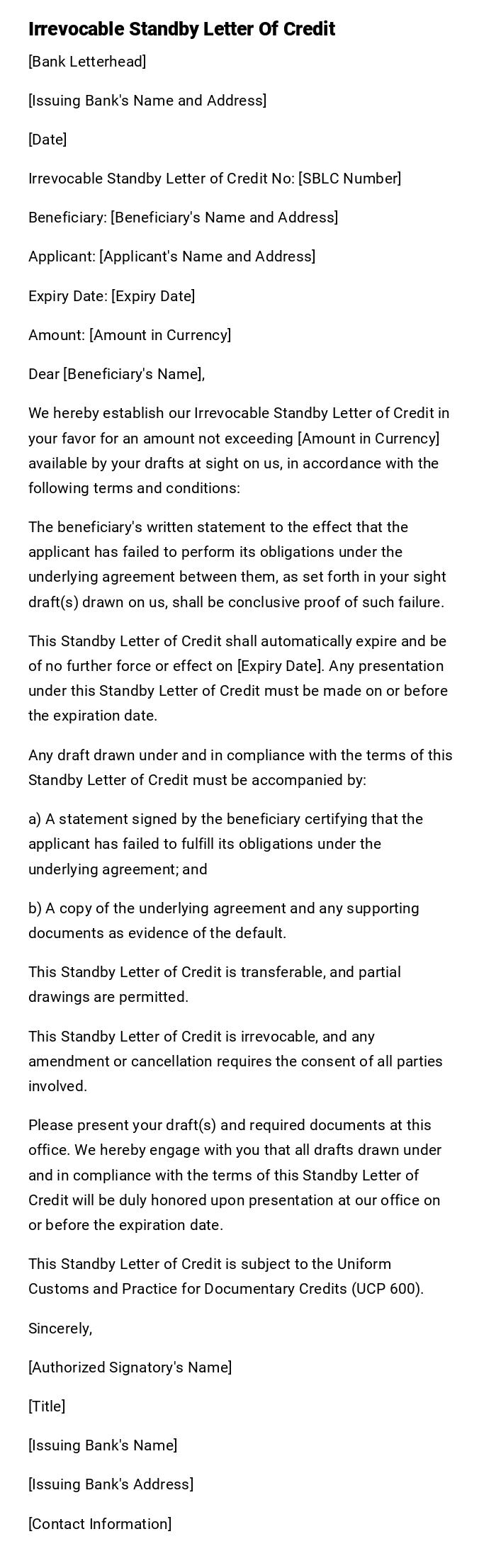

Irrevocable Standby Letter Of Credit

[Bank Letterhead]

[Issuing Bank's Name and Address]

[Date]

Irrevocable Standby Letter of Credit No: [SBLC Number]

Beneficiary: [Beneficiary's Name and Address]

Applicant: [Applicant's Name and Address]

Expiry Date: [Expiry Date]

Amount: [Amount in Currency]

Dear [Beneficiary's Name],

We hereby establish our Irrevocable Standby Letter of Credit in your favor for an amount not exceeding [Amount in Currency] available by your drafts at sight on us, in accordance with the following terms and conditions:

The beneficiary's written statement to the effect that the applicant has failed to perform its obligations under the underlying agreement between them, as set forth in your sight draft(s) drawn on us, shall be conclusive proof of such failure.

This Standby Letter of Credit shall automatically expire and be of no further force or effect on [Expiry Date]. Any presentation under this Standby Letter of Credit must be made on or before the expiration date.

Any draft drawn under and in compliance with the terms of this Standby Letter of Credit must be accompanied by:

a) A statement signed by the beneficiary certifying that the applicant has failed to fulfill its obligations under the underlying agreement; and

b) A copy of the underlying agreement and any supporting documents as evidence of the default.

This Standby Letter of Credit is transferable, and partial drawings are permitted.

This Standby Letter of Credit is irrevocable, and any amendment or cancellation requires the consent of all parties involved.

Please present your draft(s) and required documents at this office. We hereby engage with you that all drafts drawn under and in compliance with the terms of this Standby Letter of Credit will be duly honored upon presentation at our office on or before the expiration date.

This Standby Letter of Credit is subject to the Uniform Customs and Practice for Documentary Credits (UCP 600).

Sincerely,

[Authorized Signatory's Name]

[Title]

[Issuing Bank's Name]

[Issuing Bank's Address]

[Contact Information]

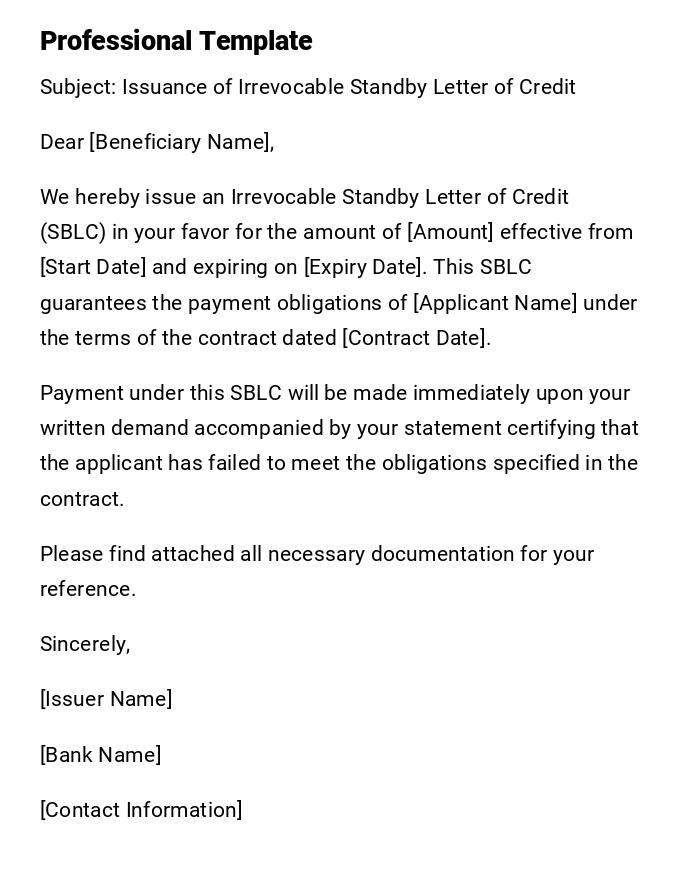

Basic Irrevocable Standby Letter of Credit Template

Subject: Issuance of Irrevocable Standby Letter of Credit

Dear [Beneficiary Name],

We hereby issue an Irrevocable Standby Letter of Credit (SBLC) in your favor for the amount of [Amount] effective from [Start Date] and expiring on [Expiry Date]. This SBLC guarantees the payment obligations of [Applicant Name] under the terms of the contract dated [Contract Date].

Payment under this SBLC will be made immediately upon your written demand accompanied by your statement certifying that the applicant has failed to meet the obligations specified in the contract.

Please find attached all necessary documentation for your reference.

Sincerely,

[Issuer Name]

[Bank Name]

[Contact Information]

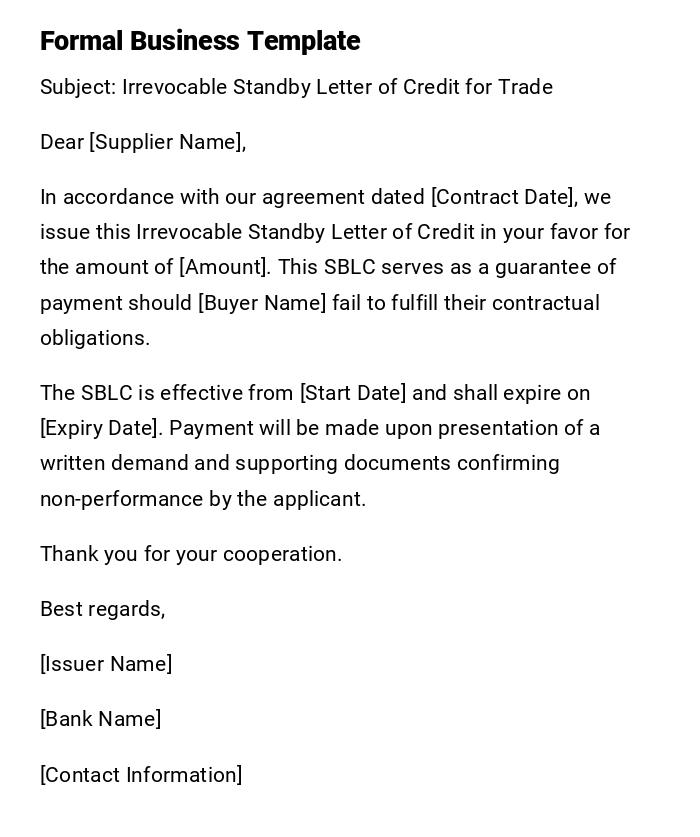

Commercial Transaction SBLC Template

Subject: Irrevocable Standby Letter of Credit for Trade

Dear [Supplier Name],

In accordance with our agreement dated [Contract Date], we issue this Irrevocable Standby Letter of Credit in your favor for the amount of [Amount]. This SBLC serves as a guarantee of payment should [Buyer Name] fail to fulfill their contractual obligations.

The SBLC is effective from [Start Date] and shall expire on [Expiry Date]. Payment will be made upon presentation of a written demand and supporting documents confirming non-performance by the applicant.

Thank you for your cooperation.

Best regards,

[Issuer Name]

[Bank Name]

[Contact Information]

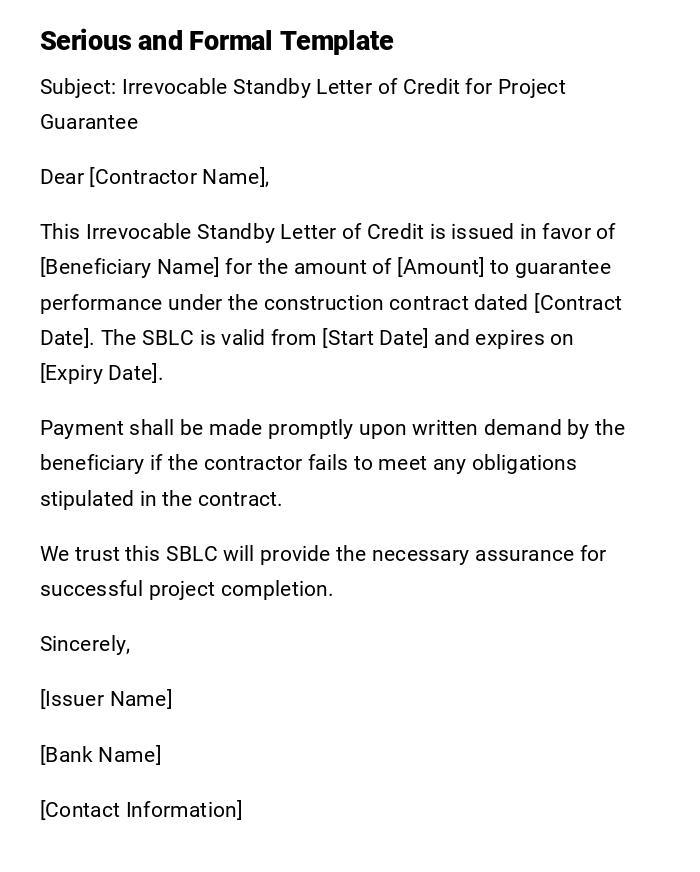

Construction Project SBLC Template

Subject: Irrevocable Standby Letter of Credit for Project Guarantee

Dear [Contractor Name],

This Irrevocable Standby Letter of Credit is issued in favor of [Beneficiary Name] for the amount of [Amount] to guarantee performance under the construction contract dated [Contract Date]. The SBLC is valid from [Start Date] and expires on [Expiry Date].

Payment shall be made promptly upon written demand by the beneficiary if the contractor fails to meet any obligations stipulated in the contract.

We trust this SBLC will provide the necessary assurance for successful project completion.

Sincerely,

[Issuer Name]

[Bank Name]

[Contact Information]

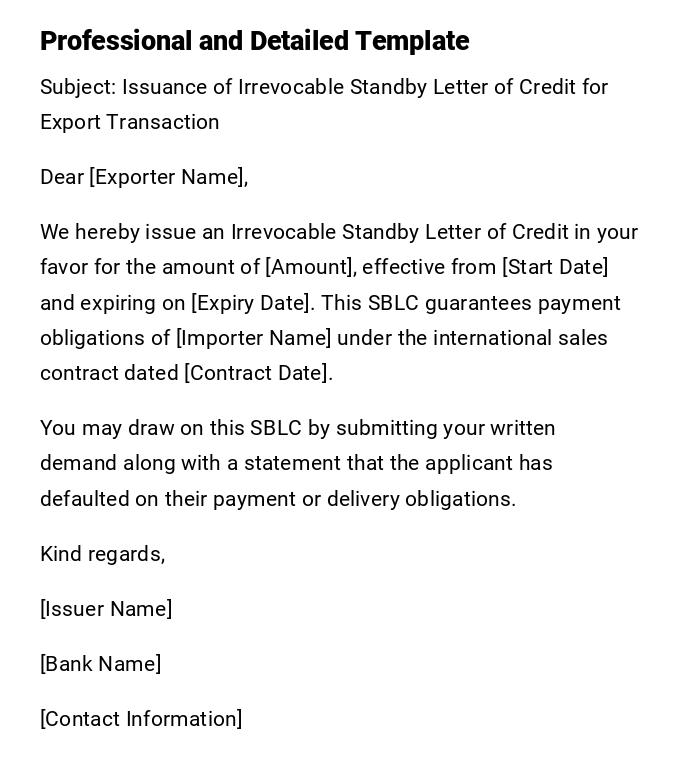

International Trade SBLC Template

Subject: Issuance of Irrevocable Standby Letter of Credit for Export Transaction

Dear [Exporter Name],

We hereby issue an Irrevocable Standby Letter of Credit in your favor for the amount of [Amount], effective from [Start Date] and expiring on [Expiry Date]. This SBLC guarantees payment obligations of [Importer Name] under the international sales contract dated [Contract Date].

You may draw on this SBLC by submitting your written demand along with a statement that the applicant has defaulted on their payment or delivery obligations.

Kind regards,

[Issuer Name]

[Bank Name]

[Contact Information]

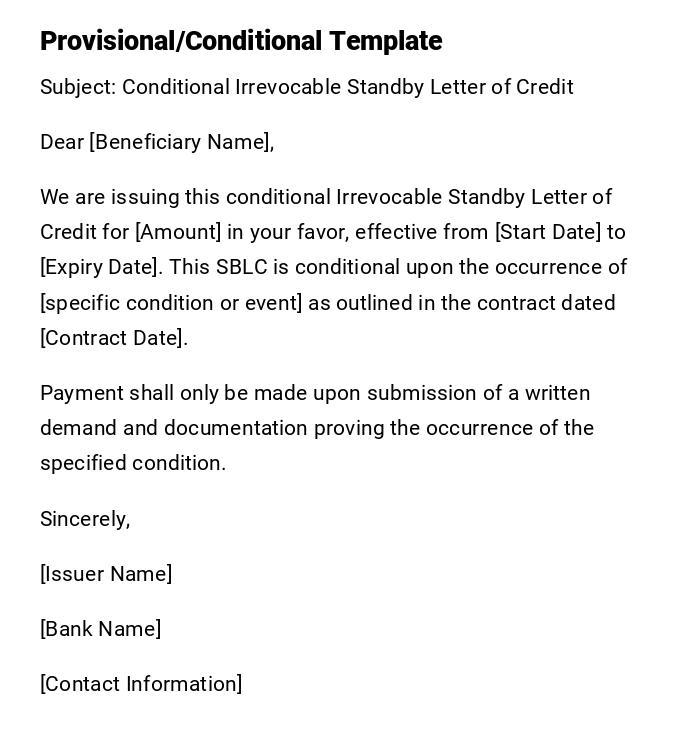

Provisional/Conditional SBLC Template

Subject: Conditional Irrevocable Standby Letter of Credit

Dear [Beneficiary Name],

We are issuing this conditional Irrevocable Standby Letter of Credit for [Amount] in your favor, effective from [Start Date] to [Expiry Date]. This SBLC is conditional upon the occurrence of [specific condition or event] as outlined in the contract dated [Contract Date].

Payment shall only be made upon submission of a written demand and documentation proving the occurrence of the specified condition.

Sincerely,

[Issuer Name]

[Bank Name]

[Contact Information]

What / Why: Purpose of an Irrevocable Standby Letter of Credit

What / Why: Purpose of an Irrevocable Standby Letter of Credit

- A financial instrument issued by a bank guaranteeing payment to a beneficiary if the applicant fails to meet contractual obligations.

- Provides security and reduces risk in commercial, construction, and international transactions.

- Ensures confidence in business dealings by acting as a safety net for payments.

- Commonly used in trade finance, construction projects, and service contracts to secure performance or payment.

Who Should Send an SBLC

Who Should Send an SBLC

- Typically, a bank or financial institution issues the SBLC on behalf of the applicant.

- The applicant is usually a buyer, contractor, or importer seeking to guarantee their obligations to the beneficiary.

- Banks issue SBLCs for clients with a solid credit history and a defined contractual agreement.

Whom the SBLC Should Be Addressed To

Whom the SBLC Should Be Addressed To

- The beneficiary of the SBLC, typically the seller, supplier, contractor, or service provider.

- In international trade, the beneficiary could be located overseas and will rely on the SBLC for financial security.

- The letter can also be addressed to a designated agent or financial institution authorized to process claims under the SBLC.

When to Use an Irrevocable Standby Letter of Credit

When to Use an Irrevocable Standby Letter of Credit

- Before initiating high-value commercial or trade transactions.

- During large-scale construction projects to guarantee contractor performance.

- In international trade to assure exporters of payment from overseas buyers.

- When a contractual obligation carries high risk or potential non-performance.

- For provisional or conditional guarantees, when payment depends on certain events.

How to Write and Issue an SBLC

How to Write and Issue an SBLC

- Review the contract and identify the amount, expiration date, and conditions for payment.

- Choose the appropriate type: unconditional or conditional, depending on agreement terms.

- Draft the SBLC clearly specifying payment triggers and documentation requirements.

- Submit the draft to the issuing bank for review and authorization.

- Deliver the SBLC to the beneficiary, ensuring acknowledgment and proper documentation.

How Much / How Many

How Much / How Many

- The amount should match the maximum potential liability or obligation under the contract.

- Typically expressed in the currency of the transaction or agreed upon by both parties.

- SBLCs can be single or multiple, depending on the number of obligations or contracts being secured.

Requirements and Prerequisites for Issuing an SBLC

Requirements and Prerequisites for Issuing an SBLC

- Signed contract between applicant and beneficiary specifying obligations.

- Applicant’s creditworthiness and bank approval for issuing the SBLC.

- Determination of SBLC amount, duration, and conditions.

- Identification of documentation required for payment under the SBLC.

- Bank account and legal authorization to issue financial guarantees.

Formatting Guidelines for an SBLC

Formatting Guidelines for an SBLC

- Keep the letter concise and professional, typically one page in length.

- Use formal language and precise financial terminology.

- Include subject, beneficiary, amount, validity period, and conditions.

- Clearly state payment triggers and required documentation.

- Preferred mode: printed and signed by bank, but electronic copies can be used if authorized.

After Sending / Follow-up Procedures

After Sending / Follow-up Procedures

- Confirm receipt of the SBLC by the beneficiary.

- Retain copies for legal and financial records.

- Monitor contract performance and be prepared to respond to any claims.

- Renew or amend SBLC if the contract terms change before expiration.

- Ensure that any payment requests comply with the specified documentation requirements.

Pros and Cons of Using an SBLC

Pros and Cons of Using an SBLC

Pros:

- Reduces payment risk for the beneficiary.

- Facilitates business transactions and international trade.

- Provides a formal, bank-backed guarantee.

- Enhances credibility of the applicant.

Cons:

- May require collateral or credit evaluation.

- Costs and fees associated with issuance.

- Legal and administrative complexity.

- Limited flexibility if conditions are too rigid.

Common Mistakes When Issuing an SBLC

Common Mistakes When Issuing an SBLC

- Vague or unclear payment triggers and documentation requirements.

- Incorrect or mismatched contract amounts.

- Missing signatures or bank authorizations.

- Overlooking expiration dates or renewal conditions.

- Failure to communicate with beneficiary prior to issuance.

Elements and Structure of an SBLC

Elements and Structure of an SBLC

- Subject line clearly indicating it is an Irrevocable Standby Letter of Credit.

- Identification of beneficiary and applicant.

- Guaranteed amount and currency.

- Effective and expiry dates.

- Terms and conditions triggering payment.

- Documentation required to claim payment.

- Authorized signatures and bank seal.

Does an SBLC Require Authorization?

Does an SBLC Require Authorization?

- Yes, SBLCs require formal authorization by the issuing bank.

- Bank officials must verify applicant's creditworthiness and legal ability to issue the guarantee.

- Some SBLCs may also need notarization or certification depending on the country and type of transaction.

Download Word Doc

Download Word Doc

Download PDF

Download PDF