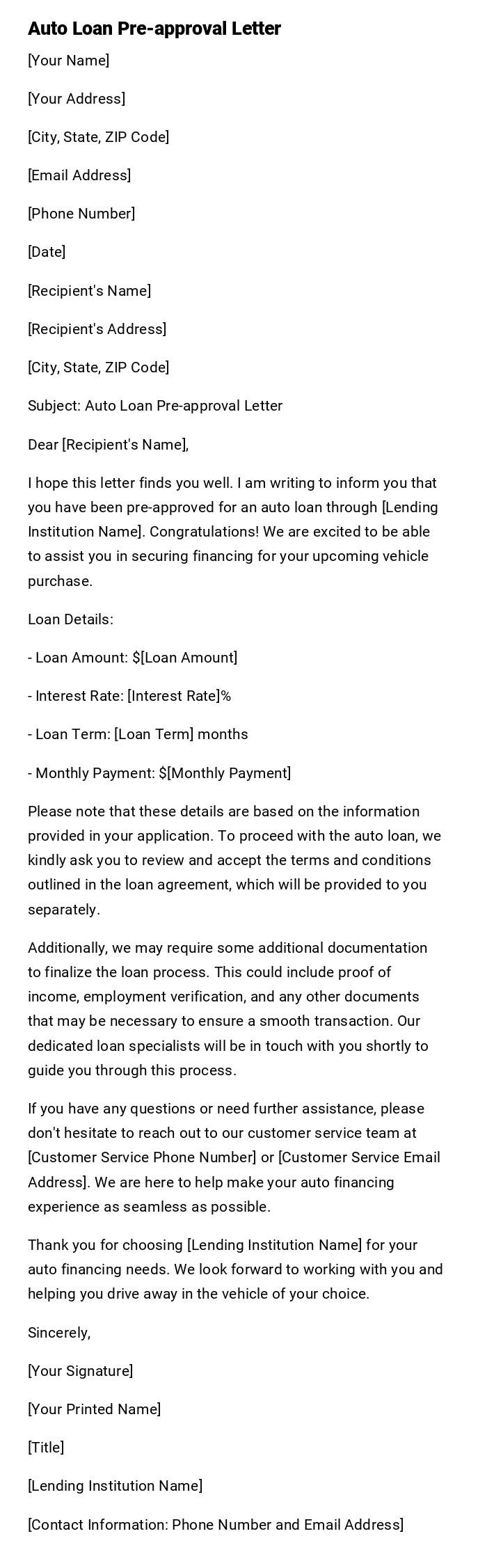

Auto Loan Pre-approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Auto Loan Pre-approval Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to inform you that you have been pre-approved for an auto loan through [Lending Institution Name]. Congratulations! We are excited to be able to assist you in securing financing for your upcoming vehicle purchase.

Loan Details:

- Loan Amount: $[Loan Amount]

- Interest Rate: [Interest Rate]%

- Loan Term: [Loan Term] months

- Monthly Payment: $[Monthly Payment]

Please note that these details are based on the information provided in your application. To proceed with the auto loan, we kindly ask you to review and accept the terms and conditions outlined in the loan agreement, which will be provided to you separately.

Additionally, we may require some additional documentation to finalize the loan process. This could include proof of income, employment verification, and any other documents that may be necessary to ensure a smooth transaction. Our dedicated loan specialists will be in touch with you shortly to guide you through this process.

If you have any questions or need further assistance, please don't hesitate to reach out to our customer service team at [Customer Service Phone Number] or [Customer Service Email Address]. We are here to help make your auto financing experience as seamless as possible.

Thank you for choosing [Lending Institution Name] for your auto financing needs. We look forward to working with you and helping you drive away in the vehicle of your choice.

Sincerely,

[Your Signature]

[Your Printed Name]

[Title]

[Lending Institution Name]

[Contact Information: Phone Number and Email Address]

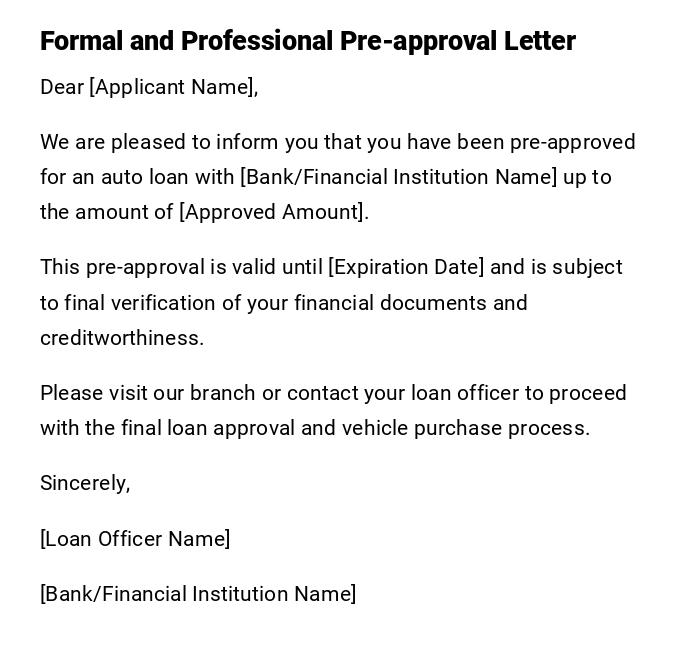

Standard Auto Loan Pre-approval Letter

Dear [Applicant Name],

We are pleased to inform you that you have been pre-approved for an auto loan with [Bank/Financial Institution Name] up to the amount of [Approved Amount].

This pre-approval is valid until [Expiration Date] and is subject to final verification of your financial documents and creditworthiness.

Please visit our branch or contact your loan officer to proceed with the final loan approval and vehicle purchase process.

Sincerely,

[Loan Officer Name]

[Bank/Financial Institution Name]

Quick Pre-approval Email for Auto Loan

Hi [Applicant Name],

Good news! You’re pre-approved for an auto loan of [Approved Amount] with [Bank Name].

This pre-approval is valid until [Expiration Date]. Reach out to us soon to complete the final steps and get your new car.

Cheers,

[Loan Officer Name]

Conditional Auto Loan Pre-approval Letter

Dear [Applicant Name],

This letter confirms your pre-approval for an auto loan of [Approved Amount], subject to the following conditions:

1. Verification of income documents.

2. Confirmation of employment status.

3. Final credit check review.

Once all conditions are met, your loan will proceed to full approval. Please contact your loan officer for guidance.

Best regards,

[Loan Officer Name]

[Bank Name]

Auto Loan Pre-approval for High-Value Vehicle

Dear [Applicant Name],

We are pleased to inform you that you are pre-approved for an auto loan of up to [Approved Amount] specifically for the purchase of [Vehicle Make and Model].

This pre-approval is valid until [Expiration Date] and requires submission of your financial statements, proof of income, and insurance confirmation before final approval.

Please contact us to schedule a meeting with your loan advisor.

Sincerely,

[Loan Officer Name]

[Bank Name]

Auto Loan Pre-approval Message for Digital Submission

Hello [Applicant Name],

Your auto loan pre-approval for [Approved Amount] with [Bank Name] has been processed!

This pre-approval is valid until [Expiration Date]. Submit your final documents online or visit a branch to complete the loan process.

Thanks,

[Bank Name] Loan Team

Provisional Auto Loan Pre-approval Letter

Dear [Applicant Name],

This provisional pre-approval letter confirms that you qualify for an auto loan up to [Approved Amount].

Please note this approval is preliminary and contingent upon verification of your credit report and employment status.

Kindly submit all required documentation to proceed to full approval.

Regards,

[Loan Officer Name]

[Bank Name]

Auto Loan Pre-approval for Returning Customer

Dear [Applicant Name],

As a valued customer of [Bank Name], you are pre-approved for an auto loan of [Approved Amount] to purchase your next vehicle.

This offer is valid until [Expiration Date] and is subject to confirmation of current financial details.

Contact your account manager to finalize the loan and enjoy special benefits for loyal customers.

Sincerely,

[Account Manager Name]

[Bank Name]

What / Why is an Auto Loan Pre-approval Letter

An Auto Loan Pre-approval Letter is a formal document from a bank or financial institution stating that a borrower qualifies for a specific loan amount, subject to verification.

Purpose includes:

- Informing the applicant of eligibility for an auto loan.

- Helping the borrower negotiate with car dealers.

- Providing confidence that financing is ready before selecting a vehicle.

- Setting conditions or contingencies for final loan approval.

Who should send an Auto Loan Pre-approval Letter

- Loan officers or managers at banks or credit unions.

- Financial institutions offering auto financing services.

- Online loan platforms communicating through email or messaging systems.

Whom should the Auto Loan Pre-approval Letter be addressed to

- The applicant who applied for an auto loan.

- Existing customers seeking additional financing.

- Car dealerships (optional) to confirm pre-approval status for specific purchases.

When should an Auto Loan Pre-approval Letter be issued

- After an applicant submits a loan application and preliminary checks.

- Before visiting a car dealership to purchase a vehicle.

- For digital applications as an email confirmation of eligibility.

- During promotional campaigns for loan offers to qualified clients.

How to write and send an Auto Loan Pre-approval Letter

- Verify the applicant’s credit score, income, and financial status.

- Choose tone: formal for print, casual for email/message.

- Include loan amount, expiration date, and any conditions.

- Attach or reference required documents.

- Send via secure email, postal service, or in-person delivery.

- Request acknowledgment or confirmation of receipt.

Requirements and Prerequisites

- Completed auto loan application form.

- Verified income and employment details.

- Credit report assessment.

- Applicant identification and documentation.

- Institutional approval for pre-approval thresholds.

Formatting Guidelines for Auto Loan Pre-approval Letters

- Length: 1–2 pages for formal letters, 1–3 paragraphs for email messages.

- Tone: Professional, clear, and reassuring.

- Style: Structured with headings and bullet points if necessary.

- Mode: Print letter, email, or digital message.

- Attachments: Terms, conditions, and required verification documents.

- Wording: Precise, avoiding ambiguity about pre-approval vs. final approval.

After Sending / Follow-up Actions

- Confirm recipient received and understood the pre-approval.

- Advise on document submission for full approval.

- Monitor responses and provide assistance with final loan processing.

- Update internal records with pre-approval status.

Tricks and Tips for Effective Auto Loan Pre-approval Letters

- Clearly differentiate between pre-approval and full approval.

- Include expiration date to create urgency.

- Mention conditions clearly to avoid confusion.

- Personalize with applicant name for trust and clarity.

- Provide direct contact for questions and next steps.

Common Mistakes to Avoid

- Using vague or misleading loan amounts.

- Omitting conditions or contingencies.

- Sending without confirming eligibility.

- Failing to include expiration date or contact details.

- Mixing informal tone in official communication.

Elements and Structure of an Auto Loan Pre-approval Letter

- Greeting / Salutation: Personalize with applicant name.

- Loan Amount: Specify pre-approved amount.

- Validity Period: Include expiration date.

- Conditions: Outline any contingencies for full approval.

- Contact Information: Loan officer or department contact.

- Closing: Professional sign-off.

- Attachments: Optional supporting documents or terms.

FAQ on Auto Loan Pre-approval Letters

Q: Is pre-approval a guarantee of loan?

A: No, final approval is subject to verification of documents and credit checks.

Q: How long is pre-approval valid?

A: Typically 30–90 days, depending on the financial institution.

Q: Can I use pre-approval at any dealership?

A: Usually yes, but confirm with the lender for specific terms.

Q: Can pre-approval be increased?

A: Possibly, after submitting updated financial information and reassessment.

Q: Do I need to pay anything to get pre-approval?

A: No, pre-approval is generally free and part of the application process.

Download Word Doc

Download Word Doc

Download PDF

Download PDF