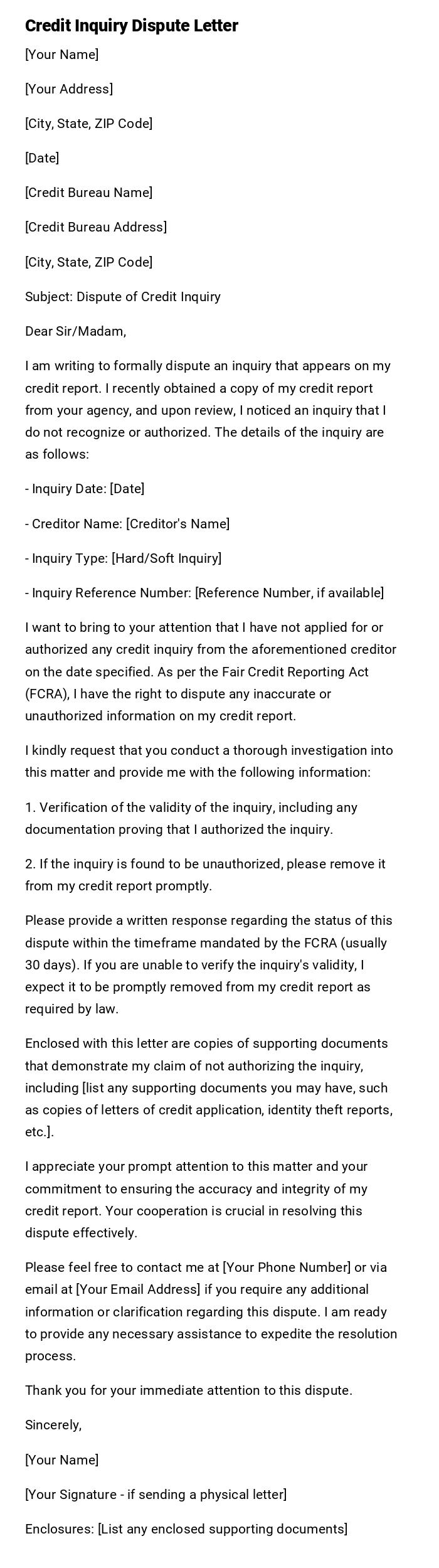

Credit Inquiry Dispute Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, ZIP Code]

Subject: Dispute of Credit Inquiry

Dear Sir/Madam,

I am writing to formally dispute an inquiry that appears on my credit report. I recently obtained a copy of my credit report from your agency, and upon review, I noticed an inquiry that I do not recognize or authorized. The details of the inquiry are as follows:

- Inquiry Date: [Date]

- Creditor Name: [Creditor's Name]

- Inquiry Type: [Hard/Soft Inquiry]

- Inquiry Reference Number: [Reference Number, if available]

I want to bring to your attention that I have not applied for or authorized any credit inquiry from the aforementioned creditor on the date specified. As per the Fair Credit Reporting Act (FCRA), I have the right to dispute any inaccurate or unauthorized information on my credit report.

I kindly request that you conduct a thorough investigation into this matter and provide me with the following information:

1. Verification of the validity of the inquiry, including any documentation proving that I authorized the inquiry.

2. If the inquiry is found to be unauthorized, please remove it from my credit report promptly.

Please provide a written response regarding the status of this dispute within the timeframe mandated by the FCRA (usually 30 days). If you are unable to verify the inquiry's validity, I expect it to be promptly removed from my credit report as required by law.

Enclosed with this letter are copies of supporting documents that demonstrate my claim of not authorizing the inquiry, including [list any supporting documents you may have, such as copies of letters of credit application, identity theft reports, etc.].

I appreciate your prompt attention to this matter and your commitment to ensuring the accuracy and integrity of my credit report. Your cooperation is crucial in resolving this dispute effectively.

Please feel free to contact me at [Your Phone Number] or via email at [Your Email Address] if you require any additional information or clarification regarding this dispute. I am ready to provide any necessary assistance to expedite the resolution process.

Thank you for your immediate attention to this dispute.

Sincerely,

[Your Name]

[Your Signature - if sending a physical letter]

Enclosures: [List any enclosed supporting documents]

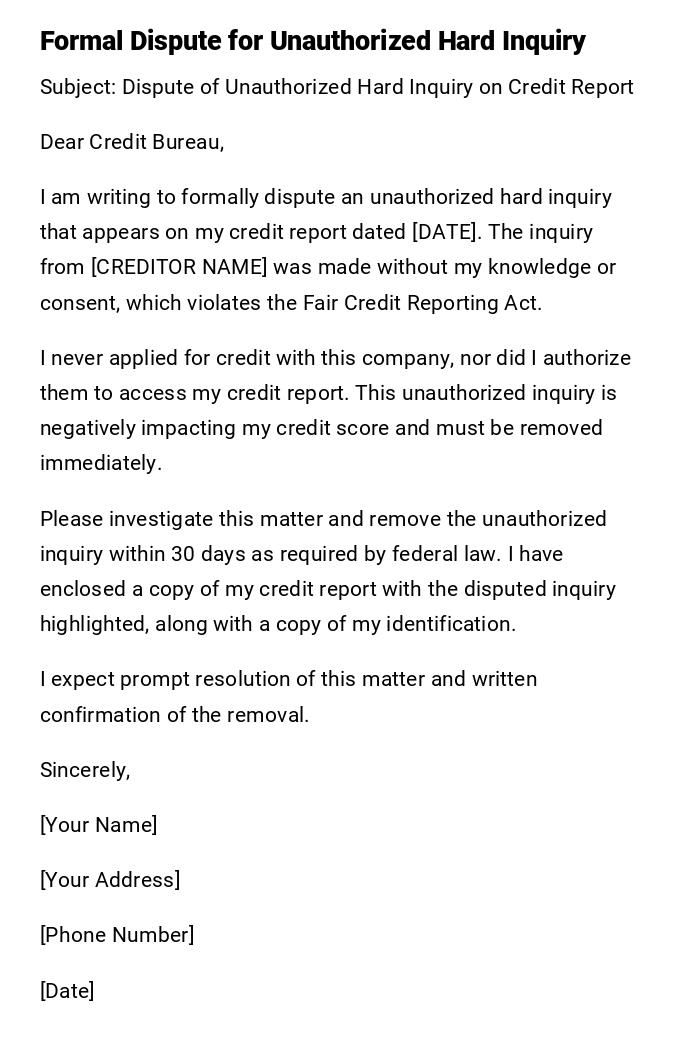

Unauthorized Hard Inquiry Dispute Letter

Subject: Dispute of Unauthorized Hard Inquiry on Credit Report

Dear Credit Bureau,

I am writing to formally dispute an unauthorized hard inquiry that appears on my credit report dated [DATE]. The inquiry from [CREDITOR NAME] was made without my knowledge or consent, which violates the Fair Credit Reporting Act.

I never applied for credit with this company, nor did I authorize them to access my credit report. This unauthorized inquiry is negatively impacting my credit score and must be removed immediately.

Please investigate this matter and remove the unauthorized inquiry within 30 days as required by federal law. I have enclosed a copy of my credit report with the disputed inquiry highlighted, along with a copy of my identification.

I expect prompt resolution of this matter and written confirmation of the removal.

Sincerely,

[Your Name]

[Your Address]

[Phone Number]

[Date]

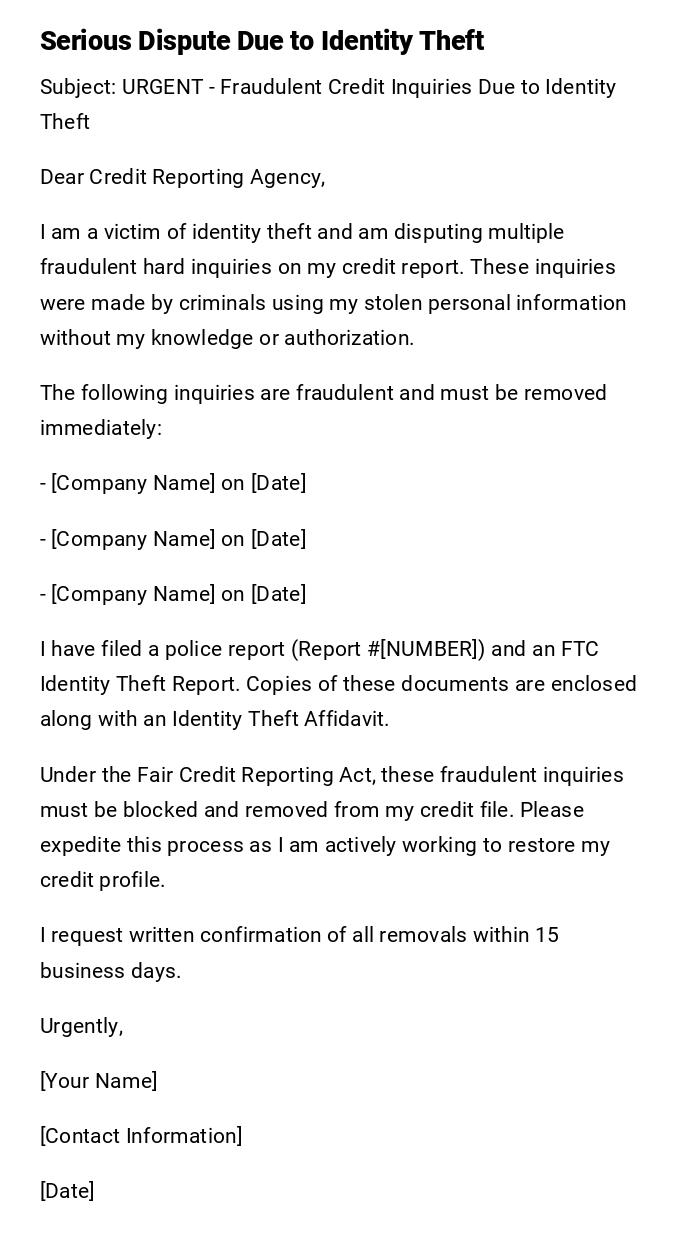

Identity Theft Related Credit Inquiry Dispute

Subject: URGENT - Fraudulent Credit Inquiries Due to Identity Theft

Dear Credit Reporting Agency,

I am a victim of identity theft and am disputing multiple fraudulent hard inquiries on my credit report. These inquiries were made by criminals using my stolen personal information without my knowledge or authorization.

The following inquiries are fraudulent and must be removed immediately:

- [Company Name] on [Date]

- [Company Name] on [Date]

- [Company Name] on [Date]

I have filed a police report (Report #[NUMBER]) and an FTC Identity Theft Report. Copies of these documents are enclosed along with an Identity Theft Affidavit.

Under the Fair Credit Reporting Act, these fraudulent inquiries must be blocked and removed from my credit file. Please expedite this process as I am actively working to restore my credit profile.

I request written confirmation of all removals within 15 business days.

Urgently,

[Your Name]

[Contact Information]

[Date]

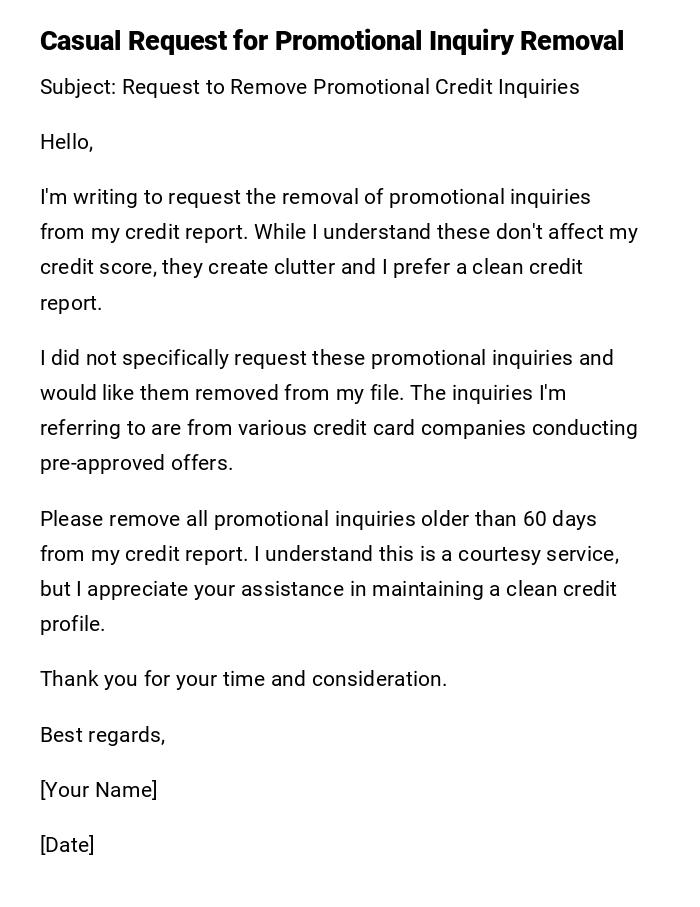

Promotional Inquiry Removal Request

Subject: Request to Remove Promotional Credit Inquiries

Hello,

I'm writing to request the removal of promotional inquiries from my credit report. While I understand these don't affect my credit score, they create clutter and I prefer a clean credit report.

I did not specifically request these promotional inquiries and would like them removed from my file. The inquiries I'm referring to are from various credit card companies conducting pre-approved offers.

Please remove all promotional inquiries older than 60 days from my credit report. I understand this is a courtesy service, but I appreciate your assistance in maintaining a clean credit profile.

Thank you for your time and consideration.

Best regards,

[Your Name]

[Date]

Duplicate Credit Inquiry Dispute

Subject: Dispute of Duplicate Hard Inquiries

Dear Credit Bureau Representative,

I am disputing duplicate hard inquiries appearing on my credit report. While I did authorize one credit check with [CREDITOR NAME], multiple inquiries appear for the same application, which is inaccurate and unfair to my credit profile.

The duplicate inquiries are:

- [Date 1] [Creditor Name]

- [Date 2] [Creditor Name] (DUPLICATE)

I applied only once with this creditor on [DATE], and the additional inquiry is either a system error or unauthorized duplicate. These multiple inquiries for a single application are artificially lowering my credit score.

Please investigate and remove the duplicate inquiry. I have attached documentation showing my single application with the creditor.

I look forward to your prompt resolution of this matter within the statutory 30-day period.

Respectfully,

[Your Full Name]

[Account Information]

[Date]

Old Credit Inquiry Dispute

Subject: Removal of Outdated Credit Inquiries

Dear Credit Reporting Team,

I noticed several hard inquiries on my credit report that are older than two years and should be automatically removed according to credit reporting guidelines.

The following inquiries should no longer appear on my report:

- [Creditor Name] from [Date over 2 years ago]

- [Creditor Name] from [Date over 2 years ago]

Please update my credit file to reflect the accurate reporting timeframe and remove these aged inquiries.

Thank you for maintaining accurate credit reporting.

Sincerely,

[Your Name]

[Date]

Medical Provider Credit Inquiry Dispute

Subject: Dispute of Medical Provider Hard Inquiry

Dear Credit Bureau,

I am disputing a hard inquiry from [MEDICAL PROVIDER/FINANCING COMPANY] related to medical services. This inquiry should not have been processed as a hard pull, as medical inquiries are typically treated differently under credit reporting guidelines.

I was seeking medical treatment and was not applying for traditional credit. The provider should have conducted a soft pull for verification purposes only, not a hard inquiry that affects my credit score.

This inquiry is inappropriate for medical services and should be removed or reclassified. Medical financing inquiries should be handled with special consideration for patients' credit protection.

Please investigate this matter and remove the inappropriate hard inquiry from my credit report.

I expect resolution within 30 days as required by law.

Respectfully,

[Your Name]

[Medical Account Reference]

[Date]

Car Shopping Multiple Inquiry Dispute

Subject: Dispute of Multiple Auto Loan Inquiries Outside Rate Shopping Window

Dear Credit Bureau,

I'm reaching out about multiple auto loan inquiries on my credit report that are being counted separately instead of as a single shopping event. I was responsibly shopping for the best auto loan rates within what I believed was the appropriate timeframe.

The inquiries from the following auto lenders should be counted as one:

- [Lender 1] on [Date]

- [Lender 2] on [Date]

- [Lender 3] on [Date]

I completed all my auto loan shopping within a 14-day period, which should qualify for rate shopping protections. Having these count as separate inquiries unfairly penalizes me for being a responsible consumer seeking the best rates.

Please consolidate these auto loan inquiries to reflect one shopping event and adjust my credit score accordingly.

I appreciate your understanding and assistance.

Sincerely,

[Your Name]

[Date]

What Are Credit Inquiry Dispute Letters and Why Do You Need Them

Credit inquiry dispute letters are formal communications sent to credit reporting agencies to challenge inaccurate, unauthorized, or outdated credit inquiries appearing on your credit report. These letters serve as your primary tool for correcting errors that can negatively impact your credit score and borrowing ability.

Hard inquiries can lower your credit score by several points and remain on your report for two years. When these inquiries are unauthorized, duplicated, or incorrectly reported, they unfairly damage your credit profile. Dispute letters help restore accuracy to your credit report and protect your financial reputation.

The purpose extends beyond simple error correction - these letters establish a paper trail for legal protection, demonstrate your diligence in monitoring your credit, and can prevent future unauthorized access to your credit information.

When to Send Credit Inquiry Dispute Letters

Several scenarios trigger the need for credit inquiry dispute letters:

- Unauthorized inquiries from companies you never contacted or authorized

- Identity theft situations where criminals accessed your credit using stolen information

- Promotional inquiries cluttering your report from pre-approved credit offers

- Duplicate inquiries from the same creditor for a single application

- Aged inquiries remaining on your report beyond the two-year reporting period

- Medical provider inquiries that should have been soft pulls rather than hard inquiries

- Rate shopping inquiries not properly consolidated within the designated timeframe

- Employment background checks incorrectly reported as credit inquiries

- Utility or rental inquiries that exceed standard verification purposes

- Incorrect inquiry dates that don't match your actual application timeline

The sooner you address these issues, the better your chances of successful removal and credit score improvement.

Who Should Send Credit Inquiry Dispute Letters

The primary sender should be the individual whose credit report contains the disputed inquiry. This ensures proper legal standing and verification of identity.

Authorized representatives can send these letters in specific circumstances:

- Attorneys representing clients in credit disputes

- Spouses with proper authorization and joint account relationships

- Parents or guardians for minor children's credit reports

- Power of attorney holders with documented legal authority

- Credit repair services with signed client agreements

However, personal submission often yields better results as credit bureaus prioritize direct consumer communications and may be more responsive to individual complaints than third-party representations.

To Whom Should Credit Inquiry Dispute Letters Be Addressed

Send dispute letters to all three major credit reporting agencies where the inquiry appears:

- Experian - Consumer dispute department

- Equifax - Dispute resolution team

- TransUnion - Consumer relations department

Additionally, send copies to:

- The creditor who made the inquiry for direct resolution

- State attorney general's office if patterns of abuse exist

- Consumer Financial Protection Bureau for federal oversight

- Federal Trade Commission in cases involving identity theft

Each agency maintains separate databases, so an inquiry may appear on one, two, or all three reports. Comprehensive disputes ensure complete removal across all platforms.

How to Write and Send Effective Credit Inquiry Dispute Letters

Start by obtaining current copies of your credit reports from all three bureaus to identify specific inquiries requiring dispute. Document each inquiry's details including date, creditor name, and account reference numbers.

Writing process:

- Use clear, concise language stating facts without emotional language

- Include specific inquiry details and explain why removal is warranted

- Attach supporting documentation like identity theft reports or application records

- Request written confirmation of any removals or investigations

- Keep copies of all correspondence for your records

Sending methods:

- Certified mail with return receipt for paper trails

- Online dispute systems for faster processing

- Fax transmission with delivery confirmation

- Email only if specifically accepted by the bureau

Always include photocopies of identification and supporting documents, never originals.

Requirements and Prerequisites Before Disputing Credit Inquiries

Before writing dispute letters, ensure you have:

Essential documentation:

- Current credit reports from all three major bureaus

- Photo identification (driver's license or passport)

- Proof of current address (utility bill or bank statement)

- Any relevant supporting documents (police reports, application records, correspondence)

Information gathering:

- Account numbers or reference numbers for disputed inquiries

- Exact dates and creditor names as they appear on reports

- Documentation proving your claims (identity theft reports, application denials)

- Records of previous dispute attempts if applicable

Legal standing verification:

- Confirm you have legal right to dispute the inquiry

- Gather authorization documents if representing someone else

- Ensure you're within applicable statute of limitations

Financial preparation:

- Budget for certified mail costs and document copying

- Consider potential credit monitoring service subscriptions

- Prepare for possible follow-up correspondence expenses

Formatting Guidelines for Credit Inquiry Dispute Letters

Length and structure:

- Keep letters to one page when possible, maximum two pages

- Use standard business letter format with clear paragraphs

- Include specific inquiry details in bullet points for clarity

Tone and style:

- Maintain professional, factual tone throughout

- Avoid emotional language or accusations

- State facts clearly and request specific actions

- Use formal business language for serious disputes

Required elements:

- Your full legal name and current address

- Date of the letter

- Credit bureau's correct address

- Clear subject line identifying the purpose

- Specific inquiry details being disputed

- Explanation of why removal is warranted

- Request for specific action (removal, investigation)

- Your signature and contact information

Delivery preferences:

- Send via certified mail for important disputes

- Use online systems for faster processing when available

- Keep electronic copies of all submissions

Follow-up Actions After Sending Dispute Letters

Immediate steps:

- Save all receipts and delivery confirmations

- Create calendar reminders for response deadlines (typically 30 days)

- Monitor your email and mailbox for responses

- Continue regular credit report monitoring

During investigation period:

- Avoid applying for new credit that might complicate matters

- Document any changes to your credit report

- Prepare additional documentation if requested

- Respond promptly to any bureau requests for information

After receiving responses:

- Review all correspondence carefully for accuracy

- Verify removals appear on updated credit reports

- File complaints with regulatory agencies if disputes are wrongfully denied

- Consider legal consultation for persistent violations

- Send thank you acknowledgments for successful resolutions

Long-term monitoring:

- Check credit reports quarterly to ensure removed inquiries don't reappear

- Set up credit monitoring alerts for new inquiries

- Maintain organized files of all dispute correspondence

Common Mistakes to Avoid When Disputing Credit Inquiries

Documentation errors:

- Sending original documents instead of copies

- Failing to include proper identification

- Using outdated credit reports for dispute basis

- Not keeping copies of all correspondence

Communication mistakes:

- Using emotional or threatening language

- Making vague or general complaints without specifics

- Disputing legitimate inquiries you actually authorized

- Sending disputes to wrong addresses or departments

Process errors:

- Not following up within required timeframes

- Disputing with only one credit bureau when inquiry appears on multiple reports

- Failing to include supporting evidence for claims

- Not documenting the dispute process properly

Strategic mistakes:

- Disputing too many items simultaneously, appearing frivolous

- Not researching the creditor's dispute process

- Ignoring bureau responses or requests for additional information

- Giving up too quickly on legitimate disputes

Pros and Cons of Sending Credit Inquiry Dispute Letters

Advantages:

- Can improve credit scores by removing negative impacts

- Establishes official record of dispute for legal protection

- Often resolves issues without attorney involvement

- May prevent future unauthorized access to credit

- Demonstrates responsible credit monitoring habits

- Can reveal identity theft or fraud early

Disadvantages:

- Time-consuming process requiring patience and persistence

- No guarantee of successful removal even for legitimate disputes

- May trigger additional scrutiny of your entire credit profile

- Requires organization and documentation skills

- Can be emotionally stressful when dealing with credit issues

- Success depends on credit bureau cooperation and investigation quality

Considerations:

- Weigh potential credit score improvement against time investment

- Consider professional help for complex cases involving multiple disputes

- Evaluate whether the inquiry significantly impacts your credit profile

- Assess your ability to maintain organized documentation throughout the process

Download Word Doc

Download Word Doc

Download PDF

Download PDF