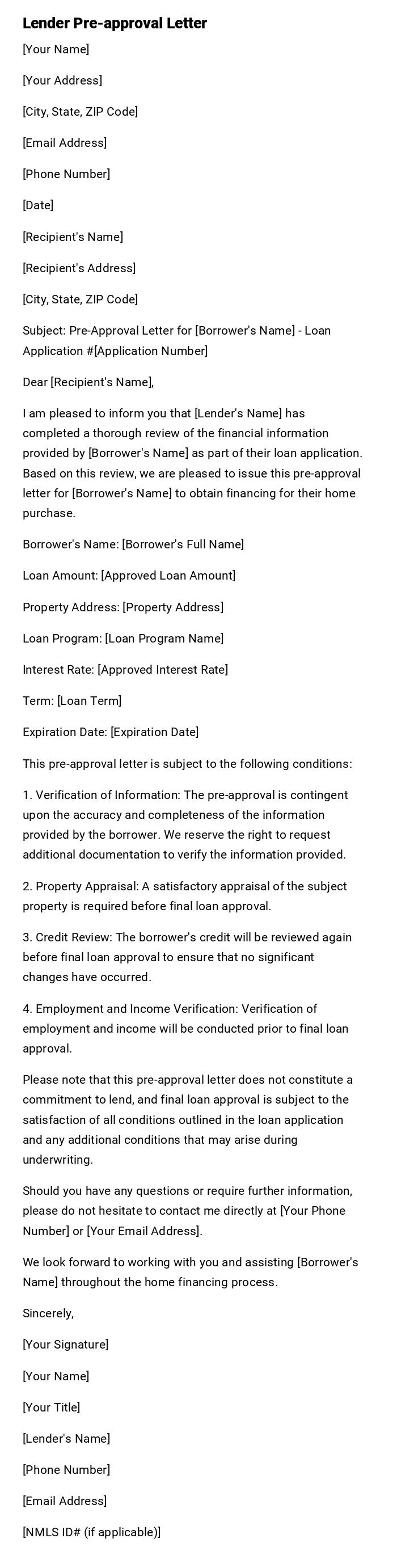

Lender Pre-approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Pre-Approval Letter for [Borrower's Name] - Loan Application #[Application Number]

Dear [Recipient's Name],

I am pleased to inform you that [Lender's Name] has completed a thorough review of the financial information provided by [Borrower's Name] as part of their loan application. Based on this review, we are pleased to issue this pre-approval letter for [Borrower's Name] to obtain financing for their home purchase.

Borrower's Name: [Borrower's Full Name]

Loan Amount: [Approved Loan Amount]

Property Address: [Property Address]

Loan Program: [Loan Program Name]

Interest Rate: [Approved Interest Rate]

Term: [Loan Term]

Expiration Date: [Expiration Date]

This pre-approval letter is subject to the following conditions:

1. Verification of Information: The pre-approval is contingent upon the accuracy and completeness of the information provided by the borrower. We reserve the right to request additional documentation to verify the information provided.

2. Property Appraisal: A satisfactory appraisal of the subject property is required before final loan approval.

3. Credit Review: The borrower's credit will be reviewed again before final loan approval to ensure that no significant changes have occurred.

4. Employment and Income Verification: Verification of employment and income will be conducted prior to final loan approval.

Please note that this pre-approval letter does not constitute a commitment to lend, and final loan approval is subject to the satisfaction of all conditions outlined in the loan application and any additional conditions that may arise during underwriting.

Should you have any questions or require further information, please do not hesitate to contact me directly at [Your Phone Number] or [Your Email Address].

We look forward to working with you and assisting [Borrower's Name] throughout the home financing process.

Sincerely,

[Your Signature]

[Your Name]

[Your Title]

[Lender's Name]

[Phone Number]

[Email Address]

[NMLS ID# (if applicable)]

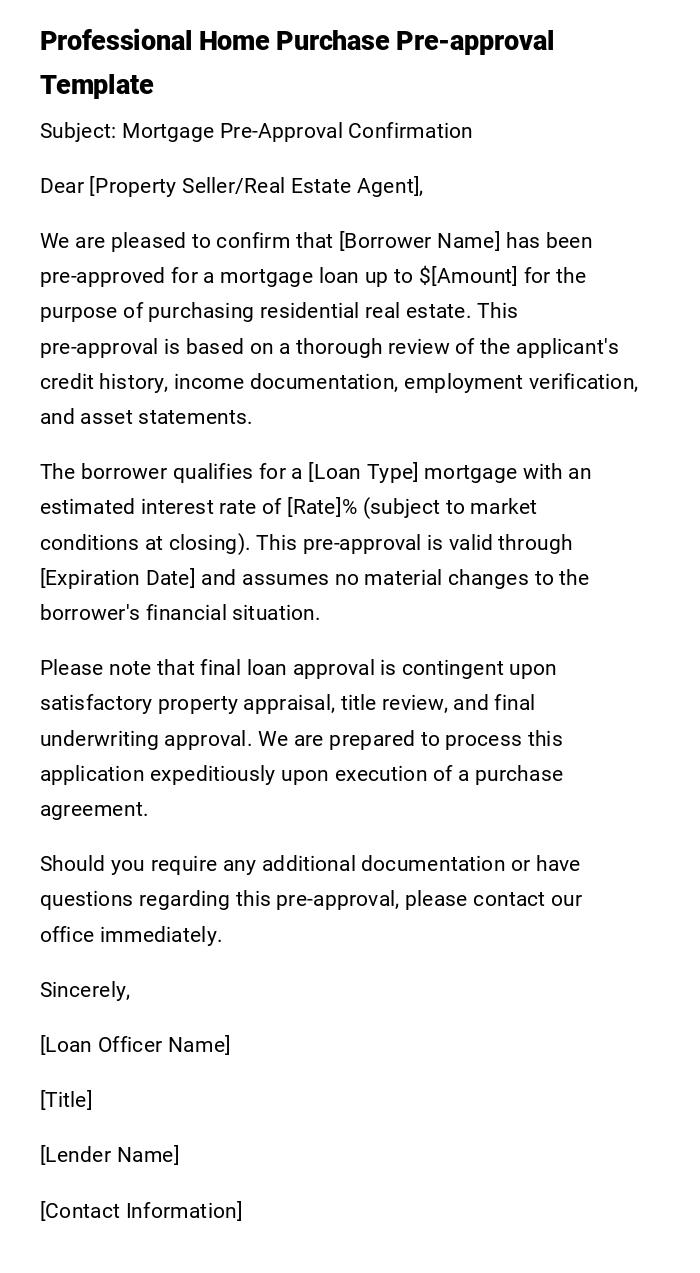

Standard Home Purchase Pre-approval Letter

Subject: Mortgage Pre-Approval Confirmation

Dear [Property Seller/Real Estate Agent],

We are pleased to confirm that [Borrower Name] has been pre-approved for a mortgage loan up to $[Amount] for the purpose of purchasing residential real estate. This pre-approval is based on a thorough review of the applicant's credit history, income documentation, employment verification, and asset statements.

The borrower qualifies for a [Loan Type] mortgage with an estimated interest rate of [Rate]% (subject to market conditions at closing). This pre-approval is valid through [Expiration Date] and assumes no material changes to the borrower's financial situation.

Please note that final loan approval is contingent upon satisfactory property appraisal, title review, and final underwriting approval. We are prepared to process this application expeditiously upon execution of a purchase agreement.

Should you require any additional documentation or have questions regarding this pre-approval, please contact our office immediately.

Sincerely,

[Loan Officer Name]

[Title]

[Lender Name]

[Contact Information]

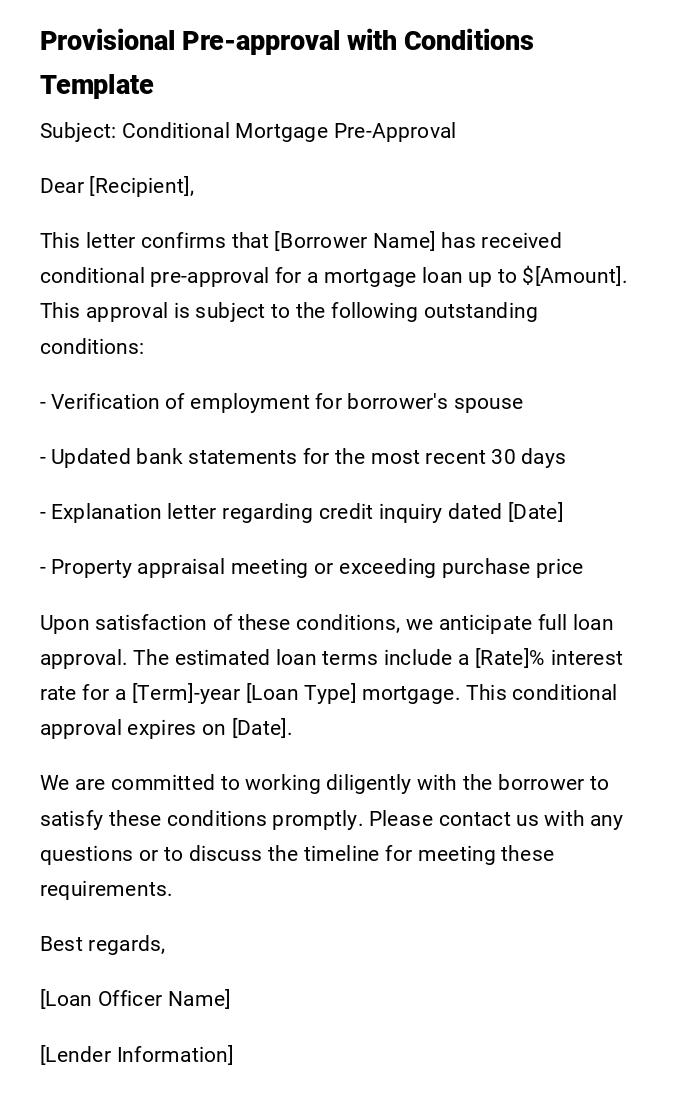

Conditional Pre-approval Letter with Stipulations

Subject: Conditional Mortgage Pre-Approval

Dear [Recipient],

This letter confirms that [Borrower Name] has received conditional pre-approval for a mortgage loan up to $[Amount]. This approval is subject to the following outstanding conditions:

- Verification of employment for borrower's spouse

- Updated bank statements for the most recent 30 days

- Explanation letter regarding credit inquiry dated [Date]

- Property appraisal meeting or exceeding purchase price

Upon satisfaction of these conditions, we anticipate full loan approval. The estimated loan terms include a [Rate]% interest rate for a [Term]-year [Loan Type] mortgage. This conditional approval expires on [Date].

We are committed to working diligently with the borrower to satisfy these conditions promptly. Please contact us with any questions or to discuss the timeline for meeting these requirements.

Best regards,

[Loan Officer Name]

[Lender Information]

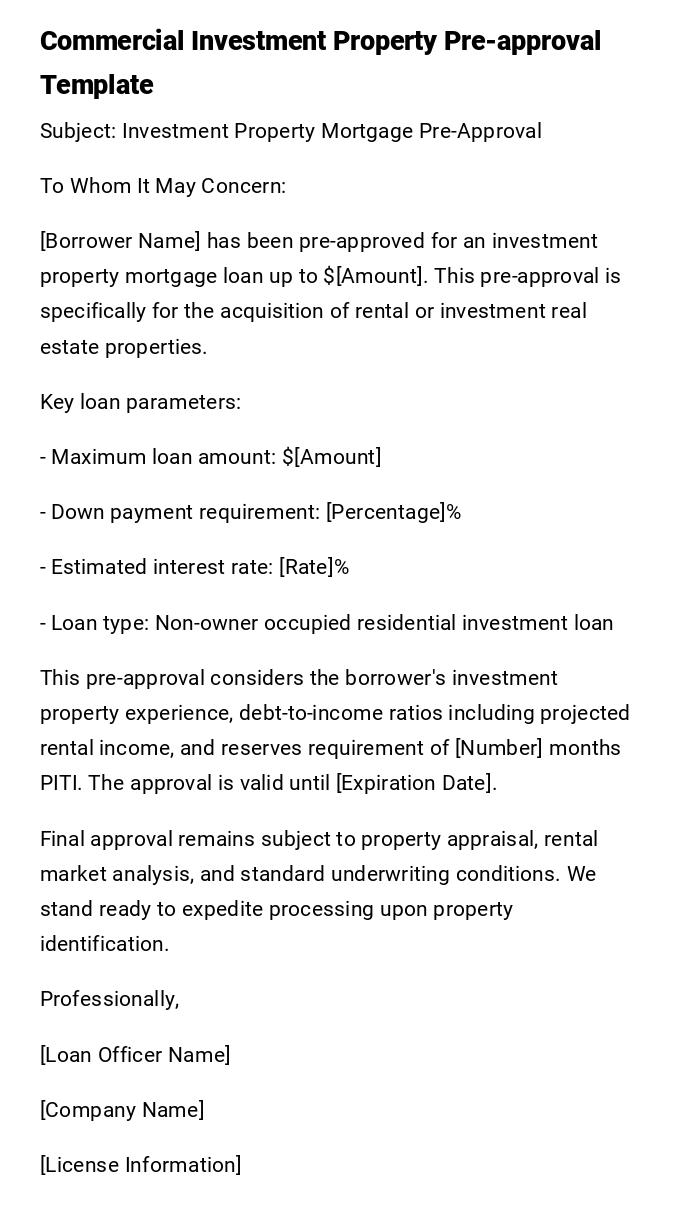

Investment Property Pre-approval Letter

Subject: Investment Property Mortgage Pre-Approval

To Whom It May Concern:

[Borrower Name] has been pre-approved for an investment property mortgage loan up to $[Amount]. This pre-approval is specifically for the acquisition of rental or investment real estate properties.

Key loan parameters:

- Maximum loan amount: $[Amount]

- Down payment requirement: [Percentage]%

- Estimated interest rate: [Rate]%

- Loan type: Non-owner occupied residential investment loan

This pre-approval considers the borrower's investment property experience, debt-to-income ratios including projected rental income, and reserves requirement of [Number] months PITI. The approval is valid until [Expiration Date].

Final approval remains subject to property appraisal, rental market analysis, and standard underwriting conditions. We stand ready to expedite processing upon property identification.

Professionally,

[Loan Officer Name]

[Company Name]

[License Information]

First-Time Homebuyer Pre-approval Letter

Subject: First-Time Homebuyer Pre-Approval - Congratulations!

Dear [Borrower Name] and [Real Estate Professional],

Congratulations! We are excited to confirm that [Borrower Name] has been pre-approved for their first home purchase with a mortgage loan up to $[Amount]. As first-time homebuyers, they qualify for special programs and benefits designed to make homeownership more accessible.

This pre-approval includes:

- FHA loan qualification with 3.5% down payment option

- First-time buyer grant program eligibility

- Estimated monthly payment of $[Amount] (including taxes and insurance)

- Pre-approval valid through [Date]

We understand that purchasing your first home is both exciting and overwhelming. Our team is committed to guiding you through every step of the process with patience and expertise.

We look forward to helping you achieve your homeownership dreams!

Warmest regards,

[Loan Officer Name]

[Lender Name]

[Contact Details]

High-Value Luxury Property Pre-approval Letter

Subject: Jumbo Mortgage Pre-Approval Confirmation

Distinguished Real Estate Professional,

We are pleased to provide formal confirmation that [Borrower Name] has been pre-approved for a jumbo mortgage loan in the amount of $[Amount] for the acquisition of luxury residential real estate.

This pre-approval reflects our comprehensive evaluation of the borrower's substantial assets, exceptional credit profile, and verified high-income documentation. The proposed loan structure includes:

- Jumbo loan amount: $[Amount]

- Competitive interest rate: [Rate]%

- Flexible down payment options available

- Expedited processing capabilities

Our private banking division stands ready to facilitate a seamless transaction for properties of exceptional value. This pre-approval demonstrates the borrower's serious intent and financial capability to complete purchases in the luxury market segment.

We maintain the highest standards of discretion and professionalism in all our client relationships.

Respectfully yours,

[Senior Loan Officer Name]

[Private Banking Division]

[Institution Name]

Quick Cash-Alternative Pre-approval Letter

Subject: Express Pre-Approval - Cash-Competitive Offer

URGENT - TIME-SENSITIVE PRE-APPROVAL

Dear Listing Agent,

[Borrower Name] has been FULLY pre-approved for a mortgage loan up to $[Amount] with EXPEDITED processing capabilities. In today's competitive market, this pre-approval offers cash-like certainty with the following advantages:

✓ Complete underwriting review already performed

✓ All documentation verified and approved

✓ 15-day closing capability

✓ No financing contingencies required beyond appraisal

✓ Dedicated processing team assigned

This is NOT a basic pre-qualification - this is a comprehensive approval ready for immediate action. We understand the urgency in multiple offer situations and are prepared to provide same-day loan commitment letters.

Contact us immediately for any additional documentation needed.

Ready to close!

[Loan Officer Name]

[Direct Phone]

[Email]

Refinance Pre-approval Letter

Subject: Refinance Mortgage Pre-Approval

Dear [Borrower Name],

You have been pre-approved for a mortgage refinance on your property located at [Property Address]. Based on our review of your current financial situation and property value, we can offer the following refinance options:

Current estimated property value: $[Amount]

Available refinance amount: Up to $[Amount]

New estimated interest rate: [Rate]%

Potential monthly savings: $[Amount]

This pre-approval allows you to proceed confidently with your refinance decision. We have streamlined documentation requirements since you are an existing homeowner, and we anticipate a smooth closing process within [Timeline] days.

Benefits of your refinance:

- Lower monthly payment

- Reduced total interest over loan term

- Optional cash-out availability: $[Amount]

This pre-approval is valid for [Duration]. Please contact us to lock your rate and begin the refinance process.

Best regards,

[Loan Officer Name]

[Lender Name]

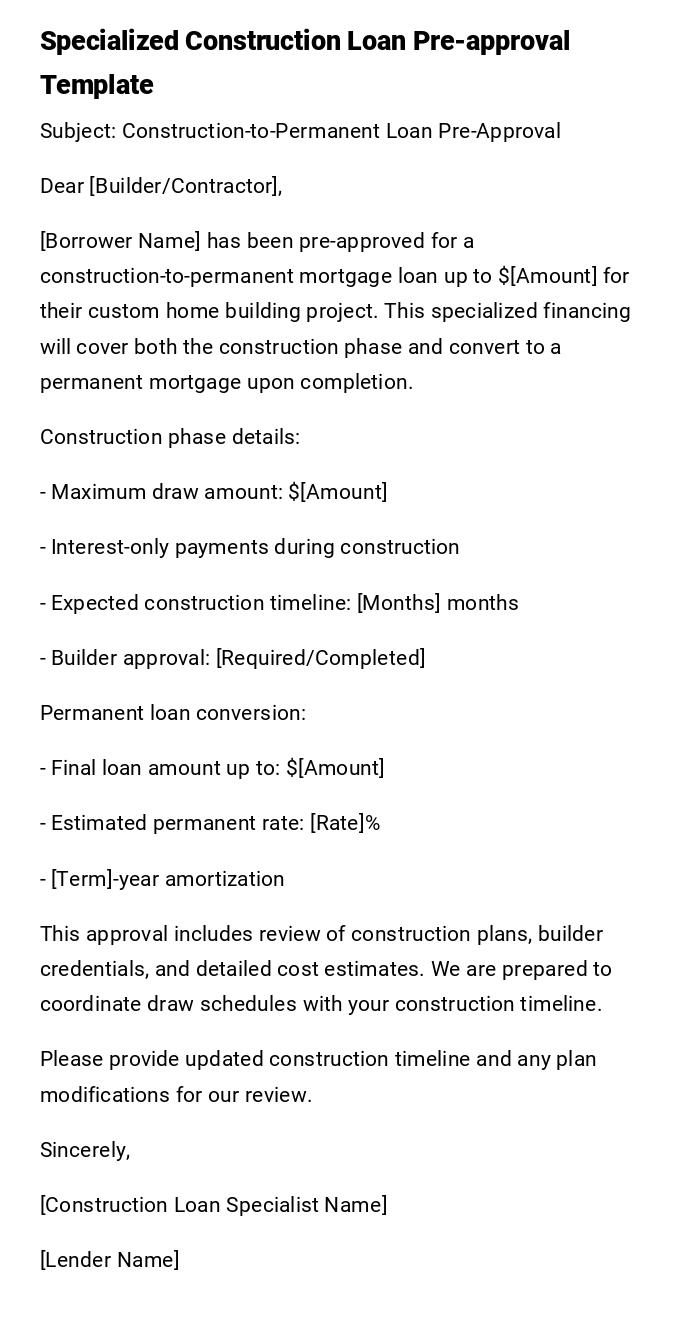

Construction-to-Permanent Loan Pre-approval Letter

Subject: Construction-to-Permanent Loan Pre-Approval

Dear [Builder/Contractor],

[Borrower Name] has been pre-approved for a construction-to-permanent mortgage loan up to $[Amount] for their custom home building project. This specialized financing will cover both the construction phase and convert to a permanent mortgage upon completion.

Construction phase details:

- Maximum draw amount: $[Amount]

- Interest-only payments during construction

- Expected construction timeline: [Months] months

- Builder approval: [Required/Completed]

Permanent loan conversion:

- Final loan amount up to: $[Amount]

- Estimated permanent rate: [Rate]%

- [Term]-year amortization

This approval includes review of construction plans, builder credentials, and detailed cost estimates. We are prepared to coordinate draw schedules with your construction timeline.

Please provide updated construction timeline and any plan modifications for our review.

Sincerely,

[Construction Loan Specialist Name]

[Lender Name]

What is a Lender Pre-approval Letter and Why Do You Need One

A lender pre-approval letter is an official document from a mortgage lender confirming that a borrower has been preliminarily approved for a specific loan amount based on their financial qualifications. Unlike a simple pre-qualification, a pre-approval involves thorough documentation review and credit verification.

Key purposes include:

- Demonstrates serious buyer intent to sellers and real estate agents

- Provides competitive advantage in multiple offer situations

- Establishes realistic budget for home shopping

- Streamlines final loan approval process

- Shows financial credibility in negotiations

- Reduces closing timeline uncertainty

Who Should Issue Pre-approval Letters

Pre-approval letters must come from licensed mortgage professionals with authority to make lending decisions:

- Mortgage loan officers at banks, credit unions, or mortgage companies

- Senior underwriters with approval authority

- Mortgage brokers representing multiple lenders

- Portfolio lenders for non-conforming loans

- Credit union lending officers for member loans

- Private lenders for alternative financing

The issuer must have:

- Valid mortgage licensing in the property state

- Authority to approve loans up to the stated amount

- Access to complete borrower financial documentation

- Underwriting approval or delegation authority

When Pre-approval Letters Are Required or Beneficial

Critical scenarios requiring pre-approval letters:

- Competitive housing markets with multiple offers

- Luxury property purchases above conforming loan limits

- Investment property acquisitions requiring specialized financing

- First-time homebuyer programs with specific requirements

- Short sale or foreclosure property purchases

- New construction or custom home building

- Relocation purchases with timing constraints

- Self-employed borrowers needing income verification proof

- Cash-out refinances for debt consolidation

- Bridge financing for property transitions

How to Obtain and Process Pre-approval Letters

The pre-approval process involves several key steps:

Documentation gathering:

- Recent pay stubs and tax returns

- Bank statements and investment accounts

- Credit report authorization

- Employment verification letters

- Asset and debt documentation

Application submission:

- Complete mortgage application (1003 form)

- Property type and location preferences

- Loan program selection

- Down payment source verification

Lender review process:

- Credit score and history analysis

- Debt-to-income ratio calculations

- Asset verification and reserves

- Employment stability confirmation

- Underwriter preliminary approval

Letter issuance timeline:

- Documentation review: 1-3 business days

- Underwriting decision: 2-5 business days

- Letter preparation and delivery: Same day

Requirements and Prerequisites Before Requesting Pre-approval

Essential preparations before applying:

Financial documentation:

- Two years of tax returns with all schedules

- 30-60 days of recent pay stubs

- 2-3 months of bank statements for all accounts

- Investment and retirement account statements

- Documentation of other income sources

Credit preparation:

- Review credit reports for accuracy

- Resolve any outstanding disputes

- Pay down credit card balances below 30% utilization

- Avoid new credit applications during process

Employment verification:

- Stable employment history (preferably 2+ years)

- Written employment verification letter

- Recent promotion or job change documentation

- Self-employment: Business tax returns and profit/loss statements

Down payment preparation:

- Savings account statements showing fund accumulation

- Gift letter documentation if applicable

- Asset liquidation timeline if needed

Formatting Guidelines and Best Practices

Professional pre-approval letters should include:

Essential elements:

- Lender letterhead and contact information

- Specific borrower name(s) exactly as on application

- Exact loan amount approved

- Loan type and estimated terms

- Expiration date of approval

- Contingency conditions clearly stated

Tone and style:

- Professional, confident language

- Clear, concise statements

- Avoid jargon or complex terms

- Include specific dollar amounts and percentages

- Use active voice for stronger impact

Length and format:

- Single page preferred for quick review

- Standard business letter format

- Easy-to-scan bullet points for key terms

- Professional font and clean layout

- Digital delivery with PDF format

Follow-up Actions After Sending Pre-approval Letters

Post-issuance responsibilities and timeline:

Immediate follow-up (24-48 hours):

- Confirm receipt by real estate agent or seller

- Provide loan officer direct contact information

- Clarify any questions about approval terms

- Discuss timeline expectations for purchase offers

Ongoing maintenance:

- Monitor expiration date and renewal needs

- Update approval if financial situation changes

- Maintain regular contact with borrower during house hunting

- Prepare for rate lock decisions when property identified

Purchase contract support:

- Provide loan commitment letter within contract timeframes

- Coordinate with real estate agents on contingency dates

- Begin formal loan processing immediately

- Schedule property appraisal and inspections

Advantages and Disadvantages of Pre-approval Letters

Advantages:

- Competitive edge in seller negotiations and multiple offer situations

- Budget clarity prevents looking at unaffordable properties

- Faster closing due to preliminary underwriting completion

- Rate protection options during house hunting period

- Seller confidence in buyer's ability to complete purchase

Disadvantages:

- Limited validity period requiring renewal if house hunting extends

- Rate fluctuation risk between approval and closing

- Conditional nature means final approval still required

- Credit inquiry impact on credit score

- Financial snapshot may not reflect future changes

- False confidence if conditions aren't fully understood

Common Mistakes to Avoid with Pre-approval Letters

Documentation errors:

- Providing incomplete financial information

- Using outdated bank statements or pay stubs

- Omitting debt obligations or income sources

- Misrepresenting employment status or income stability

Process mistakes:

- Shopping for homes above approved amount

- Making major financial changes during approval period

- Ignoring expiration dates and renewal requirements

- Assuming pre-approval guarantees final loan approval

Communication errors:

- Failing to understand conditional approval terms

- Not maintaining contact with loan officer during house hunting

- Misrepresenting approval terms to sellers or agents

- Using pre-approval letter beyond its intended scope

Comparison with Other Financing Options

Pre-approval vs. Pre-qualification:

- Pre-approval requires full documentation review

- Pre-qualification based on stated information only

- Pre-approval carries more weight with sellers

- Pre-qualification faster but less reliable

Pre-approval vs. Cash offers:

- Cash offers eliminate financing contingencies

- Pre-approval requires appraisal and final underwriting

- Cash provides faster closing capability

- Pre-approval allows larger purchase amounts for most buyers

Pre-approval vs. Portfolio lending:

- Traditional pre-approval follows conventional guidelines

- Portfolio lending offers more flexibility for unique situations

- Portfolio loans may have different approval processes

- Conventional pre-approval typically offers better rates

Download Word Doc

Download Word Doc

Download PDF

Download PDF