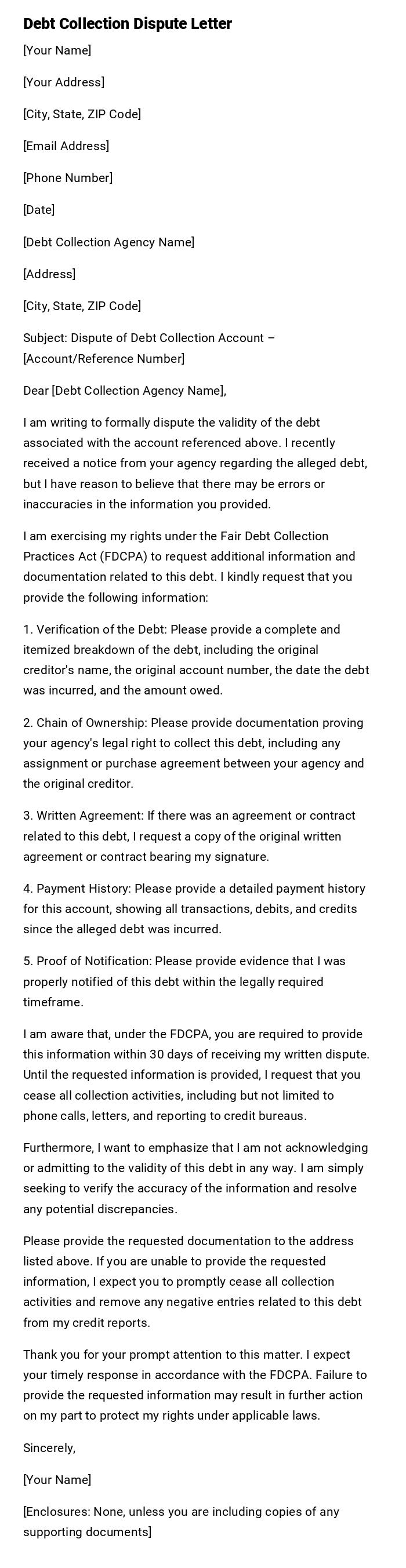

Debt Collection Dispute Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Debt Collection Agency Name]

[Address]

[City, State, ZIP Code]

Subject: Dispute of Debt Collection Account – [Account/Reference Number]

Dear [Debt Collection Agency Name],

I am writing to formally dispute the validity of the debt associated with the account referenced above. I recently received a notice from your agency regarding the alleged debt, but I have reason to believe that there may be errors or inaccuracies in the information you provided.

I am exercising my rights under the Fair Debt Collection Practices Act (FDCPA) to request additional information and documentation related to this debt. I kindly request that you provide the following information:

1. Verification of the Debt: Please provide a complete and itemized breakdown of the debt, including the original creditor's name, the original account number, the date the debt was incurred, and the amount owed.

2. Chain of Ownership: Please provide documentation proving your agency's legal right to collect this debt, including any assignment or purchase agreement between your agency and the original creditor.

3. Written Agreement: If there was an agreement or contract related to this debt, I request a copy of the original written agreement or contract bearing my signature.

4. Payment History: Please provide a detailed payment history for this account, showing all transactions, debits, and credits since the alleged debt was incurred.

5. Proof of Notification: Please provide evidence that I was properly notified of this debt within the legally required timeframe.

I am aware that, under the FDCPA, you are required to provide this information within 30 days of receiving my written dispute. Until the requested information is provided, I request that you cease all collection activities, including but not limited to phone calls, letters, and reporting to credit bureaus.

Furthermore, I want to emphasize that I am not acknowledging or admitting to the validity of this debt in any way. I am simply seeking to verify the accuracy of the information and resolve any potential discrepancies.

Please provide the requested documentation to the address listed above. If you are unable to provide the requested information, I expect you to promptly cease all collection activities and remove any negative entries related to this debt from my credit reports.

Thank you for your prompt attention to this matter. I expect your timely response in accordance with the FDCPA. Failure to provide the requested information may result in further action on my part to protect my rights under applicable laws.

Sincerely,

[Your Name]

[Enclosures: None, unless you are including copies of any supporting documents]

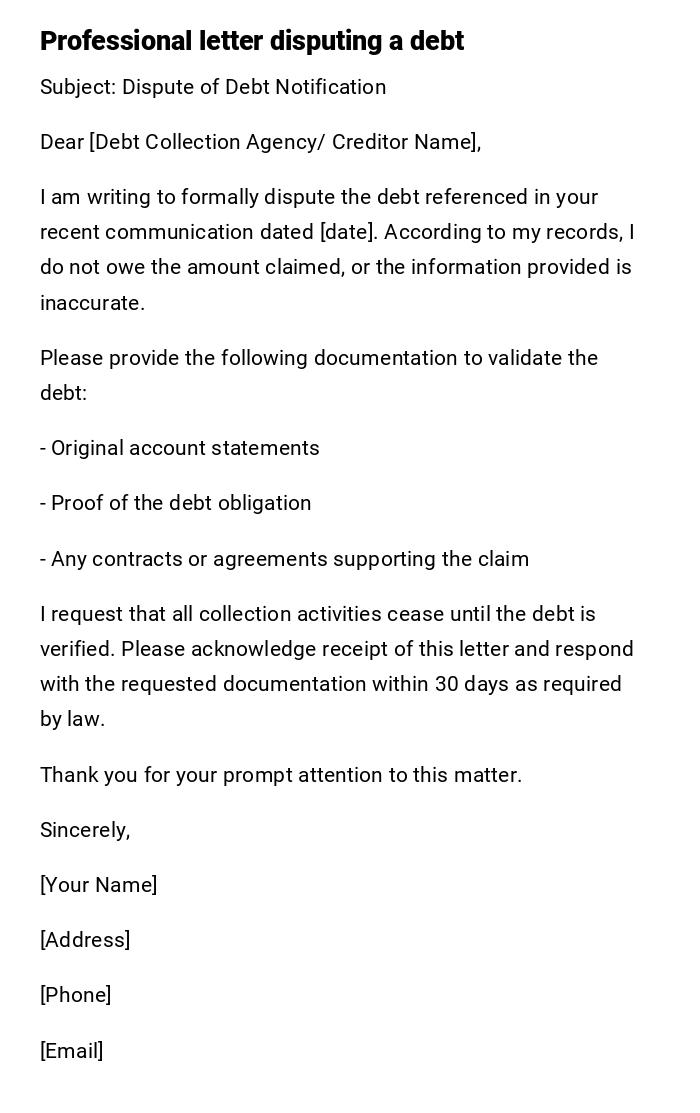

Formal Debt Collection Dispute Letter

Subject: Dispute of Debt Notification

Dear [Debt Collection Agency/ Creditor Name],

I am writing to formally dispute the debt referenced in your recent communication dated [date]. According to my records, I do not owe the amount claimed, or the information provided is inaccurate.

Please provide the following documentation to validate the debt:

- Original account statements

- Proof of the debt obligation

- Any contracts or agreements supporting the claim

I request that all collection activities cease until the debt is verified. Please acknowledge receipt of this letter and respond with the requested documentation within 30 days as required by law.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Address]

[Phone]

[Email]

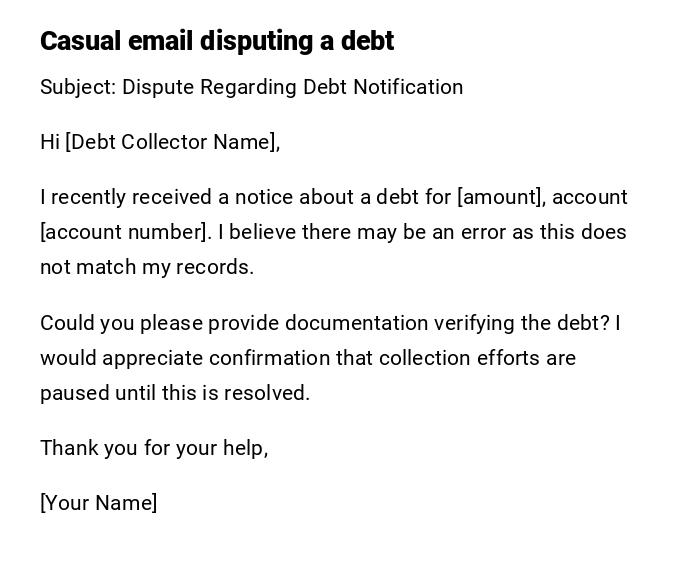

Informal Email Debt Dispute

Subject: Dispute Regarding Debt Notification

Hi [Debt Collector Name],

I recently received a notice about a debt for [amount], account [account number]. I believe there may be an error as this does not match my records.

Could you please provide documentation verifying the debt? I would appreciate confirmation that collection efforts are paused until this is resolved.

Thank you for your help,

[Your Name]

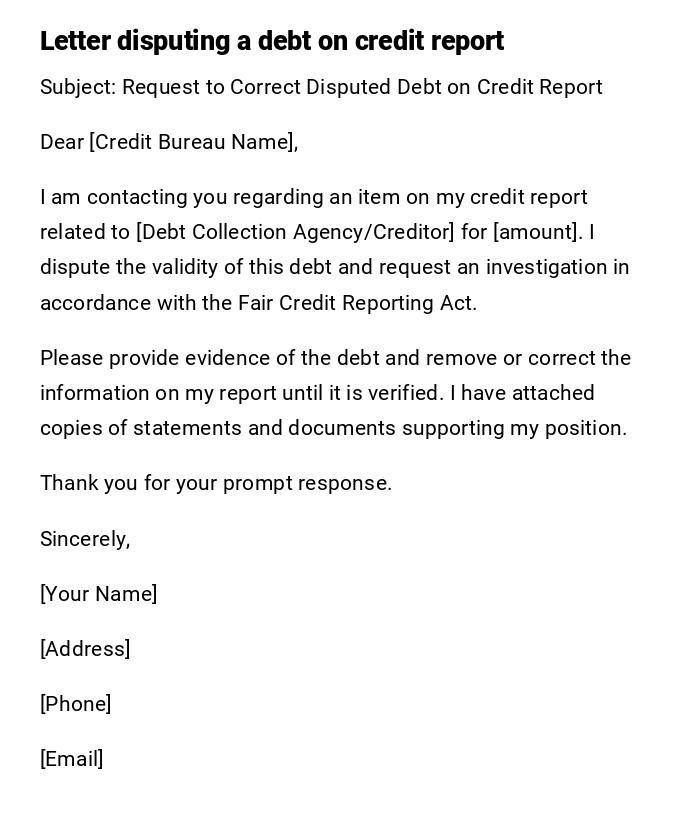

Detailed Debt Dispute Letter for Credit Report

Subject: Request to Correct Disputed Debt on Credit Report

Dear [Credit Bureau Name],

I am contacting you regarding an item on my credit report related to [Debt Collection Agency/Creditor] for [amount]. I dispute the validity of this debt and request an investigation in accordance with the Fair Credit Reporting Act.

Please provide evidence of the debt and remove or correct the information on my report until it is verified. I have attached copies of statements and documents supporting my position.

Thank you for your prompt response.

Sincerely,

[Your Name]

[Address]

[Phone]

[Email]

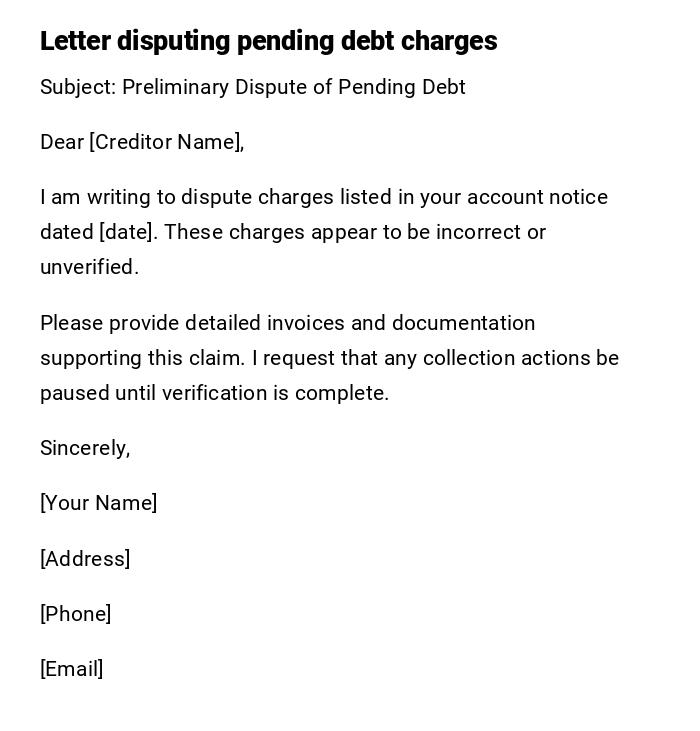

Provisional Debt Dispute Letter for Pending Charges

Subject: Preliminary Dispute of Pending Debt

Dear [Creditor Name],

I am writing to dispute charges listed in your account notice dated [date]. These charges appear to be incorrect or unverified.

Please provide detailed invoices and documentation supporting this claim. I request that any collection actions be paused until verification is complete.

Sincerely,

[Your Name]

[Address]

[Phone]

[Email]

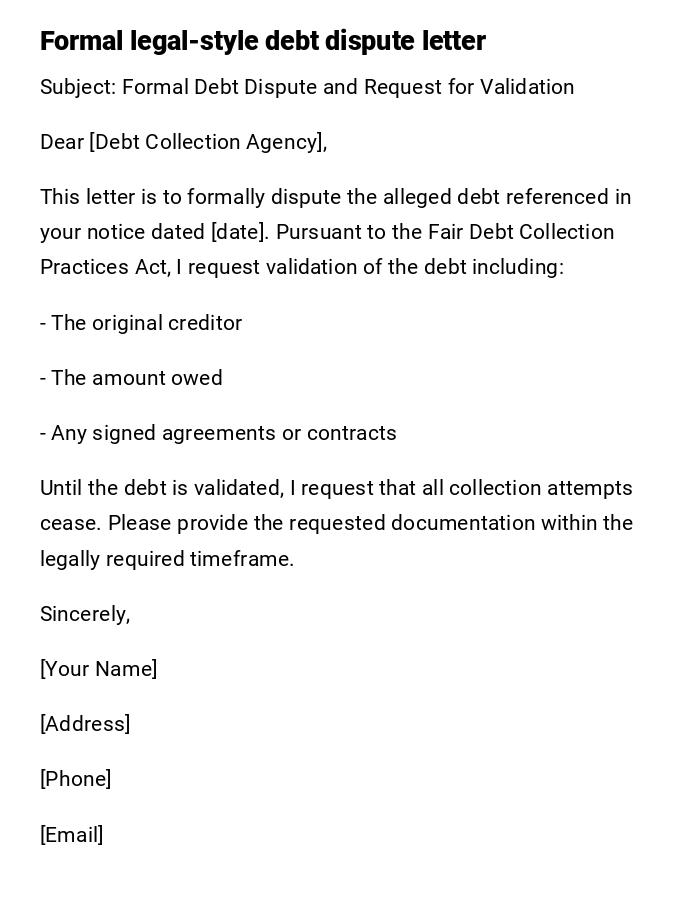

Serious and Legal Debt Dispute Letter

Subject: Formal Debt Dispute and Request for Validation

Dear [Debt Collection Agency],

This letter is to formally dispute the alleged debt referenced in your notice dated [date]. Pursuant to the Fair Debt Collection Practices Act, I request validation of the debt including:

- The original creditor

- The amount owed

- Any signed agreements or contracts

Until the debt is validated, I request that all collection attempts cease. Please provide the requested documentation within the legally required timeframe.

Sincerely,

[Your Name]

[Address]

[Phone]

[Email]

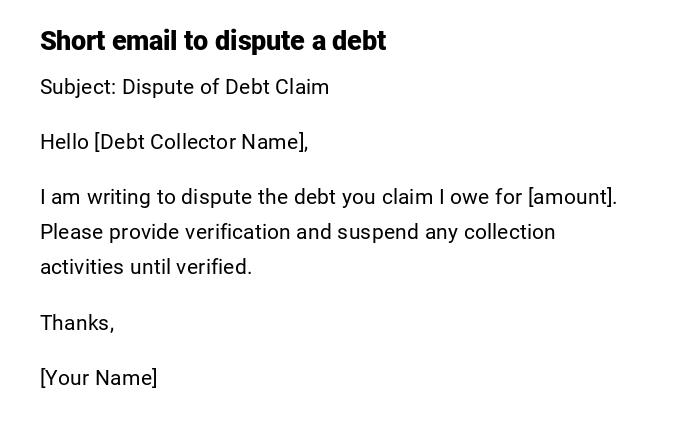

Quick Email Debt Dispute

Subject: Dispute of Debt Claim

Hello [Debt Collector Name],

I am writing to dispute the debt you claim I owe for [amount]. Please provide verification and suspend any collection activities until verified.

Thanks,

[Your Name]

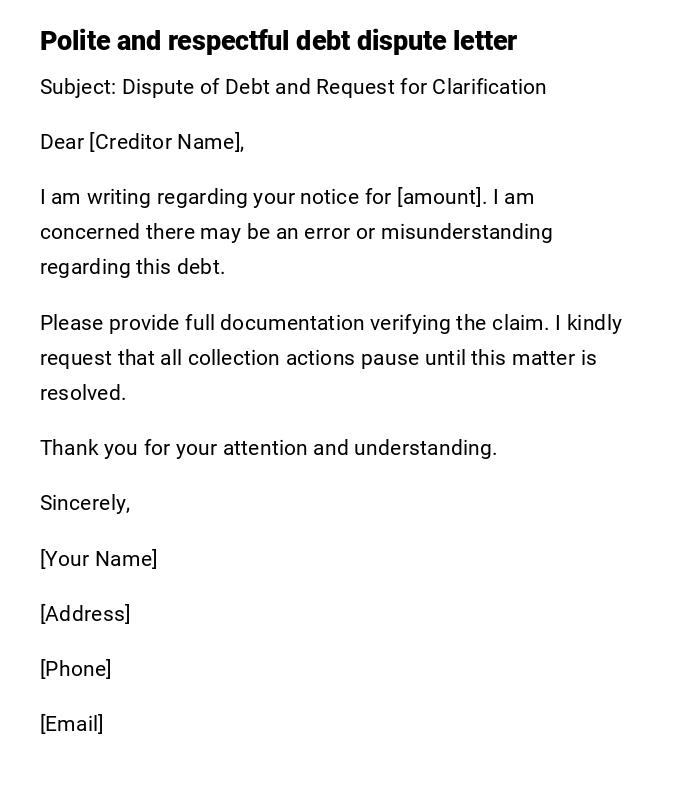

Heartfelt Debt Dispute Letter

Subject: Dispute of Debt and Request for Clarification

Dear [Creditor Name],

I am writing regarding your notice for [amount]. I am concerned there may be an error or misunderstanding regarding this debt.

Please provide full documentation verifying the claim. I kindly request that all collection actions pause until this matter is resolved.

Thank you for your attention and understanding.

Sincerely,

[Your Name]

[Address]

[Phone]

[Email]

Debt Dispute Letter Requesting Immediate Cease

Subject: Immediate Cease of Debt Collection Due to Dispute

Dear [Debt Collector Name],

I dispute the debt referenced in your recent communication. I request an immediate halt to all collection activities until you provide documentation proving the validity of this debt.

Failure to provide verification will result in formal complaints to regulatory authorities.

Sincerely,

[Your Name]

[Address]

[Phone]

[Email]

Debt Dispute Letter for Billing Error

Subject: Dispute of Billing Error on Account

Dear [Billing Department],

I am disputing a charge of [amount] on my account [account number]. According to my records, this amount was incorrectly billed.

Please review my account and provide documentation verifying the charges. Kindly correct any errors and confirm in writing.

Thank you,

[Your Name]

[Address]

[Phone]

[Email]

What is a Debt Collection Dispute Letter and Why You Need One

A debt collection dispute letter is a formal document used to challenge the validity of a debt claimed by a creditor or collection agency. The purpose is to request verification, correct errors, halt unjust collection efforts, and protect your rights under laws such as the Fair Debt Collection Practices Act.

Who Should Send a Debt Collection Dispute Letter

- Individuals receiving collection notices for disputed debts

- Consumers who notice inaccuracies on their accounts or credit reports

- Authorized representatives acting on behalf of the debtor

The sender must have legal authority or standing to dispute the debt.

Whom to Address a Debt Collection Dispute Letter

- Original creditors

- Third-party debt collection agencies

- Credit bureaus (for reporting disputes)

- Regulatory authorities if escalation is needed

Always direct the letter to the entity legally responsible for the claim.

When to Send a Debt Collection Dispute Letter

- Upon receiving a debt collection notice that appears incorrect

- If the debt is already paid, settled, or not yours

- When noticing unauthorized charges on accounts or credit reports

- Prior to any legal proceedings or escalation by the creditor

How to Write and Send a Debt Collection Dispute Letter

- Clearly state that you are disputing the debt.

- Include your account information and any reference numbers.

- Request validation and supporting documentation.

- Maintain a polite but firm tone.

- Send via certified mail or email with read receipt for tracking.

- Keep copies for your records.

Requirements and Preparations Before Sending

- Gather account statements and relevant documentation

- Verify the debt amount, dates, and original creditor details

- Prepare a written record of any prior communications

- Know your rights under applicable consumer protection laws

Formatting and Style for a Debt Dispute Letter

- Length: 1–2 pages maximum

- Tone: Professional, firm, and respectful

- Structure: Clear subject line, introduction, dispute statement, request for verification, closing

- Attachments: Copies of evidence, prior correspondence, payment receipts

- Mode: Prefer certified mail for official records or secure email

After Sending – Follow-Up Actions

- Track responses within 30 days as legally required

- Confirm that collection has ceased until verification

- Respond promptly if additional documentation is requested

- Maintain a file of all correspondence for potential legal protection

Common Mistakes to Avoid

- Using aggressive or threatening language

- Failing to provide accurate personal or account information

- Not keeping copies of correspondence

- Ignoring deadlines for responding to disputes

- Accepting collection without requesting verification

Pros and Cons of Sending a Debt Collection Dispute Letter

Pros:

- Legally protects the consumer from inaccurate debt claims

- Pauses collection activity until verification is provided

- Provides formal documentation for potential legal actions

Cons:

- May require time and effort to gather supporting documents

- Possible delay in resolving legitimate debt if dispute is unnecessary

- Needs careful wording to avoid escalation or miscommunication

Tricks and Tips for an Effective Debt Dispute Letter

- Use certified mail to ensure proof of receipt

- Include copies, not originals, of supporting documents

- Maintain concise and clear language

- Reference relevant laws such as the Fair Debt Collection Practices Act

- Follow up promptly and record all communications

Essential Elements and Structure

- Subject line stating dispute clearly

- Account or reference numbers

- Clear statement disputing the debt

- Request for validation/documentation

- Evidence or supporting documents

- Request to cease collection until verified

- Professional closing with full contact information

Comparison with Other Financial Letters

- Unlike a payment request letter, a dispute letter challenges the validity of a claim.

- Compared to a debt settlement letter, it does not propose payment but demands verification.

- Serves as a formal protective document before legal escalation, whereas casual emails may not provide legal proof.

Download Word Doc

Download Word Doc

Download PDF

Download PDF