outline the terms and conditions of the loan, including the repayment schedule, interest rate, fees (if applicable), and other pertinent details. We kindly request you to review the agreement thoroughly before signing it. If you have any questions or concerns regarding the agreement, feel free to contact our customer support team, and they will be more than happy to assist you.

Additionally, please keep in mind that the loan amount will be disbursed to your specified bank account within [Number of Days] days, subject to the completion of all required documentation and verifications.

We appreciate your trust in [Lending Institution/Bank Name] as your financial partner. Our team is committed to providing you with excellent service and assisting you throughout the loan period. If you have any further inquiries or require any additional information, please do not hesitate to reach out to our loan department at [Loan Department Contact Number] or [Loan Department Email Address].

Once again, congratulations on the approval of your unsecured loan. We look forward to working with you and helping you achieve your financial goals.

Thank you for choosing [Lending Institution/Bank Name].

Sincerely,

[Your Name]

[Your Title/Position - if applicable]

[Lending Institution/Bank Name]

[Contact Information]

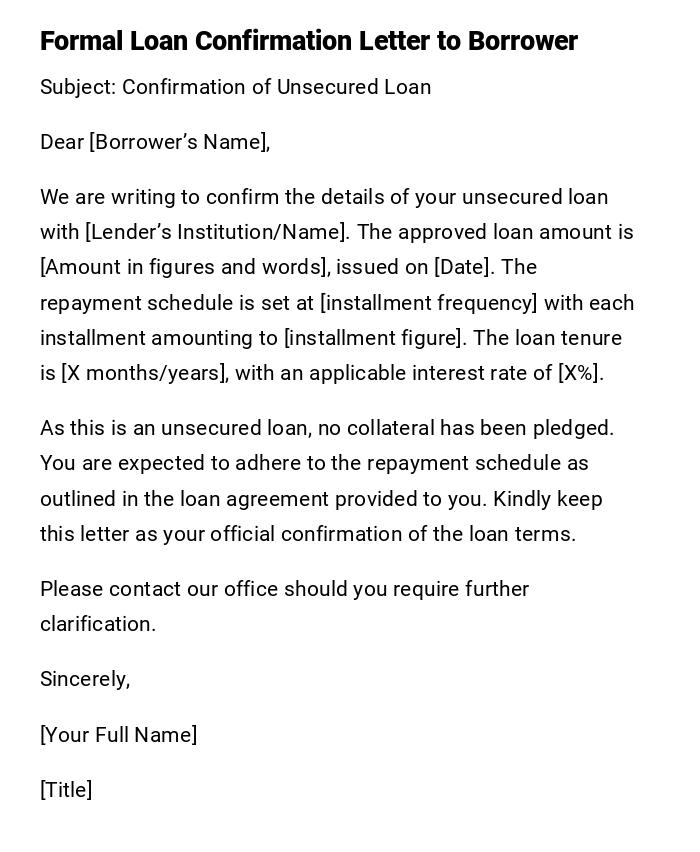

Formal Loan Confirmation Letter to Borrower

Subject: Confirmation of Unsecured Loan

Dear [Borrower’s Name],

We are writing to confirm the details of your unsecured loan with [Lender’s Institution/Name]. The approved loan amount is [Amount in figures and words], issued on [Date]. The repayment schedule is set at [installment frequency] with each installment amounting to [installment figure]. The loan tenure is [X months/years], with an applicable interest rate of [X%].

As this is an unsecured loan, no collateral has been pledged. You are expected to adhere to the repayment schedule as outlined in the loan agreement provided to you. Kindly keep this letter as your official confirmation of the loan terms.

Please contact our office should you require further clarification.

Sincerely,

[Your Full Name]

[Title]

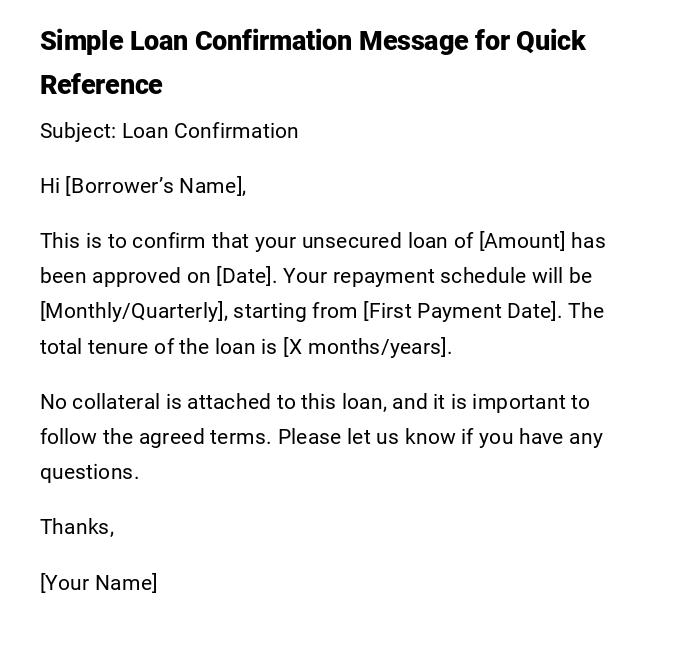

Simple Loan Confirmation Message for Quick Reference

Subject: Loan Confirmation

Hi [Borrower’s Name],

This is to confirm that your unsecured loan of [Amount] has been approved on [Date]. Your repayment schedule will be [Monthly/Quarterly], starting from [First Payment Date]. The total tenure of the loan is [X months/years].

No collateral is attached to this loan, and it is important to follow the agreed terms. Please let us know if you have any questions.

Thanks,

[Your Name]

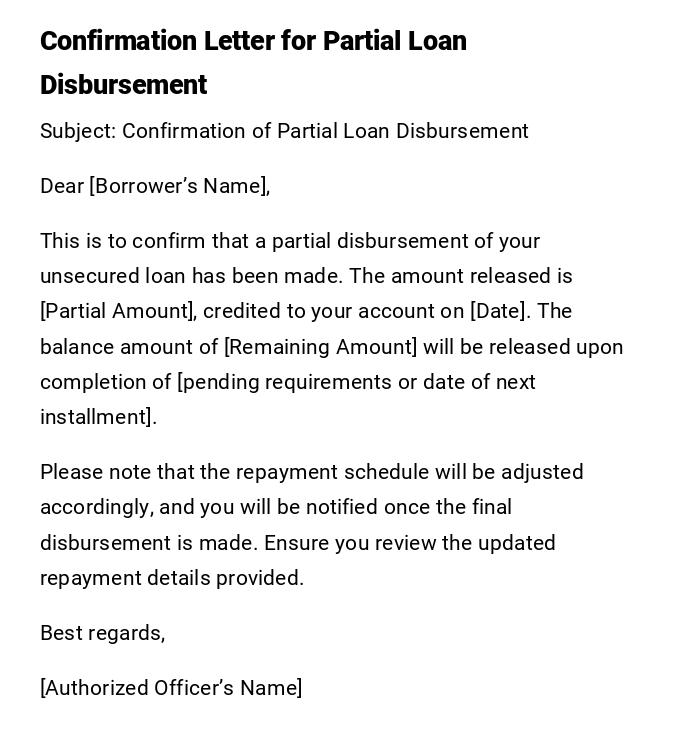

Confirmation Letter for Partial Loan Disbursement

Subject: Confirmation of Partial Loan Disbursement

Dear [Borrower’s Name],

This is to confirm that a partial disbursement of your unsecured loan has been made. The amount released is [Partial Amount], credited to your account on [Date]. The balance amount of [Remaining Amount] will be released upon completion of [pending requirements or date of next installment].

Please note that the repayment schedule will be adjusted accordingly, and you will be notified once the final disbursement is made. Ensure you review the updated repayment details provided.

Best regards,

[Authorized Officer’s Name]

Borrower’s Acknowledgment of Loan Confirmation

Subject: Acknowledgment of Loan Confirmation

Dear [Lender’s Name],

I am writing to acknowledge receipt of the unsecured loan confirmation letter dated [Date]. I confirm my understanding and acceptance of the terms and conditions stated therein, including the repayment schedule, tenure, and applicable interest rate.

I assure you of my full commitment to timely repayment of the loan as per the agreed schedule. Please consider this as my official acknowledgment.

Sincerely,

[Borrower’s Name]

Official Loan Confirmation Letter to Employer

Subject: Loan Confirmation for Employment Records

Dear [Employer’s Name],

This letter is to confirm that [Employee’s Name] has taken an unsecured loan from [Lender’s Institution/Name] amounting to [Loan Amount]. The loan was sanctioned on [Date], with a repayment period of [X months/years]. The monthly installment amount is [Amount].

This confirmation is provided at the request of the employee and is intended for official employment records only. The repayment of the loan will be managed directly between [Employee’s Name] and [Lender’s Institution].

Sincerely,

[Authorized Signatory]

Preliminary Loan Confirmation Letter Pending Final Approval

Subject: Preliminary Loan Confirmation

Dear [Borrower’s Name],

We are pleased to inform you that your application for an unsecured loan amounting to [Amount] has been reviewed and provisionally approved. The loan is subject to final verification of your documents and compliance with our internal requirements.

Once all checks are complete, a final loan confirmation letter will be issued. Please ensure all pending documents are submitted by [Deadline].

Thank you for choosing [Lender’s Name].

Sincerely,

[Loan Officer’s Name]

Heartfelt Loan Confirmation Letter to Long-Term Customer

Subject: Loan Confirmation with Our Gratitude

Dear [Borrower’s Name],

We are pleased to confirm your new unsecured loan of [Amount], approved on [Date]. As one of our valued long-term customers, we want to take this opportunity to thank you for your continued trust in our institution.

Your repayment schedule begins on [Date], and we are confident that you will manage it responsibly as you always have. Should you need any assistance or guidance during the loan tenure, our team is here to help.

Thank you once again for being part of our community.

Warm regards,

[Your Name]

What is an Unsecured Loan Confirmation Letter and Why Do You Need It?

An unsecured loan confirmation letter is a formal document issued by a lender or acknowledged by a borrower to confirm the terms of an unsecured loan. Unlike secured loans, unsecured loans do not require collateral, making it essential to have clear written confirmation. This letter protects both the lender and borrower by stating loan amount, repayment schedule, interest rate, and conditions in an official manner.

Who Should Send an Unsecured Loan Confirmation Letter?

- Lenders or financial institutions confirming loan approval

- Borrowers acknowledging receipt of the loan

- Employers requesting official confirmation for employee records

- Legal representatives when documentation is required for compliance

When Do You Need an Unsecured Loan Confirmation Letter?

- After approval of a loan application

- When partial disbursement of funds occurs

- For employment verification purposes

- During disputes or clarifications regarding repayment terms

- When a borrower acknowledges receipt of loan terms

How to Write and Send an Unsecured Loan Confirmation Letter

- Start with a clear subject line.

- Address the recipient formally.

- State the loan details: amount, tenure, interest rate, disbursement date.

- Mention repayment terms clearly.

- Add confirmation of whether collateral is involved (not required for unsecured).

- Close with a formal acknowledgment or signature.

- Send via email, postal mail, or hand delivery as required.

Formatting Guidelines for Loan Confirmation Letters

- Length: 1–2 pages, concise but complete

- Tone: Professional, clear, and direct

- Style: Formal wording for legal compliance

- Mode: Printed letters for official purposes; emails for quick confirmation

- Attachments: Loan agreement, repayment schedule, acknowledgment form

Common Mistakes to Avoid in Loan Confirmation Letters

- Forgetting to mention interest rates and repayment details

- Using vague or unclear language

- Omitting borrower or lender details

- Sending without proper signatures or official stamps

- Failing to match details with the official loan agreement

Elements and Structure of a Loan Confirmation Letter

- Subject line stating confirmation

- Borrower and lender identification

- Loan amount and terms

- Repayment schedule and interest rate

- Special conditions or remarks

- Closing signature with official designation

After Sending: What Follow-Up is Required?

- Confirm receipt with the borrower or lender

- Maintain a copy for records and compliance audits

- Monitor repayment schedule to ensure accuracy

- Provide additional clarification if the recipient raises queries

Pros and Cons of Using Loan Confirmation Letters

Pros:

- Provides legal clarity and prevents disputes

- Useful for employment or legal records

- Strengthens trust between lender and borrower

Cons:

- Requires careful drafting to avoid errors

- May cause delays if not sent promptly

- Overly complex language may confuse the borrower

Tricks and Tips for Writing Effective Loan Confirmation Letters

- Use templates to save time but personalize details

- Always double-check figures and dates before sending

- Keep the tone professional but courteous

- Include repayment start date clearly

- Provide contact details for further inquiries

Download Word Doc

Download Word Doc

Download PDF

Download PDF