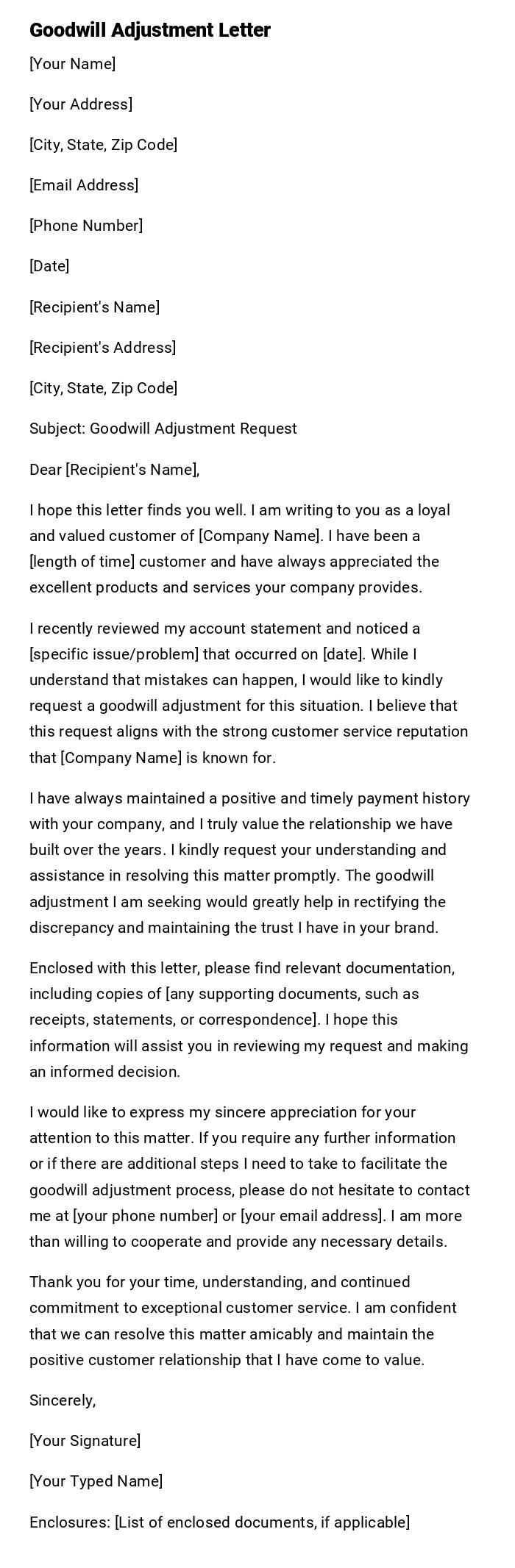

Goodwill Adjustment Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, Zip Code]

Subject: Goodwill Adjustment Request

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to you as a loyal and valued customer of [Company Name]. I have been a [length of time] customer and have always appreciated the excellent products and services your company provides.

I recently reviewed my account statement and noticed a [specific issue/problem] that occurred on [date]. While I understand that mistakes can happen, I would like to kindly request a goodwill adjustment for this situation. I believe that this request aligns with the strong customer service reputation that [Company Name] is known for.

I have always maintained a positive and timely payment history with your company, and I truly value the relationship we have built over the years. I kindly request your understanding and assistance in resolving this matter promptly. The goodwill adjustment I am seeking would greatly help in rectifying the discrepancy and maintaining the trust I have in your brand.

Enclosed with this letter, please find relevant documentation, including copies of [any supporting documents, such as receipts, statements, or correspondence]. I hope this information will assist you in reviewing my request and making an informed decision.

I would like to express my sincere appreciation for your attention to this matter. If you require any further information or if there are additional steps I need to take to facilitate the goodwill adjustment process, please do not hesitate to contact me at [your phone number] or [your email address]. I am more than willing to cooperate and provide any necessary details.

Thank you for your time, understanding, and continued commitment to exceptional customer service. I am confident that we can resolve this matter amicably and maintain the positive customer relationship that I have come to value.

Sincerely,

[Your Signature]

[Your Typed Name]

Enclosures: [List of enclosed documents, if applicable]

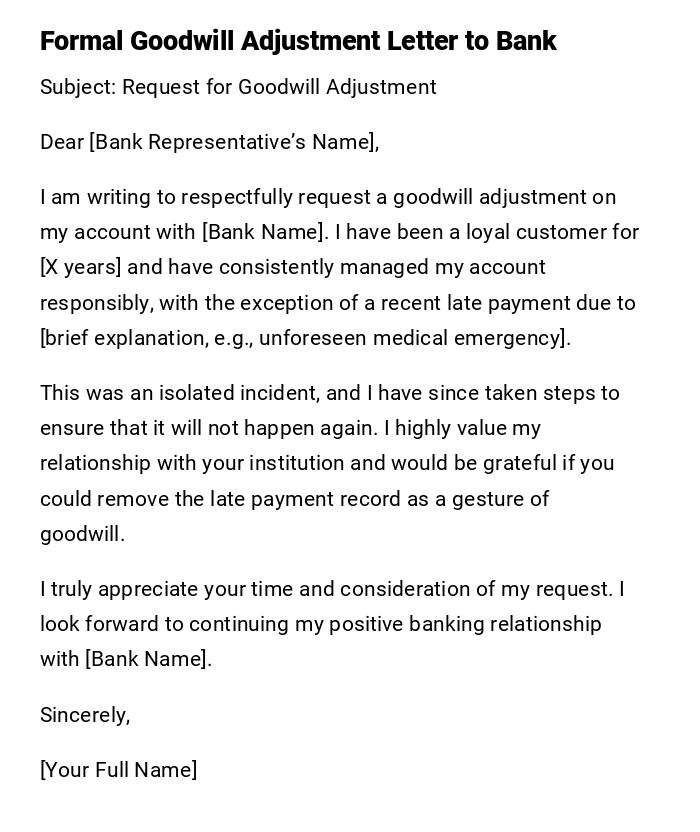

Formal Goodwill Adjustment Letter to a Bank

Subject: Request for Goodwill Adjustment

Dear [Bank Representative’s Name],

I am writing to respectfully request a goodwill adjustment on my account with [Bank Name]. I have been a loyal customer for [X years] and have consistently managed my account responsibly, with the exception of a recent late payment due to [brief explanation, e.g., unforeseen medical emergency].

This was an isolated incident, and I have since taken steps to ensure that it will not happen again. I highly value my relationship with your institution and would be grateful if you could remove the late payment record as a gesture of goodwill.

I truly appreciate your time and consideration of my request. I look forward to continuing my positive banking relationship with [Bank Name].

Sincerely,

[Your Full Name]

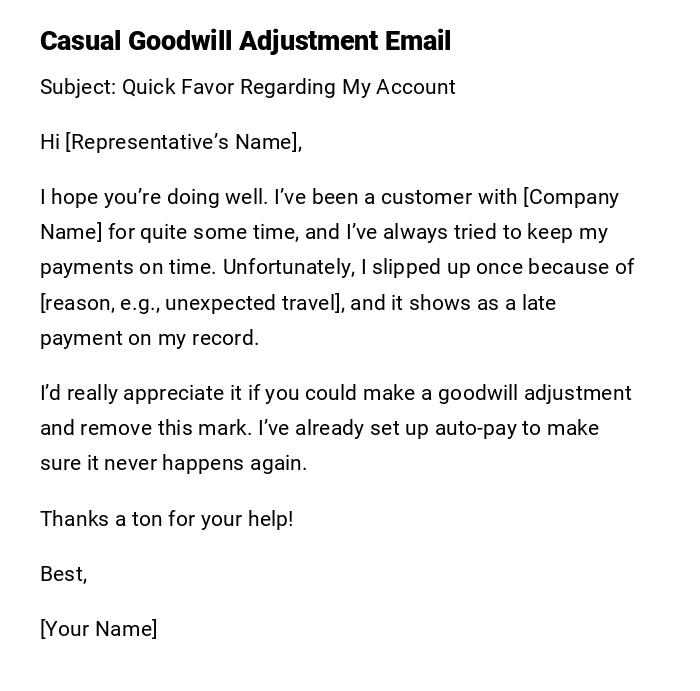

Casual Goodwill Adjustment Email for Credit Card Company

Subject: Quick Favor Regarding My Account

Hi [Representative’s Name],

I hope you’re doing well. I’ve been a customer with [Company Name] for quite some time, and I’ve always tried to keep my payments on time. Unfortunately, I slipped up once because of [reason, e.g., unexpected travel], and it shows as a late payment on my record.

I’d really appreciate it if you could make a goodwill adjustment and remove this mark. I’ve already set up auto-pay to make sure it never happens again.

Thanks a ton for your help!

Best,

[Your Name]

Goodwill Adjustment Letter for Utility Company

Subject: Request for Adjustment to My Account Record

Dear [Utility Company Representative],

I am reaching out to request a goodwill adjustment on my account, [Account Number]. I have been a customer of [Company Name] for several years and have always paid my bills promptly, with the exception of a recent missed payment caused by [explain situation].

As a responsible and long-term customer, I kindly request that you consider removing this record from my account history. I have already taken corrective measures to ensure that payments are processed on time going forward.

Thank you very much for your understanding and for considering my request.

Sincerely,

[Your Full Name]

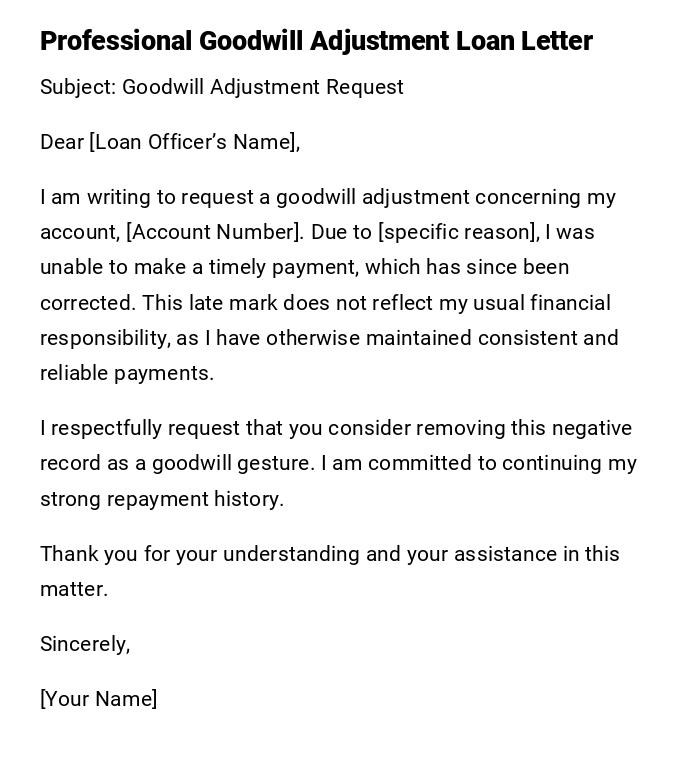

Professional Goodwill Adjustment Letter for Loan Provider

Subject: Goodwill Adjustment Request

Dear [Loan Officer’s Name],

I am writing to request a goodwill adjustment concerning my account, [Account Number]. Due to [specific reason], I was unable to make a timely payment, which has since been corrected. This late mark does not reflect my usual financial responsibility, as I have otherwise maintained consistent and reliable payments.

I respectfully request that you consider removing this negative record as a goodwill gesture. I am committed to continuing my strong repayment history.

Thank you for your understanding and your assistance in this matter.

Sincerely,

[Your Name]

Heartfelt Goodwill Adjustment Letter Explaining Hardship

Subject: Request for Goodwill Adjustment Due to Hardship

Dear [Recipient’s Name],

I am writing to you with sincerity regarding my account with [Company Name]. Due to unexpected hardships, including [brief description: illness, job loss, family emergency], I missed a payment which has affected my account history.

This situation was temporary, and I have since returned to making consistent payments. I deeply value my relationship with your company and respectfully request a goodwill adjustment to remove this record.

Your understanding and support would mean a great deal to me during this time. Thank you for considering my request.

Sincerely,

[Your Name]

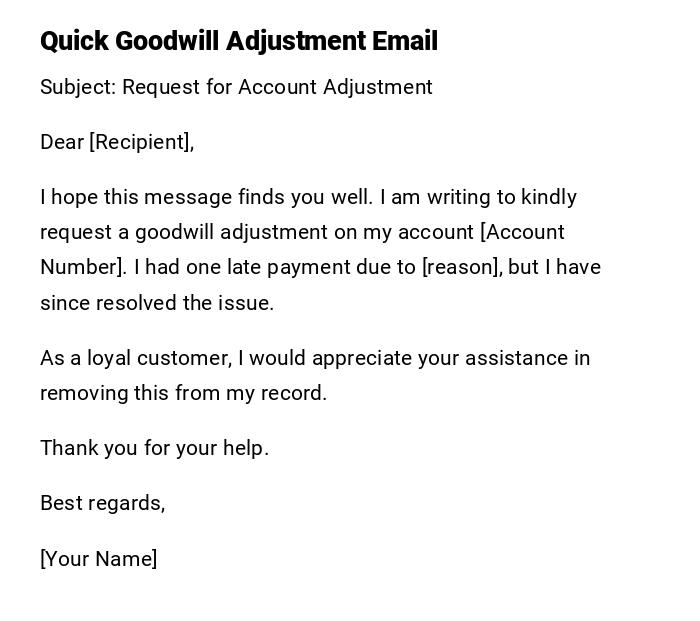

Quick Goodwill Adjustment Email

Subject: Request for Account Adjustment

Dear [Recipient],

I hope this message finds you well. I am writing to kindly request a goodwill adjustment on my account [Account Number]. I had one late payment due to [reason], but I have since resolved the issue.

As a loyal customer, I would appreciate your assistance in removing this from my record.

Thank you for your help.

Best regards,

[Your Name]

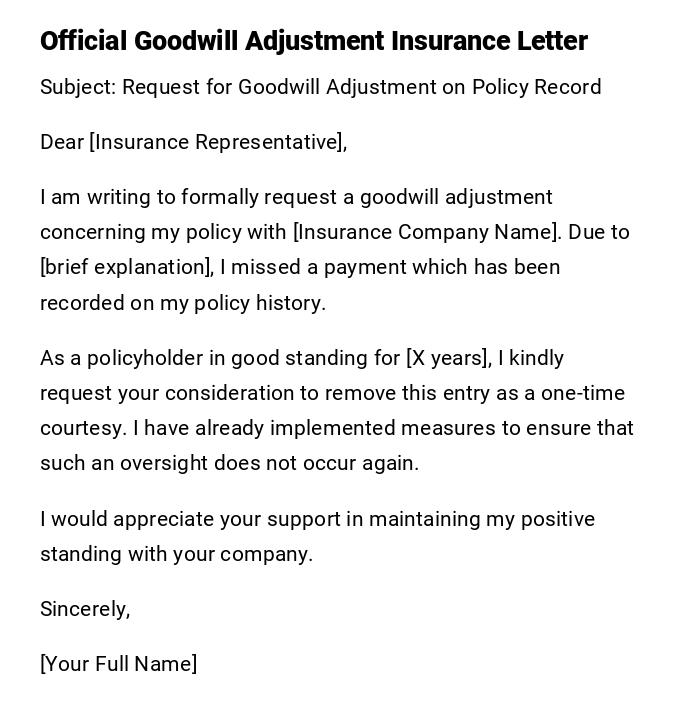

Official Goodwill Adjustment Letter for Insurance Company

Subject: Request for Goodwill Adjustment on Policy Record

Dear [Insurance Representative],

I am writing to formally request a goodwill adjustment concerning my policy with [Insurance Company Name]. Due to [brief explanation], I missed a payment which has been recorded on my policy history.

As a policyholder in good standing for [X years], I kindly request your consideration to remove this entry as a one-time courtesy. I have already implemented measures to ensure that such an oversight does not occur again.

I would appreciate your support in maintaining my positive standing with your company.

Sincerely,

[Your Full Name]

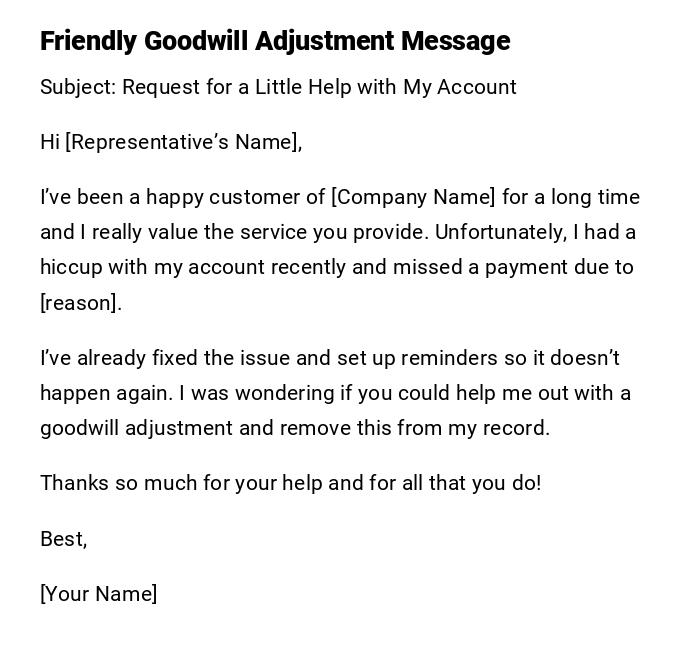

Friendly Goodwill Adjustment Message for Service Provider

Subject: Request for a Little Help with My Account

Hi [Representative’s Name],

I’ve been a happy customer of [Company Name] for a long time and I really value the service you provide. Unfortunately, I had a hiccup with my account recently and missed a payment due to [reason].

I’ve already fixed the issue and set up reminders so it doesn’t happen again. I was wondering if you could help me out with a goodwill adjustment and remove this from my record.

Thanks so much for your help and for all that you do!

Best,

[Your Name]

What is a Goodwill Adjustment Letter and Why Do You Need It

A Goodwill Adjustment Letter is a written request asking a creditor, lender, utility, or service provider to remove or correct a negative entry (like a late payment) from your account history.

You need it because:

- It helps repair or maintain your credit history.

- It demonstrates accountability while requesting leniency.

- It shows good faith and strengthens long-term customer relationships.

- It provides a documented, professional way to request assistance.

Who Should Send a Goodwill Adjustment Letter

- Customers who have generally maintained good standing but made an isolated mistake.

- Borrowers who want to fix minor blemishes on their loan or credit history.

- Policyholders or utility account holders who want to maintain positive records.

- Individuals who experienced temporary hardship and want understanding from the company.

Whom Should the Letter Be Addressed To

- Customer service representatives of the bank, utility, or service provider.

- Loan officers or account managers handling your case.

- The credit department or collections team.

- Supervisors or managers for escalated requests.

- Insurance or policy representatives for account adjustments.

When Should You Send a Goodwill Adjustment Letter

- Immediately after noticing a negative mark on your account.

- After resolving the issue that caused the late payment.

- Once you have re-established consistent payments.

- When you have maintained a good track record with the provider for years.

- When applying for a loan or mortgage and needing a cleaner credit report.

How to Write and Send a Goodwill Adjustment Letter

- Start with a polite greeting and subject line.

- State your request clearly: a goodwill adjustment.

- Explain the cause of the late payment or issue briefly.

- Show accountability and outline steps you’ve taken to prevent recurrence.

- Highlight your history of being a loyal, responsible customer.

- Close with appreciation and a request for understanding.

- Send via email for quick communication or by letter for official matters.

Formatting Guidelines for Goodwill Adjustment Letters

- Length: 2–4 paragraphs.

- Tone: Respectful, professional, sometimes heartfelt.

- Style: Polite, concise, and clear.

- Mode: Email for casual and quick requests, formal letter for official organizations.

- Etiquette: Always thank the recipient for their time and consideration.

- Attachments: Optional, such as proof of payments or hardship documentation.

Requirements and Prerequisites Before Writing

- Ensure the issue has been resolved (missed payment corrected).

- Gather account details and relevant references.

- Review your payment history to highlight reliability.

- Identify the right person or department to address.

- Prepare a clear and respectful explanation.

FAQ About Goodwill Adjustment Letters

Q: Does a goodwill adjustment always work?

A: Not always—it depends on the provider’s policies and your history.

Q: How long should I wait for a response?

A: Usually 2–4 weeks, but it can vary depending on the organization.

Q: Can I send multiple requests?

A: Yes, but space them out and avoid being pushy.

Q: Should I include documentation?

A: Only if it supports your explanation, such as medical or job loss records.

After Sending a Goodwill Adjustment Letter

- Wait for confirmation of receipt.

- Be patient, as processing can take weeks.

- If denied, politely follow up or escalate to a higher department.

- Maintain positive account activity to strengthen future requests.

- Document the correspondence for your records.

Pros and Cons of Sending a Goodwill Adjustment Letter

Pros:

- Can improve credit score and account history.

- Shows initiative and responsibility.

- Strengthens customer-provider relationship.

Cons:

- No guarantee of approval.

- Some companies may have strict policies.

- Multiple requests may be seen as bothersome.

Tricks and Tips for Effective Goodwill Adjustment Requests

- Personalize the letter instead of using a generic template.

- Emphasize loyalty and reliability as a customer.

- Be humble and polite throughout.

- Keep it short and focused on the request.

- Use specific details like account numbers and dates.

Common Mistakes to Avoid in Goodwill Adjustment Letters

- Blaming the company instead of owning the mistake.

- Writing a letter that is too long or emotional.

- Leaving out important details like account numbers.

- Demanding instead of requesting politely.

- Forgetting to proofread for grammar and tone.

Elements and Structure of a Goodwill Adjustment Letter

- Greeting: Address the recipient by name if possible.

- Introduction: State your relationship with the company.

- Reason: Brief explanation of the missed payment or issue.

- Request: Clearly ask for a goodwill adjustment.

- Assurance: Mention steps taken to prevent recurrence.

- Closing: Express appreciation and respect.

- Signature: Your name and contact information.

Download Word Doc

Download Word Doc

Download PDF

Download PDF