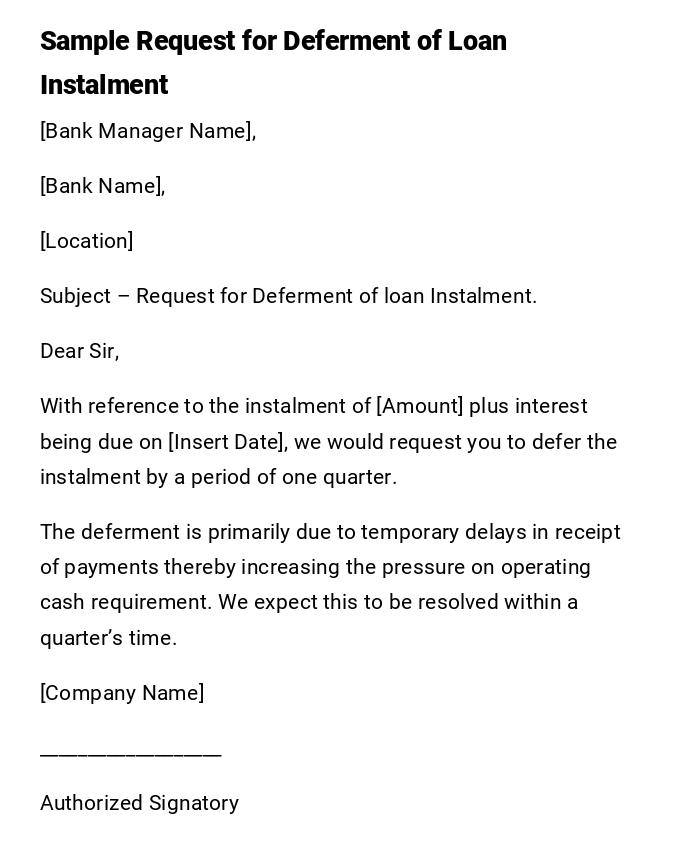

Sample Request for Deferment of Loan Instalment

[Bank Manager Name],

[Bank Name],

[Location]

Subject – Request for Deferment of loan Instalment.

Dear Sir,

With reference to the instalment of [Amount] plus interest being due on [Insert Date], we would request you to defer the instalment by a period of one quarter.

The deferment is primarily due to temporary delays in receipt of payments thereby increasing the pressure on operating cash requirement. We expect this to be resolved within a quarter’s time.

[Company Name]

___________________

Authorized Signatory

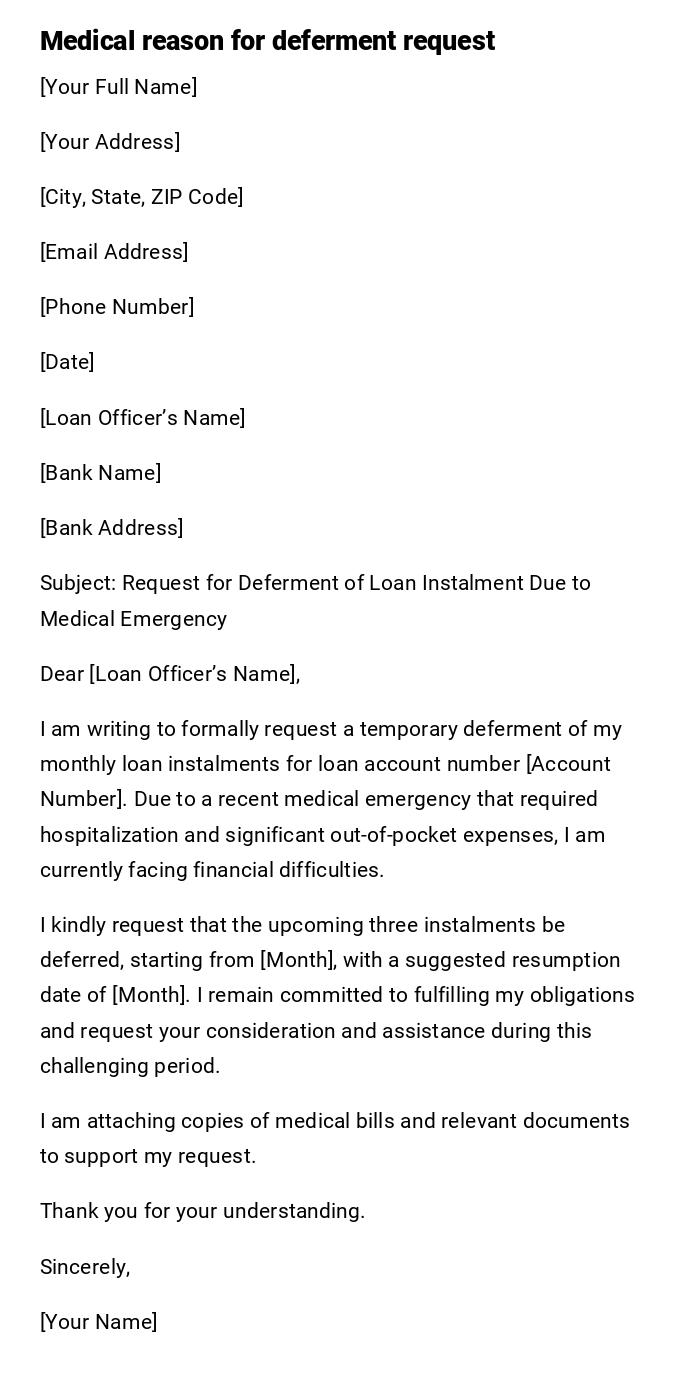

Formal Letter Requesting Loan Instalment Deferment Due to Medical Emergency

[Your Full Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Loan Officer’s Name]

[Bank Name]

[Bank Address]

Subject: Request for Deferment of Loan Instalment Due to Medical Emergency

Dear [Loan Officer’s Name],

I am writing to formally request a temporary deferment of my monthly loan instalments for loan account number [Account Number]. Due to a recent medical emergency that required hospitalization and significant out-of-pocket expenses, I am currently facing financial difficulties.

I kindly request that the upcoming three instalments be deferred, starting from [Month], with a suggested resumption date of [Month]. I remain committed to fulfilling my obligations and request your consideration and assistance during this challenging period.

I am attaching copies of medical bills and relevant documents to support my request.

Thank you for your understanding.

Sincerely,

[Your Name]

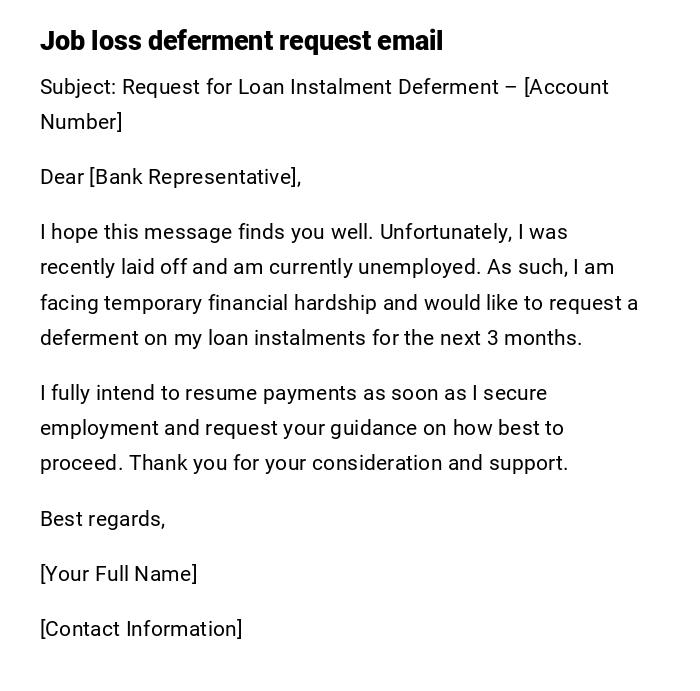

Email Requesting Loan Payment Deferment Due to Job Loss

Subject: Request for Loan Instalment Deferment – [Account Number]

Dear [Bank Representative],

I hope this message finds you well. Unfortunately, I was recently laid off and am currently unemployed. As such, I am facing temporary financial hardship and would like to request a deferment on my loan instalments for the next 3 months.

I fully intend to resume payments as soon as I secure employment and request your guidance on how best to proceed. Thank you for your consideration and support.

Best regards,

[Your Full Name]

[Contact Information]

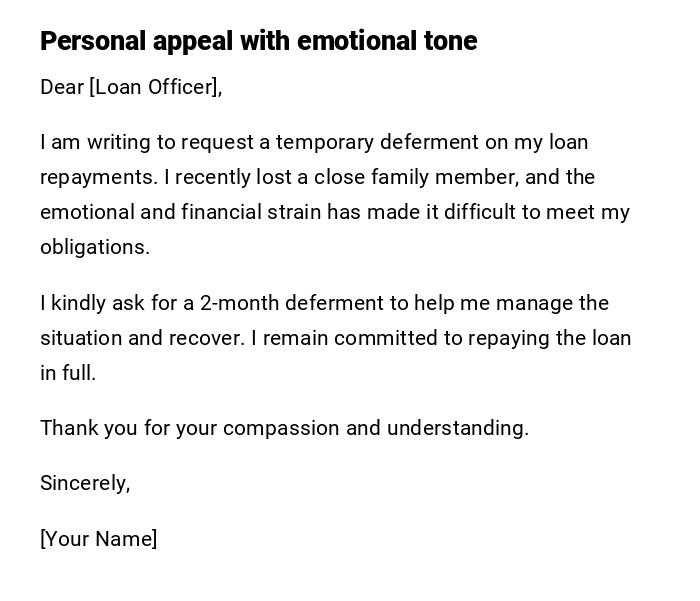

Heartfelt Letter Requesting Temporary Loan Relief After Family Death

Dear [Loan Officer],

I am writing to request a temporary deferment on my loan repayments. I recently lost a close family member, and the emotional and financial strain has made it difficult to meet my obligations.

I kindly ask for a 2-month deferment to help me manage the situation and recover. I remain committed to repaying the loan in full.

Thank you for your compassion and understanding.

Sincerely,

[Your Name]

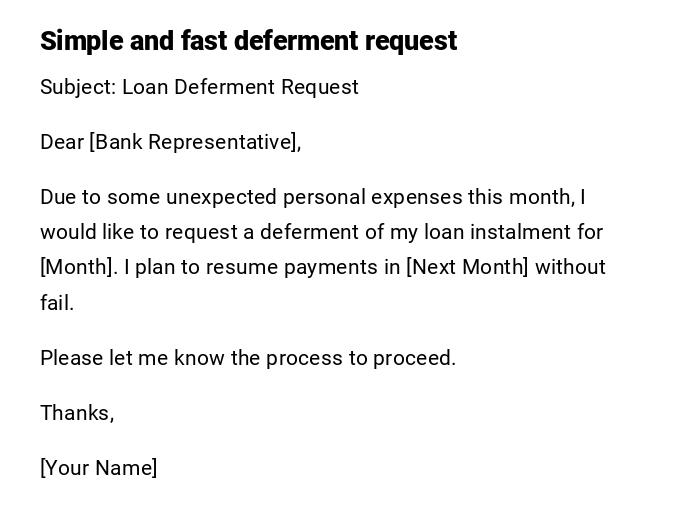

Quick Email Requesting Loan Deferment Due to Unexpected Expenses

Subject: Loan Deferment Request

Dear [Bank Representative],

Due to some unexpected personal expenses this month, I would like to request a deferment of my loan instalment for [Month]. I plan to resume payments in [Next Month] without fail.

Please let me know the process to proceed.

Thanks,

[Your Name]

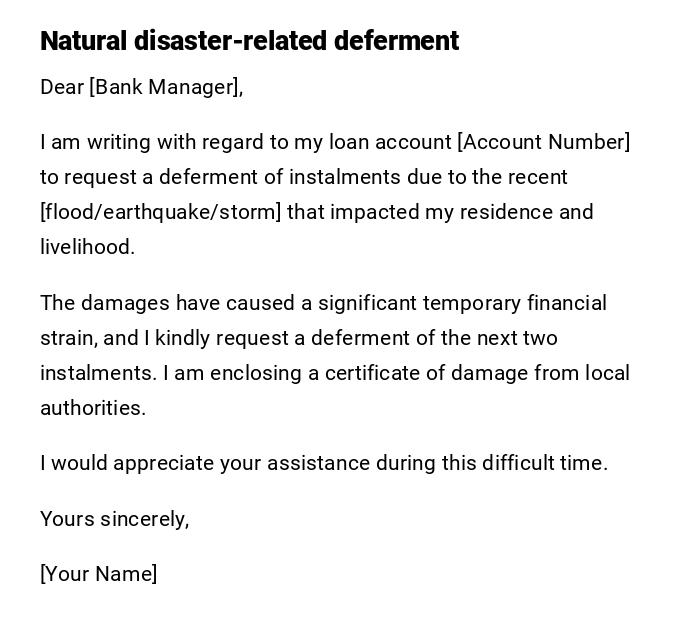

Formal Letter Requesting Loan Instalment Postponement Due to Natural Disaster

Dear [Bank Manager],

I am writing with regard to my loan account [Account Number] to request a deferment of instalments due to the recent [flood/earthquake/storm] that impacted my residence and livelihood.

The damages have caused a significant temporary financial strain, and I kindly request a deferment of the next two instalments. I am enclosing a certificate of damage from local authorities.

I would appreciate your assistance during this difficult time.

Yours sincerely,

[Your Name]

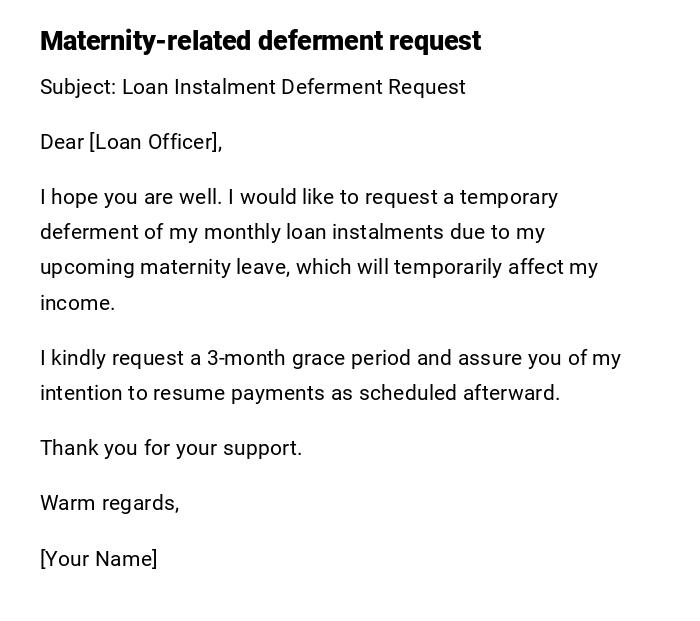

Email Asking for Loan Instalment Delay Due to Maternity Leave

Subject: Loan Instalment Deferment Request

Dear [Loan Officer],

I hope you are well. I would like to request a temporary deferment of my monthly loan instalments due to my upcoming maternity leave, which will temporarily affect my income.

I kindly request a 3-month grace period and assure you of my intention to resume payments as scheduled afterward.

Thank you for your support.

Warm regards,

[Your Name]

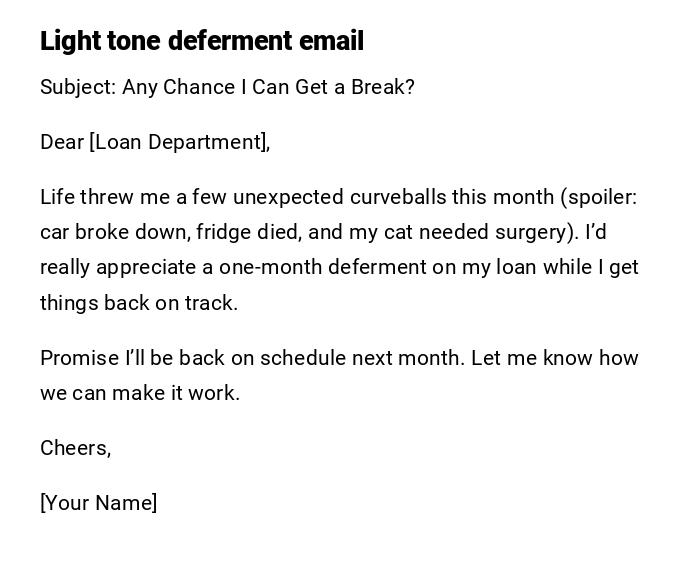

Funny But Honest Deferment Request Email

Subject: Any Chance I Can Get a Break?

Dear [Loan Department],

Life threw me a few unexpected curveballs this month (spoiler: car broke down, fridge died, and my cat needed surgery). I’d really appreciate a one-month deferment on my loan while I get things back on track.

Promise I’ll be back on schedule next month. Let me know how we can make it work.

Cheers,

[Your Name]

Professional Email Requesting Business Loan Instalment Deferment

Subject: Request for Business Loan Deferment – [Business Name]

Dear [Bank Name],

I represent [Business Name], currently holding a loan account [Account Number] with your institution. Due to a temporary downturn in operations, I am requesting a 2-month deferment on our loan instalments.

We are confident that our cash flow will stabilize soon and seek your cooperation during this period. Please advise on required documentation.

Regards,

[Your Name]

[Position, Business Name]

Serious Letter Seeking Extended Deferment Due to Long-Term Illness

Dear [Loan Officer’s Name],

I am writing to formally request a deferment on my monthly loan payments for a period of six months, due to ongoing treatment for a serious medical condition.

I have attached medical reports and treatment estimates to this letter. I remain committed to the loan and request your consideration for a revised payment plan once my treatment concludes.

Thank you for your empathy.

Sincerely,

[Your Name]

Why Do You Need a Request for Deferment of Loan Instalment?

A deferment letter is essential when a borrower cannot temporarily meet repayment obligations due to hardship. This formal communication helps preserve trust, allows lenders to evaluate the situation, and often prevents late fees or credit damage. Without it, missed payments could lead to legal or financial consequences.

Who Should Write and Send This Letter?

- Individual borrowers (students, personal loan holders, homeowners)

- Business owners on behalf of their companies

- Authorized representatives (in case of health or legal limitations)

- In some cases, legal guardians or family members with permission

What Should You Do After Sending a Deferment Request?

- Wait for the lender's confirmation or decision

- Provide any requested supporting documents promptly

- Continue communication in case of delays

- Resume payment once the deferment ends or per the agreed schedule

Requirements and Prerequisites for Deferment Requests

Before sending your letter, make sure to:

- Check if your loan policy allows deferment

- Gather supporting documents (medical bills, termination letters, etc.)

- Know your loan account number

- Clearly state the requested deferment period

- Have a plan for repayment or resumption

Common Mistakes to Avoid in Deferment Letters

- Not including the account number

- Forgetting to specify the length of the requested deferment

- Being too vague or emotional without details

- Not attaching supporting documents

- Using an inappropriate tone for a formal request

How Many Instalments Can Be Deferred?

This depends on:

- Loan type (student, personal, mortgage, business)

- Lender’s policies

- Reason for deferment

Typically, 1 to 6 months is allowed, though longer periods may be granted in special circumstances.

How Should You Format a Deferment Request Letter?

- Use a respectful, formal tone unless informality is appropriate (e.g., startups)

- Keep the letter 1 page long

- Include account number, deferment reason, and proposed deferment period

- Attach all relevant supporting documents

- Send via official channels (email, postal mail, online banking portals)

Who Should Receive the Deferment Request?

- Your loan officer or branch manager

- A centralized loan servicing department

- A company’s financial support email or portal

Always check your lender’s instructions for correspondence.

Compare: Deferment vs. Forbearance vs. Refinancing

- Deferment: Temporarily pause payments, interest may or may not accrue

- Forbearance: Similar to deferment but usually for financial hardship, interest typically accrues

- Refinancing: A new loan replaces the old one, possibly with different terms

Deferment is ideal for short-term relief without restructuring the loan.

Does a Deferment Request Need Authorization?

Yes, most lenders require the borrower or an authorized person to submit the request.

Additional documentation (power of attorney, death certificate, etc.) may be needed in certain cases.

Deferment is only valid once acknowledged and approved by the lender.

Deferment Request Due to Unexpected Medical Emergency

Subject: Request for Loan Instalment Deferment Due to Medical Emergency

Dear [Lender's Name/Loan Officer],

I am writing to formally request a temporary deferment of my loan instalments for account number [Account Number]. Due to an unexpected medical emergency, I am currently unable to meet my financial obligations as originally scheduled.

On [Date], I was diagnosed with [condition/underwent surgery] which has resulted in significant medical expenses and a temporary loss of income during my recovery period. I have been a reliable borrower with a consistent payment history, and this situation is entirely unforeseen.

I am requesting a deferment period of [X months], starting from [Date]. I have attached relevant medical documentation to support this request. I remain committed to fulfilling my loan obligations and propose to resume regular payments on [Date], with the deferred amount to be added to the end of the loan term.

I would appreciate the opportunity to discuss this matter further and explore available options. Please contact me at [Phone Number] or [Email Address] at your earliest convenience.

Thank you for your understanding and consideration during this difficult time.

Sincerely,

[Your Name]

[Account Number]

[Contact Information]

Business Cash Flow Crisis - Formal Deferment Request

Subject: Application for Temporary Loan Payment Deferment - Business Account [Account Number]

Dear [Bank Manager/Lending Institution],

I am writing on behalf of [Company Name] to request a temporary deferment of loan instalments for our business loan account [Account Number]. Our company is currently experiencing a temporary cash flow disruption due to delayed receivables from major clients.

Despite our best efforts in collection and cash flow management, several key clients have postponed payments due to [specific industry challenges/economic conditions], creating an unexpected shortfall. This situation is temporary, and we have confirmed payment schedules from these clients for [timeframe].

Our business has maintained an excellent payment record over the past [X years], and we remain financially viable with strong fundamentals. We are requesting deferment of [number] instalments, from [start date] to [end date]. During this period, we will continue to pay interest charges to demonstrate our commitment.

Attached please find our current financial statements, accounts receivable aging report, and client payment commitments. We are confident that this temporary relief will allow us to navigate this challenge without compromising our long-term relationship with your institution.

I am available to meet at your convenience to discuss this request in detail and provide any additional documentation required.

Thank you for your consideration.

Respectfully,

[Name]

[Title]

[Company Name]

[Contact Details]

Job Loss - Heartfelt Personal Letter

Subject: Loan Payment Deferment Request - Account [Account Number]

Dear [Loan Officer's Name],

I hope this message finds you well. I am reaching out during what has been an incredibly challenging time for my family and me. I recently lost my job at [Company Name] due to company-wide layoffs, and I am writing to request temporary relief from my loan payments.

For the past [X years], I have taken great pride in making my payments on time, and it breaks my heart to find myself in this position. I am actively seeking new employment and have already had several promising interviews, but I need a brief window to get back on my feet.

I am requesting a deferment of three months, from [Date] to [Date]. I have unemployment benefits that will help with essential expenses, but they are not sufficient to cover all my obligations. I want to be completely transparent with you about my situation because I value the trust we've built through our banking relationship.

I have modest savings that I am preserving for absolute emergencies, and I am taking on freelance work while job hunting. I am confident that I will secure employment within the next two months, and I am committed to resuming payments as soon as I am able.

Thank you for taking the time to consider my situation. I would be grateful for any flexibility you can offer during this difficult period.

With sincere appreciation,

[Your Name]

[Account Number]

[Phone Number]

Natural Disaster Impact - Official Deferment Request

Subject: Emergency Loan Deferment Request Following Natural Disaster

Dear [Financial Institution Representative],

I am submitting this formal request for loan payment deferment for account [Account Number] due to the recent [type of disaster] that struck our area on [Date]. My property and livelihood have been significantly impacted, and I require temporary financial relief.

The disaster has resulted in [specific impacts: property damage, business closure, loss of income source]. I have filed claims with my insurance company (Claim Number: [X]), but the settlement process will take several months. Additionally, I am incurring immediate expenses for temporary housing and essential repairs.

I am requesting a deferment period of [X months] to allow time for insurance processing and recovery. I have been a customer in good standing for [X years] and have maintained consistent payment history. I am prepared to provide documentation including damage assessments, insurance claims, and FEMA declarations if applicable.

I understand that interest may continue to accrue during the deferment period, and I accept those terms. I propose resuming regular payments on [Date] once my situation stabilizes.

Please advise on the required documentation and approval process. I can be reached at [alternate contact information] as my primary residence is currently uninhabitable.

Thank you for your assistance during this crisis.

Yours truly,

[Your Name]

[Loan Account Number]

[Contact Information]

Maternity/Paternity Leave - Professional Email

Subject: Loan Deferment Request During Parental Leave

Dear [Loan Department],

I am writing to request a temporary deferment of my loan payments for account [Account Number] during my upcoming parental leave. I am expecting a child on [Due Date] and will be taking [X weeks/months] of leave from my employment.

While my employer provides partial salary continuation, the reduced income during this period will make it challenging to meet all financial obligations. I am planning ahead to ensure I maintain my financial responsibilities to the best of my ability.

I am requesting deferment for [number] instalments, covering the period from [Date] to [Date]. I will be returning to full-time employment on [Date] and will resume regular payments at that time. I am willing to discuss options such as extending the loan term or adding the deferred amount to the principal.

I have maintained perfect payment history since opening this account [X years ago], and I am committed to continuing that record once I return to work. Please let me know what documentation you require, such as employment verification or leave approval letters.

Thank you for considering my request. I appreciate your flexibility during this important family transition.

Best regards,

[Your Name]

[Account Number]

[Email Address]

[Phone Number]

Seasonal Income Reduction - Simple Request

Subject: Seasonal Income Deferment Request

Dear [Lender],

I am requesting a deferment of my loan payments for account [Account Number] during the upcoming off-season period. My work in [industry] is seasonal, and I experience significantly reduced income from [Month] to [Month] each year.

This is a predictable pattern in my industry, and I have budgeted accordingly. However, unexpected expenses this year have depleted my reserves earlier than anticipated. I am requesting deferment of [number] payments during my low-income period.

I will resume full payments in [Month] when my busy season begins. I have successfully managed this loan for [X years] and have never missed a payment. I am happy to provide documentation of my seasonal employment pattern if needed.

Please let me know if you can accommodate this request and what steps I need to take.

Thank you,

[Your Name]

[Account Number]

[Phone Number]

Education/Training Program - Provisional Request

Subject: Loan Deferment Request for Educational Advancement

Dear [Financial Services Team],

I am writing to request a deferment of loan instalments for account [Account Number] while I participate in a full-time educational program. I have been accepted into [Program Name] at [Institution], which runs from [Start Date] to [End Date].

This program will significantly enhance my career prospects and earning potential, but it requires me to reduce my work hours to part-time status. My income during this period will be approximately [X%] less than my current earnings.

I am requesting deferment for [number] months, with the understanding that this investment in my education will position me to better fulfill my financial obligations in the future. Upon completion, my projected income will increase by approximately [X%].

I have explored all options including scholarships and part-time work to minimize the impact on my loan obligations. I am prepared to resume payments immediately upon program completion and graduation.

Please advise on the approval process and any documentation you require, such as enrollment verification or program schedule.

Thank you for supporting my professional development.

Sincerely,

[Your Name]

[Account Number]

[Contact Details]

Multiple Financial Hardships - Serious Formal Letter

Subject: Urgent Request for Loan Payment Deferment - Account [Account Number]

Dear [Senior Loan Officer/Branch Manager],

I am writing to request an immediate deferment of my loan instalments due to multiple concurrent financial hardships that have severely impacted my ability to meet my obligations. This request is made with utmost seriousness and full transparency regarding my current situation.

Within the past [timeframe], I have experienced the following circumstances: [1) specific hardship, 2) specific hardship, 3) specific hardship]. The cumulative effect of these events has created an unprecedented financial crisis for my household.

Despite my efforts to maintain all payments through savings depletion and expense reduction, I have reached a point where I must request institutional support. I am requesting a deferment period of [X months], during which time I am taking the following specific actions to improve my situation: [list concrete steps].

I have been a responsible borrower for [X years] and have never requested hardship assistance before. I am committed to working through this difficult period and maintaining my relationship with your institution. I am open to any conditions or requirements you deem necessary, including financial counseling or modified payment plans upon resumption.

Attached please find supporting documentation for each hardship claim. I am available to meet in person to discuss this matter in detail and demonstrate my commitment to resolution.

I respectfully request your prompt consideration of this matter.

Yours sincerely,

[Your Name]

[Loan Account Number]

[Complete Contact Information]

What is a Loan Instalment Deferment Request and Why is it Needed

A loan instalment deferment request is a formal communication to a lending institution asking for temporary postponement of scheduled loan payments. The purpose is to provide financial relief during periods when borrowers face legitimate hardships that prevent them from meeting their regular payment obligations. This mechanism serves as a middle ground between maintaining payments and defaulting on the loan, protecting both the borrower's credit standing and the lender's interests. Deferment acknowledges temporary setbacks while demonstrating the borrower's commitment to eventually fulfilling their obligations.

When Should You Request a Loan Instalment Deferment

- Job loss or unemployment - Sudden termination, layoffs, or company closures

- Medical emergencies - Serious illness, injury, surgery requiring recovery time, or disability

- Natural disasters - Floods, earthquakes, hurricanes, fires affecting property or income

- Business downturns - Seasonal fluctuations, client payment delays, market contractions

- Family emergencies - Death of income earner, divorce, dependent care responsibilities

- Maternity or paternity leave - Reduced income during parental leave periods

- Military deployment - Active duty service affecting civilian income

- Educational pursuits - Full-time study requiring reduced work hours

- Temporary disability - Short-term inability to work due to injury or illness

- Economic crises - Pandemic impacts, recession effects, industry-specific downturns

Who Should Send This Request

- Individual borrowers experiencing personal financial hardships

- Business owners facing cash flow challenges or operational disruptions

- Co-borrowers when joint financial circumstances change

- Authorized representatives with power of attorney for incapacitated borrowers

- Company financial officers for corporate loan obligations

- Estate executors managing deceased borrower's obligations temporarily

- Legal guardians acting on behalf of dependents or protected persons

The sender should be the person legally responsible for the loan or their authorized representative with proper documentation.

Requirements and Prerequisites Before Requesting Deferment

- Review loan agreement - Check terms for existing hardship provisions or deferment clauses

- Verify account standing - Ensure account is current or understand arrears status

- Gather documentation - Collect proof of hardship (medical records, termination letters, disaster declarations)

- Calculate finances - Determine realistic deferment period needed and ability to resume payments

- Check credit impact - Understand how deferment may affect credit reporting

- Explore alternatives - Consider if refinancing, loan modification, or partial payments are better options

- Prepare financial statements - Have income, expense, and asset information ready

- Identify contacts - Know proper department and personnel to address request to

- Review communication history - Compile records of previous interactions with lender

- Legal consultation - Consider attorney advice for complex situations or large loans

How to Write and Submit a Loan Deferment Request

- Act promptly - Contact lender before missing payments, not after default

- Choose proper channel - Use formal written request even if initial contact is verbal

- Be honest and specific - Clearly explain circumstances without exaggeration or omission

- Quantify the request - State exact number of payments and specific time period

- Propose solution - Suggest how and when you'll resume payments

- Provide evidence - Attach relevant supporting documentation

- Demonstrate good faith - Show payment history and willingness to cooperate

- Express commitment - Affirm intention to fulfill obligations once able

- Request confirmation - Ask for written approval and terms of deferment

- Follow up - Contact lender within one week if no response received

- Keep records - Maintain copies of all correspondence and agreements

- Submit through verified channels - Use official email addresses or certified mail for important requests

Letter Formatting and Composition Guidelines

- Length: One to two pages maximum; concise yet comprehensive

- Tone: Professional and respectful, regardless of circumstances; avoid emotional language in business contexts

- Structure: Clear subject line, formal greeting, body with specific request, courteous closing

- Language: Direct and unambiguous; avoid jargon unless industry-appropriate

- Documentation references: Explicitly mention attached supporting documents

- Contact information: Include multiple ways to reach you

- Account details: Always reference specific loan account numbers

- Delivery method: Email for urgent matters with follow-up hard copy; certified mail for legal documentation

- Formatting: Professional business letter format with proper spacing and margins

- Proofreading: Essential - errors undermine credibility

- Timeliness: Submit as early as possible, ideally 30-60 days before affected payment

Essential Elements and Structure of the Request

- Subject line - Clear indication of purpose including account number

- Formal greeting - Address to specific person or department when possible

- Opening statement - Immediate declaration of request purpose

- Account identification - Loan account number, loan type, current balance if known

- Hardship explanation - Specific circumstances causing payment difficulty

- Timeline details - When hardship began and expected duration

- Financial impact - How circumstances affect ability to pay

- Request specifics - Number of payments, dates, and total deferment period

- Repayment proposal - How and when payments will resume

- Supporting documentation - List of attached evidence

- Contact information - Phone, email, alternative contact if applicable

- Appreciation statement - Thank lender for consideration

- Formal closing - Professional sign-off with signature

- Attachments notation - List of enclosed documents

After Sending Your Deferment Request - Follow-Up Actions

- Confirm receipt - Verify lender received your request within 2-3 business days

- Track timeline - Note submission date and follow up if no response within one week

- Maintain communication - Respond promptly to any lender inquiries or document requests

- Continue budget management - Don't assume approval; plan for various outcomes

- Document everything - Keep detailed records of all interactions and correspondence

- Get written approval - Ensure all agreed terms are documented in writing before stopping payments

- Understand new terms - Review modification agreements carefully, including interest accrual

- Mark calendar - Set reminders for when deferment ends and payments resume

- Prepare for resumption - Budget for return to regular payments well before deferment expires

- Monitor account - Regularly check that deferment is properly applied to your account

- Report changes - Notify lender immediately if circumstances improve or worsen

- Request status updates - If hardship continues near end of deferment, communicate proactively

Common Mistakes to Avoid When Requesting Deferment

- Waiting until after default - Request before missing payments to protect credit

- Being vague or dishonest - Ambiguous explanations or false information damage credibility

- Failing to provide documentation - Unsupported claims often result in denial

- Requesting unrealistic timeframes - Asking for excessive deferment periods without justification

- Ignoring loan terms - Not reviewing contract provisions about hardship assistance

- Assuming automatic approval - Continuing to skip payments before receiving written authorization

- Not proposing solutions - Simply stating problems without offering repayment plans

- Poor communication - Unprofessional tone, errors, or incomplete information

- Missing follow-up - Failing to respond to lender requests for additional information

- Overlooking alternatives - Not exploring other options that might be more suitable

- Forgetting to resume payments - Missing restart date after approved deferment expires

- Not getting written confirmation - Accepting verbal approval without documented terms

Advantages and Disadvantages of Loan Deferment

Advantages:

- Prevents loan default and resulting credit damage

- Provides breathing room during genuine hardships

- Maintains relationship with lender for future needs

- Allows time to recover financially without immediate pressure

- May prevent repossession, foreclosure, or legal action

- Shows responsible financial management and communication

- Often more favorable than forbearance or default alternatives

Disadvantages:

- Interest typically continues accruing during deferment period

- May extend overall loan term and increase total interest paid

- Could be noted on credit reports depending on lender policies

- Requires documentation effort and approval process time

- Not guaranteed; lender may deny request

- May affect future credit applications during deferment

- Creates larger future obligation when payments resume

- Some lenders charge deferment processing fees

Comparing Deferment with Alternative Options

Deferment vs. Forbearance: Deferment typically stops payments completely for a period, while forbearance may reduce (not eliminate) payments. Forbearance often has stricter qualification requirements but may have better credit impact.

Deferment vs. Loan Modification: Modification permanently changes loan terms (interest rate, payment amount, duration), while deferment is temporary. Modification may be better for long-term hardships.

Deferment vs. Refinancing: Refinancing creates a new loan with different terms, potentially lower payments permanently. Better for those with adequate credit and income, but requires qualification.

Deferment vs. Partial Payments: Continuing partial payments shows good faith but may not be accepted by all lenders and could still result in late fees or credit damage.

Deferment vs. Default: Default destroys credit, invites collection actions, and loses all negotiating power. Deferment preserves relationship and credit standing.

Deferment vs. Debt Consolidation: Consolidation combines multiple debts into one payment, potentially lowering overall monthly obligations permanently rather than temporarily pausing one loan.

Tips and Best Practices for Successful Deferment Requests

- Time it right - Request 30-60 days before first affected payment when possible

- Use templates wisely - Adapt templates to your specific situation; don't send generic requests

- Be specific with numbers - Exact dates, amounts, and account numbers eliminate confusion

- Show your track record - Highlight positive payment history to demonstrate reliability

- Offer compromise - Consider proposing interest-only payments if full deferment denied

- Research lender policies - Some institutions have formal hardship programs with specific applications

- Get contact names - Direct your request to specific loan officers for faster processing

- Send through multiple channels - Email for speed, certified mail for documentation

- Include action plan - Describe concrete steps you're taking to resolve the hardship

- Stay professional - Even in dire circumstances, maintain courteous, business-like communication

- Update promptly - If situation changes (better or worse), inform lender immediately

- Consider timing - Submit requests early in the month when departments are less overwhelmed

- Request written terms - Never accept verbal-only approval; insist on documented agreement

How Many Payments Can Be Deferred

The number of instalments that can be deferred varies significantly based on multiple factors:

- Typical range: Most lenders allow 3-6 months of deferment for standard hardships

- Extended circumstances: Natural disasters or medical emergencies may qualify for 6-12 months

- Government programs: Special programs (pandemic relief, military service) may offer longer periods

- Loan type factors: Mortgages often allow longer deferments than personal loans or auto loans

- Lender discretion: Each institution has policies ranging from 1-2 payments to 12+ months

- Borrower history: Long-standing customers with excellent payment records may receive more flexibility

- Multiple requests: First-time requests generally approved more easily than repeat requests

- Frequency limitations: Most lenders limit deferments to once per 12-24 month period

- Total loan deferment: Some contracts limit total lifetime deferments regardless of circumstances

To Whom Should This Request Be Addressed

- Primary contact: Loan officer or account manager assigned to your loan

- Department options: Loan servicing department, customer service, or hardship assistance team

- Escalation path: Branch manager or regional director for complex situations

- Specialized units: Some banks have dedicated financial hardship or loan workout departments

- Corporate structure: For business loans, address to commercial lending or business banking officers

- Online platforms: Many institutions now have specific online portals for hardship requests

- General approach: If unsure, address to "Loan Department" or "Customer Service Manager" with your account details

- Finding information: Check loan documents, monthly statements, or lender website for correct contact

Download Word Doc

Download Word Doc

Download PDF

Download PDF