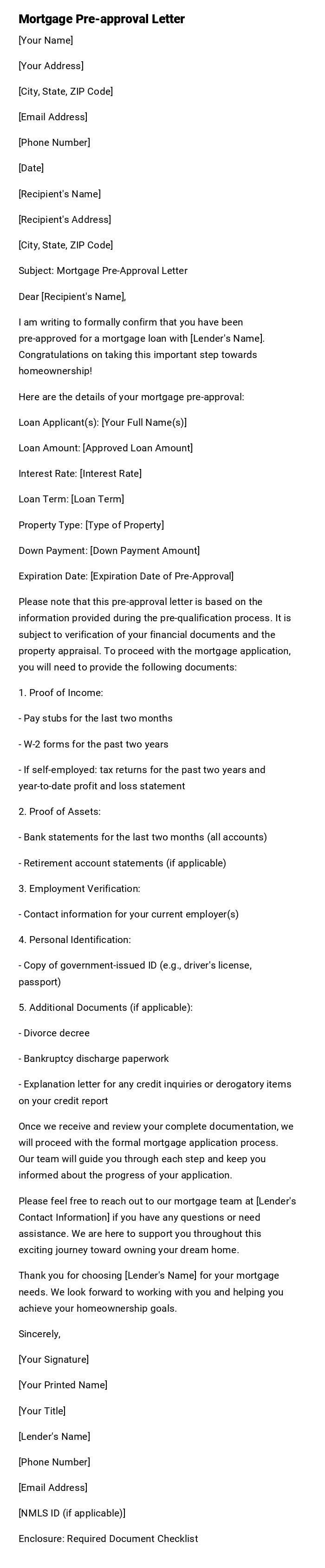

Mortgage Pre-approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Mortgage Pre-Approval Letter

Dear [Recipient's Name],

I am writing to formally confirm that you have been pre-approved for a mortgage loan with [Lender's Name]. Congratulations on taking this important step towards homeownership!

Here are the details of your mortgage pre-approval:

Loan Applicant(s): [Your Full Name(s)]

Loan Amount: [Approved Loan Amount]

Interest Rate: [Interest Rate]

Loan Term: [Loan Term]

Property Type: [Type of Property]

Down Payment: [Down Payment Amount]

Expiration Date: [Expiration Date of Pre-Approval]

Please note that this pre-approval letter is based on the information provided during the pre-qualification process. It is subject to verification of your financial documents and the property appraisal. To proceed with the mortgage application, you will need to provide the following documents:

1. Proof of Income:

- Pay stubs for the last two months

- W-2 forms for the past two years

- If self-employed: tax returns for the past two years and year-to-date profit and loss statement

2. Proof of Assets:

- Bank statements for the last two months (all accounts)

- Retirement account statements (if applicable)

3. Employment Verification:

- Contact information for your current employer(s)

4. Personal Identification:

- Copy of government-issued ID (e.g., driver's license, passport)

5. Additional Documents (if applicable):

- Divorce decree

- Bankruptcy discharge paperwork

- Explanation letter for any credit inquiries or derogatory items on your credit report

Once we receive and review your complete documentation, we will proceed with the formal mortgage application process. Our team will guide you through each step and keep you informed about the progress of your application.

Please feel free to reach out to our mortgage team at [Lender's Contact Information] if you have any questions or need assistance. We are here to support you throughout this exciting journey toward owning your dream home.

Thank you for choosing [Lender's Name] for your mortgage needs. We look forward to working with you and helping you achieve your homeownership goals.

Sincerely,

[Your Signature]

[Your Printed Name]

[Your Title]

[Lender's Name]

[Phone Number]

[Email Address]

[NMLS ID (if applicable)]

Enclosure: Required Document Checklist

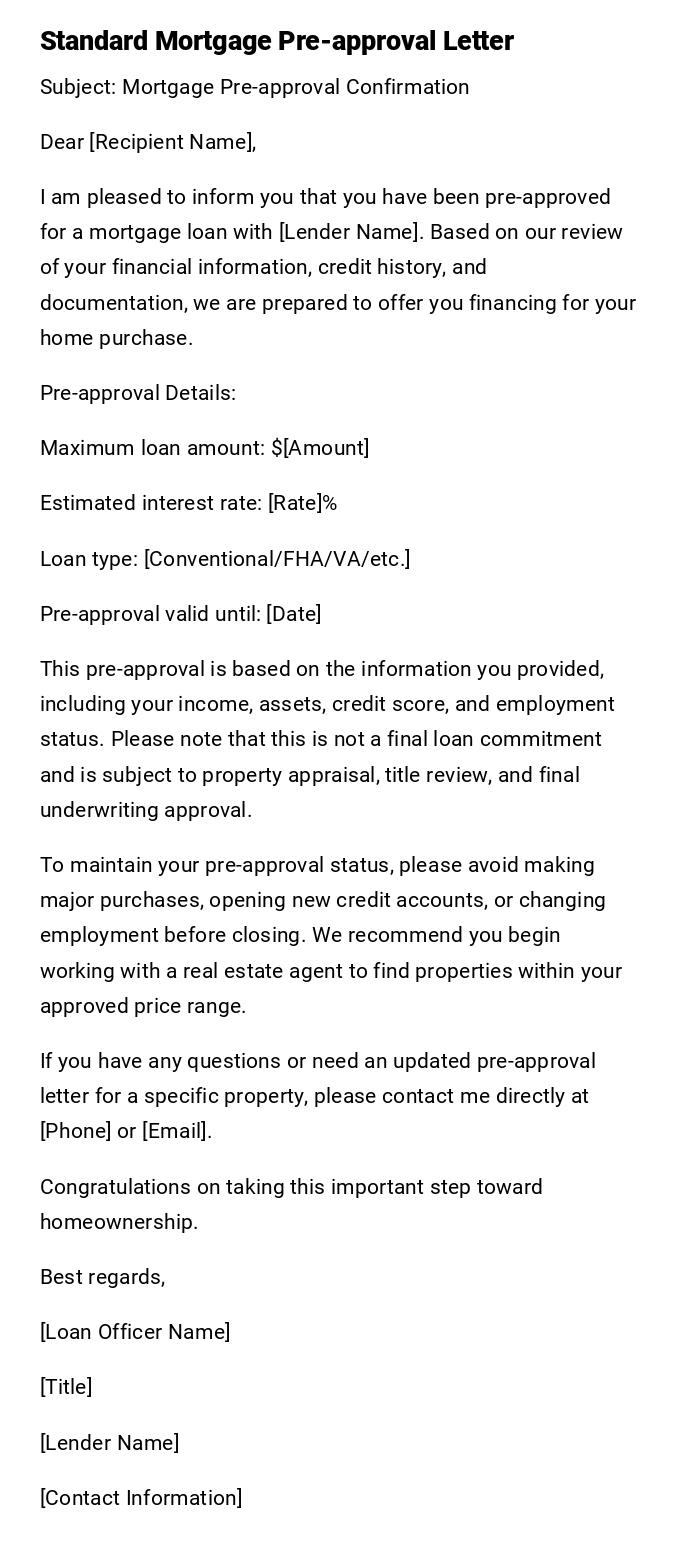

Standard Mortgage Pre-approval Letter

Subject: Mortgage Pre-approval Confirmation

Dear [Recipient Name],

I am pleased to inform you that you have been pre-approved for a mortgage loan with [Lender Name]. Based on our review of your financial information, credit history, and documentation, we are prepared to offer you financing for your home purchase.

Pre-approval Details:

Maximum loan amount: $[Amount]

Estimated interest rate: [Rate]%

Loan type: [Conventional/FHA/VA/etc.]

Pre-approval valid until: [Date]

This pre-approval is based on the information you provided, including your income, assets, credit score, and employment status. Please note that this is not a final loan commitment and is subject to property appraisal, title review, and final underwriting approval.

To maintain your pre-approval status, please avoid making major purchases, opening new credit accounts, or changing employment before closing. We recommend you begin working with a real estate agent to find properties within your approved price range.

If you have any questions or need an updated pre-approval letter for a specific property, please contact me directly at [Phone] or [Email].

Congratulations on taking this important step toward homeownership.

Best regards,

[Loan Officer Name]

[Title]

[Lender Name]

[Contact Information]

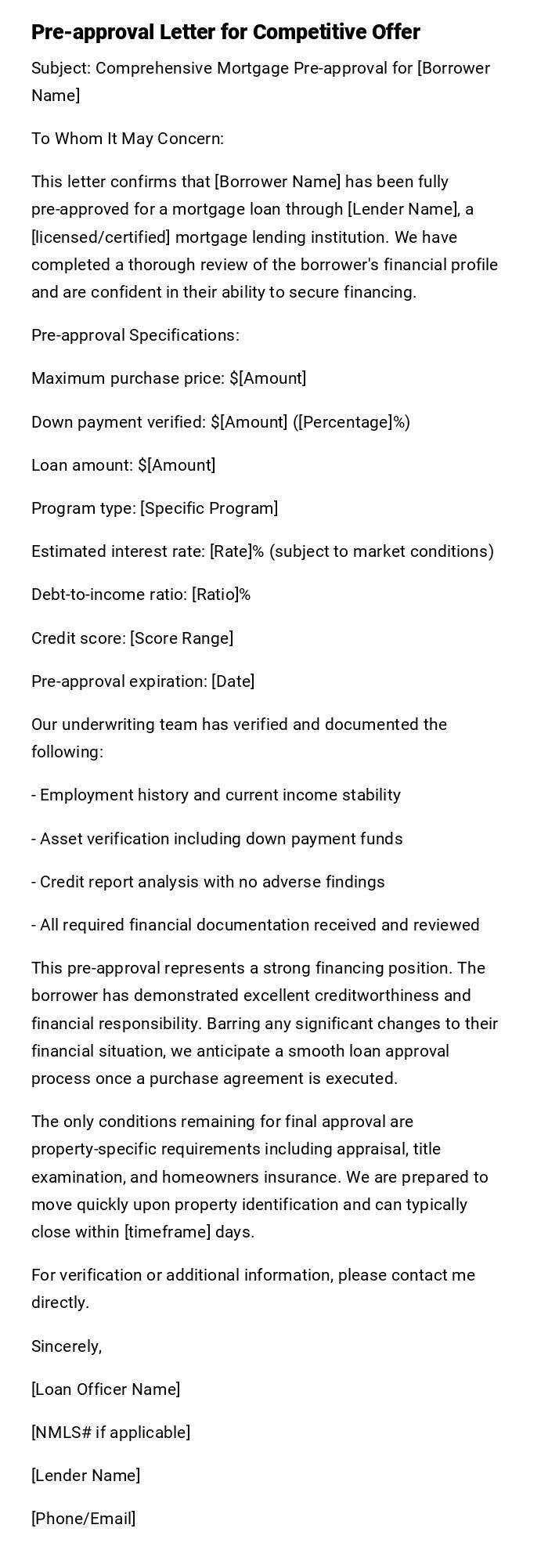

Pre-approval Letter for Competitive Offer (Detailed)

Subject: Comprehensive Mortgage Pre-approval for [Borrower Name]

To Whom It May Concern:

This letter confirms that [Borrower Name] has been fully pre-approved for a mortgage loan through [Lender Name], a [licensed/certified] mortgage lending institution. We have completed a thorough review of the borrower's financial profile and are confident in their ability to secure financing.

Pre-approval Specifications:

Maximum purchase price: $[Amount]

Down payment verified: $[Amount] ([Percentage]%)

Loan amount: $[Amount]

Program type: [Specific Program]

Estimated interest rate: [Rate]% (subject to market conditions)

Debt-to-income ratio: [Ratio]%

Credit score: [Score Range]

Pre-approval expiration: [Date]

Our underwriting team has verified and documented the following:

- Employment history and current income stability

- Asset verification including down payment funds

- Credit report analysis with no adverse findings

- All required financial documentation received and reviewed

This pre-approval represents a strong financing position. The borrower has demonstrated excellent creditworthiness and financial responsibility. Barring any significant changes to their financial situation, we anticipate a smooth loan approval process once a purchase agreement is executed.

The only conditions remaining for final approval are property-specific requirements including appraisal, title examination, and homeowners insurance. We are prepared to move quickly upon property identification and can typically close within [timeframe] days.

For verification or additional information, please contact me directly.

Sincerely,

[Loan Officer Name]

[NMLS# if applicable]

[Lender Name]

[Phone/Email]

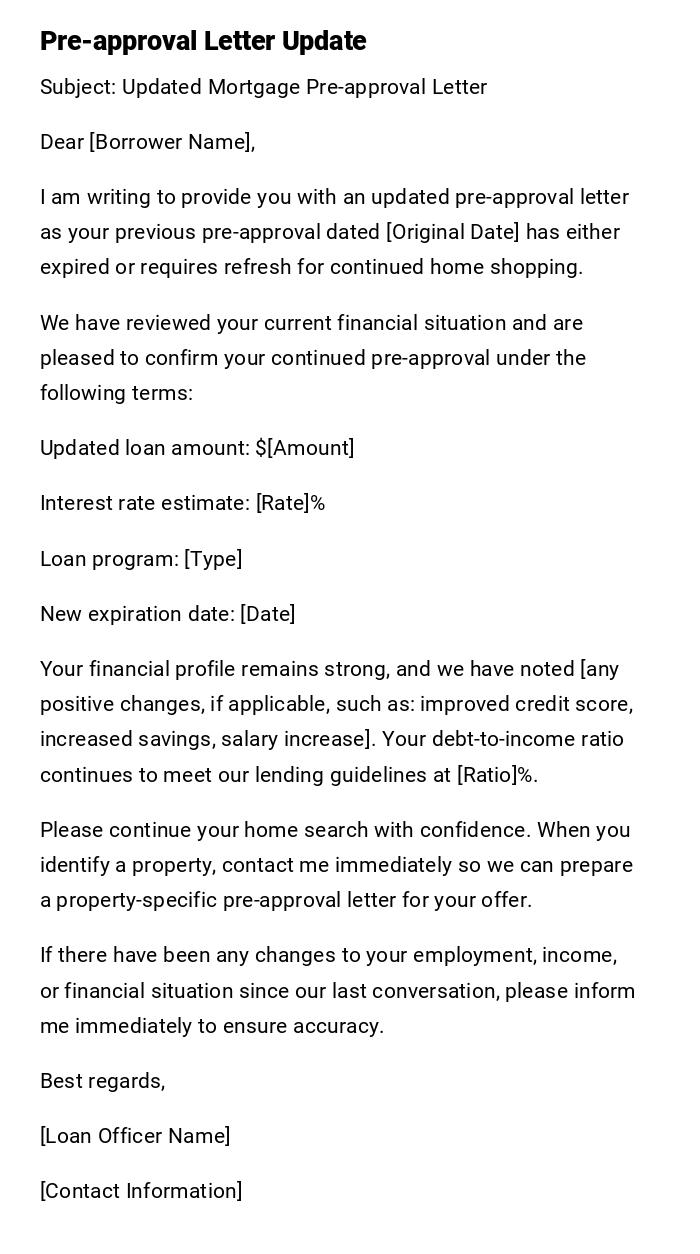

Pre-approval Letter Update/Renewal

Subject: Updated Mortgage Pre-approval Letter

Dear [Borrower Name],

I am writing to provide you with an updated pre-approval letter as your previous pre-approval dated [Original Date] has either expired or requires refresh for continued home shopping.

We have reviewed your current financial situation and are pleased to confirm your continued pre-approval under the following terms:

Updated loan amount: $[Amount]

Interest rate estimate: [Rate]%

Loan program: [Type]

New expiration date: [Date]

Your financial profile remains strong, and we have noted [any positive changes, if applicable, such as: improved credit score, increased savings, salary increase]. Your debt-to-income ratio continues to meet our lending guidelines at [Ratio]%.

Please continue your home search with confidence. When you identify a property, contact me immediately so we can prepare a property-specific pre-approval letter for your offer.

If there have been any changes to your employment, income, or financial situation since our last conversation, please inform me immediately to ensure accuracy.

Best regards,

[Loan Officer Name]

[Contact Information]

Pre-approval Letter for Specific Property

Subject: Mortgage Pre-approval for [Property Address]

Dear [Seller/Listing Agent],

This letter confirms that our client, [Borrower Name], is pre-approved for mortgage financing to purchase the property located at [Full Property Address].

Property-Specific Pre-approval Details:

Property address: [Address]

Purchase price: Up to $[Amount]

Loan amount: $[Amount]

Down payment: $[Amount] ([Percentage]%)

Loan program: [Type]

Estimated closing timeline: [Days] days

[Borrower Name] has provided complete financial documentation, and our underwriting team has thoroughly reviewed their application. All income, asset, and credit verifications have been completed successfully. The borrower's financial qualifications are solid and meet all our lending criteria.

Pending satisfactory property appraisal, clear title, and homeowners insurance, we are prepared to fund this loan. Our borrower is highly qualified, motivated, and ready to proceed to closing quickly.

We stand ready to answer any questions you may have regarding the borrower's financing capabilities.

Respectfully,

[Loan Officer Name]

[Title]

[Lender Name]

[NMLS#]

[Contact Information]

Pre-approval Letter with Contingencies (Honest)

Subject: Conditional Mortgage Pre-approval

Dear [Recipient Name],

Based on our preliminary review of your financial information, we are pleased to provide you with conditional pre-approval for a mortgage loan with [Lender Name].

Conditional Pre-approval Terms:

Maximum loan amount: $[Amount]

Estimated rate: [Rate]%

Loan type: [Type]

Valid through: [Date]

Please note that this pre-approval is conditional and subject to the following requirements:

Outstanding Items Required:

- [Specific documentation needed, e.g., "Two years of tax returns"]

- [Additional verification needed, e.g., "Verification of employment"]

- [Any other conditions, e.g., "Explanation of recent credit inquiry"]

Once we receive and verify the above documentation, we can issue a full pre-approval letter without conditions. This will strengthen your position when making offers on properties.

Your financial profile shows strong potential, and we are committed to working with you to complete the pre-approval process. Please submit the outstanding items at your earliest convenience so we can move forward.

I am available to discuss any questions or concerns you may have about these requirements.

Sincerely,

[Loan Officer Name]

[Contact Information]

Pre-approval Letter for First-Time Homebuyer

Subject: First-Time Homebuyer Mortgage Pre-approval

Dear [Borrower Name],

Congratulations on taking your first step toward homeownership! I am delighted to inform you that you have been pre-approved for a first-time homebuyer mortgage through [Lender Name].

Your Pre-approval Details:

Maximum loan amount: $[Amount]

Down payment assistance: [If applicable]

Loan program: [FHA/Conventional/State Program]

Interest rate estimate: [Rate]%

Pre-approval valid until: [Date]

As a first-time homebuyer, you may qualify for special programs and benefits including reduced down payment requirements, closing cost assistance, and favorable interest rates. We have reviewed your financial situation carefully and structured your pre-approval to maximize your purchasing power while ensuring comfortable monthly payments.

Next Steps for You:

- Connect with a buyer's agent experienced in working with first-time buyers

- Begin exploring neighborhoods and properties within your budget

- Attend homebuyer education workshops (some programs require this)

- Continue saving for down payment and closing costs

- Maintain your current employment and avoid major financial changes

I will be with you throughout this exciting journey, answering questions and guiding you through the mortgage process. Please don't hesitate to reach out as you begin your home search.

Welcome to the path of homeownership!

Warmly,

[Loan Officer Name]

[Lender Name]

[Contact Information]

Pre-approval Letter for Self-Employed Borrower

Subject: Mortgage Pre-approval for Self-Employed Applicant

Dear [Borrower Name],

After careful review of your self-employment income documentation and financial records, I am pleased to confirm your mortgage pre-approval with [Lender Name].

Pre-approval Summary:

Maximum loan amount: $[Amount]

Qualified income: $[Amount annually]

Loan program: [Type]

Interest rate range: [Rate]%

Pre-approval expires: [Date]

As a self-employed borrower, we have analyzed your business income using [two years of personal and business tax returns/profit and loss statements/bank statements]. Your business shows stable income and healthy financial performance, which supports your mortgage qualification.

Documentation Reviewed:

- Personal tax returns ([Years])

- Business tax returns ([Years])

- Year-to-date profit and loss statement

- Business bank statements

- CPA letter [if applicable]

Your self-employment income has been carefully calculated according to lending guidelines, and you have been qualified at a conservative income level to ensure loan approval confidence. This approach strengthens your application and demonstrates to sellers that your financing is secure.

As you move forward with home shopping, please maintain regular business operations and avoid any major business restructuring or unusual expenses that could affect your income calculation.

I appreciate the additional documentation required for self-employed borrowers and commend you on maintaining excellent business records.

Best regards,

[Loan Officer Name]

[Contact Information]

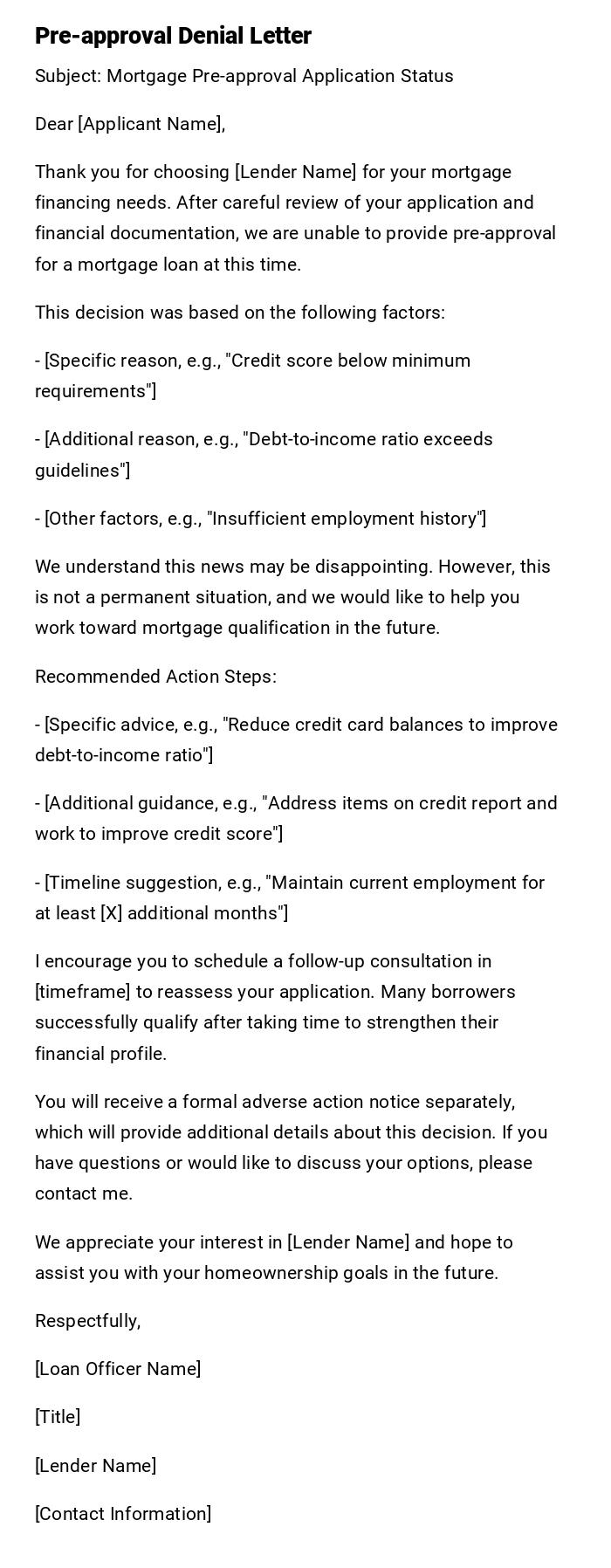

Pre-approval Denial Letter (Professional)

Subject: Mortgage Pre-approval Application Status

Dear [Applicant Name],

Thank you for choosing [Lender Name] for your mortgage financing needs. After careful review of your application and financial documentation, we are unable to provide pre-approval for a mortgage loan at this time.

This decision was based on the following factors:

- [Specific reason, e.g., "Credit score below minimum requirements"]

- [Additional reason, e.g., "Debt-to-income ratio exceeds guidelines"]

- [Other factors, e.g., "Insufficient employment history"]

We understand this news may be disappointing. However, this is not a permanent situation, and we would like to help you work toward mortgage qualification in the future.

Recommended Action Steps:

- [Specific advice, e.g., "Reduce credit card balances to improve debt-to-income ratio"]

- [Additional guidance, e.g., "Address items on credit report and work to improve credit score"]

- [Timeline suggestion, e.g., "Maintain current employment for at least [X] additional months"]

I encourage you to schedule a follow-up consultation in [timeframe] to reassess your application. Many borrowers successfully qualify after taking time to strengthen their financial profile.

You will receive a formal adverse action notice separately, which will provide additional details about this decision. If you have questions or would like to discuss your options, please contact me.

We appreciate your interest in [Lender Name] and hope to assist you with your homeownership goals in the future.

Respectfully,

[Loan Officer Name]

[Title]

[Lender Name]

[Contact Information]

What is a Mortgage Pre-approval Letter and Why Do You Need It

A mortgage pre-approval letter is an official document from a lender stating that you have been conditionally approved for a specific loan amount based on a thorough review of your financial situation. This letter serves multiple critical purposes in the home buying process:

- Establishes credibility with sellers who want assurance that buyers can actually secure financing

- Demonstrates serious intent to purchase, separating you from casual browsers

- Provides clarity on your budget so you don't waste time looking at unaffordable properties

- Strengthens your negotiating position in competitive markets where multiple offers are common

- Speeds up the closing process since much of the financial vetting is already complete

- Identifies potential issues early allowing time to address credit or documentation problems before finding your dream home

- Shows real estate agents you're worth their time making them more likely to prioritize showing you properties

The pre-approval letter differs significantly from pre-qualification, which is merely an estimate based on self-reported information without verification. Pre-approval involves actual document submission, credit checks, and underwriter review, making it far more valuable and reliable.

When Do You Need a Mortgage Pre-approval Letter

Understanding the right timing for obtaining pre-approval can significantly impact your home buying success:

- Before beginning your home search to establish a realistic budget and avoid emotional attachment to unaffordable properties

- In competitive housing markets where sellers receive multiple offers and need confidence in buyer financing

- When making an offer on a property as most sellers and listing agents require it as part of any serious offer

- After significant financial improvements such as paying off debt or receiving a raise that increases your buying power

- When pre-approval is expiring (typically 60-90 days) and you're still actively house hunting

- Before attending open houses in hot markets where agents may prioritize pre-approved buyers

- When relocating to a new area to demonstrate to out-of-state sellers that you're a serious, qualified buyer

- After major life changes like marriage, divorce, or job changes that affect your financial profile

- When switching from renting to buying to understand what you can truly afford versus your current rent

- During new construction purchases as builders typically require pre-approval before reserving units or lots

- When interest rates are favorable to lock in your buying power at current market conditions

- Before real estate agent consultations so agents can appropriately target their property recommendations

Requirements and Prerequisites Before Obtaining Pre-approval

Proper preparation significantly increases your chances of strong pre-approval and smooth processing:

- Credit report review: Check your credit score and report for errors at least 30-60 days before applying

- Two years of employment history: Gather employment verification, pay stubs, and employer contact information

- Income documentation: Collect recent pay stubs (typically 30 days), W-2 forms (2 years), and tax returns if self-employed

- Asset statements: Obtain bank statements (2-3 months) for all accounts to verify down payment and reserves

- Debt information: List all current debts including credit cards, auto loans, student loans, and other obligations

- Government-issued ID: Have driver's license or passport ready for identity verification

- Rental history: Prepare contact information for landlords if currently renting (12-24 months history)

- Self-employment documentation: If applicable, gather business tax returns, profit/loss statements, and CPA letters

- Gift letter: If receiving down payment assistance from family, document this properly

- Divorce decrees or separation agreements: If applicable, showing alimony or child support obligations

- Bankruptcy or foreclosure documentation: If in your history, include discharge papers and explanations

- Down payment savings: Have funds readily accessible and documented (not borrowed money)

- Stable financial behavior: Avoid opening new credit, making large purchases, or changing jobs during the process

Who Should Request a Mortgage Pre-approval Letter

Understanding who needs to initiate and be involved in the pre-approval process:

- Primary borrower: The main applicant whose income and credit will be primarily evaluated

- Co-borrowers: Spouses or partners who will be on the loan and title, improving combined qualifying power

- First-time homebuyers: Especially important to understand affordability and strengthen inexperienced buyer credibility

- Self-employed individuals: Need extra time for documentation review and income calculation verification

- Buyers in competitive markets: Where multiple offers are common and seller selection is highly competitive

- Relocating professionals: Moving to new cities or states where local credibility matters

- Investment property buyers: Seeking rental properties requiring different qualification standards

- Buyers with complex finances: Multiple income sources, recent credit events, or unusual financial situations

- Cash-out refinance candidates: Using pre-approval concept for refinancing with cash withdrawal

- Buyers upgrading homes: Trading up and need to know new affordability limits

- Military members: Seeking VA loans with specific benefit documentation requirements

The request typically comes from the borrower but involves coordination with real estate agents who often recommend specific lenders or facilitate introductions.

To Whom Should the Pre-approval Letter Be Addressed

Proper addressing ensures the letter serves its intended purpose effectively:

- Seller or seller's agent: When making an offer on a specific property, address it to the listing agent or seller

- "To Whom It May Concern": Generic format for general house hunting when no specific property is identified

- Real estate agent: Your buyer's agent may need copies for their records and to present with offers

- Specific property address: Include when writing for a particular home to show targeted intent

- Multiple recipients: In some cases, both seller and listing agent should be named

- Builder or developer: For new construction, address to the sales office or development company

- Estate executors: When purchasing estate sales or probate properties

- Bank-owned property departments: For REO (real estate owned) or foreclosure purchases

- Short sale negotiators: When dealing with pre-foreclosure short sale situations

The letter may need multiple versions—one generic for house hunting and specific versions tailored to individual properties you're seriously pursuing. Some lenders provide digital copies you can customize the recipient field as needed.

How to Obtain and Write a Mortgage Pre-approval Letter

The process involves multiple steps requiring organization and attention to detail:

- Research and select lenders: Compare multiple mortgage lenders, banks, or credit unions for rates and terms

- Submit initial application: Complete mortgage application providing basic financial and personal information

- Authorize credit check: Sign authorization allowing hard credit inquiry (may slightly impact credit score)

- Gather required documentation: Compile all financial documents, employment records, and asset statements

- Submit documentation package: Provide all materials to lender for comprehensive review

- Await underwriter review: Allow 1-3 days for preliminary underwriting assessment of your application

- Discuss findings with loan officer: Review approval amount, interest rate estimate, and any conditions

- Request appropriate letter type: Specify if you need generic or property-specific version

- Review letter accuracy: Verify all information is correct before using it in offers

- Obtain multiple copies: Get both digital and physical copies for various uses

- Update as needed: Request revised letters when circumstances change or original expires

Note that borrowers don't typically write these letters themselves—lenders produce them based on their underwriting findings. However, understanding the process helps you prepare appropriately and request what you need.

Elements and Structure of a Pre-approval Letter

A comprehensive pre-approval letter should include specific components to maximize effectiveness:

- Lender letterhead and contact information: Official branding establishing legitimacy and providing verification contact

- Date of issuance: Shows currency of the approval

- Borrower name(s): All applicants who will be on the loan

- Property address: If applicable for specific property offers

- Maximum loan amount: Clear statement of approved borrowing capacity

- Down payment amount or percentage: Demonstrating borrower's financial contribution

- Loan program type: Conventional, FHA, VA, USDA, or other specific programs

- Interest rate estimate: Current rate approximation (subject to change)

- Pre-approval expiration date: Typically 60-90 days from issuance

- Conditions or contingencies: Any outstanding requirements for final approval

- Verification statement: Confirmation that documentation has been reviewed

- Loan officer signature and credentials: Including NMLS number if applicable

- Lender license information: Establishing official lending authority

- Direct contact information: Phone and email for verification or questions

- Property conditions: Statement about appraisal and title requirements still needed

Avoid letters that are vague or overly brief—detailed letters carry more weight with sellers and their agents. The specificity demonstrates thorough vetting and serious buyer qualification.

Formatting Guidelines and Best Practices for Pre-approval Letters

Proper formatting enhances credibility and professional presentation:

- Length: Typically one page, occasionally two for detailed competitive market letters

- Tone: Professional and confident without being arrogant or presumptuous

- Font and layout: Clean, professional business letter format on official letterhead

- Language precision: Specific numbers and dates rather than vague approximations

- Delivery method: Email PDF for quick submission, printed hard copy for formal offer packets

- File naming: Clear, descriptive filenames like "Smith_Preapproval_123MainSt_2025.pdf"

- Updated versions: Date clearly and mark as "Updated" or "Revised" when reissuing

- Customization level: Generic for browsing, highly specific for actual offers

- Signature quality: Original signatures preferred over electronic stamps when possible

- Color vs black-and-white: Color letterhead acceptable, but ensure black-and-white copies remain professional

- Confidentiality balance: Include enough detail to be convincing without exposing sensitive personal information

- Multiple property offers: Never reuse a property-specific letter for different addresses

- Agent coordination: Ensure your agent approves the letter before submission

Remember that this letter represents your financial credibility—presentation quality matters significantly in how sellers and their representatives perceive your offer's strength.

Common Mistakes to Avoid with Mortgage Pre-approval

Understanding pitfalls helps prevent problems during the home buying process:

- Shopping beyond your approved amount: Becoming emotionally attached to homes you can't actually afford

- Making major purchases: Buying cars, furniture, or electronics before closing that affect debt-to-income ratio

- Opening new credit accounts: New credit cards or loans change your credit profile and may invalidate pre-approval

- Changing employment: Job switches, even for higher pay, can derail approval requiring new employment verification

- Making large deposits: Unexplained bank deposits raise questions about fund sources and require extensive documentation

- Accepting gift money improperly: Down payment gifts must be properly documented with gift letters

- Ignoring expiration dates: Allowing pre-approval to expire without renewal during extended house hunting

- Using multiple lenders simultaneously: Multiple credit inquiries can lower credit scores and create confusion

- Assuming pre-approval equals final approval: Misunderstanding that property appraisal and final underwriting are still required

- Sharing pre-approval letter publicly: Posting on social media or giving to too many people risks identity theft

- Exaggerating on application: Providing inflated income or hidden debts that will be discovered during verification

- Skipping document review: Not reading the letter carefully for errors before submitting with offers

- Neglecting to update changed circumstances: Failing to inform lender of income changes, new debts, or credit issues

- Verbal approval confusion: Relying on verbal approval without getting written pre-approval letter

After Sending: Follow-up and Next Steps

Proper post-submission actions ensure continued loan qualification and successful closing:

- Maintain financial status quo: Avoid any significant financial changes until after closing

- Respond promptly to lender requests: Quickly provide any additional documentation needed

- Keep lender informed: Notify immediately of job changes, address changes, or financial shifts

- Monitor credit report: Watch for unauthorized inquiries or errors that could affect approval

- Continue saving: Build additional reserves for closing costs and post-purchase expenses

- Stay in contact with loan officer: Regular check-ins ensure continued approval status

- Coordinate with real estate agent: Keep agent updated on pre-approval status and any changes

- Prepare for appraisal: Once property identified, understand appraisal process and timeline

- Gather property-specific documents: When offer accepted, begin collecting homeowners insurance quotes

- Review closing disclosures carefully: Verify all numbers match your expectations and pre-approval terms

- Avoid confirmation requests to sellers: Don't expect sellers to call your lender—let agents handle communication

- Update pre-approval if needed: Request new letters for subsequent offers if first property doesn't work out

- Plan for closing costs: Confirm exact amounts needed at closing and have funds accessible

- Schedule final walkthrough: Coordinate pre-closing property inspection

The pre-approval letter initiates the process, but maintaining qualification through closing requires ongoing diligence and communication with all parties involved.

Comparing Pre-approval with Similar Mortgage Documents

Understanding distinctions helps you know what you're receiving and its value:

- Pre-qualification vs Pre-approval: Pre-qualification is informal estimate based on self-reported information without verification or credit check; pre-approval involves actual document review, credit pull, and underwriter assessment, making it far more reliable

- Pre-approval vs Commitment letter: Pre-approval is conditional on finding property and final underwriting; commitment letter comes after property identified and represents near-final approval

- Pre-approval vs Pre-underwriting: Pre-underwriting is even more thorough than pre-approval, with complete underwriter file review before property selection

- Conditional vs Full pre-approval: Conditional pre-approval requires outstanding documentation; full pre-approval means all borrower documents are verified and approved

- Generic vs Property-specific letters: Generic works for house hunting; property-specific is tailored for offers

- Pre-approval vs Proof of funds: Pre-approval shows financing capability; proof of funds demonstrates cash availability

- Bank pre-approval vs Mortgage broker pre-approval: Banks underwrite their own loans; brokers represent multiple lenders offering more options

The strongest position involves comprehensive pre-approval (or pre-underwriting) with verified funds, giving you cash-buyer-like credibility while leveraging financing benefits.

Tips, Tricks, and Best Practices for Maximum Advantage

Strategic approaches enhance your pre-approval's effectiveness:

- Get pre-approved before house hunting: Knowing your exact budget prevents wasted time and emotional disappointment

- Choose experienced loan officers: Reputation matters—sellers trust known, reputable lenders

- Request detailed letters for competitive offers: More specifics demonstrate thorough vetting

- Obtain pre-approval from multiple lenders: Compare offers but ultimately use one to avoid credit score damage

- Time your application strategically: Apply when finances look strongest, after paying down debt or receiving bonuses

- Include down payment proof: Some lenders will reference verified assets in the letter strengthening your position

- Get local lender pre-approval: Out-of-state buyers benefit from using lenders familiar with target market

- Ask for quick-close capability: If you can close faster than typical 30-45 days, have lender mention this

- Refresh before expiration: Renew 1-2 weeks before expiration to maintain continuous coverage

- Request digital and physical copies: Have both immediately available for various submission methods

- Escalation clause consideration: Strong pre-approval allows for escalation clauses in bidding wars

- Combine with personal letter: Attach buyer personal letter alongside pre-approval for emotional connection

- Loan officer accessibility: Choose lenders who respond quickly for verification calls from selling agents

- Consider larger approval amount: Get approved for slightly more than you intend to spend for flexibility

These strategies position you as the strongest possible buyer, maximizing offer acceptance chances in competitive situations.

Advantages and Disadvantages of Obtaining Pre-approval

Weighing benefits against potential drawbacks helps inform your decision:

Advantages:

- Demonstrates serious buyer intent and financial capability to sellers

- Provides accurate budget knowledge preventing wasted time on unaffordable properties

- Speeds up closing process with preliminary underwriting already complete

- Strengthens negotiating position in competitive multiple-offer situations

- Identifies credit or documentation issues early allowing time for correction

- Builds confidence in house hunting knowing exactly what you can afford

- May lock favorable interest rate estimates during rate shopping period

- Real estate agents prioritize pre-approved buyers for showing appointments

- Reduces stress by clarifying financial position before emotional property attachment

Disadvantages:

- Hard credit inquiry slightly lowers credit score temporarily

- Limits shopping flexibility to approved amount even if higher-priced perfect property appears

- Expires after 60-90 days requiring renewal for extended searches

- Requires significant documentation gathering and time investment

- May reveal credit issues you weren't aware of

- Creates false confidence that final approval is guaranteed

- Locks you into specific lender making comparison shopping more difficult later

- Requires maintaining strict financial discipline throughout house hunting period

- Personal financial information shared with lender before identifying specific property

For most buyers, advantages significantly outweigh disadvantages, making pre-approval essential in today's competitive housing market.

Frequently Asked Questions About Mortgage Pre-approval

How long does pre-approval take? Typically 1-3 business days with complete documentation, though some lenders offer same-day pre-approval.

Does pre-approval guarantee final loan approval? No, it's conditional on property appraisal, title review, final underwriting, and maintaining financial status through closing.

Can I get pre-approved with multiple lenders? Yes, but limit inquiries to 14-45 days to minimize credit score impact as multiple mortgage inquiries in this window count as one.

What credit score do I need? Minimum varies by loan type: typically 580+ for FHA, 620+ for conventional, though higher scores get better rates.

How much does pre-approval cost? Many lenders offer free pre-approval, though some charge application fees ($50-$500) credited toward closing if you proceed.

Can pre-approval be denied? Yes, if credit, income, or documentation don't meet lending guidelines, though you'll receive explanation and improvement guidance.

What if my finances change after pre-approval? Immediately notify your lender as changes may affect approval status and require reassessment.

Do I need pre-approval for new construction? Builders almost always require it, often before reserving units or lots.

Can I use pre-approval for multiple properties? Generic letters yes, but property-specific letters should be unique for each offer.

What if I'm self-employed? Process is similar but requires additional documentation including business tax returns and profit/loss statements.

Does pre-approval affect my credit score? Yes, temporarily by 5-10 points from hard inquiry, but recovers quickly with responsible credit management.

Download Word Doc

Download Word Doc

Download PDF

Download PDF