Credit Inquiry Removal Letter

If you want to remove a credit inquiry from your credit report, you can follow these steps and use the following template as a guide for writing a credit inquiry removal letter. Before proceeding, make sure you have a valid reason for disputing the inquiry and that you have evidence to support your claim.

1. Gather Information: Collect all relevant information about the credit inquiry you wish to remove. This includes the date of the inquiry, the name of the creditor, and any supporting documents or evidence.

2. Verify the Inquiry: Ensure that the inquiry is indeed incorrect or unauthorized. Sometimes, inquiries may have legitimate reasons or could be the result of actions you've taken, such as applying for a loan or credit card.

3. Draft the Letter: Write a formal and concise letter to the credit reporting agency (CRA) responsible for the credit inquiry. In the letter, include the following information:

- Your full name and contact information

- The date of the letter

- The CRA's name and address (you can find this on your credit report)

- A clear statement that you are disputing the inquiry

- Details about the inquiry you want to be removed (creditor's name, date, etc.)

- The reason for the dispute (e.g., unauthorized inquiry, incorrect information)

- Any supporting evidence or documentation

- A request for a thorough investigation and removal of the inquiry

- A statement requesting a written response with the results of the investigation

4. Send the Letter: Send the letter via certified mail with a return receipt requested. This way, you'll have proof that the CRA received your dispute letter.

5. Follow Up: If you don't receive a response within 30-45 days, or if the inquiry is not removed as requested, follow up with the CRA to inquire about the status of your dispute.

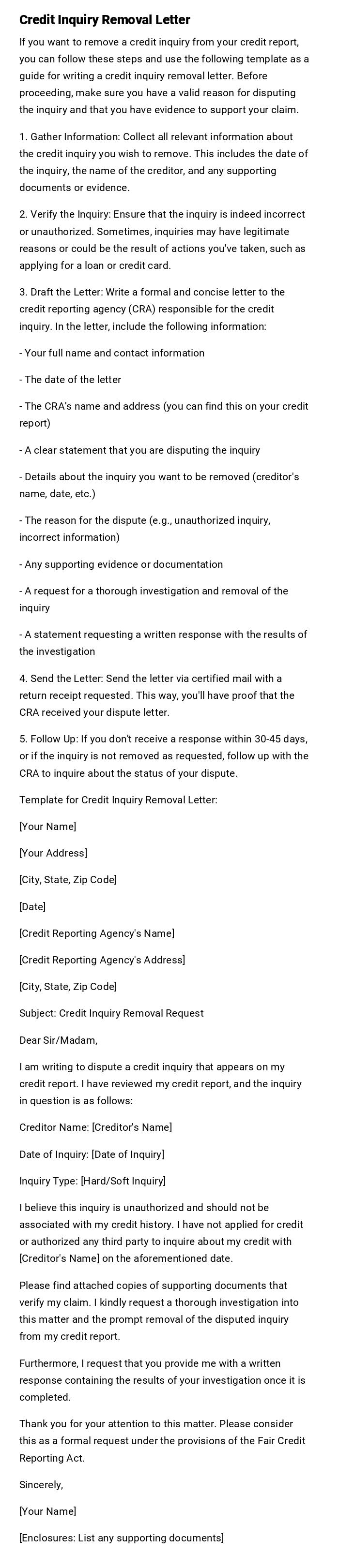

Template for Credit Inquiry Removal Letter:

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Credit Reporting Agency's Name]

[Credit Reporting Agency's Address]

[City, State, Zip Code]

Subject: Credit Inquiry Removal Request

Dear Sir/Madam,

I am writing to dispute a credit inquiry that appears on my credit report. I have reviewed my credit report, and the inquiry in question is as follows:

Creditor Name: [Creditor's Name]

Date of Inquiry: [Date of Inquiry]

Inquiry Type: [Hard/Soft Inquiry]

I believe this inquiry is unauthorized and should not be associated with my credit history. I have not applied for credit or authorized any third party to inquire about my credit with [Creditor's Name] on the aforementioned date.

Please find attached copies of supporting documents that verify my claim. I kindly request a thorough investigation into this matter and the prompt removal of the disputed inquiry from my credit report.

Furthermore, I request that you provide me with a written response containing the results of your investigation once it is completed.

Thank you for your attention to this matter. Please consider this as a formal request under the provisions of the Fair Credit Reporting Act.

Sincerely,

[Your Name]

[Enclosures: List any supporting documents]

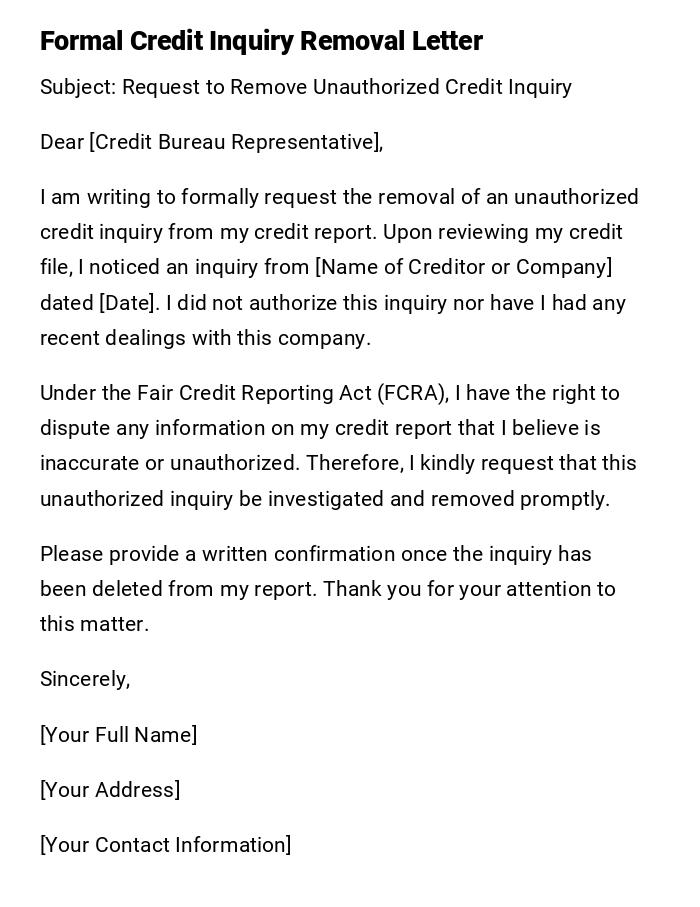

Formal Credit Inquiry Removal Letter

Subject: Request to Remove Unauthorized Credit Inquiry

Dear [Credit Bureau Representative],

I am writing to formally request the removal of an unauthorized credit inquiry from my credit report. Upon reviewing my credit file, I noticed an inquiry from [Name of Creditor or Company] dated [Date]. I did not authorize this inquiry nor have I had any recent dealings with this company.

Under the Fair Credit Reporting Act (FCRA), I have the right to dispute any information on my credit report that I believe is inaccurate or unauthorized. Therefore, I kindly request that this unauthorized inquiry be investigated and removed promptly.

Please provide a written confirmation once the inquiry has been deleted from my report. Thank you for your attention to this matter.

Sincerely,

[Your Full Name]

[Your Address]

[Your Contact Information]

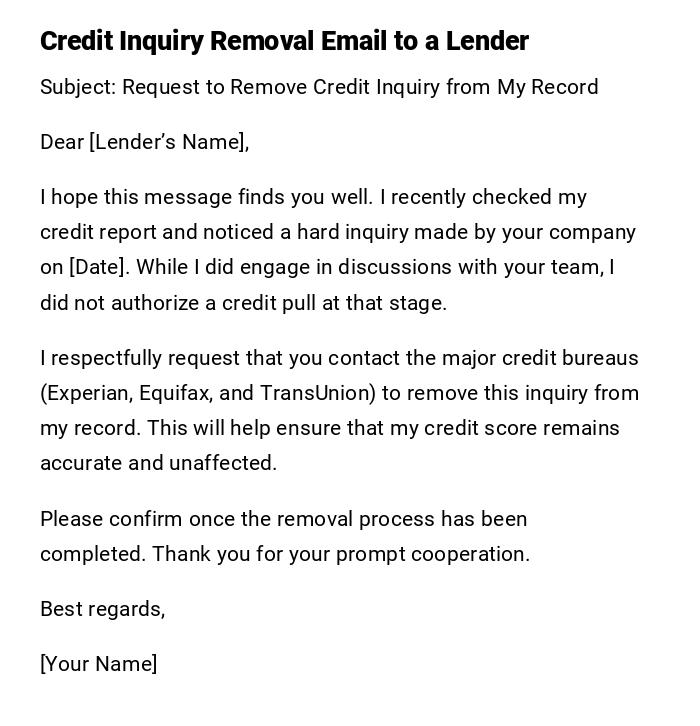

Credit Inquiry Removal Email to a Lender

Subject: Request to Remove Credit Inquiry from My Record

Dear [Lender’s Name],

I hope this message finds you well. I recently checked my credit report and noticed a hard inquiry made by your company on [Date]. While I did engage in discussions with your team, I did not authorize a credit pull at that stage.

I respectfully request that you contact the major credit bureaus (Experian, Equifax, and TransUnion) to remove this inquiry from my record. This will help ensure that my credit score remains accurate and unaffected.

Please confirm once the removal process has been completed. Thank you for your prompt cooperation.

Best regards,

[Your Name]

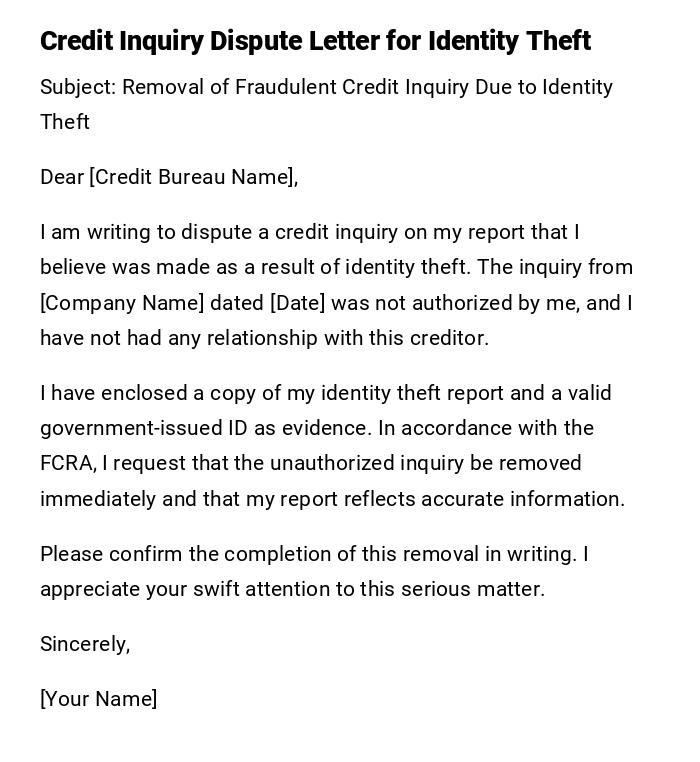

Credit Inquiry Dispute Letter for Identity Theft

Subject: Removal of Fraudulent Credit Inquiry Due to Identity Theft

Dear [Credit Bureau Name],

I am writing to dispute a credit inquiry on my report that I believe was made as a result of identity theft. The inquiry from [Company Name] dated [Date] was not authorized by me, and I have not had any relationship with this creditor.

I have enclosed a copy of my identity theft report and a valid government-issued ID as evidence. In accordance with the FCRA, I request that the unauthorized inquiry be removed immediately and that my report reflects accurate information.

Please confirm the completion of this removal in writing. I appreciate your swift attention to this serious matter.

Sincerely,

[Your Name]

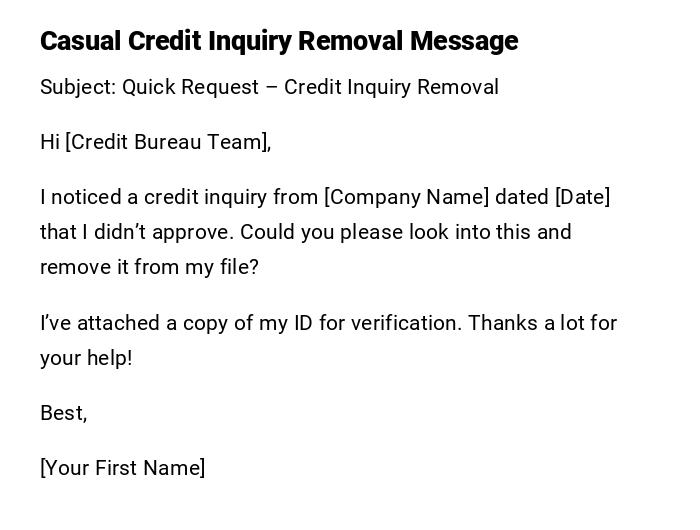

Casual Credit Inquiry Removal Message

Subject: Quick Request – Credit Inquiry Removal

Hi [Credit Bureau Team],

I noticed a credit inquiry from [Company Name] dated [Date] that I didn’t approve. Could you please look into this and remove it from my file?

I’ve attached a copy of my ID for verification. Thanks a lot for your help!

Best,

[Your First Name]

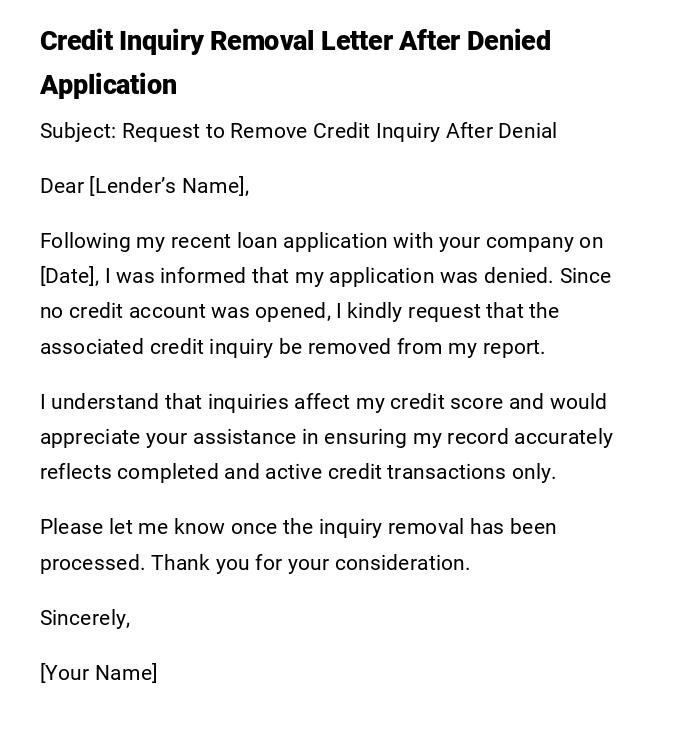

Credit Inquiry Removal Letter After Denied Application

Subject: Request to Remove Credit Inquiry After Denial

Dear [Lender’s Name],

Following my recent loan application with your company on [Date], I was informed that my application was denied. Since no credit account was opened, I kindly request that the associated credit inquiry be removed from my report.

I understand that inquiries affect my credit score and would appreciate your assistance in ensuring my record accurately reflects completed and active credit transactions only.

Please let me know once the inquiry removal has been processed. Thank you for your consideration.

Sincerely,

[Your Name]

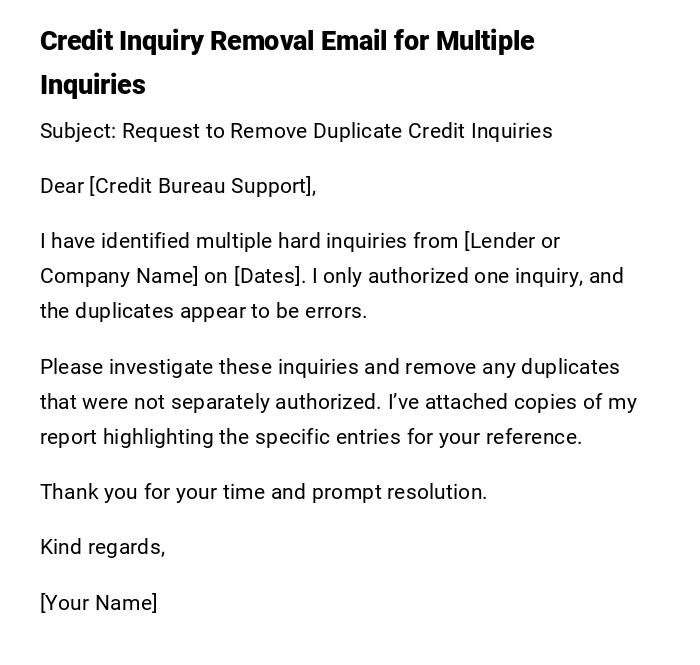

Credit Inquiry Removal Email for Multiple Inquiries

Subject: Request to Remove Duplicate Credit Inquiries

Dear [Credit Bureau Support],

I have identified multiple hard inquiries from [Lender or Company Name] on [Dates]. I only authorized one inquiry, and the duplicates appear to be errors.

Please investigate these inquiries and remove any duplicates that were not separately authorized. I’ve attached copies of my report highlighting the specific entries for your reference.

Thank you for your time and prompt resolution.

Kind regards,

[Your Name]

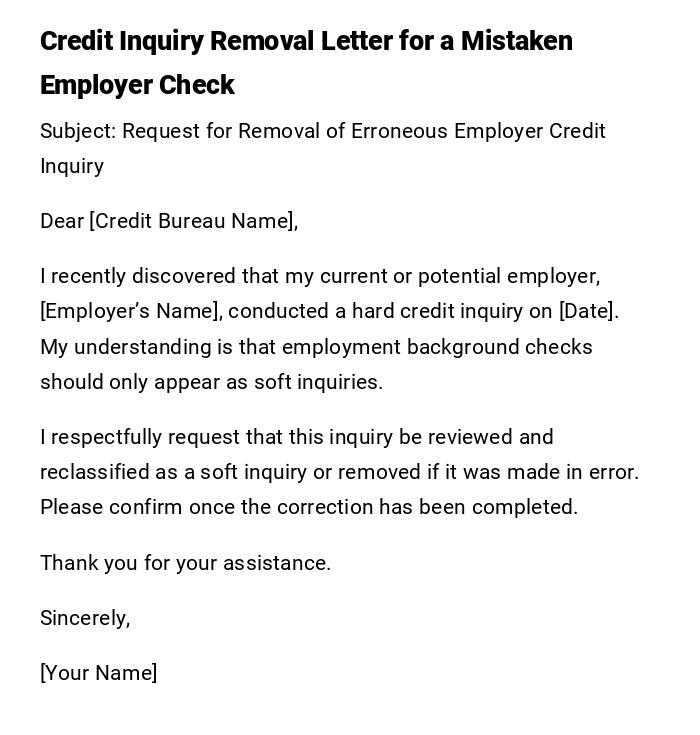

Credit Inquiry Removal Letter for a Mistaken Employer Check

Subject: Request for Removal of Erroneous Employer Credit Inquiry

Dear [Credit Bureau Name],

I recently discovered that my current or potential employer, [Employer’s Name], conducted a hard credit inquiry on [Date]. My understanding is that employment background checks should only appear as soft inquiries.

I respectfully request that this inquiry be reviewed and reclassified as a soft inquiry or removed if it was made in error. Please confirm once the correction has been completed.

Thank you for your assistance.

Sincerely,

[Your Name]

Polite Credit Inquiry Removal Email to Credit Bureau

Subject: Kindly Remove Unauthorized Credit Inquiry

Dear [Credit Bureau Team],

I hope you’re doing well. I’m reaching out because I noticed an inquiry on my credit file from [Company Name] on [Date]. I didn’t authorize this and would appreciate your help in getting it removed.

Please let me know if you need any further details or documents from my side. Thank you for your time and assistance!

Warm regards,

[Your Name]

What is a Credit Inquiry Removal Letter and Why You Need One

A Credit Inquiry Removal Letter is a formal request sent to credit bureaus or lenders asking them to delete an unauthorized or inaccurate credit inquiry from your report. Each credit inquiry slightly impacts your credit score, especially hard inquiries. The main purpose of this letter is to protect your credit rating and ensure that your credit history reflects only inquiries you actually approved.

Who Should Send a Credit Inquiry Removal Letter

Typically, this letter should be sent by the credit holder or consumer whose credit report contains the inquiry. It can also be sent by a legal representative, credit repair company, or identity theft victim acting on behalf of the consumer. The sender must have proper documentation proving their identity and the legitimacy of their claim.

To Whom the Credit Inquiry Removal Letter Should Be Addressed

You can send this letter to the major credit bureaus (Equifax, Experian, and TransUnion), the lender or creditor who made the inquiry, or both. If the inquiry was fraudulent, the letter should be addressed directly to the bureau. If it was authorized by mistake, contacting the lender first may resolve it faster.

When to Send a Credit Inquiry Removal Letter

Send the letter as soon as you identify an inquiry you didn’t approve or recognize. It’s also applicable when:

- A lender pulled your credit without permission.

- Multiple inquiries were made by mistake.

- An inquiry was linked to identity theft.

- You withdrew your application before approval.

- A job-related credit check appeared as a hard inquiry. Prompt action helps prevent long-term score damage.

How to Write and Send a Credit Inquiry Removal Letter

Follow these steps:

- Obtain your credit report and identify the incorrect inquiry.

- Gather supporting documents such as a photo ID, utility bill, and any fraud reports.

- Write clearly and politely, including the inquiry date and company name.

- State your reason for requesting removal and reference your rights under the FCRA.

- Send it via certified mail or email (depending on the recipient’s policy).

- Keep copies of all communications and confirmations.

Formatting and Tone of a Credit Inquiry Removal Letter

- Length: 1 page is ideal.

- Tone: Professional, polite, and factual.

- Mode: Can be a formal letter or digital message.

- Key parts: Subject, brief explanation, specific request, and a closing statement.

- Avoid emotional language or accusations; stick to facts.

Common Mistakes to Avoid When Writing This Letter

- Not specifying the exact inquiry details.

- Forgetting to attach proof of identity.

- Sending the letter to the wrong department.

- Using an aggressive or threatening tone.

- Not keeping a record of correspondence. Avoiding these mistakes improves the chances of a successful removal.

After Sending: Follow-Up and Next Steps

After sending the letter:

- Wait about 30 days for a response or confirmation.

- If you don’t hear back, send a follow-up message with a copy of your original request.

- Check your updated credit report to verify removal.

- If the issue persists, consider filing a formal complaint with the Consumer Financial Protection Bureau (CFPB).

Requirements and Prerequisites Before Writing the Letter

Make sure you have:

- A recent copy of your credit report.

- Proof of identity (government ID and address verification).

- Documentation of communication with lenders, if applicable.

- Knowledge of your rights under the Fair Credit Reporting Act (FCRA). Having these ready ensures your request is credible and complete.

Pros and Cons of Sending a Credit Inquiry Removal Letter

Pros:

- Improves your credit score.

- Protects against identity theft consequences.

- Keeps your report accurate and trustworthy.

Cons:

- Time-consuming if multiple inquiries exist.

- Requires documentation and patience.

- Some lenders may deny removal requests without proof.

Tricks and Tips for Successful Credit Inquiry Removal

- Always include the exact inquiry date and company name.

- Send your letter by certified mail for tracking.

- Attach copies of identification, not originals.

- Keep your tone polite and professional.

- Use separate letters for different bureaus for faster resolution.

Elements and Structure of a Proper Credit Inquiry Removal Letter

A complete letter should include:

- Subject line (Request to Remove Credit Inquiry)

- Introduction stating the issue.

- Details of the inquiry (creditor, date, reference number).

- Explanation of why removal is requested.

- Legal reference (FCRA, if applicable).

- Contact information and signature.

- Attachments list (proofs of identity, reports, etc.).

Download Word Doc

Download Word Doc

Download PDF

Download PDF