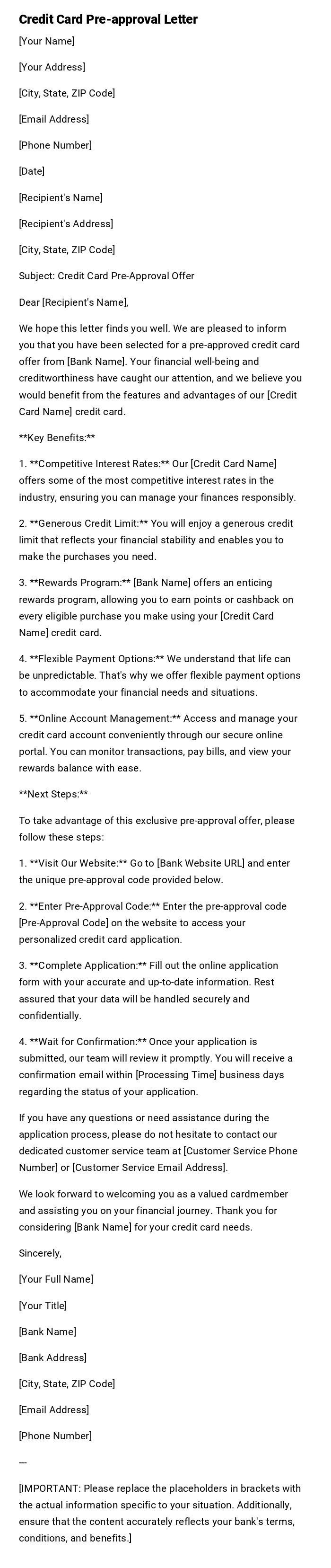

Credit Card Pre-approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Credit Card Pre-Approval Offer

Dear [Recipient's Name],

We hope this letter finds you well. We are pleased to inform you that you have been selected for a pre-approved credit card offer from [Bank Name]. Your financial well-being and creditworthiness have caught our attention, and we believe you would benefit from the features and advantages of our [Credit Card Name] credit card.

**Key Benefits:**

1. **Competitive Interest Rates:** Our [Credit Card Name] offers some of the most competitive interest rates in the industry, ensuring you can manage your finances responsibly.

2. **Generous Credit Limit:** You will enjoy a generous credit limit that reflects your financial stability and enables you to make the purchases you need.

3. **Rewards Program:** [Bank Name] offers an enticing rewards program, allowing you to earn points or cashback on every eligible purchase you make using your [Credit Card Name] credit card.

4. **Flexible Payment Options:** We understand that life can be unpredictable. That's why we offer flexible payment options to accommodate your financial needs and situations.

5. **Online Account Management:** Access and manage your credit card account conveniently through our secure online portal. You can monitor transactions, pay bills, and view your rewards balance with ease.

**Next Steps:**

To take advantage of this exclusive pre-approval offer, please follow these steps:

1. **Visit Our Website:** Go to [Bank Website URL] and enter the unique pre-approval code provided below.

2. **Enter Pre-Approval Code:** Enter the pre-approval code [Pre-Approval Code] on the website to access your personalized credit card application.

3. **Complete Application:** Fill out the online application form with your accurate and up-to-date information. Rest assured that your data will be handled securely and confidentially.

4. **Wait for Confirmation:** Once your application is submitted, our team will review it promptly. You will receive a confirmation email within [Processing Time] business days regarding the status of your application.

If you have any questions or need assistance during the application process, please do not hesitate to contact our dedicated customer service team at [Customer Service Phone Number] or [Customer Service Email Address].

We look forward to welcoming you as a valued cardmember and assisting you on your financial journey. Thank you for considering [Bank Name] for your credit card needs.

Sincerely,

[Your Full Name]

[Your Title]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

---

[IMPORTANT: Please replace the placeholders in brackets with the actual information specific to your situation. Additionally, ensure that the content accurately reflects your bank's terms, conditions, and benefits.]

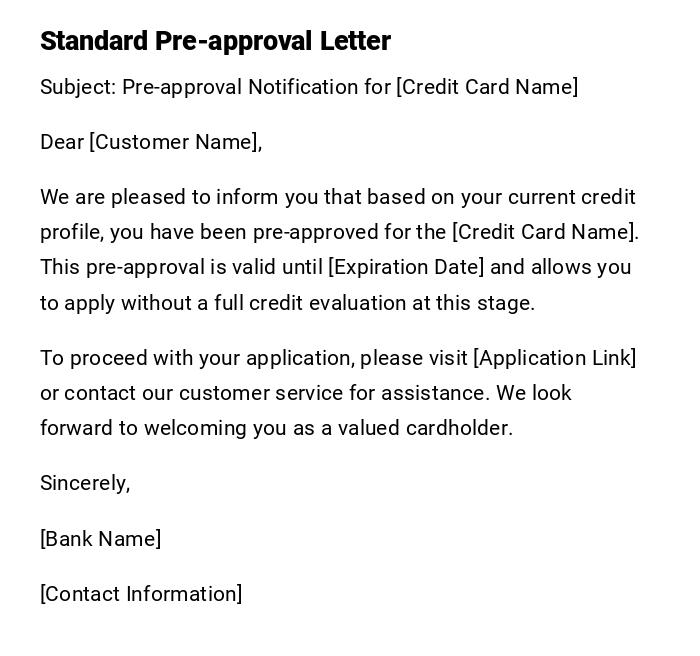

Standard Credit Card Pre-approval Letter

Subject: Pre-approval Notification for [Credit Card Name]

Dear [Customer Name],

We are pleased to inform you that based on your current credit profile, you have been pre-approved for the [Credit Card Name]. This pre-approval is valid until [Expiration Date] and allows you to apply without a full credit evaluation at this stage.

To proceed with your application, please visit [Application Link] or contact our customer service for assistance. We look forward to welcoming you as a valued cardholder.

Sincerely,

[Bank Name]

[Contact Information]

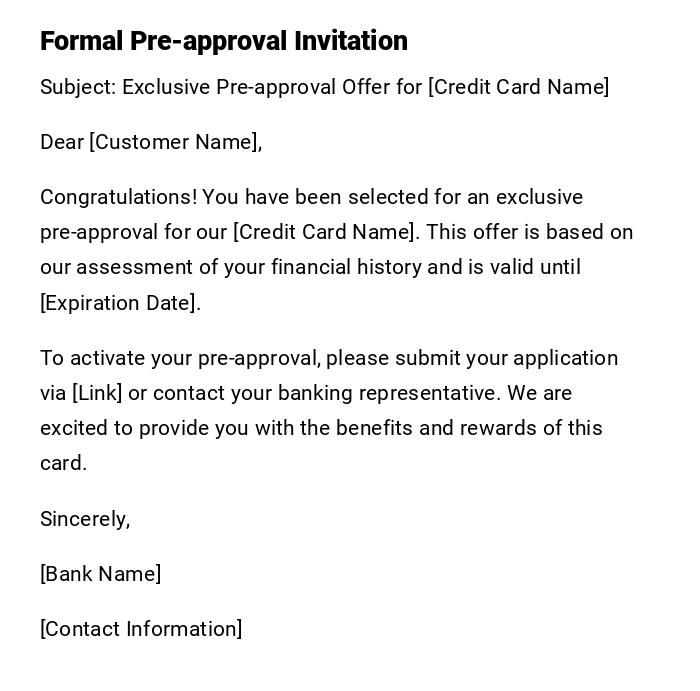

Formal Invitation Credit Card Pre-approval Letter

Subject: Exclusive Pre-approval Offer for [Credit Card Name]

Dear [Customer Name],

Congratulations! You have been selected for an exclusive pre-approval for our [Credit Card Name]. This offer is based on our assessment of your financial history and is valid until [Expiration Date].

To activate your pre-approval, please submit your application via [Link] or contact your banking representative. We are excited to provide you with the benefits and rewards of this card.

Sincerely,

[Bank Name]

[Contact Information]

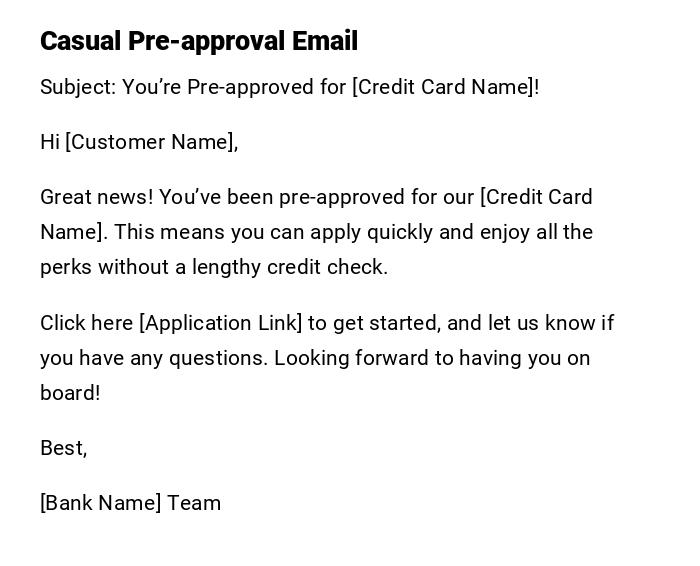

Casual / Friendly Credit Card Pre-approval Email

Subject: You’re Pre-approved for [Credit Card Name]!

Hi [Customer Name],

Great news! You’ve been pre-approved for our [Credit Card Name]. This means you can apply quickly and enjoy all the perks without a lengthy credit check.

Click here [Application Link] to get started, and let us know if you have any questions. Looking forward to having you on board!

Best,

[Bank Name] Team

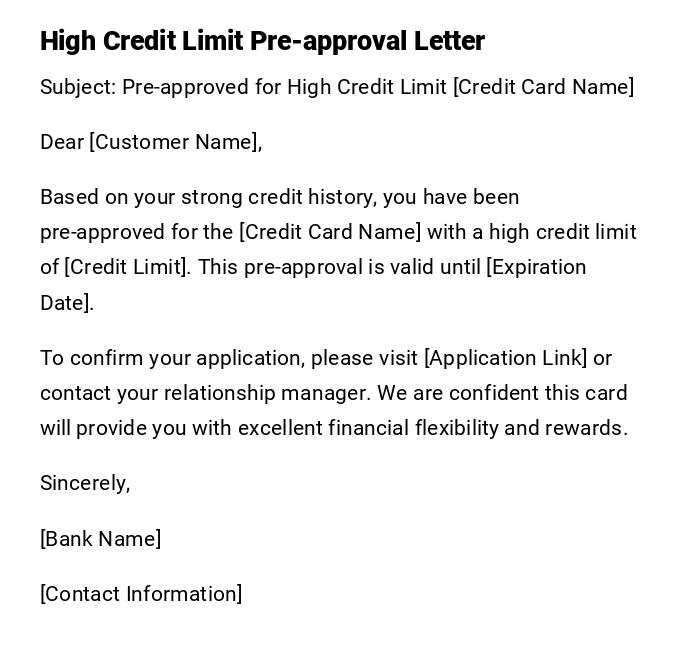

High Credit Limit Pre-approval Letter

Subject: Pre-approved for High Credit Limit [Credit Card Name]

Dear [Customer Name],

Based on your strong credit history, you have been pre-approved for the [Credit Card Name] with a high credit limit of [Credit Limit]. This pre-approval is valid until [Expiration Date].

To confirm your application, please visit [Application Link] or contact your relationship manager. We are confident this card will provide you with excellent financial flexibility and rewards.

Sincerely,

[Bank Name]

[Contact Information]

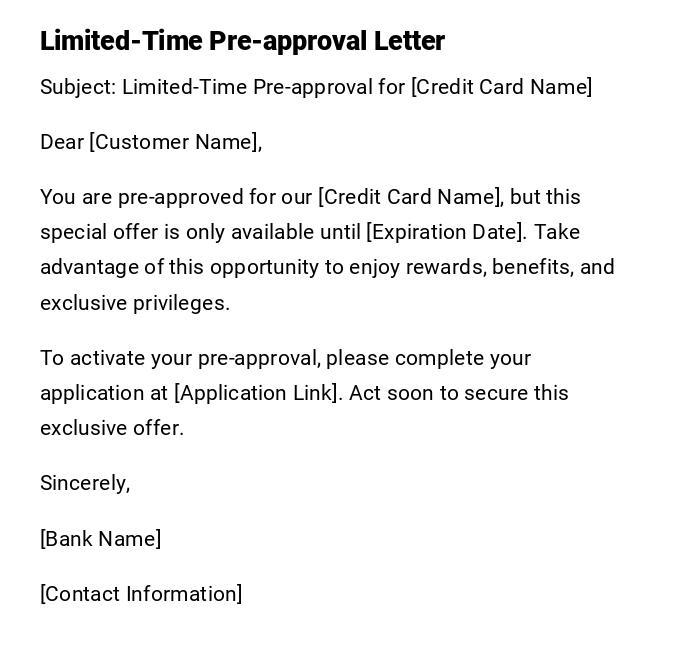

Limited-Time Pre-approval Offer Letter

Subject: Limited-Time Pre-approval for [Credit Card Name]

Dear [Customer Name],

You are pre-approved for our [Credit Card Name], but this special offer is only available until [Expiration Date]. Take advantage of this opportunity to enjoy rewards, benefits, and exclusive privileges.

To activate your pre-approval, please complete your application at [Application Link]. Act soon to secure this exclusive offer.

Sincerely,

[Bank Name]

[Contact Information]

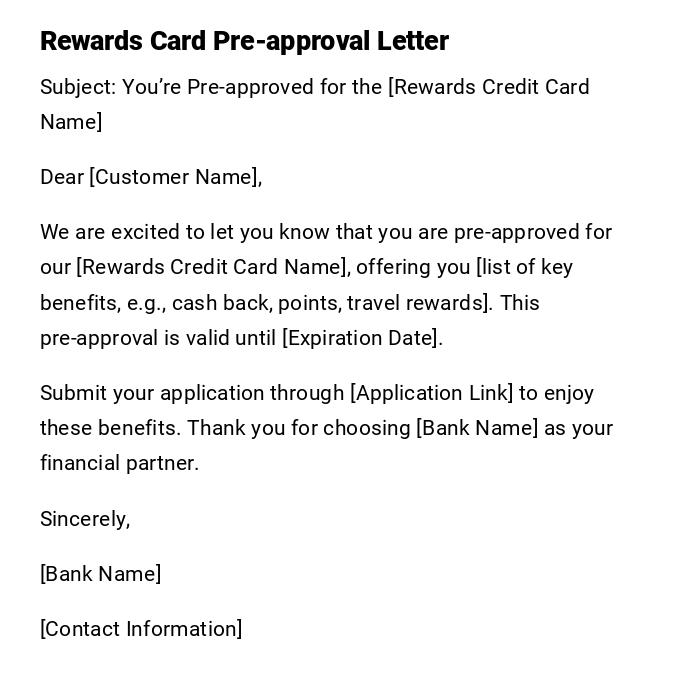

Pre-approval for Rewards Card

Subject: You’re Pre-approved for the [Rewards Credit Card Name]

Dear [Customer Name],

We are excited to let you know that you are pre-approved for our [Rewards Credit Card Name], offering you [list of key benefits, e.g., cash back, points, travel rewards]. This pre-approval is valid until [Expiration Date].

Submit your application through [Application Link] to enjoy these benefits. Thank you for choosing [Bank Name] as your financial partner.

Sincerely,

[Bank Name]

[Contact Information]

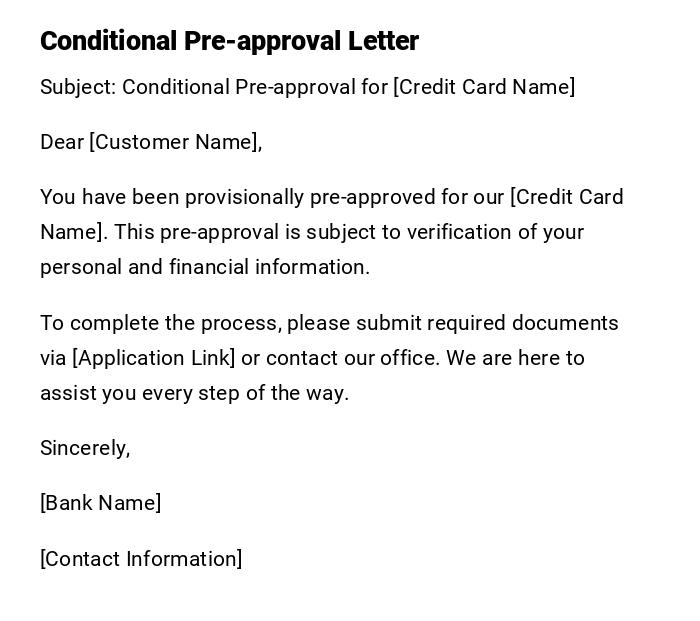

Provisional / Conditional Pre-approval Letter

Subject: Conditional Pre-approval for [Credit Card Name]

Dear [Customer Name],

You have been provisionally pre-approved for our [Credit Card Name]. This pre-approval is subject to verification of your personal and financial information.

To complete the process, please submit required documents via [Application Link] or contact our office. We are here to assist you every step of the way.

Sincerely,

[Bank Name]

[Contact Information]

What a Credit Card Pre-approval Letter Is and Its Purpose

- A Credit Card Pre-approval Letter informs a customer that they meet preliminary credit criteria to apply for a card.

- Purpose:

- To provide a fast-track application process.

- Encourage potential cardholders to take advantage of exclusive offers.

- Highlight benefits and rewards associated with the credit card.

Who Sends the Pre-approval Letter

- The credit card issuer or bank.

- Marketing or customer relations departments within the bank.

- Authorized representatives or account managers for specific clients.

Whom the Pre-approval Letter Is Addressed To

- Individual potential cardholders identified as qualified candidates based on credit assessment.

- Existing bank clients with eligible financial profiles.

- High-value customers for targeted reward card offers.

When to Send a Credit Card Pre-approval Letter

- Following a preliminary credit assessment by the bank.

- During promotional campaigns for new credit card products.

- As part of targeted marketing to high-credit-score clients.

- When renewing offers or updating reward programs for existing clients.

How to Write and Issue a Pre-approval Letter

- Begin with a clear subject line indicating pre-approval.

- Use a formal or friendly greeting based on the audience.

- State the pre-approval status and any special benefits or credit limits.

- Include expiry date and next steps for completing the application.

- Add contact information and application links.

- Review for accuracy, clarity, and compliance with regulations before sending.

Formatting Guidelines for Pre-approval Letters

- Length: 1 page; concise and informative.

- Tone: Professional, promotional, and inviting.

- Structure: Subject, greeting, pre-approval details, benefits, instructions, closing.

- Mode: Email for speed; printed letter for formal offers.

- Visuals: Optional bank branding, logos, and headers.

Requirements and Prerequisites Before Sending

- Preliminary credit check and eligibility assessment.

- Determine specific card offer and benefits.

- Set expiration date for the pre-approval offer.

- Ensure compliance with legal and marketing regulations.

Tricks and Tips for Effective Pre-approval Letters

- Personalize with recipient's name for a personal touch.

- Highlight the card’s unique benefits to encourage application.

- Provide clear, easy-to-follow instructions for next steps.

- Mention the expiration date to create urgency.

- Keep the tone inviting without over-promising.

Common Mistakes to Avoid

- Sending to unqualified recipients.

- Omitting key instructions or expiration date.

- Using unclear or confusing language regarding pre-approval.

- Failing to include contact information or links for application.

- Overly aggressive marketing that may breach regulations.

Elements and Structure of a Credit Card Pre-approval Letter

- Subject: Clear indication of pre-approval.

- Greeting: Personalized or professional salutation.

- Introduction: State the pre-approval and purpose of the letter.

- Body: Include benefits, credit limit (if applicable), and instructions.

- Expiration Details: Specify validity period of pre-approval.

- Next Steps: Application link or contact instructions.

- Closing: Thank the recipient and encourage action.

- Signature: Bank name, department, and contact details.

After Sending the Pre-approval Letter: Follow-up

- Track application completions from recipients.

- Send reminder emails or letters before the offer expires.

- Ensure customer service is prepared for inquiries.

- Analyze response rates to measure campaign effectiveness.

Pros and Cons of Sending a Pre-approval Letter

Pros:

- Increases likelihood of applications.

- Strengthens customer engagement and brand loyalty.

- Streamlines application process for qualified clients.

Cons:

- May be perceived as spam if not targeted correctly.

- Risk of sending to clients who do not meet final approval criteria.

- Requires accurate credit data to avoid legal or regulatory issues.

FAQ About Credit Card Pre-approval Letters

Q: Does pre-approval guarantee acceptance?

A: No, final approval is subject to full credit verification and other eligibility checks.

Q: Can the recipient decline the pre-approval?

A: Yes, pre-approval is an invitation; acceptance is voluntary.

Q: How long is pre-approval valid?

A: Typically 30–90 days, depending on the issuer.

Q: Is pre-approval credit inquiry-free?

A: Usually, pre-approval does not involve a hard credit check until full application is submitted.

Compare and Contrast With Other Credit Offers

- Pre-approval vs. Pre-qualification: Pre-approval often implies a higher confidence level in creditworthiness than pre-qualification.

- Email vs. Printed Letter: Emails are faster and trackable; printed letters provide a formal presentation.

- Reward vs. Standard Cards: Pre-approval letters for reward cards highlight benefits, whereas standard cards focus on credit flexibility.

Download Word Doc

Download Word Doc

Download PDF

Download PDF