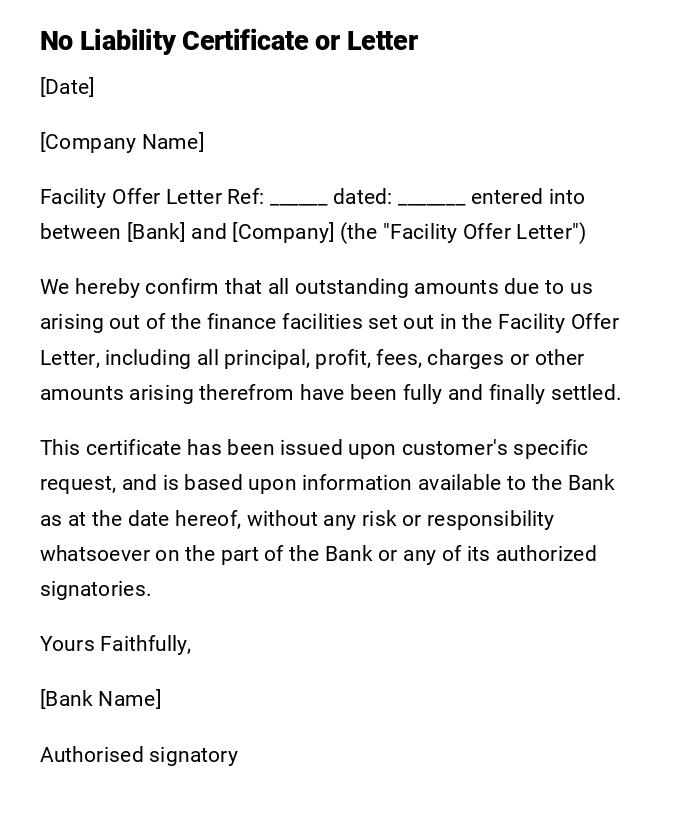

No Liability Certificate or Letter

[Date]

[Company Name]

Facility Offer Letter Ref: ______ dated: _______ entered into between [Bank] and [Company] (the "Facility Offer Letter")

We hereby confirm that all outstanding amounts due to us arising out of the finance facilities set out in the Facility Offer Letter, including all principal, profit, fees, charges or other amounts arising therefrom have been fully and finally settled.

This certificate has been issued upon customer's specific request, and is based upon information available to the Bank as at the date hereof, without any risk or responsibility whatsoever on the part of the Bank or any of its authorized signatories.

Yours Faithfully,

[Bank Name]

Authorised signatory

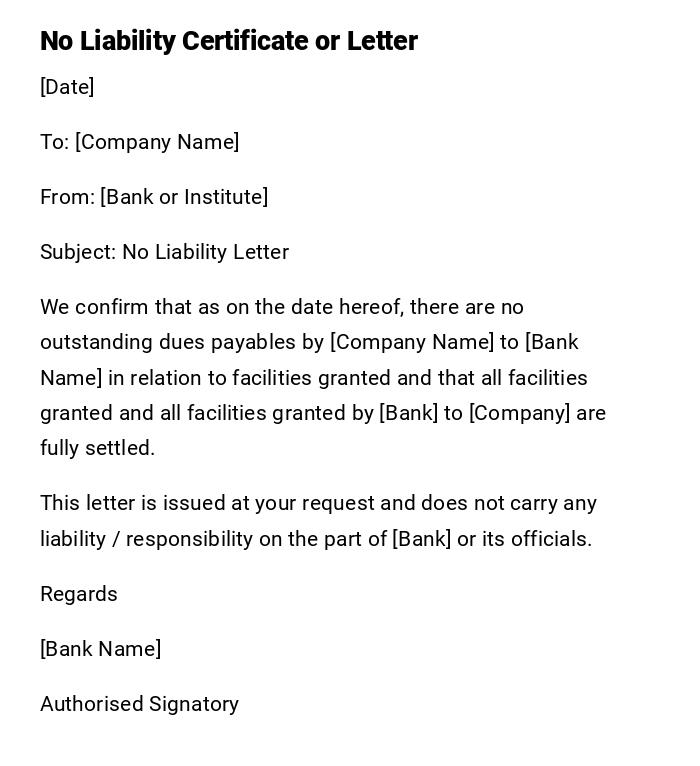

No Liability Certificate or Letter

[Date]

To: [Company Name]

From: [Bank or Institute]

Subject: No Liability Letter

We confirm that as on the date hereof, there are no outstanding dues payables by [Company Name] to [Bank Name] in relation to facilities granted and that all facilities granted and all facilities granted by [Bank] to [Company] are fully settled.

This letter is issued at your request and does not carry any liability / responsibility on the part of [Bank] or its officials.

Regards

[Bank Name]

Authorised Signatory

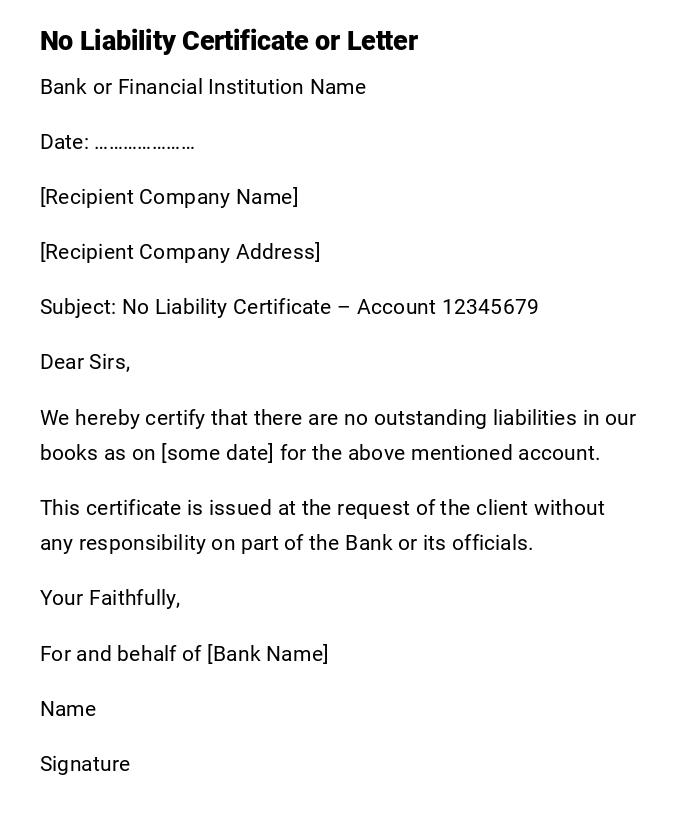

No Liability Certificate or Letter

Bank or Financial Institution Name

Date: …………………

[Recipient Company Name]

[Recipient Company Address]

Subject: No Liability Certificate – Account 12345679

Dear Sirs,

We hereby certify that there are no outstanding liabilities in our books as on [some date] for the above mentioned account.

This certificate is issued at the request of the client without any responsibility on part of the Bank or its officials.

Your Faithfully,

For and behalf of [Bank Name]

Name

Signature

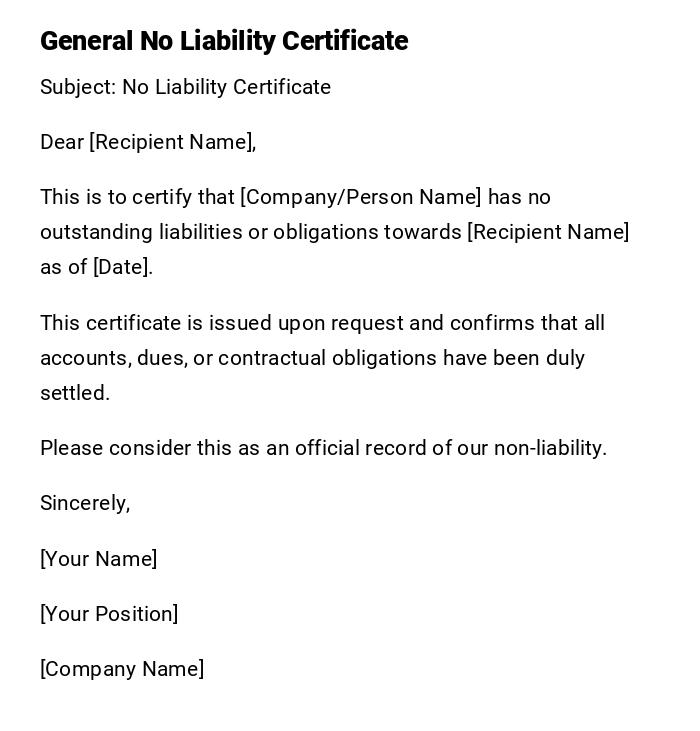

General No Liability Certificate

Subject: No Liability Certificate

Dear [Recipient Name],

This is to certify that [Company/Person Name] has no outstanding liabilities or obligations towards [Recipient Name] as of [Date].

This certificate is issued upon request and confirms that all accounts, dues, or contractual obligations have been duly settled.

Please consider this as an official record of our non-liability.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

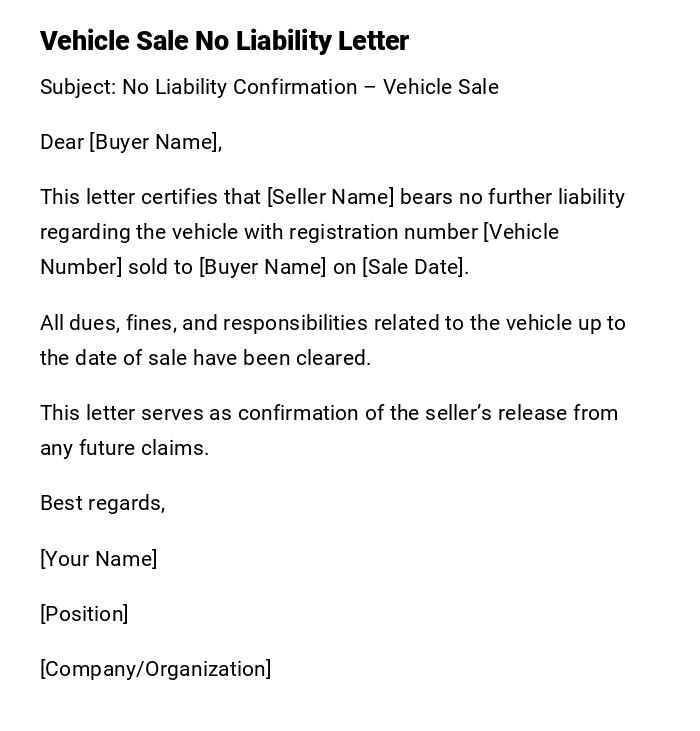

No Liability Letter for Vehicle Sale

Subject: No Liability Confirmation – Vehicle Sale

Dear [Buyer Name],

This letter certifies that [Seller Name] bears no further liability regarding the vehicle with registration number [Vehicle Number] sold to [Buyer Name] on [Sale Date].

All dues, fines, and responsibilities related to the vehicle up to the date of sale have been cleared.

This letter serves as confirmation of the seller’s release from any future claims.

Best regards,

[Your Name]

[Position]

[Company/Organization]

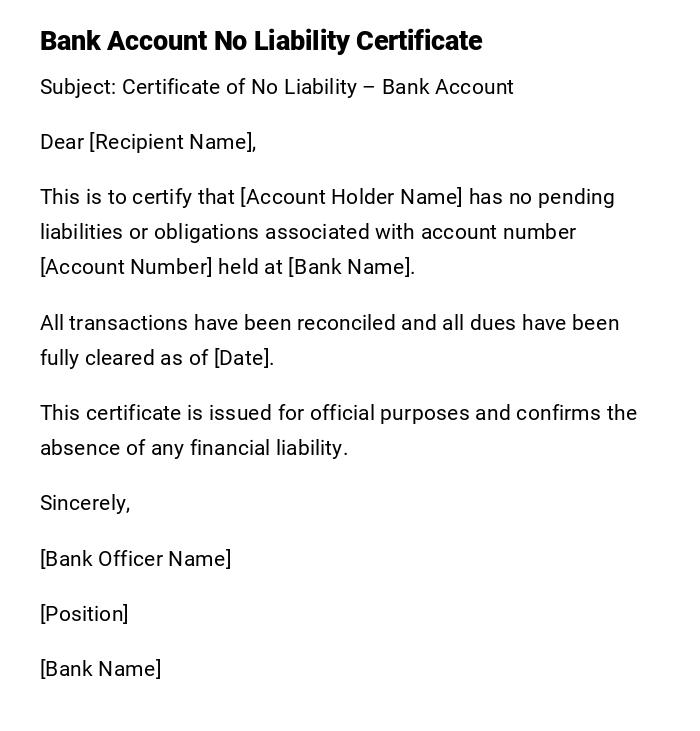

Bank Account No Liability Certificate

Subject: Certificate of No Liability – Bank Account

Dear [Recipient Name],

This is to certify that [Account Holder Name] has no pending liabilities or obligations associated with account number [Account Number] held at [Bank Name].

All transactions have been reconciled and all dues have been fully cleared as of [Date].

This certificate is issued for official purposes and confirms the absence of any financial liability.

Sincerely,

[Bank Officer Name]

[Position]

[Bank Name]

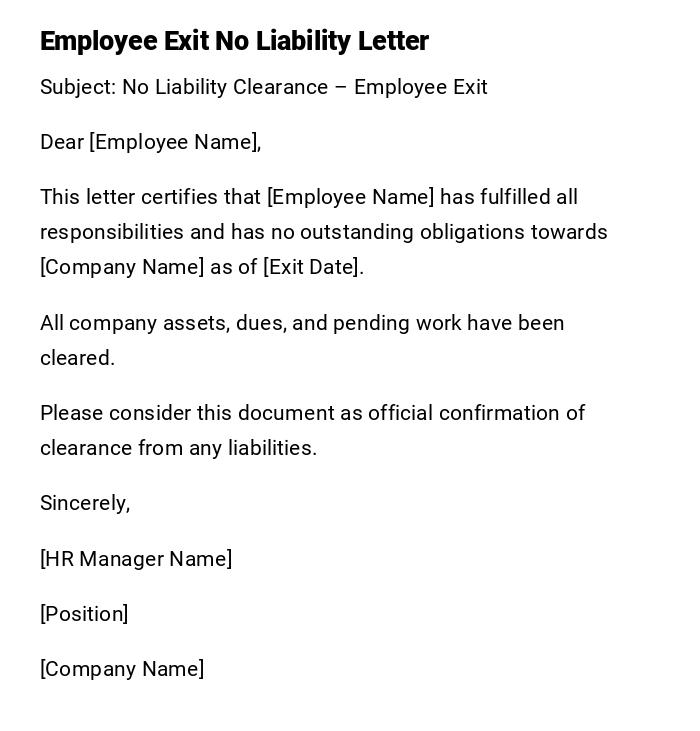

Employee Exit No Liability Letter

Subject: No Liability Clearance – Employee Exit

Dear [Employee Name],

This letter certifies that [Employee Name] has fulfilled all responsibilities and has no outstanding obligations towards [Company Name] as of [Exit Date].

All company assets, dues, and pending work have been cleared.

Please consider this document as official confirmation of clearance from any liabilities.

Sincerely,

[HR Manager Name]

[Position]

[Company Name]

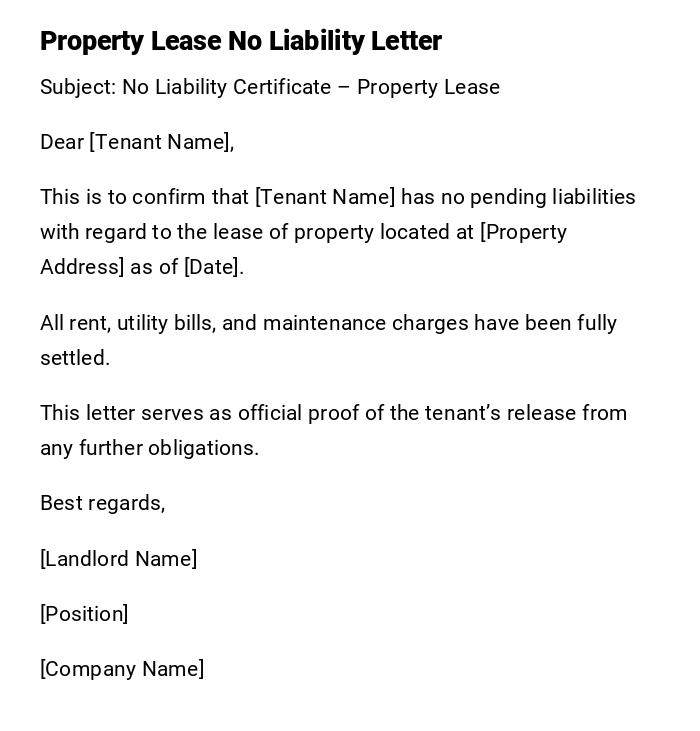

Property Lease No Liability Letter

Subject: No Liability Certificate – Property Lease

Dear [Tenant Name],

This is to confirm that [Tenant Name] has no pending liabilities with regard to the lease of property located at [Property Address] as of [Date].

All rent, utility bills, and maintenance charges have been fully settled.

This letter serves as official proof of the tenant’s release from any further obligations.

Best regards,

[Landlord Name]

[Position]

[Company Name]

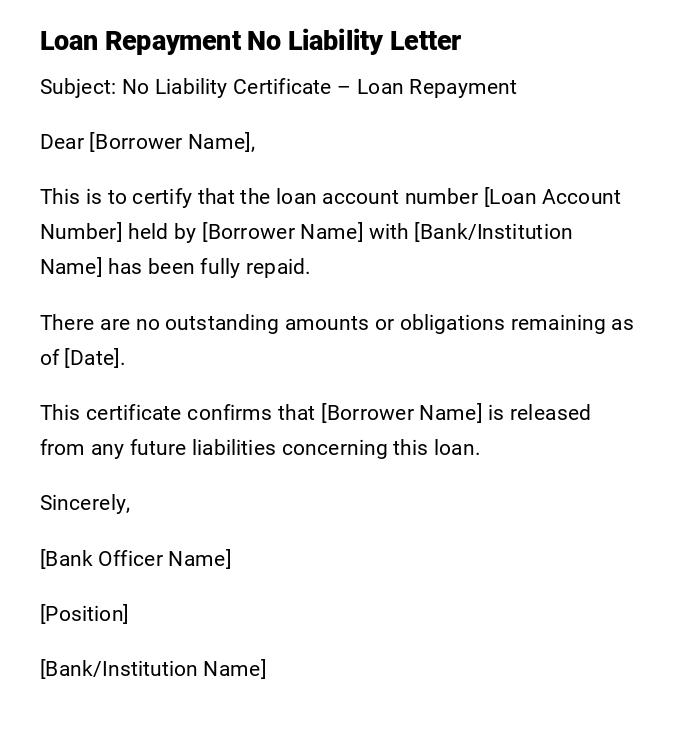

Loan Repayment No Liability Letter

Subject: No Liability Certificate – Loan Repayment

Dear [Borrower Name],

This is to certify that the loan account number [Loan Account Number] held by [Borrower Name] with [Bank/Institution Name] has been fully repaid.

There are no outstanding amounts or obligations remaining as of [Date].

This certificate confirms that [Borrower Name] is released from any future liabilities concerning this loan.

Sincerely,

[Bank Officer Name]

[Position]

[Bank/Institution Name]

Preliminary No Liability Confirmation Email

Subject: Preliminary Confirmation of No Liability

Hi [Recipient Name],

We are issuing this preliminary confirmation that [Company/Person Name] currently holds no outstanding liabilities towards your organization as of [Date].

This is an initial record and may be followed by a formal certificate if required.

Kind regards,

[Your Name]

[Company Name]

Creative No Liability Certificate

Subject: Your Peace of Mind – No Liability Certificate

Hello [Recipient Name],

We’re happy to confirm that [Company/Person Name] owes nothing and bears no liabilities as of [Date].

Think of this as a little legal hug—a paper that says you’re fully free and clear!

Keep this certificate for your records and enjoy peace of mind.

Cheers,

[Your Name]

[Company Name]

What is a No Liability Certificate and Why You Might Need It

A No Liability Certificate or Letter is an official document stating that an individual or entity holds no financial, legal, or contractual obligations towards another party.

It is used to:

- Provide formal proof of cleared dues or obligations.

- Facilitate transactions such as sales, exits, or closures.

- Serve as evidence for legal, banking, or administrative purposes.

- Offer assurance to the recipient that no claims can be made in the future.

Who Can Issue a No Liability Certificate

- Banks or financial institutions for loans, accounts, or credit facilities.

- Employers for employee exits or settlements.

- Property owners or landlords for tenancy clearance.

- Companies or individuals in any contractual relationship.

The issuer must be authorized and have complete knowledge of the liabilities.

Whom the No Liability Letter is Addressed To

- Individuals or companies requesting proof of non-liability.

- Buyers in case of asset or property transfers.

- Financial or legal authorities requiring confirmation of clearance.

- Internal departments like HR or accounts when closing employee or client accounts.

When Should You Send a No Liability Letter

- After loan repayment or closure of a bank account.

- During property lease termination or sale.

- When an employee exits a company.

- During business or contractual relationship closure.

- Whenever proof of non-obligation is required by law, regulation, or third parties.

How to Prepare a No Liability Certificate

- Verify all dues, obligations, and accounts are fully settled.

- Confirm the recipient’s details and purpose for the certificate.

- Choose the format: official letter for print or email for quick confirmation.

- Clearly state the absence of liabilities with dates and account numbers if applicable.

- Include issuer’s name, position, and organization details.

- Sign and, if required, stamp or notarize the document.

Requirements and Prerequisites Before Issuing

- Complete reconciliation of accounts or obligations.

- Proof of clearance of payments, fines, or dues.

- Authorization to issue the certificate.

- Recipient details and purpose of the document.

- Any regulatory or organizational formats needed for validity.

Formatting and Style of a No Liability Letter

- Length: concise, usually one page.

- Tone: professional, formal, and clear.

- Structure: subject line, greeting, body, closing, signature.

- Wording: assertive but polite, confirming absence of liability.

- Mode: printed letter for legal purposes, email for faster confirmation.

After Sending the No Liability Certificate

- Keep a copy for internal records.

- Confirm receipt with the recipient.

- Be ready to provide attachments or additional clarification if requested.

- No further follow-up is generally needed unless discrepancies arise.

Common Mistakes to Avoid

- Issuing without verifying all obligations are cleared.

- Ambiguous wording that may create future disputes.

- Omitting crucial details like dates, account numbers, or signatures.

- Sending without proper authorization.

- Using informal tone for legal or official matters.

Elements and Structure of a No Liability Certificate

- Subject Line: Clearly states the purpose.

- Recipient Details: Name and relevant identification.

- Statement of No Liability: Explicit declaration of cleared obligations.

- Reference Details: Account numbers, transaction IDs, or property addresses.

- Date of Effect: Date when the certificate is valid.

- Issuer Details: Name, position, and organization.

- Signature and Stamp/Seal: To validate authenticity.

- Attachments: Proof of payment or clearance if applicable.

Pros and Cons of Issuing a No Liability Certificate

Pros:

- Provides legal and financial clarity.

- Facilitates transactions, sales, and closures.

- Builds trust with the recipient.

Cons:

- Issuer must verify all records carefully; mistakes can cause liability.

- Requires proper authorization and record-keeping.

- Misuse or fraudulent issuance can lead to legal consequences.

Tricks and Tips for Issuing No Liability Certificates

- Always double-check the accounts or obligations before issuing.

- Include all relevant identifiers to avoid ambiguity.

- Use clear and formal language to prevent disputes.

- Provide the certificate in both digital and hard copy if needed.

- Keep a log of all issued certificates for future reference.

Does a No Liability Certificate Require Attestation or Authorization?

- Yes, often required for legal validity, especially for banks, loans, or property transfers.

- May need signatures from authorized personnel, notarization, or company stamp.

- The level of attestation depends on the purpose and regulatory requirements.

Download Word Doc

Download Word Doc

Download PDF

Download PDF