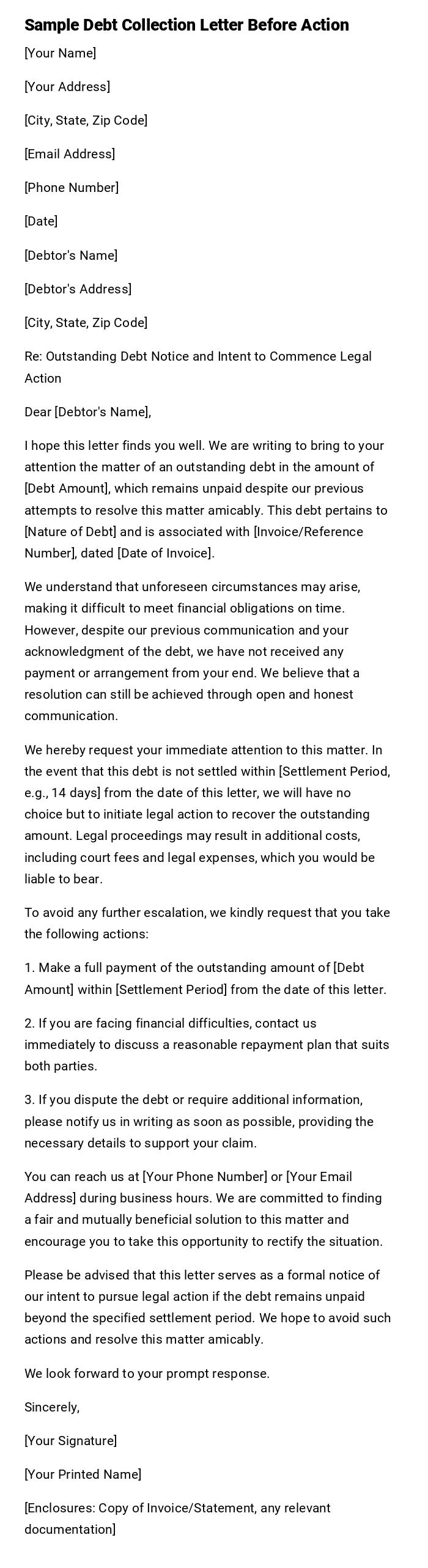

Sample Debt Collection Letter Before Action

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Debtor's Name]

[Debtor's Address]

[City, State, Zip Code]

Re: Outstanding Debt Notice and Intent to Commence Legal Action

Dear [Debtor's Name],

I hope this letter finds you well. We are writing to bring to your attention the matter of an outstanding debt in the amount of [Debt Amount], which remains unpaid despite our previous attempts to resolve this matter amicably. This debt pertains to [Nature of Debt] and is associated with [Invoice/Reference Number], dated [Date of Invoice].

We understand that unforeseen circumstances may arise, making it difficult to meet financial obligations on time. However, despite our previous communication and your acknowledgment of the debt, we have not received any payment or arrangement from your end. We believe that a resolution can still be achieved through open and honest communication.

We hereby request your immediate attention to this matter. In the event that this debt is not settled within [Settlement Period, e.g., 14 days] from the date of this letter, we will have no choice but to initiate legal action to recover the outstanding amount. Legal proceedings may result in additional costs, including court fees and legal expenses, which you would be liable to bear.

To avoid any further escalation, we kindly request that you take the following actions:

1. Make a full payment of the outstanding amount of [Debt Amount] within [Settlement Period] from the date of this letter.

2. If you are facing financial difficulties, contact us immediately to discuss a reasonable repayment plan that suits both parties.

3. If you dispute the debt or require additional information, please notify us in writing as soon as possible, providing the necessary details to support your claim.

You can reach us at [Your Phone Number] or [Your Email Address] during business hours. We are committed to finding a fair and mutually beneficial solution to this matter and encourage you to take this opportunity to rectify the situation.

Please be advised that this letter serves as a formal notice of our intent to pursue legal action if the debt remains unpaid beyond the specified settlement period. We hope to avoid such actions and resolve this matter amicably.

We look forward to your prompt response.

Sincerely,

[Your Signature]

[Your Printed Name]

[Enclosures: Copy of Invoice/Statement, any relevant documentation]

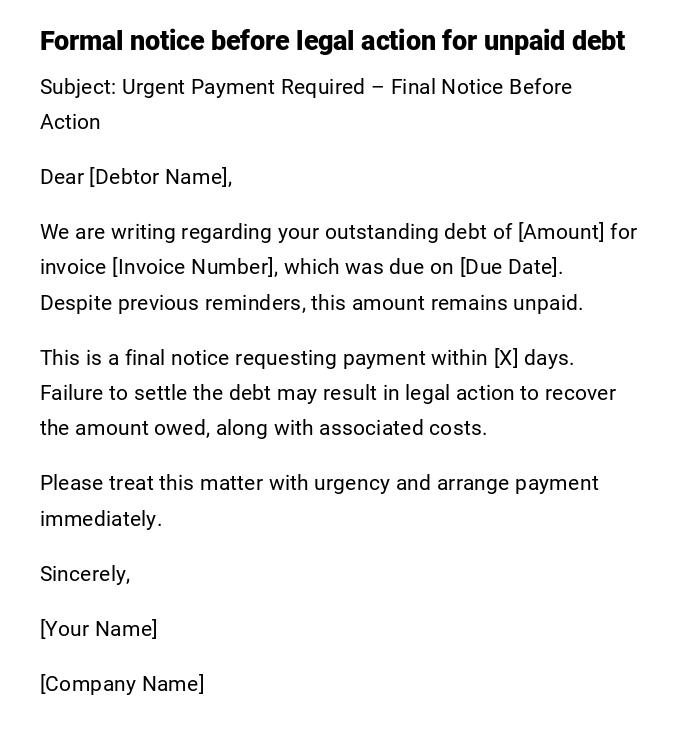

Professional Debt Collection Letter Before Action

Subject: Urgent Payment Required – Final Notice Before Action

Dear [Debtor Name],

We are writing regarding your outstanding debt of [Amount] for invoice [Invoice Number], which was due on [Due Date]. Despite previous reminders, this amount remains unpaid.

This is a final notice requesting payment within [X] days. Failure to settle the debt may result in legal action to recover the amount owed, along with associated costs.

Please treat this matter with urgency and arrange payment immediately.

Sincerely,

[Your Name]

[Company Name]

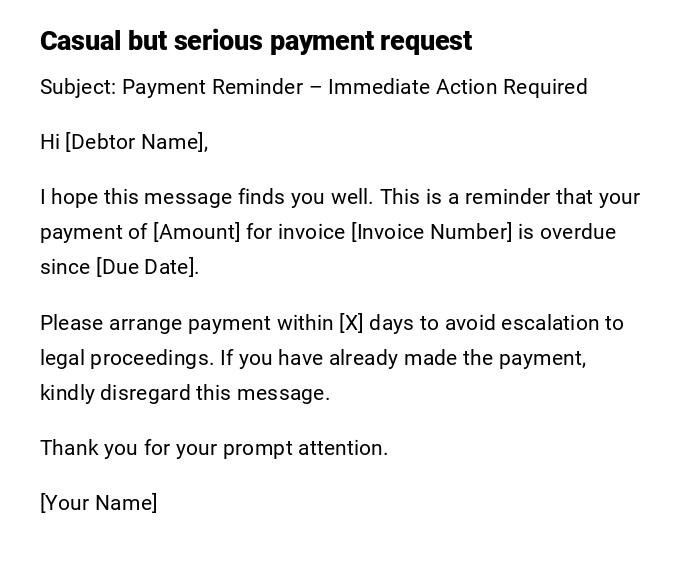

Informal Friendly Reminder Before Legal Action

Subject: Payment Reminder – Immediate Action Required

Hi [Debtor Name],

I hope this message finds you well. This is a reminder that your payment of [Amount] for invoice [Invoice Number] is overdue since [Due Date].

Please arrange payment within [X] days to avoid escalation to legal proceedings. If you have already made the payment, kindly disregard this message.

Thank you for your prompt attention.

[Your Name]

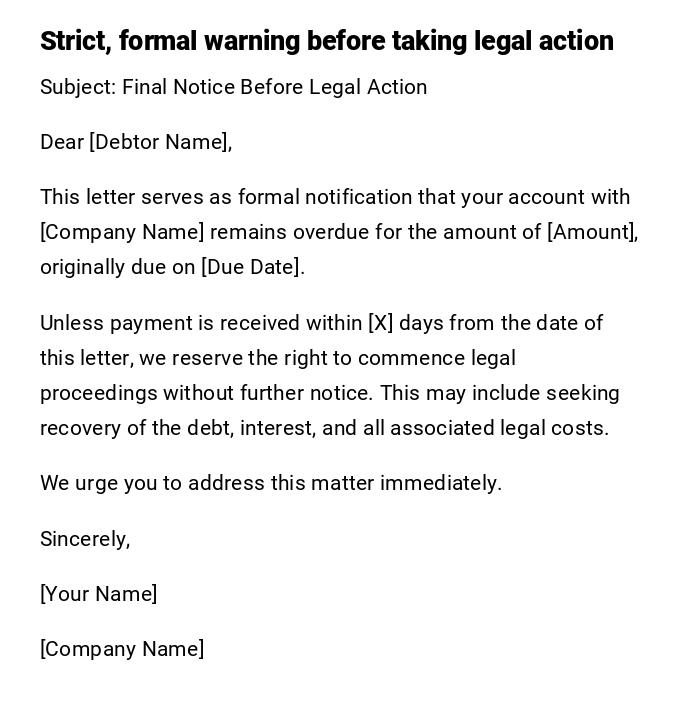

Serious Legal Tone Debt Collection Letter

Subject: Final Notice Before Legal Action

Dear [Debtor Name],

This letter serves as formal notification that your account with [Company Name] remains overdue for the amount of [Amount], originally due on [Due Date].

Unless payment is received within [X] days from the date of this letter, we reserve the right to commence legal proceedings without further notice. This may include seeking recovery of the debt, interest, and all associated legal costs.

We urge you to address this matter immediately.

Sincerely,

[Your Name]

[Company Name]

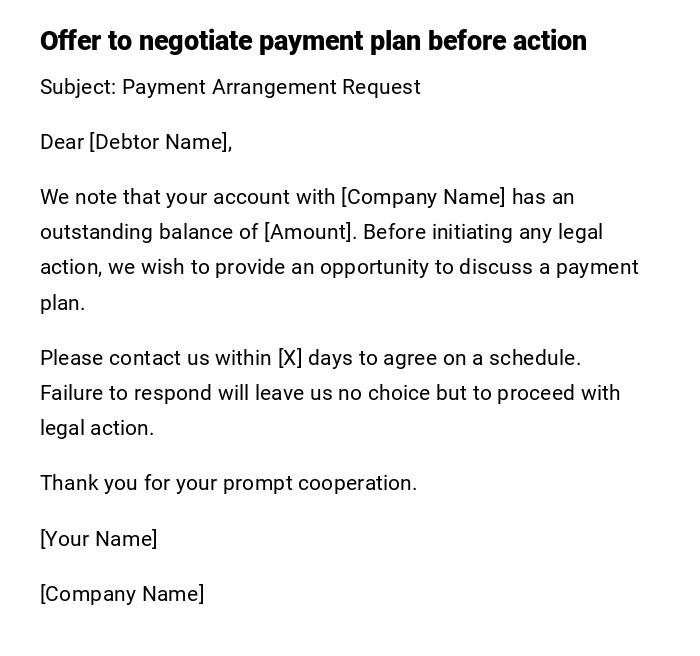

Provisional Payment Arrangement Request

Subject: Payment Arrangement Request

Dear [Debtor Name],

We note that your account with [Company Name] has an outstanding balance of [Amount]. Before initiating any legal action, we wish to provide an opportunity to discuss a payment plan.

Please contact us within [X] days to agree on a schedule. Failure to respond will leave us no choice but to proceed with legal action.

Thank you for your prompt cooperation.

[Your Name]

[Company Name]

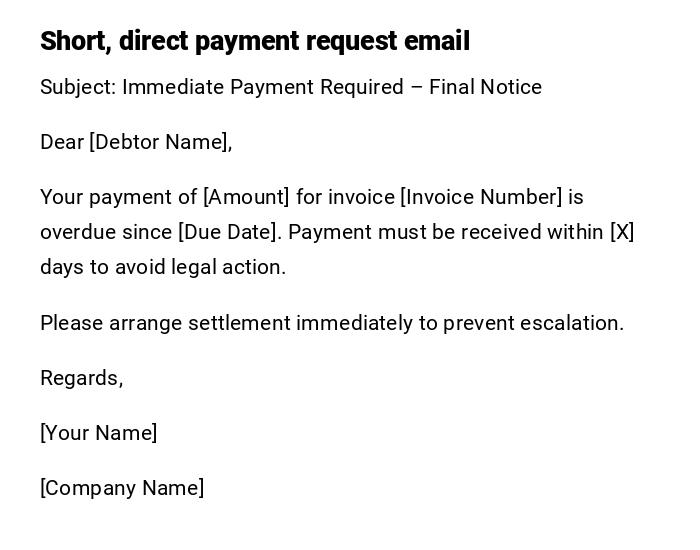

Quick Debt Collection Email Before Action

Subject: Immediate Payment Required – Final Notice

Dear [Debtor Name],

Your payment of [Amount] for invoice [Invoice Number] is overdue since [Due Date]. Payment must be received within [X] days to avoid legal action.

Please arrange settlement immediately to prevent escalation.

Regards,

[Your Name]

[Company Name]

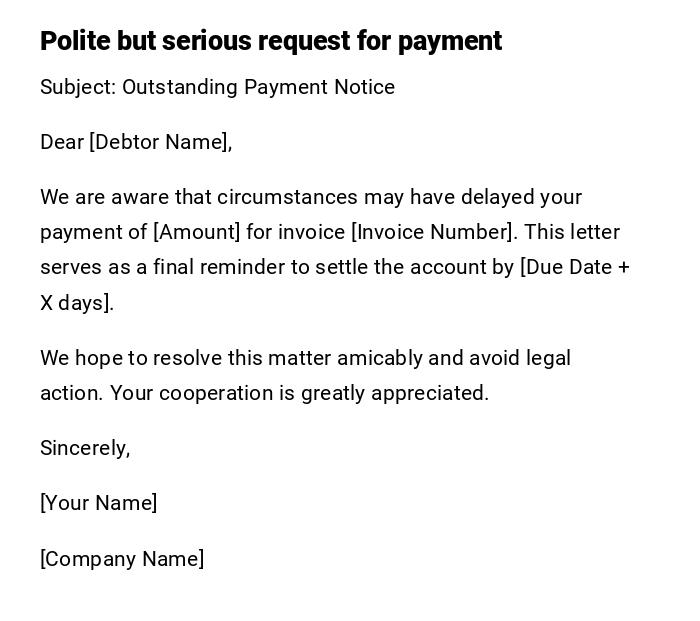

Heartfelt Reminder Before Action

Subject: Outstanding Payment Notice

Dear [Debtor Name],

We are aware that circumstances may have delayed your payment of [Amount] for invoice [Invoice Number]. This letter serves as a final reminder to settle the account by [Due Date + X days].

We hope to resolve this matter amicably and avoid legal action. Your cooperation is greatly appreciated.

Sincerely,

[Your Name]

[Company Name]

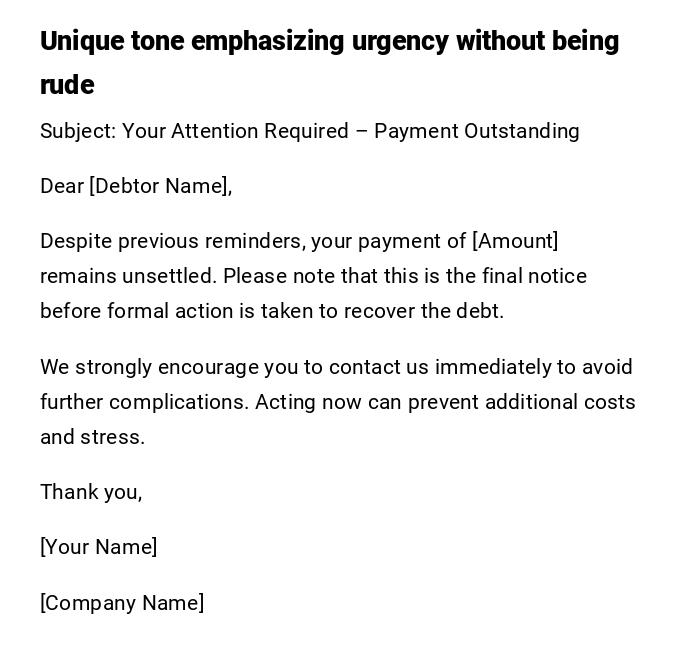

Creative Yet Firm Collection Letter

Subject: Your Attention Required – Payment Outstanding

Dear [Debtor Name],

Despite previous reminders, your payment of [Amount] remains unsettled. Please note that this is the final notice before formal action is taken to recover the debt.

We strongly encourage you to contact us immediately to avoid further complications. Acting now can prevent additional costs and stress.

Thank you,

[Your Name]

[Company Name]

What is a Debt Collection Letter Before Action and Why Do You Need It?

A debt collection letter before action is a formal notification sent to a debtor informing them of overdue payments and warning that legal action may follow if payment is not made. Its purpose is to:

- Encourage prompt payment.

- Serve as legal evidence of attempts to recover the debt.

- Avoid unnecessary litigation by providing a final opportunity to settle.

Who Should Send a Debt Collection Letter Before Action?

- Businesses or creditors seeking repayment of outstanding debts.

- Debt collection agencies acting on behalf of the creditor.

- Legal representatives authorized to notify debtors of pending action.

Whom Should This Letter Be Addressed To?

- The individual or company responsible for the unpaid debt.

- Ensure the recipient is legally accountable for the invoice or agreement.

- Include the correct name, contact information, and account details.

When Should a Debt Collection Letter Before Action Be Sent?

- After previous reminders or notices have failed.

- Once the payment is significantly overdue, typically as per contractual terms.

- Before initiating formal legal proceedings to demonstrate good faith.

How to Write and Send a Debt Collection Letter Before Action

- State the purpose clearly in the subject line.

- Address the debtor by name and reference the invoice/account.

- Specify the overdue amount and original due date.

- Provide a final deadline for payment.

- Warn of potential legal action if payment is not made.

- Maintain a professional, firm, and polite tone.

- Send via registered mail or email to ensure proof of delivery.

Formatting Guidelines for Debt Collection Letters Before Action

- Length: One page, concise and precise.

- Tone: Firm, serious, yet professional.

- Style: Formal for legal credibility; informal can be used for minor or friendly debts.

- Mode: Registered mail for legal records; email for quick communication.

- Attachments: Copies of invoices or contracts for reference.

Requirements and Prerequisites Before Sending

- Verify the debt amount and due dates.

- Ensure all previous reminders and notices have been sent.

- Check that the debtor's contact details are accurate.

- Prepare copies of supporting documentation (invoices, contracts, emails).

After Sending a Debt Collection Letter Before Action

- Monitor whether payment is received within the deadline.

- Document all correspondence as evidence in potential legal proceedings.

- Follow up immediately if no payment is received.

- Escalate to legal action if necessary while retaining proof of the letter.

Common Mistakes to Avoid in Debt Collection Letters Before Action

- Using aggressive or threatening language that breaches legal regulations.

- Failing to include accurate amounts, dates, and account references.

- Not providing a clear deadline for payment.

- Ignoring company or jurisdiction-specific debt collection laws.

Elements and Structure of a Debt Collection Letter Before Action

- Clear subject line.

- Proper salutation and recipient identification.

- Statement of debt and reference to invoice/contract.

- Previous reminders or attempts to collect.

- Deadline for payment and warning of legal action.

- Contact information for queries or payment arrangements.

- Closing remarks and signature.

Tricks and Tips for Effective Debt Collection Letters Before Action

- Send via a method that provides delivery proof.

- Keep a professional tone to maintain legal credibility.

- Include concise supporting evidence to reinforce your claim.

- Offer a simple payment method or plan to encourage resolution.

- Keep copies of all correspondence for potential legal defense.

- Be clear on deadlines and consequences to avoid misunderstandings.

Download Word Doc

Download Word Doc

Download PDF

Download PDF