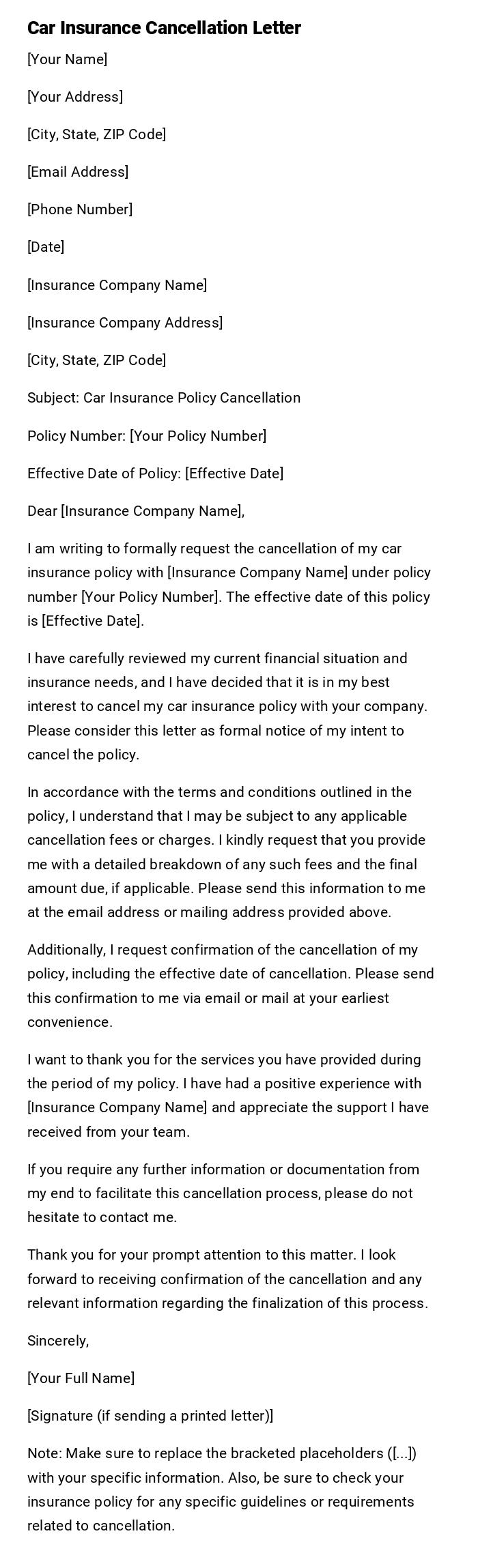

Car Insurance Cancellation Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Insurance Company Name]

[Insurance Company Address]

[City, State, ZIP Code]

Subject: Car Insurance Policy Cancellation

Policy Number: [Your Policy Number]

Effective Date of Policy: [Effective Date]

Dear [Insurance Company Name],

I am writing to formally request the cancellation of my car insurance policy with [Insurance Company Name] under policy number [Your Policy Number]. The effective date of this policy is [Effective Date].

I have carefully reviewed my current financial situation and insurance needs, and I have decided that it is in my best interest to cancel my car insurance policy with your company. Please consider this letter as formal notice of my intent to cancel the policy.

In accordance with the terms and conditions outlined in the policy, I understand that I may be subject to any applicable cancellation fees or charges. I kindly request that you provide me with a detailed breakdown of any such fees and the final amount due, if applicable. Please send this information to me at the email address or mailing address provided above.

Additionally, I request confirmation of the cancellation of my policy, including the effective date of cancellation. Please send this confirmation to me via email or mail at your earliest convenience.

I want to thank you for the services you have provided during the period of my policy. I have had a positive experience with [Insurance Company Name] and appreciate the support I have received from your team.

If you require any further information or documentation from my end to facilitate this cancellation process, please do not hesitate to contact me.

Thank you for your prompt attention to this matter. I look forward to receiving confirmation of the cancellation and any relevant information regarding the finalization of this process.

Sincerely,

[Your Full Name]

[Signature (if sending a printed letter)]

Note: Make sure to replace the bracketed placeholders ([...]) with your specific information. Also, be sure to check your insurance policy for any specific guidelines or requirements related to cancellation.

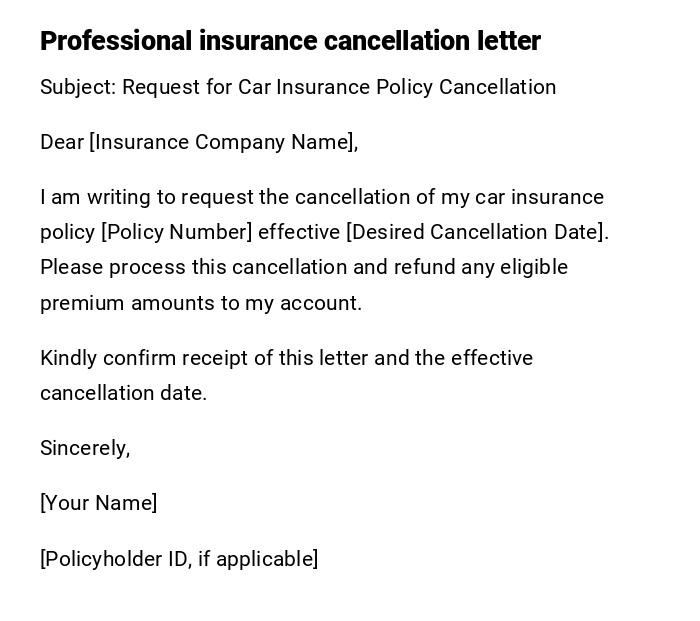

Standard Car Insurance Cancellation Letter

Subject: Request for Car Insurance Policy Cancellation

Dear [Insurance Company Name],

I am writing to request the cancellation of my car insurance policy [Policy Number] effective [Desired Cancellation Date]. Please process this cancellation and refund any eligible premium amounts to my account.

Kindly confirm receipt of this letter and the effective cancellation date.

Sincerely,

[Your Name]

[Policyholder ID, if applicable]

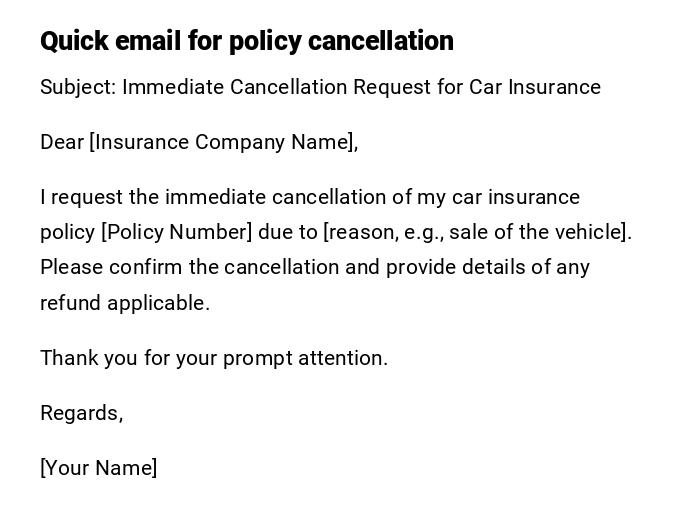

Immediate Car Insurance Cancellation Email

Subject: Immediate Cancellation Request for Car Insurance

Dear [Insurance Company Name],

I request the immediate cancellation of my car insurance policy [Policy Number] due to [reason, e.g., sale of the vehicle]. Please confirm the cancellation and provide details of any refund applicable.

Thank you for your prompt attention.

Regards,

[Your Name]

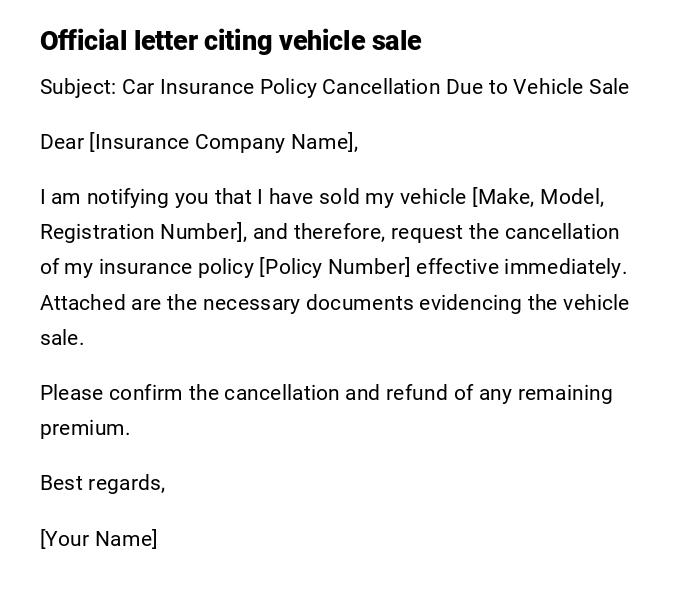

Formal Car Insurance Cancellation Letter Due to Sale of Vehicle

Subject: Car Insurance Policy Cancellation Due to Vehicle Sale

Dear [Insurance Company Name],

I am notifying you that I have sold my vehicle [Make, Model, Registration Number], and therefore, request the cancellation of my insurance policy [Policy Number] effective immediately. Attached are the necessary documents evidencing the vehicle sale.

Please confirm the cancellation and refund of any remaining premium.

Best regards,

[Your Name]

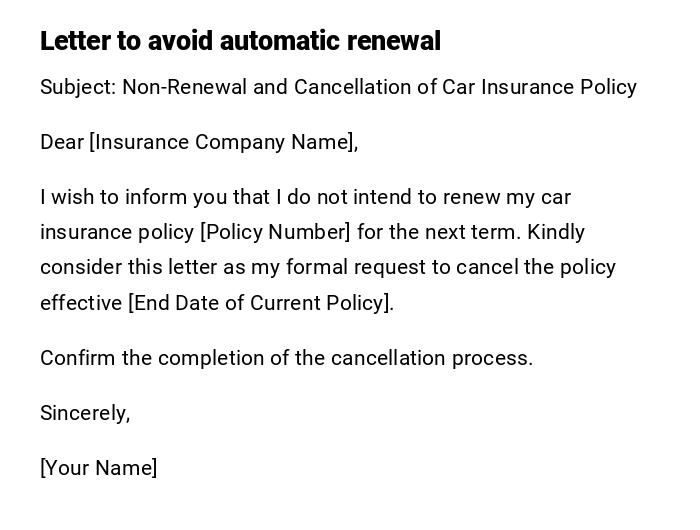

Cancellation Letter for Policy Non-Renewal

Subject: Non-Renewal and Cancellation of Car Insurance Policy

Dear [Insurance Company Name],

I wish to inform you that I do not intend to renew my car insurance policy [Policy Number] for the next term. Kindly consider this letter as my formal request to cancel the policy effective [End Date of Current Policy].

Confirm the completion of the cancellation process.

Sincerely,

[Your Name]

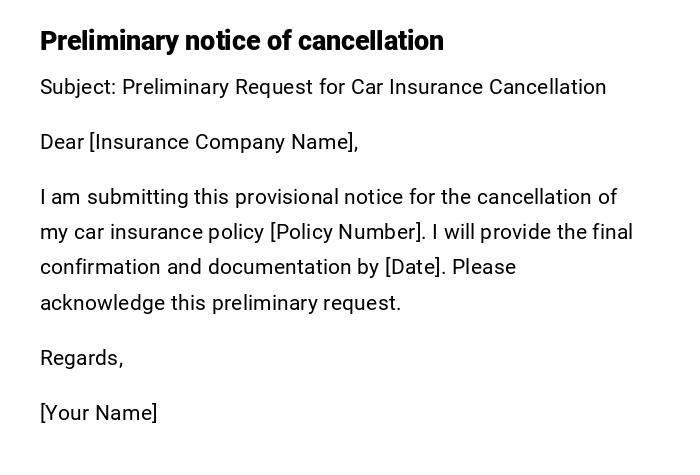

Provisional Car Insurance Cancellation Notice

Subject: Preliminary Request for Car Insurance Cancellation

Dear [Insurance Company Name],

I am submitting this provisional notice for the cancellation of my car insurance policy [Policy Number]. I will provide the final confirmation and documentation by [Date]. Please acknowledge this preliminary request.

Regards,

[Your Name]

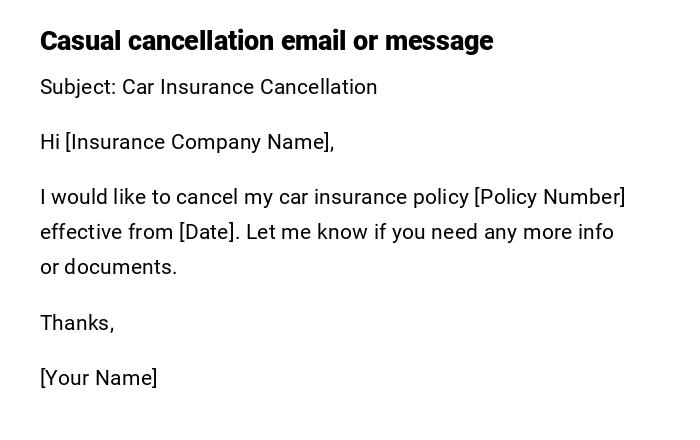

Informal Policy Cancellation Message

Subject: Car Insurance Cancellation

Hi [Insurance Company Name],

I would like to cancel my car insurance policy [Policy Number] effective from [Date]. Let me know if you need any more info or documents.

Thanks,

[Your Name]

What is a Car Insurance Cancellation Letter and Why Do You Need It?

A car insurance cancellation letter is a formal request sent to an insurance company to terminate an existing car insurance policy.

It ensures a clear record of cancellation, helps prevent automatic renewals, and serves as proof in case of disputes about coverage or refunds.

Who Should Send a Car Insurance Cancellation Letter?

- Policyholders who are selling their car.

- Policyholders switching to a new insurance provider.

- Individuals who no longer need car coverage due to vehicle disposal or other reasons.

- Anyone seeking a refund of prepaid premiums.

Whom Should the Cancellation Letter Be Addressed To?

- Customer service department of the insurance company.

- Policy manager or account representative assigned to your policy.

- Any official email or mailing address provided for policy correspondence.

When Should You Send a Car Insurance Cancellation Letter?

- Immediately after selling your vehicle.

- Prior to the renewal date to avoid automatic renewal.

- When switching to a new insurer to coordinate coverage.

- After deciding to discontinue coverage for personal reasons.

How to Write and Send a Car Insurance Cancellation Letter

- Include your full name, policy number, and contact information.

- State the reason for cancellation clearly.

- Mention the effective cancellation date.

- Request acknowledgment and confirmation of the cancellation.

- Attach supporting documents if applicable (e.g., vehicle sale proof).

- Send via registered mail for official records or email for speed.

Requirements and Prerequisites Before Sending

- Policy details (number, coverage type).

- Reason for cancellation (sale, switching, non-renewal).

- Documentation supporting your reason (e.g., sale receipt, new policy).

- Bank details if a refund is expected.

- Contact information for confirmation.

Formatting Guidelines for Car Insurance Cancellation Letters

- Length: One to two concise paragraphs for simple cases.

- Tone: Formal and professional.

- Include subject, policy number, effective date, and reason.

- Use clear, polite language requesting confirmation.

- Signature required for printed letters; typed name suffices for email.

After Sending a Car Insurance Cancellation Letter

- Keep a copy of the letter for records.

- Follow up with the insurance company to ensure cancellation is processed.

- Check for any refund of prepaid premiums.

- Confirm that no further automatic deductions occur.

Common Mistakes to Avoid in Car Insurance Cancellation Letters

- Omitting policy number or personal details.

- Failing to provide an effective cancellation date.

- Not requesting acknowledgment or confirmation.

- Using vague or incomplete reasons for cancellation.

- Forgetting to attach necessary supporting documents.

Elements and Structure of a Car Insurance Cancellation Letter

- Subject clearly stating the cancellation request.

- Salutation addressing the insurance company.

- Body with policy number, reason for cancellation, and effective date.

- Request for confirmation of cancellation and refund, if applicable.

- Closing statement with signature or typed name and contact information.

Tricks and Tips for Efficient Cancellation

- Send your letter well in advance of policy renewal dates.

- Use registered mail or official email to ensure receipt.

- Attach all supporting documents to prevent delays.

- Maintain a record of all communication for future reference.

- Follow up promptly if no acknowledgment is received within a reasonable time.

FAQ About Car Insurance Cancellation

Q: Can I cancel my policy via email?

A: Yes, many insurers accept email cancellations, but official letters are preferred for records.

Q: Will I get a refund for unused premiums?

A: Refunds depend on the insurer’s policy and the cancellation date.

Q: How soon will the cancellation take effect?

A: Usually from the date specified in the letter or the insurer’s processing date.

Q: Do I need to provide a reason for cancellation?

A: Yes, most insurers require a valid reason for recordkeeping and processing refunds.

Download Word Doc

Download Word Doc

Download PDF

Download PDF