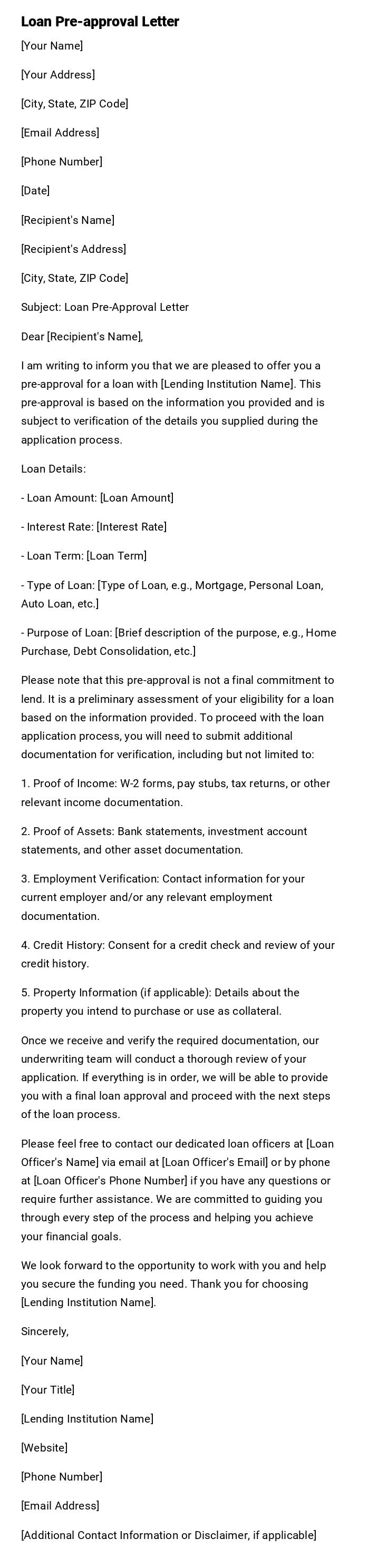

Loan Pre-approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Loan Pre-Approval Letter

Dear [Recipient's Name],

I am writing to inform you that we are pleased to offer you a pre-approval for a loan with [Lending Institution Name]. This pre-approval is based on the information you provided and is subject to verification of the details you supplied during the application process.

Loan Details:

- Loan Amount: [Loan Amount]

- Interest Rate: [Interest Rate]

- Loan Term: [Loan Term]

- Type of Loan: [Type of Loan, e.g., Mortgage, Personal Loan, Auto Loan, etc.]

- Purpose of Loan: [Brief description of the purpose, e.g., Home Purchase, Debt Consolidation, etc.]

Please note that this pre-approval is not a final commitment to lend. It is a preliminary assessment of your eligibility for a loan based on the information provided. To proceed with the loan application process, you will need to submit additional documentation for verification, including but not limited to:

1. Proof of Income: W-2 forms, pay stubs, tax returns, or other relevant income documentation.

2. Proof of Assets: Bank statements, investment account statements, and other asset documentation.

3. Employment Verification: Contact information for your current employer and/or any relevant employment documentation.

4. Credit History: Consent for a credit check and review of your credit history.

5. Property Information (if applicable): Details about the property you intend to purchase or use as collateral.

Once we receive and verify the required documentation, our underwriting team will conduct a thorough review of your application. If everything is in order, we will be able to provide you with a final loan approval and proceed with the next steps of the loan process.

Please feel free to contact our dedicated loan officers at [Loan Officer's Name] via email at [Loan Officer's Email] or by phone at [Loan Officer's Phone Number] if you have any questions or require further assistance. We are committed to guiding you through every step of the process and helping you achieve your financial goals.

We look forward to the opportunity to work with you and help you secure the funding you need. Thank you for choosing [Lending Institution Name].

Sincerely,

[Your Name]

[Your Title]

[Lending Institution Name]

[Website]

[Phone Number]

[Email Address]

[Additional Contact Information or Disclaimer, if applicable]

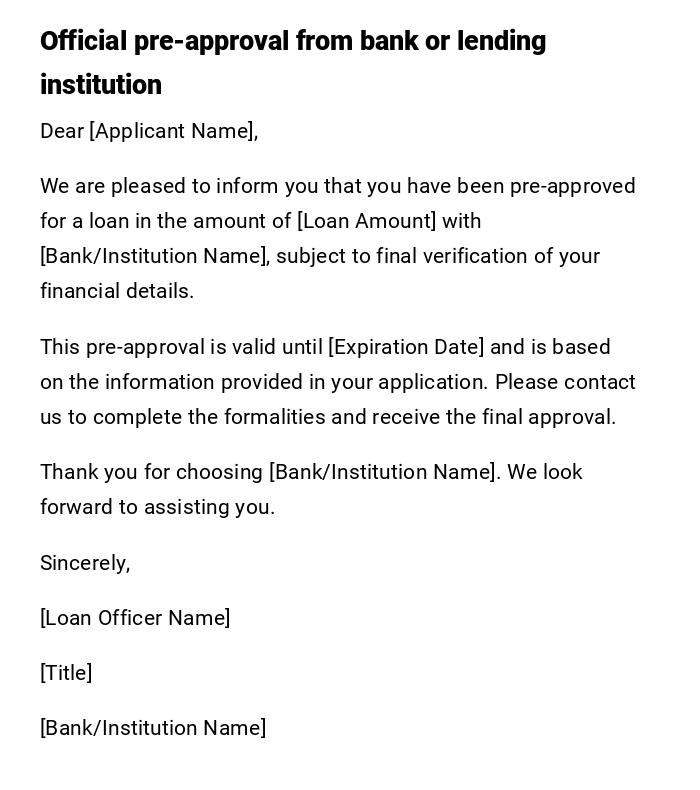

Formal Loan Pre-approval Letter

Dear [Applicant Name],

We are pleased to inform you that you have been pre-approved for a loan in the amount of [Loan Amount] with [Bank/Institution Name], subject to final verification of your financial details.

This pre-approval is valid until [Expiration Date] and is based on the information provided in your application. Please contact us to complete the formalities and receive the final approval.

Thank you for choosing [Bank/Institution Name]. We look forward to assisting you.

Sincerely,

[Loan Officer Name]

[Title]

[Bank/Institution Name]

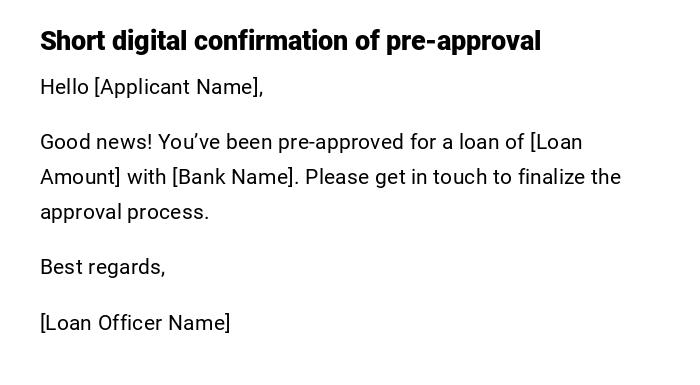

Quick Email Pre-approval Message

Hello [Applicant Name],

Good news! You’ve been pre-approved for a loan of [Loan Amount] with [Bank Name]. Please get in touch to finalize the approval process.

Best regards,

[Loan Officer Name]

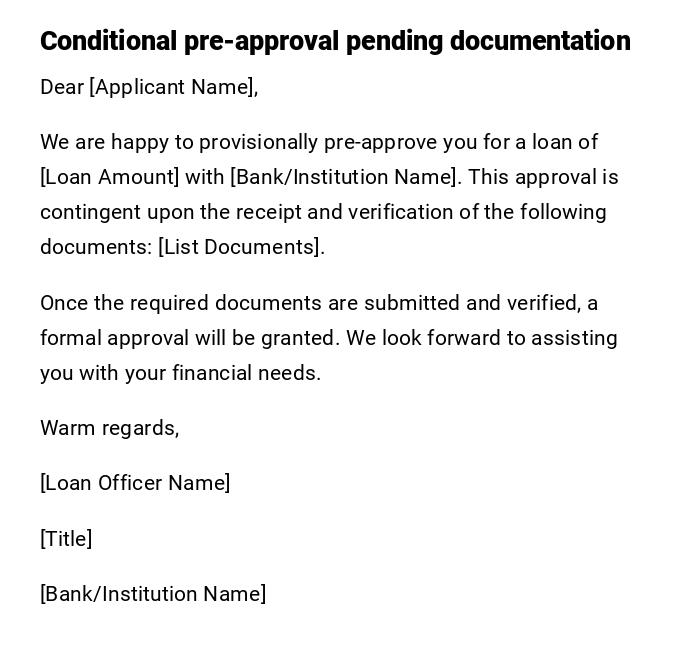

Provisional Loan Pre-approval Letter

Dear [Applicant Name],

We are happy to provisionally pre-approve you for a loan of [Loan Amount] with [Bank/Institution Name]. This approval is contingent upon the receipt and verification of the following documents: [List Documents].

Once the required documents are submitted and verified, a formal approval will be granted. We look forward to assisting you with your financial needs.

Warm regards,

[Loan Officer Name]

[Title]

[Bank/Institution Name]

Informal Pre-approval Email

Hi [Applicant Name],

Great news! You’re pre-approved for a loan of [Loan Amount] with us. Once you provide the necessary documents, we can move forward with the final approval.

Looking forward to helping you make this happen!

Cheers,

[Loan Officer Name]

Heartfelt Pre-approval Letter for Special Circumstances

Dear [Applicant Name],

We are delighted to inform you that you have been pre-approved for a loan of [Loan Amount] at [Bank Name]. We understand that your situation is unique, and we are committed to supporting your financial goals.

Please submit the requested documents to finalize the process. We look forward to helping you achieve your objectives.

Sincerely,

[Loan Officer Name]

[Title]

[Bank/Institution Name]

Official Institutional Pre-approval Letter

To: [Applicant Name]

This letter serves as official notice that you have been pre-approved for a loan of [Loan Amount] with [Bank/Institution Name], subject to the verification of all required documentation.

This pre-approval is effective until [Expiration Date]. Please contact our office to complete the necessary formalities.

Sincerely,

[Loan Officer Name]

[Title]

[Bank/Institution Name]

Creative Pre-approval Notification

Dear [Applicant Name],

Congratulations! We’re excited to let you know that you’re pre-approved for a loan of [Loan Amount] with [Bank Name]. With just a few more steps to complete, you’ll be all set to achieve your financial goals.

Please send in the required documents so we can finalize the approval and move forward together.

Best wishes,

[Loan Officer Name]

What is a Loan Pre-approval Letter and Why It’s Important

A Loan Pre-approval Letter is an official or informal document issued by a bank or financial institution confirming that a borrower qualifies for a loan up to a certain amount based on preliminary financial evaluation.

Purpose:

- Gives the borrower confidence to proceed with purchases, such as a home or vehicle.

- Demonstrates financial credibility to sellers or partners.

- Allows for quicker processing once final approval steps are completed.

- Provides a written record of the lender’s initial assessment.

Who Should Send a Loan Pre-approval Letter

- Loan officers or bank representatives.

- Authorized personnel within the lending institution.

- Financial advisors acting on behalf of a bank or credit union.

- Institutions offering specialized or government-backed loans.

Whom Should Receive a Loan Pre-approval Letter

- Individual applicants seeking loans.

- Co-applicants or joint applicants.

- Real estate agents or sellers (optional) to demonstrate borrower credibility.

- Mortgage brokers or loan processors when required.

When is a Loan Pre-approval Letter Needed

- Before making offers on property or major purchases.

- During the initial stages of loan applications to gauge eligibility.

- When proof of financing is required for negotiations.

- To plan finances and determine the budget before committing.

How to Write and Send a Loan Pre-approval Letter

- Begin with a clear greeting addressing the applicant.

- State the pre-approved loan amount and any conditions.

- Specify expiration date or validity period of the pre-approval.

- Outline steps required for final approval.

- Close with a professional sign-off including contact information.

- Choose appropriate mode: printed letter for official use or email for speed and convenience.

Requirements and Prerequisites Before Issuing a Pre-approval

- Preliminary financial evaluation of applicant.

- Credit history and income verification.

- Assessment of debt-to-income ratio and collateral (if required).

- Internal approval within the lending institution.

- Clear communication regarding terms, conditions, and validity.

Formatting Guidelines for Loan Pre-approval Letters

- Length: 1–2 pages for letters; brief for emails or messages.

- Tone: Professional, clear, and courteous.

- Wording: Avoid ambiguity; clearly state loan amount and pre-approval terms.

- Style: Formal for official letters; friendly tone acceptable in email messages.

- Mode: Printed for legal documentation or PDF/email for faster delivery.

- Etiquette: Include contact info for follow-up questions.

After Sending a Loan Pre-approval Letter

- Confirm receipt with the applicant if sent digitally.

- Monitor completion of required documents for final approval.

- Follow up if pre-approval is nearing expiration.

- Maintain records for auditing and compliance purposes.

Common Mistakes to Avoid in Loan Pre-approval Letters

- Not specifying the pre-approved amount clearly.

- Omitting validity dates or conditions.

- Using ambiguous or overly technical language.

- Failing to include contact information for queries.

- Sending to incorrect recipient or without proper authorization.

Essential Elements and Structure

- Opening: Greeting addressing the applicant.

- Pre-approval Statement: Clear confirmation of eligibility.

- Loan Amount: Maximum pre-approved sum.

- Conditions or Requirements: Any documents or steps pending.

- Validity Period: Expiration date of pre-approval.

- Closing: Professional sign-off with officer name and contact.

Tricks and Tips for Loan Pre-approval Letters

- Personalize letters with the applicant’s name for a professional touch.

- Include clear instructions for next steps to avoid confusion.

- Highlight pre-approval benefits like faster processing or negotiation power.

- Keep the letter concise yet comprehensive.

- Use secure communication methods for sensitive financial information.

Comparison with Final Loan Approval Letters

- Pre-approval vs Final Approval: Pre-approval is conditional and based on preliminary evaluation; final approval confirms the loan after verification of all documents.

- Formal vs Informal: Pre-approval letters can be emailed for speed; final approval often requires formal documentation.

- Conditional vs Unconditional: Pre-approval is typically conditional; final approval is unconditional barring unforeseen issues.

Download Word Doc

Download Word Doc

Download PDF

Download PDF