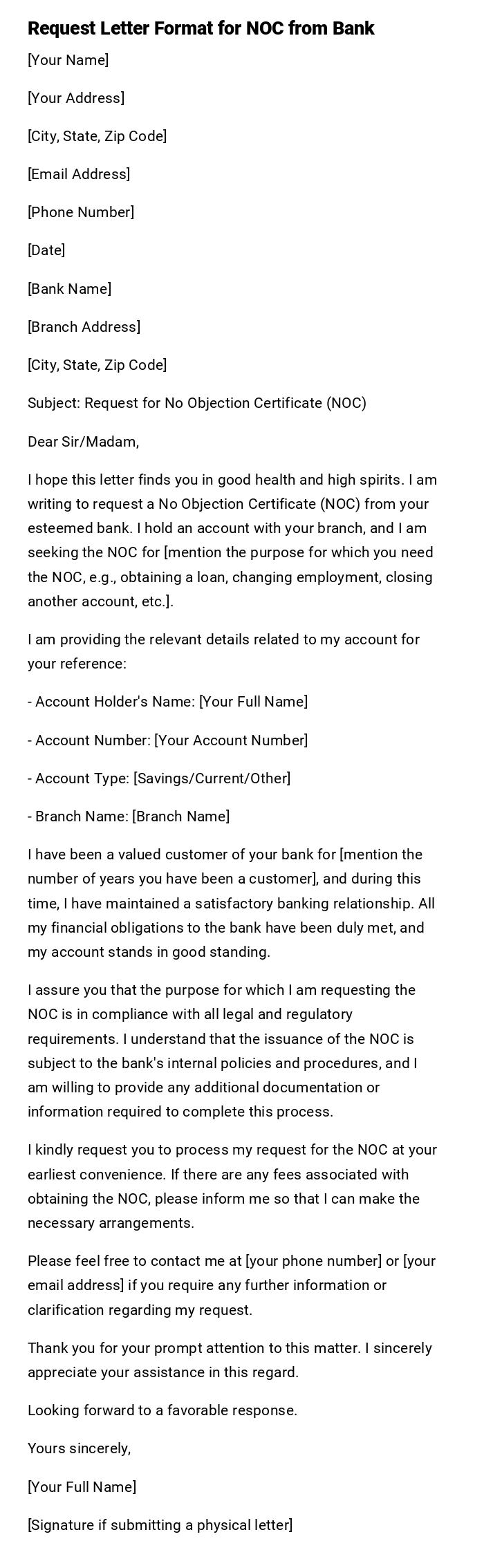

Request Letter Format for NOC from Bank

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Branch Address]

[City, State, Zip Code]

Subject: Request for No Objection Certificate (NOC)

Dear Sir/Madam,

I hope this letter finds you in good health and high spirits. I am writing to request a No Objection Certificate (NOC) from your esteemed bank. I hold an account with your branch, and I am seeking the NOC for [mention the purpose for which you need the NOC, e.g., obtaining a loan, changing employment, closing another account, etc.].

I am providing the relevant details related to my account for your reference:

- Account Holder's Name: [Your Full Name]

- Account Number: [Your Account Number]

- Account Type: [Savings/Current/Other]

- Branch Name: [Branch Name]

I have been a valued customer of your bank for [mention the number of years you have been a customer], and during this time, I have maintained a satisfactory banking relationship. All my financial obligations to the bank have been duly met, and my account stands in good standing.

I assure you that the purpose for which I am requesting the NOC is in compliance with all legal and regulatory requirements. I understand that the issuance of the NOC is subject to the bank's internal policies and procedures, and I am willing to provide any additional documentation or information required to complete this process.

I kindly request you to process my request for the NOC at your earliest convenience. If there are any fees associated with obtaining the NOC, please inform me so that I can make the necessary arrangements.

Please feel free to contact me at [your phone number] or [your email address] if you require any further information or clarification regarding my request.

Thank you for your prompt attention to this matter. I sincerely appreciate your assistance in this regard.

Looking forward to a favorable response.

Yours sincerely,

[Your Full Name]

[Signature if submitting a physical letter]

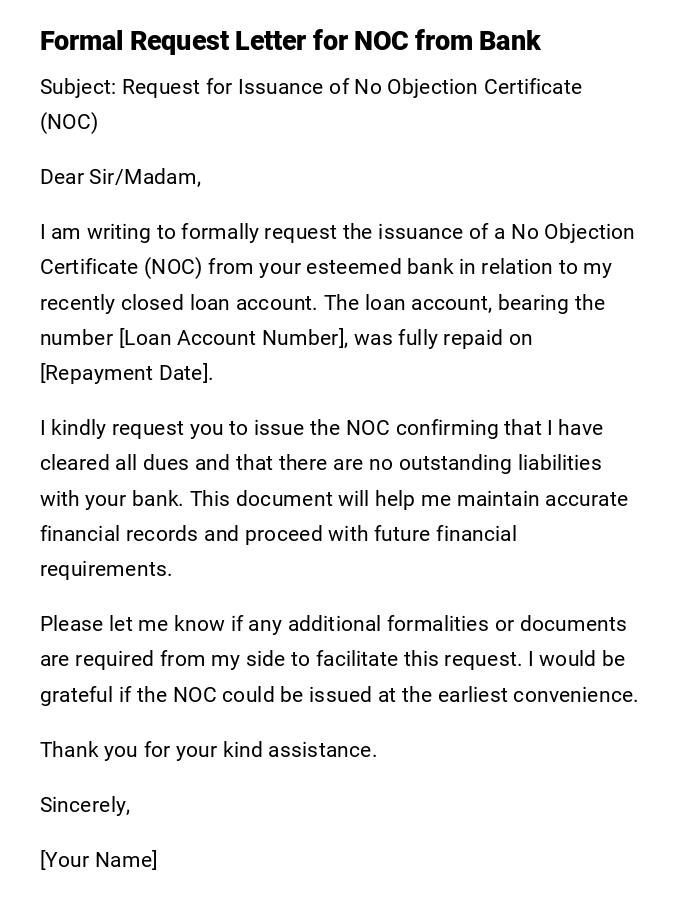

Formal Request Letter for NOC from Bank

Subject: Request for Issuance of No Objection Certificate (NOC)

Dear Sir/Madam,

I am writing to formally request the issuance of a No Objection Certificate (NOC) from your esteemed bank in relation to my recently closed loan account. The loan account, bearing the number [Loan Account Number], was fully repaid on [Repayment Date].

I kindly request you to issue the NOC confirming that I have cleared all dues and that there are no outstanding liabilities with your bank. This document will help me maintain accurate financial records and proceed with future financial requirements.

Please let me know if any additional formalities or documents are required from my side to facilitate this request. I would be grateful if the NOC could be issued at the earliest convenience.

Thank you for your kind assistance.

Sincerely,

[Your Name]

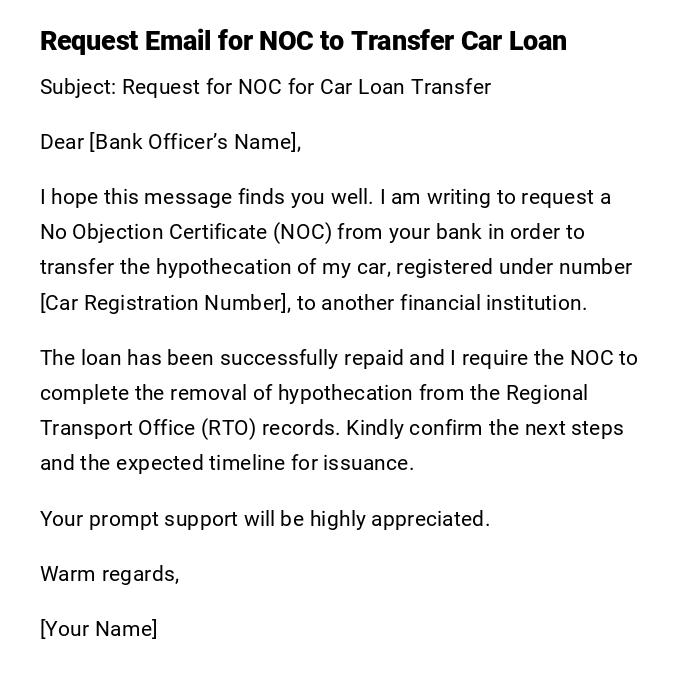

Request Email for NOC to Transfer Car Loan

Subject: Request for NOC for Car Loan Transfer

Dear [Bank Officer’s Name],

I hope this message finds you well. I am writing to request a No Objection Certificate (NOC) from your bank in order to transfer the hypothecation of my car, registered under number [Car Registration Number], to another financial institution.

The loan has been successfully repaid and I require the NOC to complete the removal of hypothecation from the Regional Transport Office (RTO) records. Kindly confirm the next steps and the expected timeline for issuance.

Your prompt support will be highly appreciated.

Warm regards,

[Your Name]

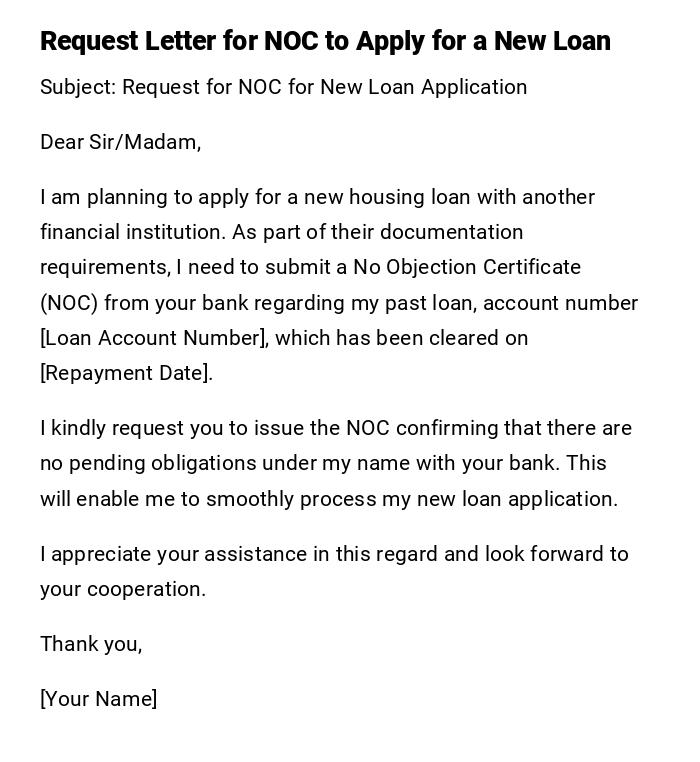

Request Letter for NOC to Apply for a New Loan

Subject: Request for NOC for New Loan Application

Dear Sir/Madam,

I am planning to apply for a new housing loan with another financial institution. As part of their documentation requirements, I need to submit a No Objection Certificate (NOC) from your bank regarding my past loan, account number [Loan Account Number], which has been cleared on [Repayment Date].

I kindly request you to issue the NOC confirming that there are no pending obligations under my name with your bank. This will enable me to smoothly process my new loan application.

I appreciate your assistance in this regard and look forward to your cooperation.

Thank you,

[Your Name]

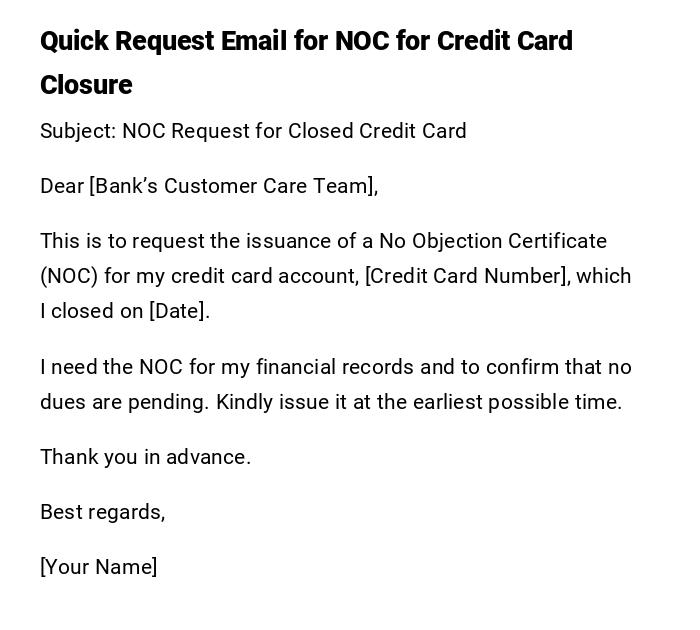

Quick Request Email for NOC for Credit Card Closure

Subject: NOC Request for Closed Credit Card

Dear [Bank’s Customer Care Team],

This is to request the issuance of a No Objection Certificate (NOC) for my credit card account, [Credit Card Number], which I closed on [Date].

I need the NOC for my financial records and to confirm that no dues are pending. Kindly issue it at the earliest possible time.

Thank you in advance.

Best regards,

[Your Name]

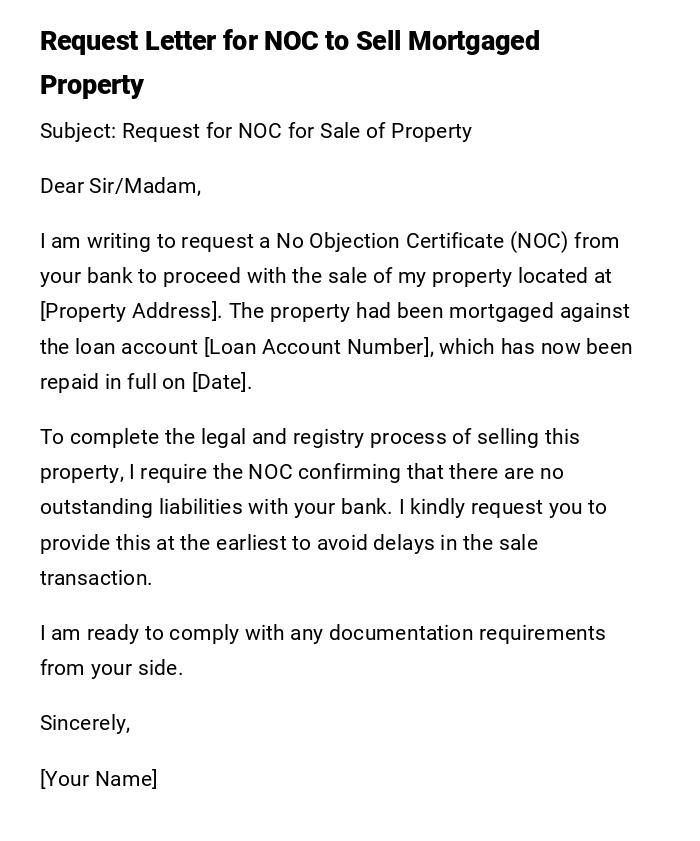

Request Letter for NOC to Sell Mortgaged Property

Subject: Request for NOC for Sale of Property

Dear Sir/Madam,

I am writing to request a No Objection Certificate (NOC) from your bank to proceed with the sale of my property located at [Property Address]. The property had been mortgaged against the loan account [Loan Account Number], which has now been repaid in full on [Date].

To complete the legal and registry process of selling this property, I require the NOC confirming that there are no outstanding liabilities with your bank. I kindly request you to provide this at the earliest to avoid delays in the sale transaction.

I am ready to comply with any documentation requirements from your side.

Sincerely,

[Your Name]

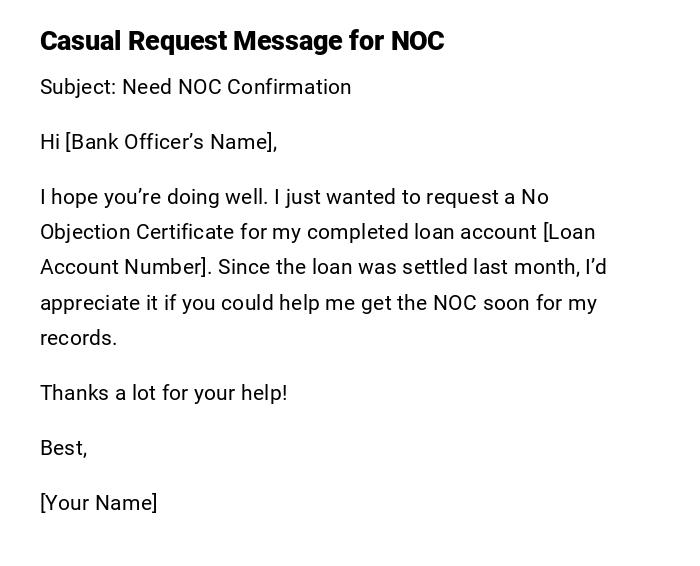

Casual Request Message for NOC

Subject: Need NOC Confirmation

Hi [Bank Officer’s Name],

I hope you’re doing well. I just wanted to request a No Objection Certificate for my completed loan account [Loan Account Number]. Since the loan was settled last month, I’d appreciate it if you could help me get the NOC soon for my records.

Thanks a lot for your help!

Best,

[Your Name]

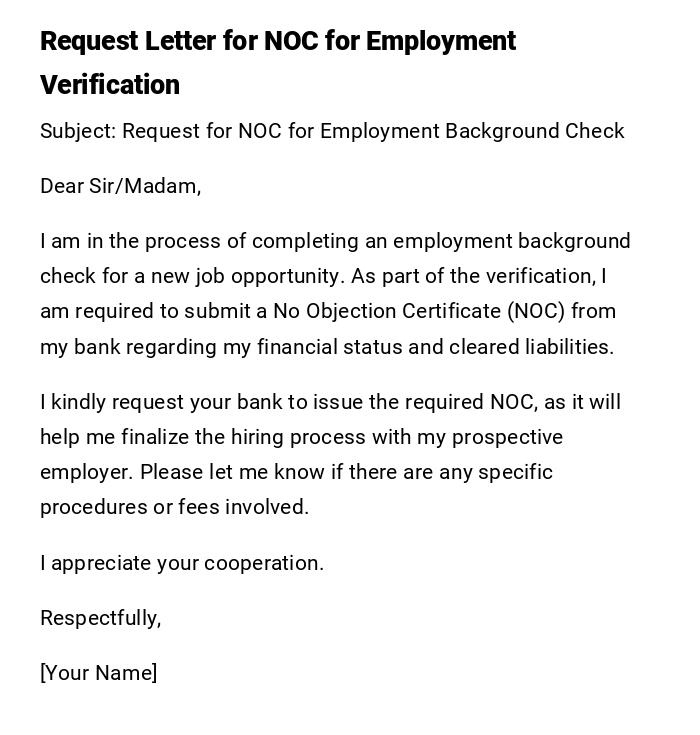

Request Letter for NOC for Employment Verification

Subject: Request for NOC for Employment Background Check

Dear Sir/Madam,

I am in the process of completing an employment background check for a new job opportunity. As part of the verification, I am required to submit a No Objection Certificate (NOC) from my bank regarding my financial status and cleared liabilities.

I kindly request your bank to issue the required NOC, as it will help me finalize the hiring process with my prospective employer. Please let me know if there are any specific procedures or fees involved.

I appreciate your cooperation.

Respectfully,

[Your Name]

Provisional Request Letter for NOC Pending Clearance

Subject: Request for Provisional NOC

Dear Sir/Madam,

I recently completed the repayment of my loan, account number [Loan Account Number]. While the final clearance formalities are still underway, I request a provisional No Objection Certificate (NOC) for submission to a third party as part of my application process.

I understand that the final NOC will be issued upon complete verification, but this provisional document will help me meet an urgent deadline.

Your prompt assistance will mean a lot.

Sincerely,

[Your Name]

What is a Request Letter for NOC from Bank and Why Do You Need It?

A Request Letter for NOC (No Objection Certificate) from a bank is a formal communication asking the bank to issue a document that certifies you have cleared all dues and there are no outstanding liabilities.

It is important because:

- It serves as proof of loan closure or account settlement.

- It is often required for legal, financial, or administrative purposes.

- It protects the customer from future claims of unpaid dues.

Who Should Write a Request for NOC from the Bank?

- Loan account holders who have repaid their debts.

- Credit card holders who closed their accounts.

- Customers selling a property or vehicle previously financed by the bank.

- Employees who need financial clearance for job verification.

To Whom Should the Request Letter Be Addressed?

- The Branch Manager of the concerned bank branch.

- The Loan Officer or Relationship Manager handling your account.

- The Customer Service Department if no specific officer is available.

- In case of digital submission, the bank’s official email for service requests.

Common Scenarios When You Need to Request an NOC from the Bank

- After completing repayment of a home, car, or personal loan.

- For removing hypothecation on a vehicle or property.

- While applying for a new loan from another bank.

- During job verification or immigration processes.

- For closure of a credit card account.

How to Write and Send a Request Letter for NOC

- Start with a clear subject line stating the purpose.

- Mention loan/account details for easy reference.

- State why you need the NOC (legal, personal, or financial reasons).

- Keep the tone formal and respectful.

- Send it via the bank’s official channel (email, in-branch submission, or postal mail).

Requirements and Prerequisites Before Requesting an NOC

- Ensure full repayment of the loan or credit card dues.

- Collect receipts or settlement letters as proof of closure.

- Verify with the bank that no pending charges exist.

- Keep identification documents handy.

- Know the specific account or loan reference numbers.

Formatting and Style Guidelines for an NOC Request

- Keep the letter one page long.

- Use professional and polite language.

- Avoid slang or overly casual expressions (unless writing a quick email).

- Clearly mention your request in the opening paragraph.

- Close the letter with gratitude and readiness to comply with any further requirements.

After Sending the Request: What Should You Do?

- Wait for the bank to confirm receipt of your request.

- Follow up with a polite reminder if there is no response within 7–10 business days.

- Collect the NOC physically or request a digital copy if available.

- Store the NOC safely as it may be required for future legal or financial transactions.

Pros and Cons of Requesting an NOC

Pros:

- Provides legal proof of cleared liabilities.

- Prevents future disputes with the bank.

- Helps with new financial applications.

Cons:

- May take time to process.

- Some banks may charge fees for issuing the certificate.

- Requires documentation that could be time-consuming.

Common Mistakes to Avoid When Requesting an NOC

- Forgetting to mention the loan or account number.

- Not checking if all dues are cleared before requesting.

- Using informal or unclear language.

- Failing to follow up with the bank after submission.

- Misplacing the issued NOC after receiving it.

Elements That Should Be Included in an NOC Request Letter

- Subject line with “Request for NOC” clearly mentioned.

- Greeting to the appropriate bank officer.

- Reference details (loan account number, card number, property, or vehicle details).

- Reason for requesting the NOC.

- Closing statement with thanks.

- Signature or digital confirmation of the applicant.

Download Word Doc

Download Word Doc

Download PDF

Download PDF